Bitcoin fell below 65k on Wednesday and has struggled to claw back losses since. The cryptocurrency plunged from a peak of 67,150 to a low of 63,670 earlier in the week before steadying around 64,500, where it trades today. BTC/USD is on track to lose 1% this week.

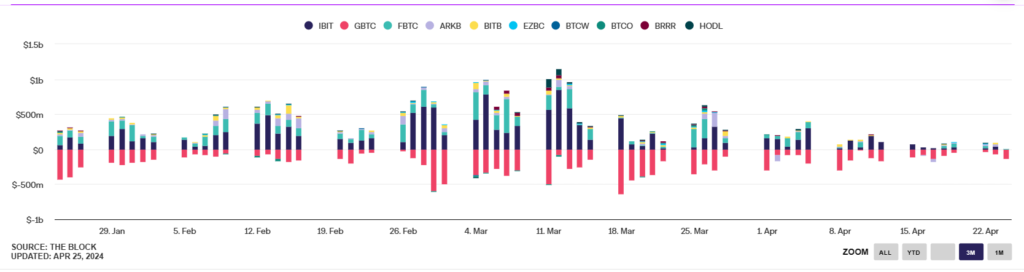

ETF inflows

The sell-off in Bitcoin coincided with a sharp slowdown in Bitcoin ETF inflows. According to data from Farside Investors, BlackRock’s BTC ETF (IBIT) has recorded net inflows every trading day since its launch on January 11. The streak, which officially placed IBIT in the top 10 of all-time for longest inflows, ended on Wednesday as net inflows halted.

IBIT also recorded 0 net inflows on Thursday, while Fidelity Wise Origin Fund (FBTC) and Ark 21Shares Bitcoin ETF recorded net outflows, as did Grayscale Bitcoin Trust, which saw $139 million in outflows. The end of the IBIT inflow streak comes after two straight weeks of net outflows across the 11 BTC ETFs.

The ETF flow data highlights a level of caution in the market after the halving event and as attention turns to today’s core PCE data, the Fed’s preferred gauge for inflation.

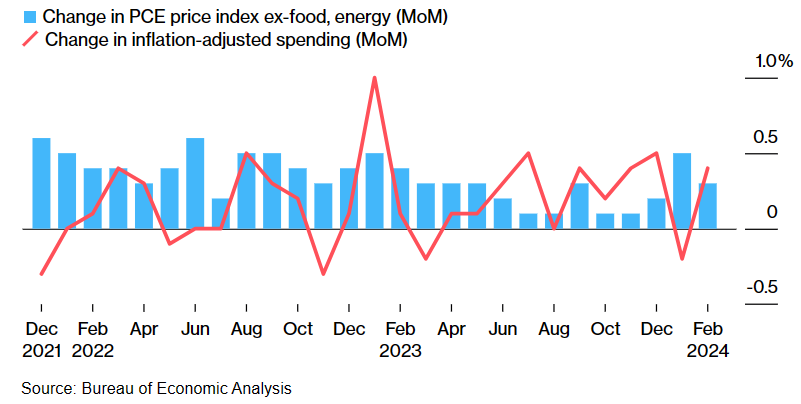

US inflation data

Economists expect core PCE to confirm sticky price pressures in March, rising 0.3% MoM, matching February’s increase and 2.6% annually.

The data is more in focus than usual, given the hotter-than-expected core PCE data for Q1 that was released yesterday. Q1 core PCE rose 3.7%, up from 2% in Q2. Hotter-than-expected inflation could see the market push back on Fed rate cut expectations further, potentially boosting the USD while hurting risk assets such as Bitcoin. Meanwhile, cooler inflation data could help lift Bitcoin higher.

The data comes as the Fed has maintained a hawkish stance lately hinting at a potential delay in rate cut plans.

The market expects the first rate cut from the Federal Reserve in September, which has been pushed back from June just a few weeks ago. The market is only pricing in one rate cut this year, down from three rate cuts a month ago.

Tech earnings could limit the downside.

While ETF inflows and nerves surrounding US inflation data are pulling on the Bitcoin price, losses are being limited by solid earnings from tech giants Alphabet and Microsoft. The Nasdaq is set to open over 1% higher.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.