Global stocks had a bad week after the FED’s narrative turned more hawkish than the markets anticipated. US stocks, with the exception of software companies and chip makers, were hard hit, with the Dow having its worst week since October 2020, losing 3.5%. The S&P 500 went 1.9% lower, while dip buying on tech names provided some support to the Nasdaq, which was down only 0.2%.

This was not good news for crypto, or equities, commodities, oil and precious metals, for that matter, as a major sell off followed in these areas. However, at least for Bitcoin, there was some good news in the investing sphere which helped soften the blow.

In the FED meeting last week, Chairman Jerome Powell cited the rise of consumer inflation as well as consistent data pointing towards economic recovery to reveal that it might raise interest rates by the end of 2023, sooner than it originally expected. The FED now expects two rate rises in 2023, compared with none before.

This sudden change of tone took the markets by surprise, which saw equities, commodities, oil, Gold and Silver selling off. The USD and bond yields spiked up, as chances grow for the central bank to taper the vast asset-purchase program it put in place last year to keep borrowing rates low and protect the economy. Fed speaker Jim Bullard further made it worse on Friday when he signalled in a tv interview that the first rate hike could even come earlier – in 2022.

The mayhem spilled over to Europe, with even the Euro50 Index crashing 2.5% on Friday in one of its largest single-day pullbacks in recent times, dragging the EURUSD down as traders scrambled to unwind the overcrowded inflation trade to find safety in the USD.

The surprise by the FED led the USD to a phenomenal 3-day rally as the intense short-squeeze caused traders fumbling to reverse positions, with Gold and Silver not spared as Gold broke through $1,800 on the way down, falling 4.8%, while Silver fell 8% to $25.80. Both assets are beginning the new week rebounding technically after being heavily bashed down last week.

Volatility which had been missing was back with a vengeance in the currency markets, with the forex majors falling an average 2.5% against the USD. AUDUSD was one of the hardest hit, falling from $0.77 to below $0.75, losing more than 3%. The EURUSD finally came under $1.20, closing the week at $1.1850. GBPUSD fell from above $1.41 to $1.380.

Oil was the most resilient, with an expected increase in demand due to economies reopening offsetting the USD effect. Oil managed to recoup some losses inflicted post FED meeting to close the week down only 1.8% and begin the new week up 1% back to $72.00.

However, a technical rebound was nowhere seen in the stock markets with Asian markets starting the new week continuing last week’s meltdown. Japan’s Nikkei 225 Index is leading declines with an almost 4% drop and dipped below 28,000 for the first time in a month, while other parts of Asia see around an average loss of 1.5%.

Early Week Positive News Sent BTC Higher To Cushion FED Slaughter

BTC started last week on a good note by having its major upgrade called Taproot confirmed for launch in November. This upgrade will allow more privacy for users in using the BTC blockchain and more significantly, allows for smart contracts to be deployed on the BTC network.

Early week also saw Paul Tudor Jones of Tudor Investment revealing that he likes BTC and calls it a great diversifier to protect his wealth, and suggested an investor go all-in on the inflation trade (Buy Gold, Buy BTC) if the FED is not going to respond to the current rising inflation. However, the FED did acknowledge the rising inflation during the FED meeting last Wednesday, which caused the price of BTC to cave in together with the rest of risky-assets, falling 20% from its week high of around $41,000 to a low of $33,000. Jones has not yet given any public comment since the FED meeting so we have no idea if he will walk back on his take.

MicroStrategy again, never failing to make BTC headlines, is riding on the overwhelming response to its $500 million junk-bond offering, to seize the chance to accumulate more BTC “on the cheap”, the firm has offered up new shares of up to $1 billion to buy even more BTC.

The series of positively skewed news flow early week managed to send the price of BTC higher to test $41,000, but that level failed to hold as traders began to pile short positions ahead of the FED meeting on Wednesday. A sudden surge of around 25,000 BTC in short positions and another 10,000 BTC of outright sale were observed to have been opened at a large spot exchange in the hours leading up to the FED meeting press release.

Coincidentally, the FED turned hawkish and caused the price of BTC to drop to $35,000. Had it not been for the rise in price earlier in the week that built a buffer, BTC could have witnessed a worse reaction when the FED shocked the markets with their sudden hawkish narrative. BTC continues to languish from the contagion effect from the FED-shock and fell to $33,000 at one point early this morning in Asia where it found dip buyers.

