The fast-paced world of Decentralized Finance (DeFi) is full of innovation, but also competition to become one of the established players. One tactic employed by some new DeFi protocols is the vampire attack.

In a vampire attack, a new platform targets established rivals by offering more attractive incentives to lure away liquidity and users. This can have a significant impact on the DeFi ecosystem, potentially luring users, draining liquidity from existing platforms, and disrupting their operations.

Key Takeaways:

- Vampire attacks exploit the competitive nature of DeFi by offering superior incentives to established platforms.

- The primary goal is to pull liquidity and users, potentially crippling competitors and creating a mass migration as investors chase after the best liquidity provider rates.

- While some see them as a sign of a healthy market, vampire attacks can raise ethical concerns about predatory practices.

What are Vampire Attacks in crypto?

A vampire attack in crypto is a cunning strategy employed by some new Decentralized Finance (DeFi) protocols. The term itself originated in the context of wireless sensor networks, where malicious devices would drain the battery life of legitimate ones.

This concept has been cleverly adapted to describe a similar tactic within the competitive world of DeFi.

Mechanics of a Vampire Attack

Some decentralized exchanges have relied on a simple yet effective strategy: lure users away from established platforms by offering better incentives. These incentives can come in various forms, such as higher yields on liquidity pools, staking rewards, or lower trading fees.

In a bid to attract investors, liquidity providers, and traders, the attacker aims to drain liquidity and trading volume away from the competitor, potentially crippling their entire ecosystem.

How do Vampire Attacks work: The Strategy Behind Vampire Attacks

Vampire attacks are a calculated assault on established DeFi protocols in their attempt to attract investors. To succeed in a successful attack, the new project must first excel at target identification. They meticulously research potential victims, focusing on platforms with a large user base, high liquidity, and potentially even lower trading fees.

These factors make established platforms prime targets, as they have more to lose in terms of drained liquidity and a disrupted user base.

Once a target is identified, the attackers move on to the execution plan. This plan will usually focus on offering higher incentives compared to the established platform. These incentives can take various forms, such as significantly higher yields on liquidity pools, lower trading fees, or even airdrops of their native tokens.

By employing aggressive marketing tactics and highlighting these enhanced incentives, the attackers aim to lure users away from the larger platform.

Vampire Attacks vs Other Crypto Attacks

The world of cryptocurrency faces a variety of threats, but a vampire attack stands out from the crowd since vampire attacks operate within a framework of strategic competition.

Examples of other malicious crypto attacks:

- Sybil attacks (manipulating voting systems)

- Front-running attacks (exploiting transaction ordering)

- Insider attacks (theft by insiders)

- 51% attacks (gaining control of the network)

These other crypto attacks typically involve exploiting vulnerabilities or manipulating systems for personal gain. In contrast, vampire attacks are a strategic attempt to outcompete established DeFi protocols by offering more attractive incentives.

Essentially, it’s a battle for market share, with new projects aiming to lure away users and liquidity from their rivals through better deals.

High-Profile Vampire Attacks

Some of the most famous vampire attacks have involved prominent players, fundamentally altering the competitive landscape. Let’s look into how two such famous vampire attacks happened:

