It has been a really promising week for traditional markets, as well as the cryptocurrency space. Bitcoin, after a few consecutive down weeks, has sprung into action and is getting people excited again.

The major cryptocurrency looked to be in for more strife before a few key events helped it hit a short squeeze and pump from $34,000 to $39,800 late Sunday night. Elon Musk is playing his part again in the rise of Bitcoin, even through regulatory fears again.

The head of Tesla and SpaceX also helped another cryptocurrency rise — and it was not Doge. Ethereum saw an even stronger reversal from its lows, rising from a low of $1,705 to above $2,300 after Musk revealed that he also bought ETH.

Meanwhile, all three U.S. stock indices closed the week in the green, rebounding very well after Monday’s sharp sell-off. The Dow dropped more than 700 points to start the week as yields fell, unnerving equity investors about the economy. However, positive earnings numbers soothed investor’s fears and reignited their risk appetite.

Strong earnings from famous tech names like Twitter and Snap gave investors reason for optimism ahead of this week’s report from the biggest names in the sector. This week will see Apple, Facebook, Amazon, Alphabet and Microsoft reporting results. As COVID cases start to surge again, investors are piling into big tech names which benefited from a stay-home population last year.

Needless to say, with optimism in tech names, Nasdaq was the top performer of the week again, adding 2.8%. The Dow ended the week up 1% while the S&P 500 rose 2%.

Positive sentiment was helped by a recovering bond market selloff, which saw 10-year Treasury yields rising back to 1.281% after falling to a 5-month low of 1.13% earlier this week on COVID-induced fears.

Oil also rebounded from its sharp selloff early week which saw it drop to a low of $65 to recover and close above $72 as risk-on sentiment returns.

Gold and Silver remained relatively subdued all week despite the drama going on in the Oil and stock market, with Gold still plastered at around $1,800 while Silver still remaining in the doldrums after hitting $25 during Monday’s selloff.

On the currency front, last week saw the ECB’s regular interest rate policy meeting which was much of a non-event. The ECB decided to leave the interest rates unchanged as expected, with the market already in the know about the ECB’s policy stance in its strategy update meeting earlier, resulting in a muted aftermath for Thursday’s meeting. The ECB, with the exception of the RBA, is now becoming one of the most dovish central banks, and this policy divergence should see the EUR weaker against most of its peers for the rest of the year.

About the RBA, last Tuesday saw the public release of its policy meeting minutes which turned out to be extremely dovish. The Australian central bank is of the opinion that economic conditions for rate hikes will not be met until at least 2024, and remains committed to maintaining highly supportive monetary conditions. The RBA further affirmed that it will not increase the cash rate until actual inflation is sustainably within the 2 to 3 percent target range.

The AUS/USD fell to $0.73 after the minutes but recovered later to close the week at around $0.7365 after risk-on sentiment sent traders buying up the AUDUSD.

While traditional markets remain flat at the opening of the new week in Asia, the crypto market starts off with a big bang, with the price of BTC finally surmounting enough firepower power to surge 13% higher to almost touch $40,000 after internal sources from Amazon revealed that Amazon is on track to accept BTC and other cryptocurrencies for payment by the end of this year.

Crypto Started Last Week on Tenterhooks On Renewed Regulation Fears

The mood wasn’t as celebratory this time last week as the crypto market started with traders on tenterhooks as they waited for the outcome of the working group meeting about regulating stablecoins, but breathed a sigh of temporary relief after the group did not yet sound too unfriendly to the crypto market in general.

The U.S. Department of the Treasury’s Office of Public Affairs announced Monday the outcome of the meeting of the President’s Working Group on Financial Markets (PWG) which U.S. Treasury Secretary Janet Yellen has asked the regulators overseeing crypto assets to “act quickly to ensure there is an appropriate U.S. regulatory framework in place” for stablecoins.

