The Bitcoin price rose to its highest level since November 2021. Driven by a record $520 million inflow into BlackRock’s IBIT and the anticipated Bitcoin halving event, BTC’s price has seen a 47% rally in February.

Key Takeaways:

– Bitcoin soars to its highest level since November 2021

– BlackRock’s IBIT saw a record $520 million of inflows

– BTC/USD rallied 47% in February

– The Bitcoin halving event happens in a matter of weeks.

ETF inflows

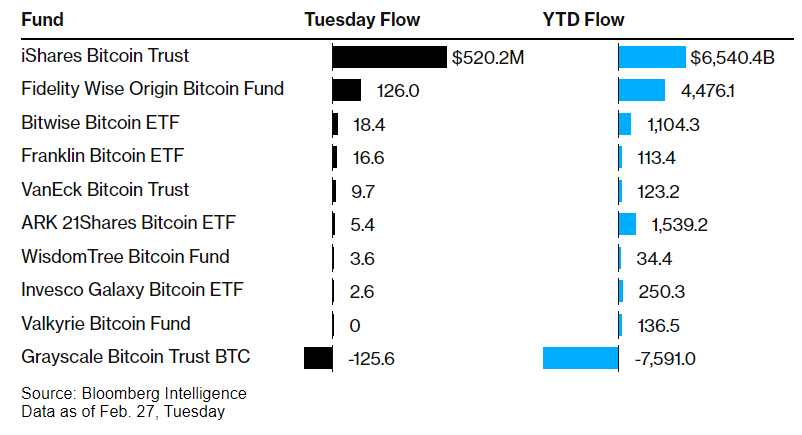

BlackRock’s ETF, the iShares Bitcoin Trust (IBIT), experienced its largest daily inflow since being approved in early January, a record $520 million. According to Bloomberg, this also marked the second-largest daily inflow for any US ETF across all asset classes ever.

As predicted, last month’s approval of spot BTC ETFs opened the door to new institutional investors, including wealth managers, hedge funds, and retail investors, sending demand soaring.

IBIT has seen 32 consecutive days of inflows. Fidelity Wise Organic Bitcoin Fund (FBTC) has attracted daily inflows totaling $4.48 billion since its approval amid a rising appetite for spot BTC ETF.

Bitcoin gains 47% in February

As ETF inflows have raced ahead, so has the price of BTC/USD, which has risen for a fifth straight day, jumping 12.6% at its peak, hitting a high of 63,968 yesterday before falling back towards its current levels of 62,0000. The rally has seen BTC/USD achieve gains of 47% this month alone. If the current momentum continues, Bitcoin could be testing its all-time high of $69000 sooner rather than later.

February has been Bitcoin’s most bullish month since December 2020, which was relatively early on within a parabolic trend of its own. This could mean that the Bitcoin rally is only just warming up.

The rally has also unsurprisingly revived memories of the 2021 bull market, which drove gains to the record high of 69,000 in November 2021. What is interesting about this bull run compared to the peaks seen in 2021 is that it appears to be driven by institutional players rather than retail investors.

Data from “IntotheBlock”, a crypto analytics site, indicates that web page searches for Bitcoin on Google and application downloads are middling. This is in contrast to Coinbase’s app rising to the number one spot by downloads on Apple’s app store in October 2021, coinciding with the market peak for BTC/USD. That said, there have been signs of rising retail demand as the Coinbase crashes following the Bitcoin pump.

BTC halving

Traders are also pouring into Bitcoin ahead of April’s halving event, a process which is designed to slow the supply of cryptocurrency. Halving, which occurs every 4-years, has historically fueled a leg higher in the BTC/USD.

Furthermore, there is the prospect of the Federal Reserve starting a rate-cutting cycle potentially as soon as June, which has fueled investor appetite for riskier and more volatile assets.

Is this a bubble?

It is impossible to say whether this is a new Bitcoin bubble forming and, if it is when it could pop. While there is a considerable element of fear of missing out, FOMO, there are also fundamentals that are supporting the rise, such as Bitcoin becoming more accessible to institutional investors through ETFs, coming technical changes to Bitcoin supply in the halving event, and Fed rate cuts.

Sources

https://nymag.com/intelligencer/article/bitcoin-fomo-is-back-this-is-officially-a-craze.html

https://www.ft.com/content/5fb04e8a-6939-43ae-9a47-be81ea75b1a1

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.