The cryptocurrency market has continued on its upward trend with the King of Crypto, Bitcoin, crossing an important milestone. Bitcoin is back above $50,000 after a steady climb last week and is now primed for another big move — but which direction is uncertain.

Bitcoin, as is often the case, is helping the rest of the crypto market with Ethereum also climbing above $3,300. However, Ethereum is less bound to Bitcoin’s movements at the moment and is now rather moving its market price based on technical updates.

Bitcoin is rising in price based on some positive news coming out of PayPal UK, and the sentiment is that this latest rally is more sustained and steady than the last climb to its all-time high above $60,000. Additionally, news from Coinbase about their launch in Japan also helped kick off this move from $44,000 to over $50,000.

Elsewhere, in the stock markets, stocks traded lower for most of last week, led by the plunge in China-related tech names as China further tightened its grips on big tech names. Stocks in Mainland China and Hong Kong fell sharply, with the Hong Kong HSI posting a 5% loss on the week, breaking the support at 25,000 which last held up in July. The HSI has fallen more than 20% off its peak seen in Feb, putting this stock market effectively into bear market territory.

The carnage in China spilled over to the rest of the world, with most Asian indices and even the US stock market indices dragged lower. While US markets rebounded on Friday, indices couldn’t fully shake away the damage inflicted by the early week rout. The Dow dipped 1.1% last week, while the S&P 500 shed nearly 0.6% and the Nasdaq Composite moved 0.7% lower.

FED minutes released on Wednesday further weighed on sentiment as the report showed that the central bank is willing to start reducing its monthly asset purchases this year. Along with the China fear as well as uncertainty to economic recovery caused by the surge in COVID Delta Variant, investors sold risky assets like stocks and commodities and bought into the safety of the USD.

The DXY rose against most other currencies in the week to rise 1%, breaking above the 93.5 threshold for the first time this year. More upside could be expected of the USD as traders may need to readjust their allocations in light of the FED Minute’s revelation about cutting back on asset purchases earlier.

This USD strength caused a huge knee-jerk reaction on the NZDUSD as the market was caught off-guard by the RBNZ not cutting the rate on Thursday due to its recent rise in COVID cases. This sent the NZDUSD reeling almost 3% to a low of $0.68.

However, Oil was the biggest casualty, tumbling more than 9% on fears of the COVID Delta Variant further worsening an already weak demand. Weak data out of China released on Monday showed the Chinese economy slowed more than expected in July, sending fears of demand glut from one of the world’s largest importers of Oil.

Gold and Silver were largely flat after rebounding from one of their worst drops in recent times two weeks ago.

This week, traders will be setting their eyes on The Jackson Hole meeting for more insights into the FED’s “taper talks” to determine the course of the USD and the broad markets in the final quarter of the year.

The only good news seems to be coming from the cryptocurrency sector, with the price of BTC breaking $50,000 after a late-week rebound pushed the price from under $44,000 to above $50,000. The final push to break the $50,000 barrier came from Paypal after it said Sunday evening that its cryptocurrency purchase service in the UK will launch this week. Paypal launching its cryptocurrency purchase in the USA was the catalyst that launched the crypto bull run late last year and this service being available in the UK has brought lots of optimism to investors.

Crypto Purchase By Coinbase Was The First Shot Last Week

The first major catalyst came last Thursday when Coinbase announced that it was launching in Japan through a new partnership with one of the largest banks in the country, Mitsubishi UFJ (MUFG) Financial Group. The partnership will allow 40 million MUFG account holders to quickly access and begin buying BTC on Coinbase. The collaboration will focus on servicing the needs of Japanese institutional investors who have recently been getting more interested in investing in cryptocurrencies.

Further to that, Coinbase also announced that they have received board approval to purchase another $500 million worth of crypto to put on their balance and will be investing 10% of all of its profit going forward in crypto. This percentage will keep growing over time as the crypto economy matures.

The positive news from Coinbase managed to shore up the price of BTC when US unemployment claims failed to incite excitement to the market.

Other adoption news includes United Wholesale Mortgage (UWM), the second-largest United States-based mortgage lender, planning to accept cryptocurrency payments this year starting with BTC.