While the USA plans to tighten laws on stablecoins, the EU also set its sights on regulation. However, it is more dirty money the EU is targeting, instead of the crypto market. The EU announced a ban on the anonymous transfers of crypto assets. Companies that transfer bitcoin or other crypto assets must collect details of senders and recipients to help authorities crackdown on money laundering.

This rule has already been applied to wire transfers and is not targeted at crypto assets in general, but a move to curb money laundering. However, with sentiment at a low, coupled with the GBTC unlock underway, the price of BTC broke the $30,000 mark to fall to a low of $29,100 by Tuesday.

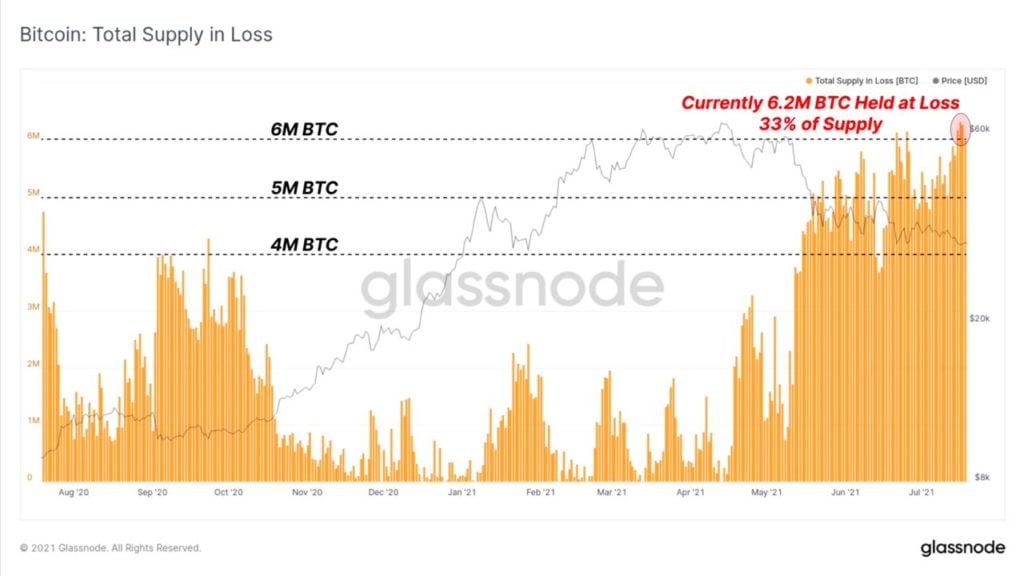

As a result of BTC’s fall, 6.2 million BTC were held at a loss, which is quite a large percentage of 33% of its circulating supply.

GBTC Unlock Did Not Crash BTC, B-Word Event Saved The Day

As the GBTC unlock went by but BTC did not witness the big selloff anticipated by some traders, the price of BTC took a break from falling and started inching higher on Wednesday as some shorts could have covered their positions ahead of the start of “The B Word” conference where pro-BTC speakers were due to explain the case for buying and holding BTC.

From a low of around $29,000, BTC rallied almost 10% to a high of $32,850 after Elon Musk said during the event that he, Tesla, and SpaceX all held BTC. Musk also affirmed that Tesla would start to accept BTC again once its environmental issues are resolved, and assured that none of his entities would be selling their BTC ever. Other than BTC, Musk also revealed that he owned ETH and of course, DOGE.

The B-word conference has begun to show its effect, as in the one-day post-event, Rapper Busta Rhymes has revealed that the conference has convinced him to hold BTC and that he will be buying ETH next. With influential figures endorsing BTC once again, the price of BTC has been creeping up, almost touching $34,000 by Friday.