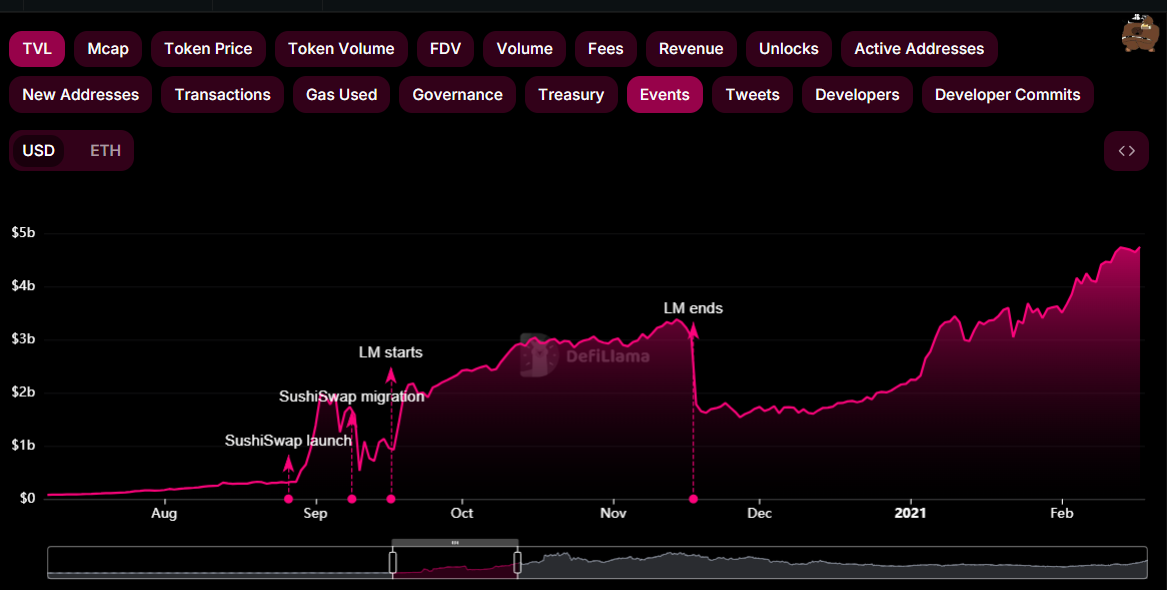

SushiSwap vs. Uniswap: This famous vampire attack happened in 2020 and is considered a landmark example. Sushiswap, a popular protocol and one of several new DeFi automated market makers, targeted Uniswap, the dominant decentralized exchange (DEX) at the time.

In a strategy to incentivize users who are providing liquidity, Sushiswap offered new liquidity providers the ability to earn additional rewards (Sushi tokens) on top of Uniswap’s existing trading fees, essentially offering higher incentives for liquidity providers to migrate their Uniswap LP tokens to Sushiswap’s platform.

Sushiswap’s attack is considered a successful vampire attack, as a significant portion of Uniswap’s liquidity was drained and migrated to Sushiswap, impacting Uniswap’s overall trading volume.

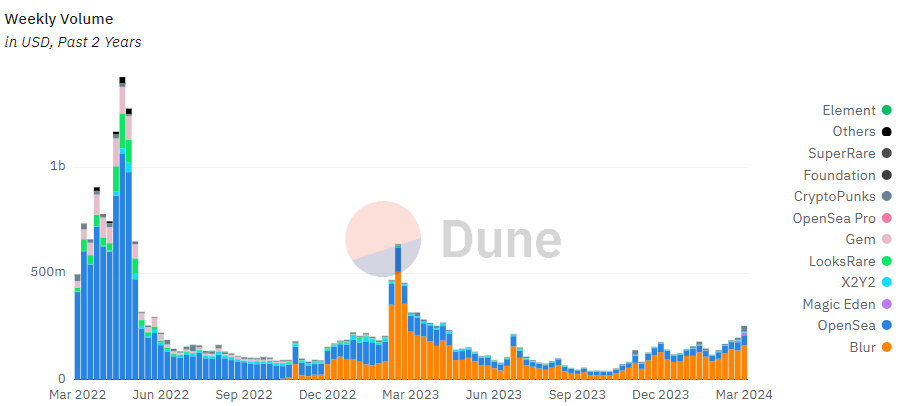

Blur vs. OpenSea: The NFT marketplace has also seen its fair share of vampire attacks. In 2022, Blur, a rising marketplace for NFTs, targeted the market leader, OpenSea. Blur offered NFT traders and creators significantly lower trading fees compared to OpenSea in their attempt to attract users. They also implemented features appealing to professional traders, such as faster transaction speeds and order book functionality.

This focus on better incentives for specific user segments attracted a portion of OpenSea’s user base, particularly high-volume traders, potentially impacting OpenSea’s overall trading activity.

The Ethical and Ecosystem Impact

Vampire attacks occupy a grey area, blurring the lines between healthy competition and potentially unethical practices. While they can stimulate innovation and benefit users in the short term, their long-term impact on the crypto ecosystem remains a subject of debate.