Crypto Adoption Skyrockets in 2021, Led By Emerging Markets

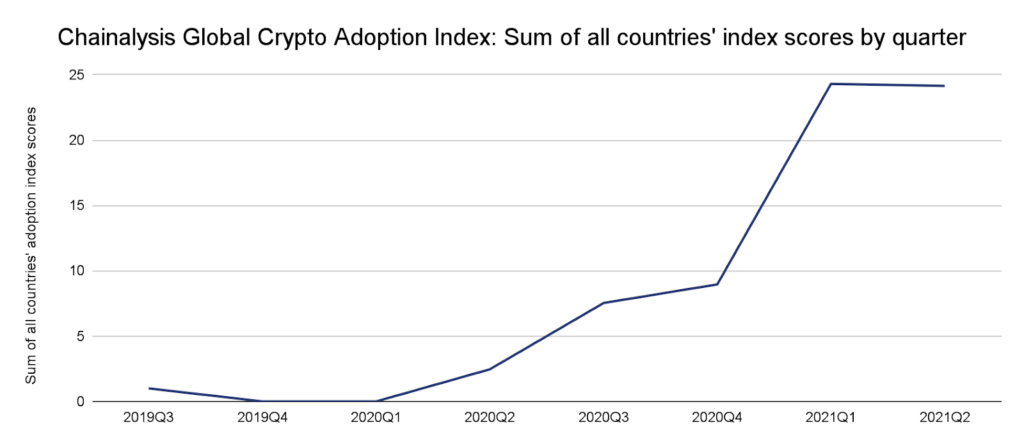

According to data, at the end of Q2 2020, following a period of little growth, total global crypto adoption stood at 2.5 based on Chainalysis country index scores. At the end of Q2 2021, that total score stands at 24, suggesting that global adoption has grown by over 2300% since Q3 2019 and over 881% in the last year. This has been primarily led by Vietnam, India, and Pakistan, which have seen adoption skyrocket in the past year.

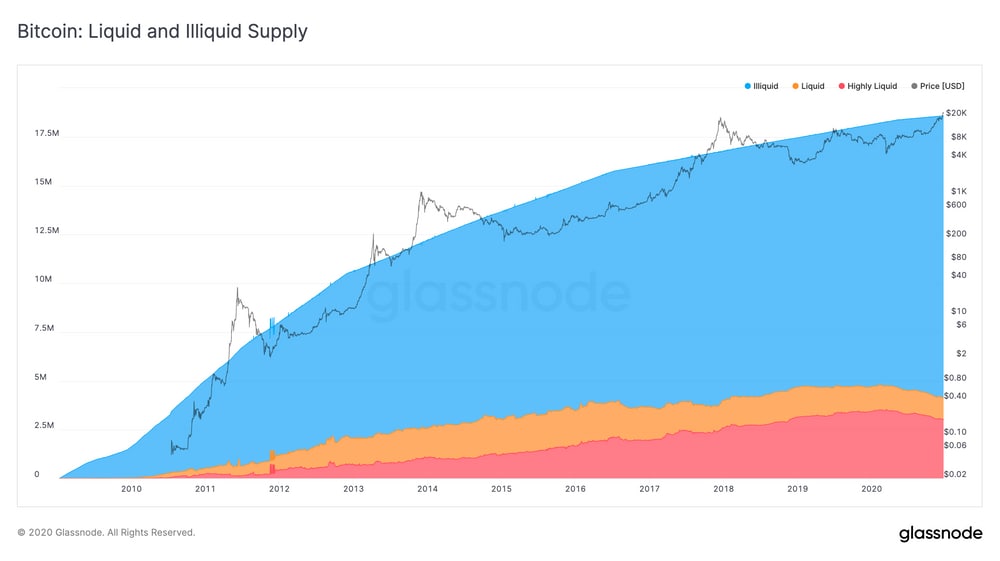

Illiquid and Dormant Supply of BTC Continues Growing

With more adoption, more new entrants have been acquiring the leading crypto. The new hands become old hands after their BTC has not been moved for 1-year, contributing to the gradual but stable growth of illiquid BTC supply.

The illiquid supply of BTC continues to grow as more supply – which used to be under the category of liquid – are now illiquid after not being moved for more than 1-year.

An on-chain metric tracking the number of “long-term held and never been moved” or lost BTC has reached 7,131,084, translating to about 33.96% of the total supply of BTC, or a whopping 39% of circulating supply, which is the highest percentage in the past five months. Hence, the real circulating supply of BTC ought to be lesser than what is published, at 18,792,493 minus 7,131,084 = 11,661,409 units only. This is how scarce BTC is right now.

