Back in April 2020, in partnership with Europe-based fintech software developer Covesting, PrimeXBT successfully launched the Covesting copy trading beta.

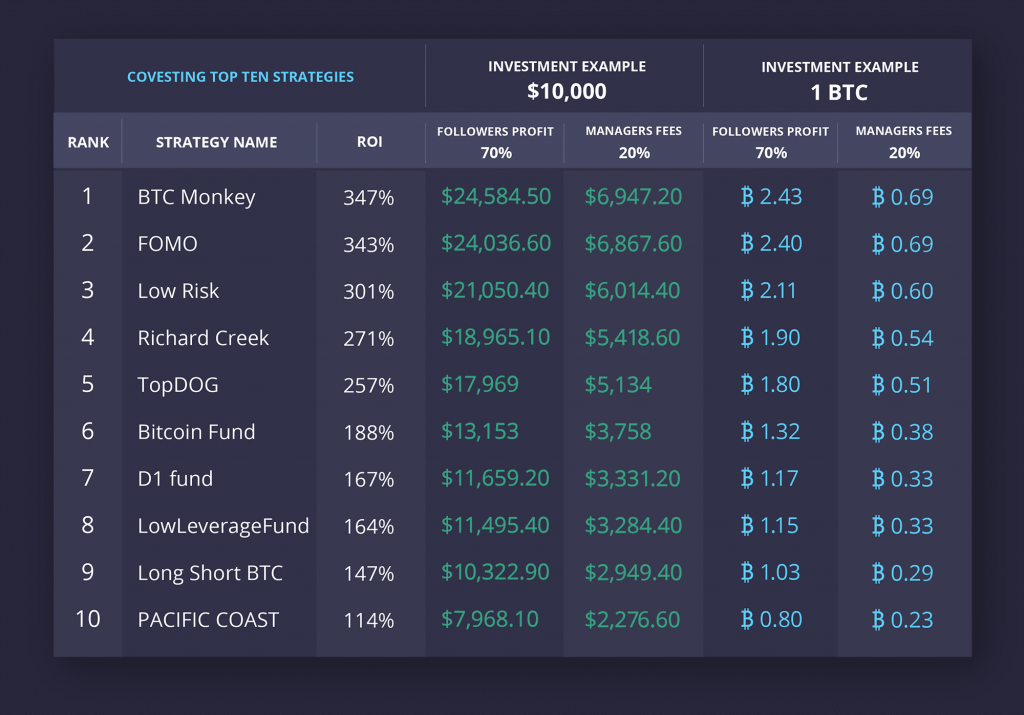

The tool lets experienced traders create strategies for investors to follow. Utilizing publicly available success metrics, followers can choose a strategy and invest equity into top traders’ trades from around the globe. Followers earn 70% from any profitable trades, while the strategy manager nets 20%.

By tapping into pro traders’ expertise, newer traders just learning the ropes can bypass many hard lessons for stress-free trading. However, even the world’s best traders have losing streaks, so it is essential to understand all risks associated with the Covesting platform and take steps to minimize this risk. As is the case with any investing or trading, capital loss is possible, so proper risk mitigation tactics are always necessary.

After months of valuable feedback and partnership with Covesting, the full public launch will be here on August 17, 2020.

Covesting Beta Recap And Overview

Upon careful review of all positive and negative beta cases, we have made some adjustments for launch. We have also prepared a roadmap in cooperation with Covesting outlining further improvements.

On the positive side, even during the beta phase of the Covesting module, total follower equity exceeded over $1 million USD. Strategy ROI reached over 360% in some cases.

However, some funds that had amassed a large stable of followers didn’t properly handle recent market volatility well and were unfortunately liquidated. This is a natural and common outcome of trading with leverage, and anyone considering doing so should be well aware of any risks associated and how to manage them properly.

We remind all users of the risk disclaimer included within the platform:

Your capital is at risk. Statistical information and historical performance are not a guarantee of future performance. Never invest more than you can afford to lose.

To further minimize the risks associated with margin trading and strategy following, we have lowered the amount of leverage available to strategy managers to 1:50 on all assets offered on the platform.

Due to continued requests for features during the beta phase, we will remain committed to a future development roadmap in partnership with Covesting. This roadmap includes several coming improvements including stop loss functionality for each follower to limit drawdown, further development of the rating logic, strategy description editing, additional risk and success metrics, and more.

PrimeXBT and Covesting will closely monitor trading activity, streamline performance, and develop new tools to reduce risk and improve user experience.

How Much Can Strategy Managers and Followers Make?

We also decided to analyze performance data to determine how much traders could realistically make by allowing others to follow their strategies. Instead of relying on theoretical projections, we pulled direct case studies from strategy managers active now in the Covesting beta to accurately reflect potential profitability.

The public rating system is packed with successful strategies like the examples below, making the module also enticing for investors and new traders to follow top performing strategies. The examples best reflect what’s in it for strategy managers, but also outlines what followers would generate for ROI from both a $1,000 and a 1 BTC investment. Earnings are adjusted to account for the 70% follower success fee share.

Note: All Covesting top ten strategy sample data reflects a statistical snapshot taken on August 13, 2020. The current Covesting top ten and data may not accurately reflect the standings or metrics pictured in the table or in the top ten ranking above. Always be certain to check the Covesting module rating section for the most up-to-date and accurate information.

Even with very little starting capital, there’s money to be made on both sides of the trade. Anyone will soon be able to follow any of these top strategies when the Covesting full public launch goes live on August 17. Traders who are able to consistently show success and profitability can build their reputation and trading career as an asset manager.

Once again, all Covesting module users have to keep in mind that volatility can quickly turn even a profitable strategy into a losing one. We provide all the tools and flexibility needed by both traders and followers in order to manage their risks accordingly. Our 24/7 support team is willing to support in case any questions arise during your Covesting journey.

We are all excited to release the platform to the public trading community at large and bring a new, innovative tool to the cryptocurrency industry.

Stay tuned for additional updates on Covesting and more from PrimeXBT, and good luck in trading during these volatile times!