Competitive vs. Unethical Practices

On the positive side, vampire attacks can foster healthy competition by forcing established platforms to adapt and improve their offerings. The promise of higher incentives for liquidity providers and investors can lead to increased liquidity and potentially better returns. This can be a win win situation for users seeking the best possible yields on their investments.

However, concerns exist regarding potential unethical practices. Some vampire attacks may prioritize short-term gains over long-term sustainability. Unsustainably high rewards offered to lure clients away from established platforms might not be financially viable in the long run. This could lead to project instability and potential loss of investor funds.

Impact on the Crypto Ecosystem

In the short term, vampire attacks can disrupt established projects and fragment liquidity across multiple platforms.

However, it’s worth noting that in the long run, they can encourage innovation as existing platforms strive to maintain their user base. This constant push and pull can ultimately lead to a more robust and diverse DeFi landscape.

Defense Mechanisms Against Vampire Attacks

A vampire attack can pose a significant threat to established DeFi projects. Fortunately, there are strategies that projects can employ to focus on preventing vampire attacks and mitigate their impact.

H3: Preventative Measures

- Competitive Liquidity Provider Rates: One of the most effective defenses is to ensure your project offers competitive liquidity provider (LP) rates. By offering attractive and sustainable rewards, you can incentivize LPs to remain loyal to your platform.

- Lock-in Period: Strategically implementing lock-in periods for tokens or rewards can also be a valuable defense mechanism. By requiring LPs to lock their tokens or rewards for a set period, you create a disincentive for them to jump ship to a vampire attacker offering short-term gains. This helps maintain liquidity on your platform and discourages short-term exploitation.

- Dynamic Rewards: A flexible approach to rewards can also be beneficial. Consider implementing dynamic rewards that adjust based on factors like total value locked (TVL) or trading volume. This allows you to offer competitive rates when necessary while remaining sustainable in the long run.

These are just a few examples, however, by implementing these measures, projects can significantly prevent vampire attacks and maintain a healthy user base.

Recovery Strategies: Bouncing Back from a Vampire Attack

Even with strong defenses in place, a project can still fall victim to a well-executed vampire attack. However, all hope is not lost. Here are some strategies projects can employ to recover from a vampire attack and rebuild their user base:

- Community Engagement: Open and transparent communication with your community is crucial. Acknowledge the attack and explain the steps you’re taking to address it. Listen to community feedback and use it to adapt your strategy.

- Innovation: A vampire attack in crypto can be a wake-up call to innovate. Use this as an opportunity to identify areas for improvement and develop new features or functionalities that differentiate your platform from the competition.

- Long-Term Focus: Don’t get caught in a short-term bidding war with vampire attackers. Maintain a focus on long-term value creation and building a sustainable platform that benefits users in the long run.

The Future of Vampire Attacks in Crypto

Vampire attacks are a dynamic phenomenon within the ever-evolving DeFi landscape. As the crypto market matures, we can expect predictions and trends regarding these attacks to shift as well.

Here are some potential considerations for the future:

- More Sophisticated Attacks: Attackers may develop more sophisticated tactics, potentially targeting specific user segments or employing complex financial instruments. Defenses will need to adapt to this evolving threat landscape.

- Community-Driven Defense: Strong communities can be a powerful defense mechanism. Projects that foster a loyal and engaged user base may be better equipped to weather vampire attacks in the future.

Finally, the role of regulatory considerations cannot be ignored. As regulators take a closer look at the DeFi space, they may introduce measures to curb potentially unethical practices associated with some vampire attacks. This could involve regulations around misleading marketing or unsustainable reward structures.

Conclusion

Vampire attacks are a strategic threat in DeFi, impacting established projects and investor returns. Understanding them is crucial for both parties.

Project Developers: Employ defense mechanisms like competitive rates, lock-in periods, and dynamic rewards to deter attacks. Fostering a strong community can also be a powerful defense.

Investors: Vampire attacks can offer short-term gains, but be wary of unsustainable rewards and project instability. Research projects thoroughly and understand the long-term implications.

As the crypto landscape evolves, so too will vampire attacks. Staying informed about trends and potential regulations will be key for both developers and investors in the future.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.