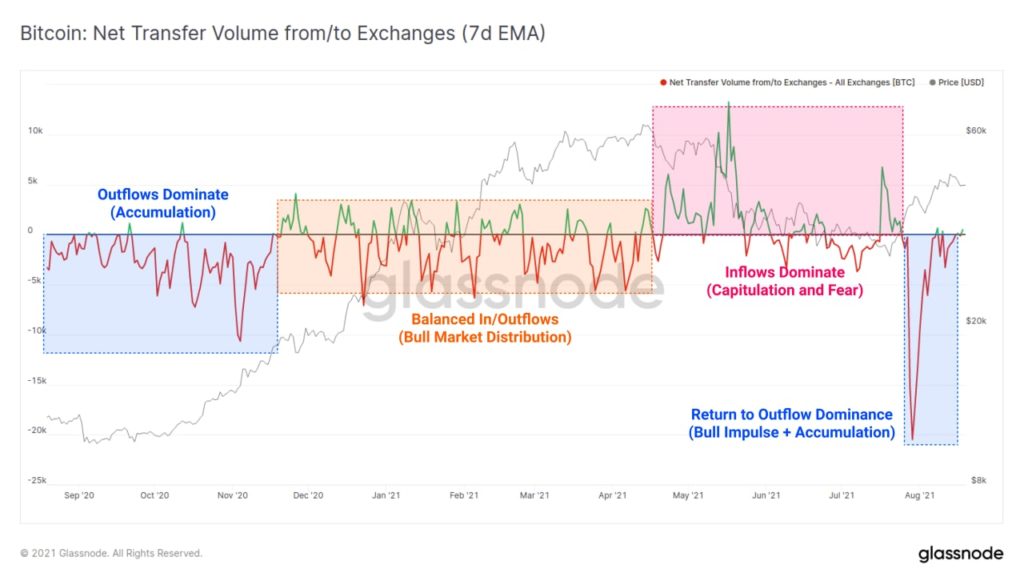

BTC exchange flows have also returned to a dominance of outflows since August after a period of inflows from May to July. This reflects the return of accumulation similar to that witnessed in Nov 2020 just before the BTC rally early this year, except that this time around, the accumulation outflow is twice as intense, signaling even more aggressive accumulation.

All the above information is pointing towards even more vigorous accumulation of BTC by long-term holders despite the third week of price increase. This reduction of supply usually does not present an immediate uptick in price as we have seen in the above example where aggressive accumulation took place in Nov 2020, but BTC’s explosive price uptick only came in the second half of Dec 2020, around a month later. Hence, if this theory is correct, we could see the price of BTC move sharply higher next month. Could BTC break its ATH next month?