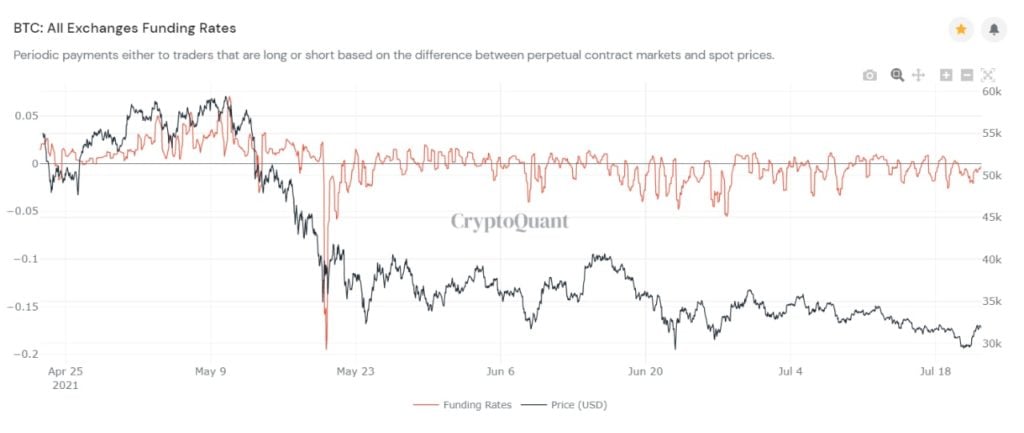

Despite BTC rising and pulling all other altcoins with it higher by around 20%, the funding rate across all exchanges remained below 0, a sign that traders were still not too convinced by the BTC rally and have not started to pile in on long positions as yet, which is actually positive since funding rates are usually taken as a contrarian indicator. This metric has once again proven itself since the price of BTC indeed underwent a large short-squeeze as price pumped from $34,000 to $39,800 late Sunday night.