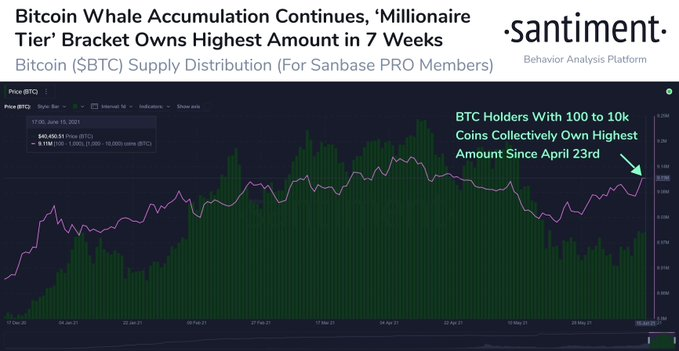

Whales Who Sold The Peak Are Buying Back The Dip

Despite the short-term bearishness, long-term BTC whales are continuing to accumulate at every dip opportunity, with wallets holding 100 to 10,000 BTC adding another 10,000 BTC last week, taking their total to around 90,000 BTC acquired since the May 19 drop. This group of whales now collectively own a whopping 9.11 million BTC, which is around 48.7% of the current BTC supply. This group of investors could have special relevance to the price trend of BTC as can be seen in the data plot below, they sold BTC at the market peak in mid-April when BTC hit $64,000, and have started buying back since the crash of May 19. Could their re-accumulation be a sign that the bottom is in? Note that their stash of BTC is back up close to their original holding before the mid-April price reversal. They now hold 9.11 million while before the crash, they held 9.15 million. Add another 40,000 more BTC and they will be back where they started while netting an almost 50% gain.

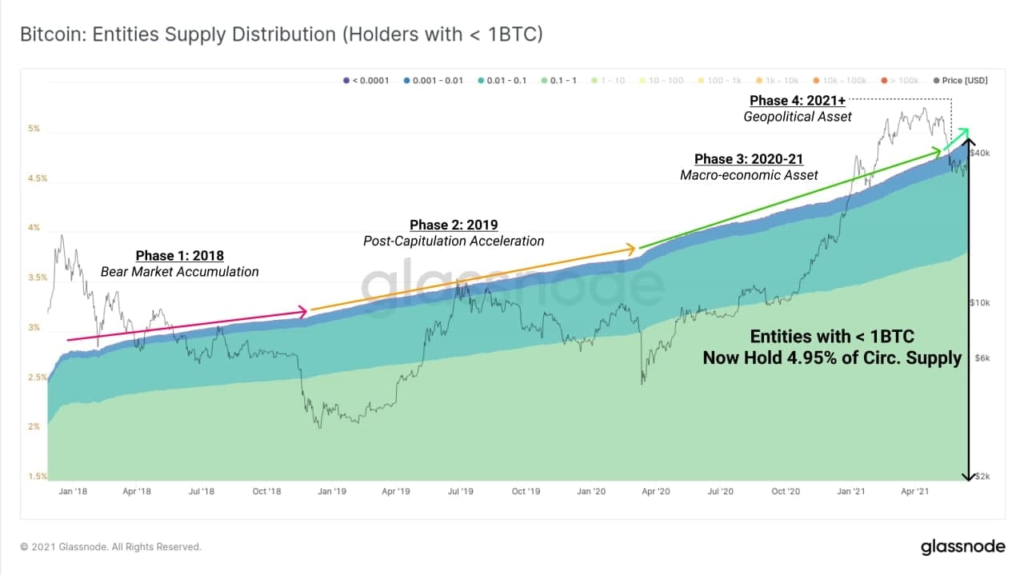

Not only whales are taking the dip to accumulate more BTC, smaller BTC investors with a long-term perspective are also seen to be adding BTC more aggressively during this dip. This group of holders now account for around 5% of the current BTC supply. Including the data about large whale holdings above, the two groups of hodlers together hold around 54% of the supply of BTC.

New Entrants Buying The BTC Dip Suggests Healthy Adoption

The dip buyers of BTC during this downturn isn’t entirely made up of the people currently within the crypto-verse as well. BTC Net Entities Growth, i.e. new BTC account growth, has seen a sharp increase of more than 100% since the May 19 dip. This suggests that new players with fresh fiat money are acquiring BTC at top speed, which does not appear like the beginning of a bear market which typically is preceded by a waning interest from new buyers.

Energy Exodus in China Sees BTC Hashrate Fall 15%

Miners also appear to be accumulating BTC, with on-chain data identifying that weekly BTC outflows from miner addresses slumped to a five-month low of around 50 BTC on Wednesday. The low outflow could be a result of Chinese miners hoarding BTC in anticipation of imminent government regulation to cease all mining activities in Sichuan, China.

The government of Sichuan, China, has formally requested power generation companies to stop supplying power to cryptocurrency mining farms there with effect from Friday June 18, which means Sichuan miners will no longer be able to earn from mining BTC until after they manage to move their facilities into another country.