Illiquid Supply of ETH Is Growing at Similar Pace

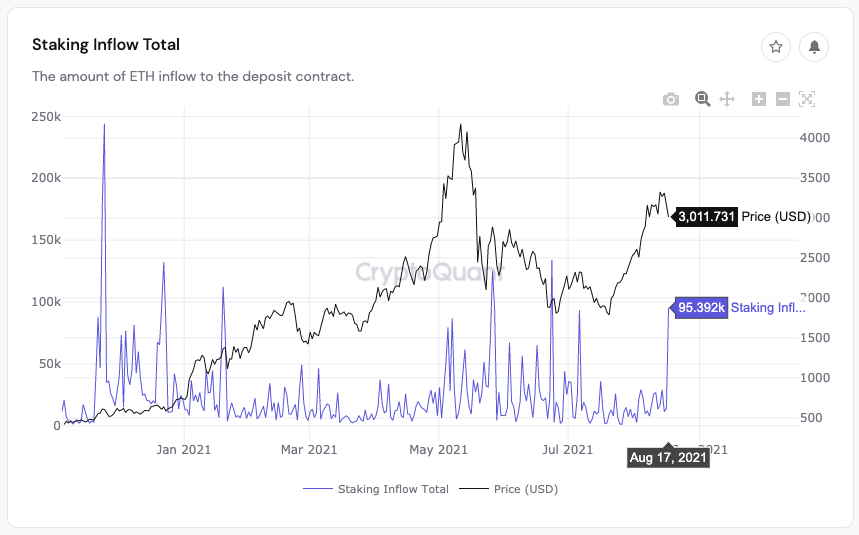

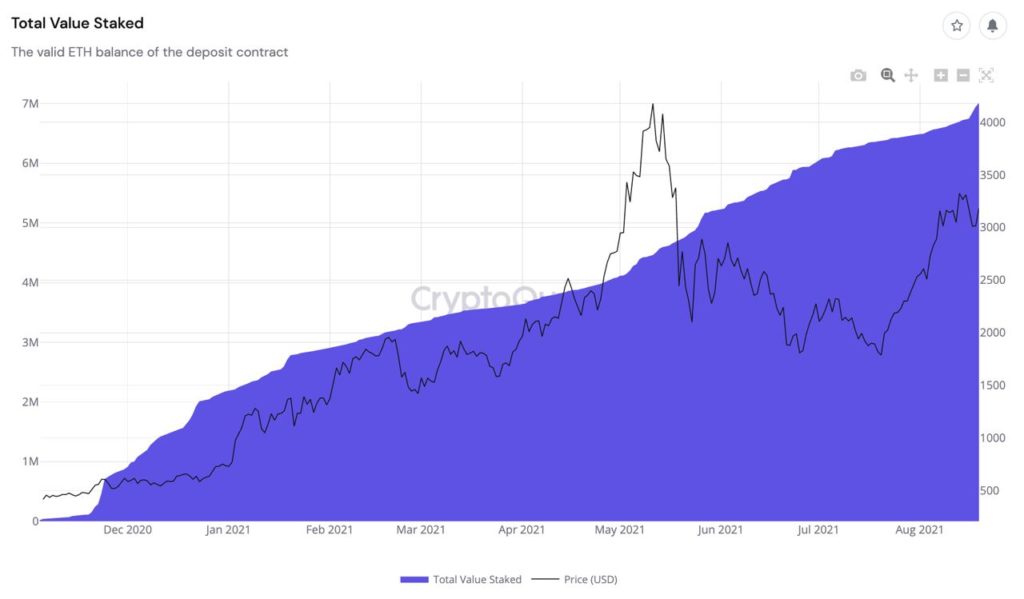

ETH saw one of the largest spikes in ETH staking deposit last week ever since its price rebounded, with 95,392 ETH worth around $287 million staked in the ETH 2.0 contract on August 17. As of now, 5.84% out of the total ETH supply has been staked in the ETH 2.0 contract and the amount continues to increase even as more ETH get burned.

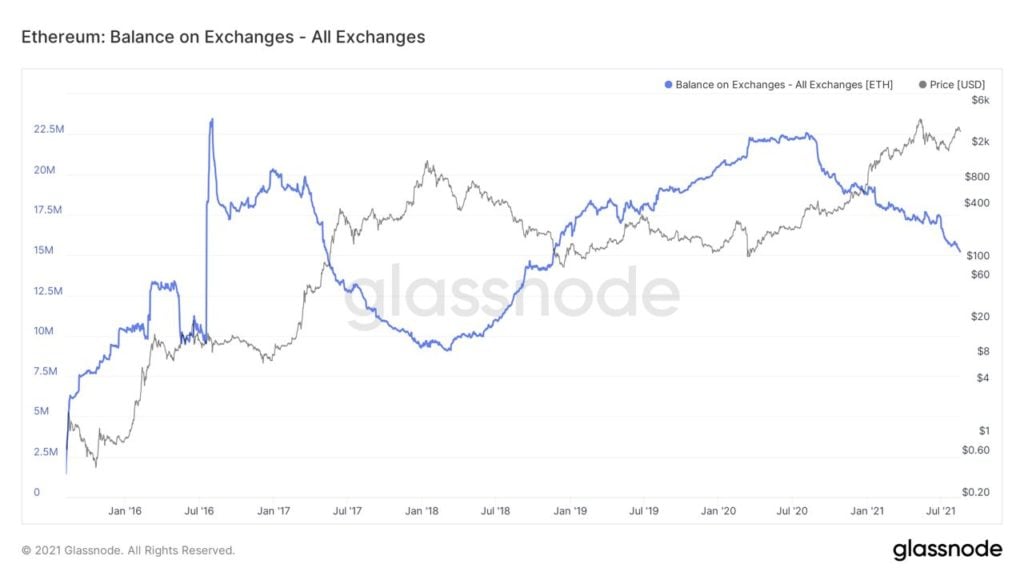

ETH reserve for all exchanges has also extended its downward trend last week, renewing a two-year low as more ETH is being removed from exchanges.

Meanwhile, staking at ETH 2.0 started to pick up pace again, with close to 250,000 units of ETH added to the ETH 2.0 pool last week. As of now, around 7 million units of ETH have been staked at ETH 2.0, representing around 6% of circulating supply, or approximately $21.5 billion.

Wrapped ether (WETH) is also getting more and more popular, holding around 6.7 million ETH, worth around $21 billion, according to around 5.5% of ETH supply. Collectively, both protocols are locking up around 11.5% of the circulating supply of ETH.

Altcoin Market Where The Main Action Was

Things are even more cheery in the altcoin space, with popular altcoins taking turns to rally. SOL and AVAX were the stars last week after both smart contract protocols announced campaigns to attract new users to their respective ecosystems.

Both tokens doubled during the week, with SOL breaking its ATH of $57 made in May to a high of $82, while AVAX saw an explosion in trading volumes as traders rushed in to chase the latest hot token. The extent of the rush was so intense that AVAX hit an extreme overbought condition, with its RSI showing 99.9 on Saturday, with a score of 100 as the maximum possible.

Even though these newer blockchains were the star performers of the week, their market cap is nowhere near the top ten, with the exception of SOL who has just made it to number 10. With four more months to go till the end of the year and a flourishing altcoin market, it is still anybody’s guess which coin will flourish next and reshuffle the top ten.

That said, the altcoin run is currently looking a little tired. Hence, most eyes might be on BTC and ETH this week to see if they manage to break higher. Should BTC manage to hold above $50,000, we could see more traders hopping onto the large-cap train while letting the altcoins take a breather to cool off their overbought situation so as to continue their run to even higher levels in the days and weeks to come.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.