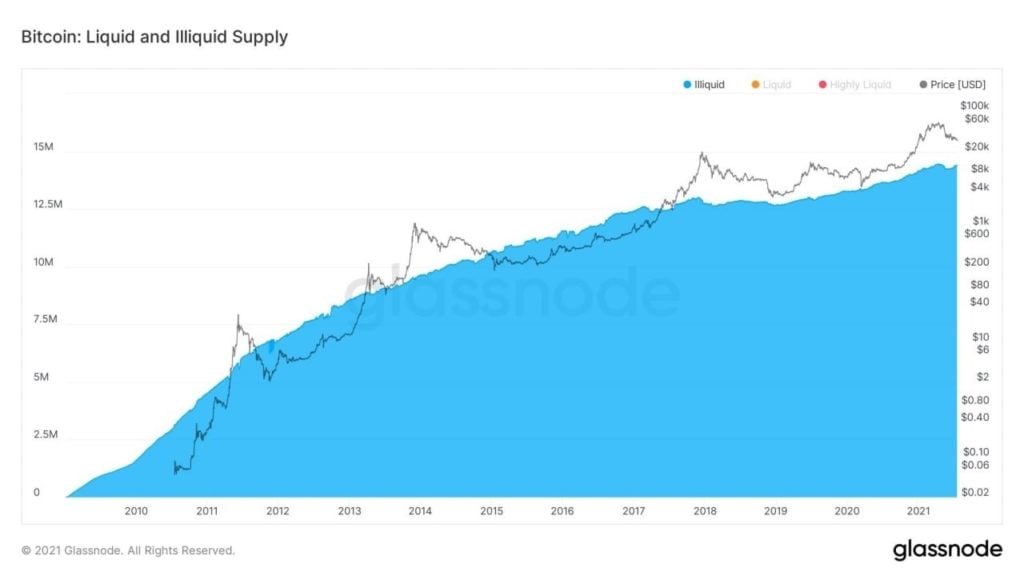

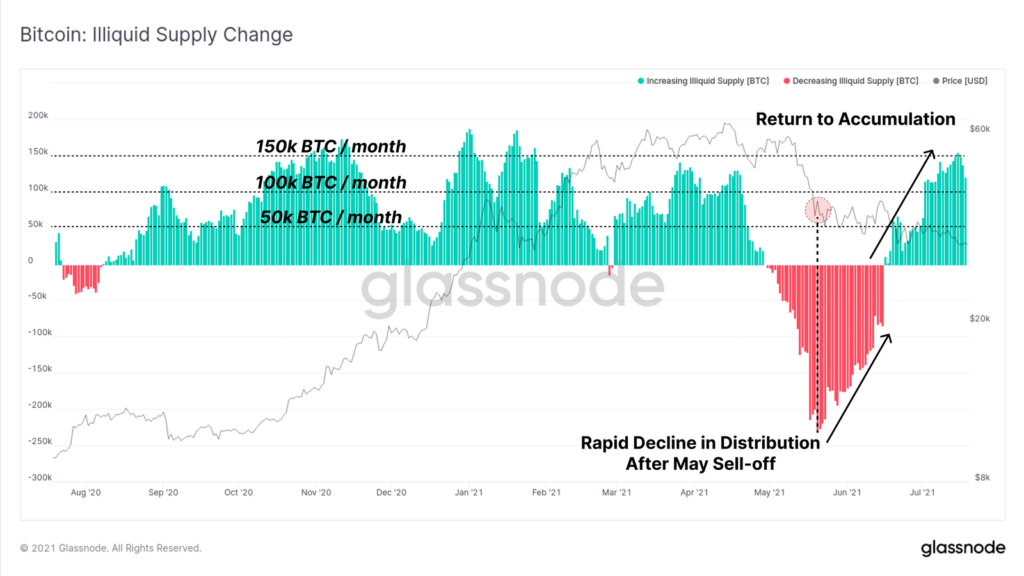

The illiquid supply of BTC is also rising again after a brief dip in May-June, which suggests that long-term holders who typically hodl instead of trade their coins are back re-accumulating BTC.

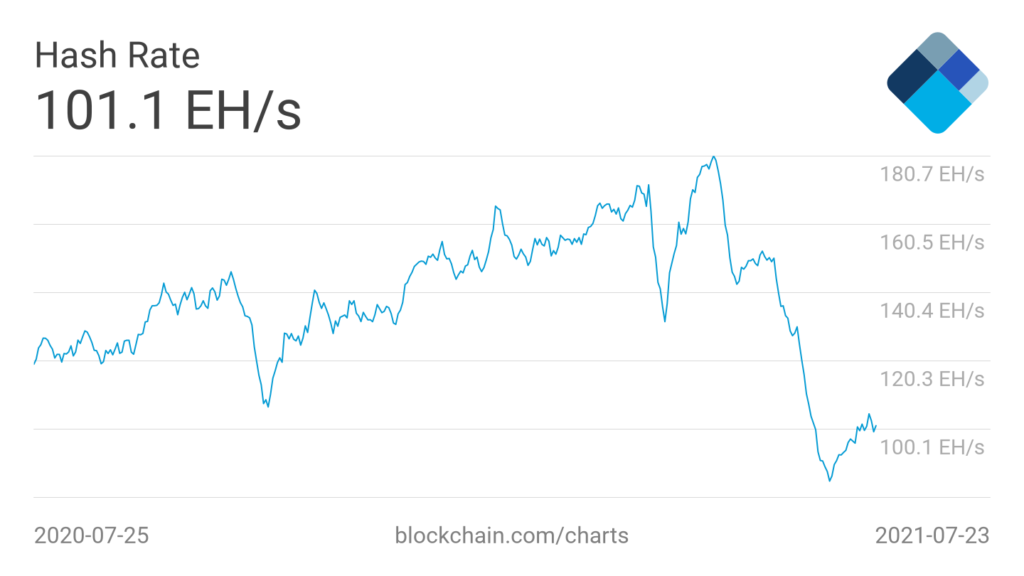

While long-term holder metrics are pointing towards re-accumulation, the network hashrate is also showing signs of recovery, albeit still a far cry from its previous high of 180 EH/s. This hashing power decrease is a result of the China mining exodus and will go back up as more of the miners restart their mining facilities elsewhere. Hence, long-term holders accumulating now seem to suggest that they are aware that this situation is temporary and are taking this dip as an opportunity to buy more BTC.

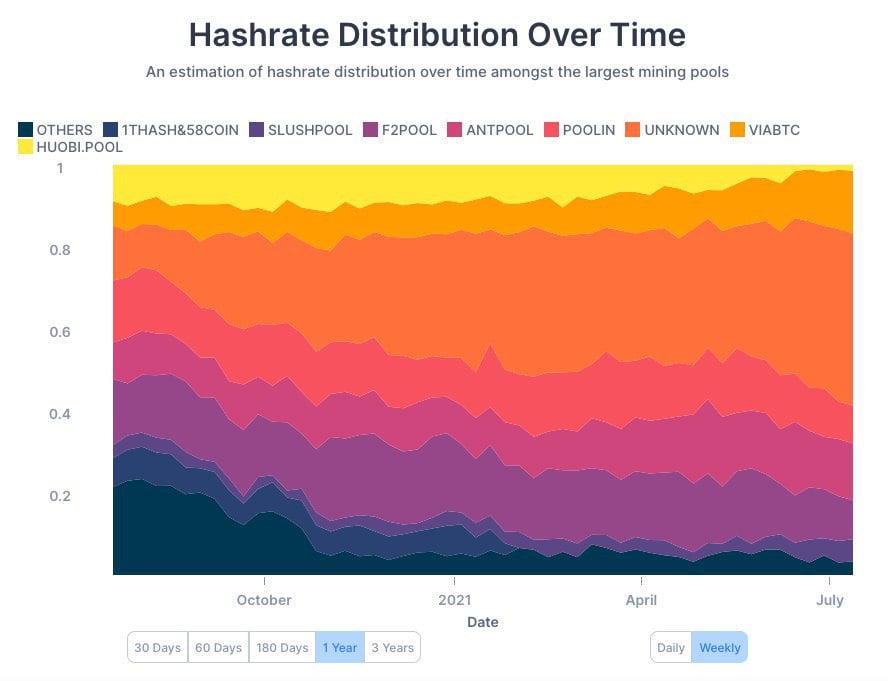

While the China mining exodus sounds bearish, it is doing much good to the BTC network for the long-term. Other than taking concentration away from China into areas that utilise more environmentally friendly resources, this exodus has given smaller mining setups a chance to join the BTC network.

The graph below shows that the share of hashing power for unknown mining pools is increasing at the expense of centralised mining facilities like Poolin. This is a great positive development for the decentralisation of BTC hash power, which will add to the security and value of the network. Naysayers will no longer be able to criticise that the hashing power of BTC is controlled by a few groups of people.

ETH Jumps After Elon’s Revelation And PoS Merge Excitement

Not to be outdone by BTC, ETH saw an even stronger reversal, rising from low of $1,705 to above $2,300 after Musk revealed that he also bought ETH. Investors are taking the chance to scoop up more ETH during the dip as more good news is being revealed by ETH developers.

On Thursday, a pull-request called EIP-3675 was created for “the merge” between the PoW chain and the new PoS chain on GitHub, formalizing the chain merge as an improvement proposal for the first time.

This brings ETH one step closer to realizing its highly anticipated proof-of-stake (PoS) transition. The EIP further notes that no safety nor liveness failures had been detected on the test chain, which means that the merge is looking good-to-go. This readiness comes as a pleasant surprise as many influential people in the ETH community, including Vitalik himself, had opined that the merger won’t happen until early 2022.

Whether or not the merger will be brought forward is becoming a hot topic and is renewing excitement among ETH supporters.

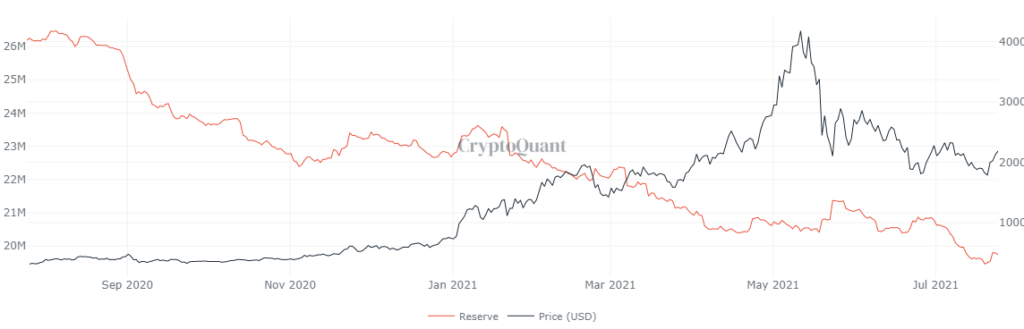

With ETH’s price recovery, some investors are sending some ETH to exchanges in preparation for sale, albeit not by a big amount. This could be a sign that some investors are still not confident about a full market recovery and wish to take the opportunity to take some money off the table.

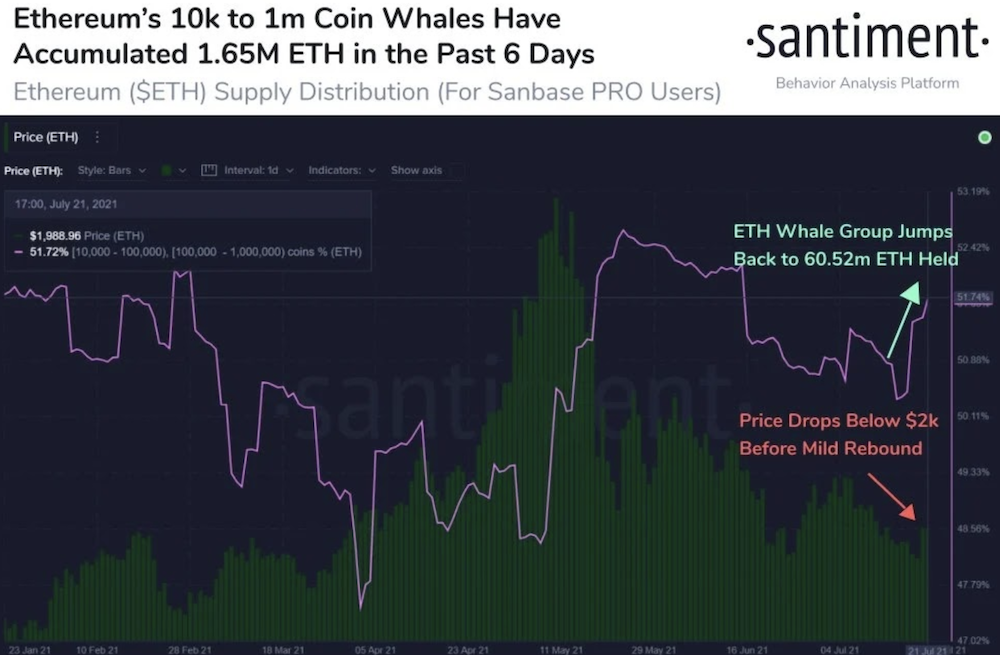

However, despite the additional bit of selling, the price of ETH remains well-bid as whales are still accumulating ETH. Data has shown that over the week, whales holding 10,000 to 1 million units of ETH have collectively accumulated 1.65 million units of ETH.

The pick-up in buying also extends to ETH investment products. According to asset management firm CoinShares, ETH-related investment products recorded inflows worth $11.7 million over the past week. In contrast, Bitcoin investment products had outflows of $10.4 million.

The recent outperformance of ETH relative to BTC has resulted in experts predicting the asset might surpass BTC as an investment vehicle. Recently, ETH received massive support after American banking giant Goldman Sachs stated that the growing popularity of ETH makes it the top contender to overtake BTC as the most valuable digital currency. However, the fantastic performance from BTC on Sunday night clearly shows that BTC is not to be easily ousted as yet.

The rise of BTC has brought life back into the altcoin universe, with many battered and bruised altcoins finally showing signs of life and are up an average 25% from the lows of last week. Could this price action signal a sustained recovery in the works?

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.