While this could put a near-term dark cloud in investor sentiment, the move is actually beneficial for the decentralization of cryptocurrency mining, especially for BTC since China accounts for too much BTC hash power – around 45%. Countries like Canada and US states like Miami have already introduced programs to attract these miners to set up their facilities there to mine BTC using clean energy.

This short-term pain will open the road to a greener BTC which will definitely aid in the adoption of BTC. This is especially evident where Elon Musk has outrightly stated on twitter that Tesla will accept BTC again once 50% of the BTC hashrate comes from green energy. Over the weekend since the power cut started, the 24-hour average hashrate of BTC and ETH has fallen around 15%.

BTC moving towards green energy will also greatly encourage other countries to make BTC legal tender. To illustrate, the World Bank used BTC’s environmental issues to reject El Salvador’s request for help in execution. Hence, should the image of BTC improve with it becoming environmentally friendly, the push to make BTC legal tender would become a lot less taboo to a lot of other countries. Meanwhile, another country has pushed forward plans to make BTC legal tender.

The Congressmen of Paraguay has introduced a BTC legislation and will submit the bill for voting in July. If passed, BTC will be made legal tender in Paraguay. Paraguay has recently approved the licensing of two cryptocurrency exchanges in the country.

Overall, taking on-chain data and news events into consideration, the fundamental picture for BTC is improving even as we continue to see near-term price weakness.

Vitalik Warns About ETH2.0, Funds Flow Out of ETH

It is not just BTC that is evolving positively, as ETH will also undergo its much-anticipated London Hard Fork soon. This hard fork makes way for the impending EIP-1559 upgrade on July 14, which has been much hyped by market participants.

However, ETH founder Vitalik Buterin has warned the market not to expect ETH2.0 to be launched smoothly this soon, and expects ETH2.0 to be fully operational only in the year 2022. This warning has caused some outflow in ETH institutional investment funds last week, with ETH-fund products registering their biggest weekly drawdown of around $12.7 million amongst all other cryptocurrency funds.

This corresponded with inflows of funds into ADA and XLM of $1.7 million and $1 million respectively, while BTC-funds registered an outflow of $10 million, which is 70% lower than its outflow in the previous week, a sign of improvement.

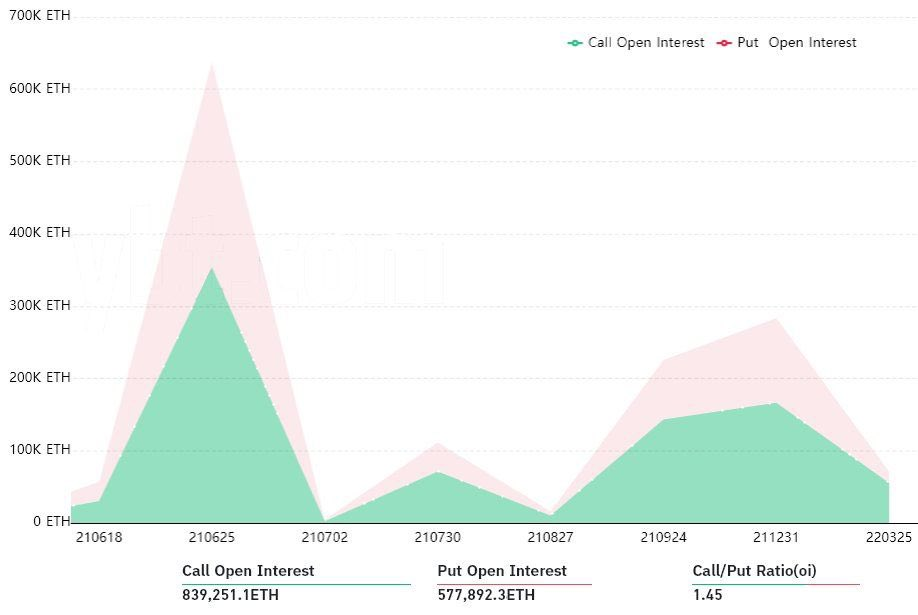

Largest ETH Option Expiry Ahead Could Reverse Price Trend

Funds could be flowing out of ETH in anticipation of another event that will be taking place soon which could pressure its price, which is the expiry of the largest-ever amount of ETH options this year. On Friday, June 25, $1.5 billion worth of open interest in ETH-options will be settled.

This figure is 30% larger than the second largest expiry on Mar 26, which saw the price of ETH plunge 17% in the 5 days prior and subsequently bottoming out at around $1,530 immediately upon expiry, after which ETH price started marching higher. Will the funds return after Friday to see if ETH charts a similar fate this time around?

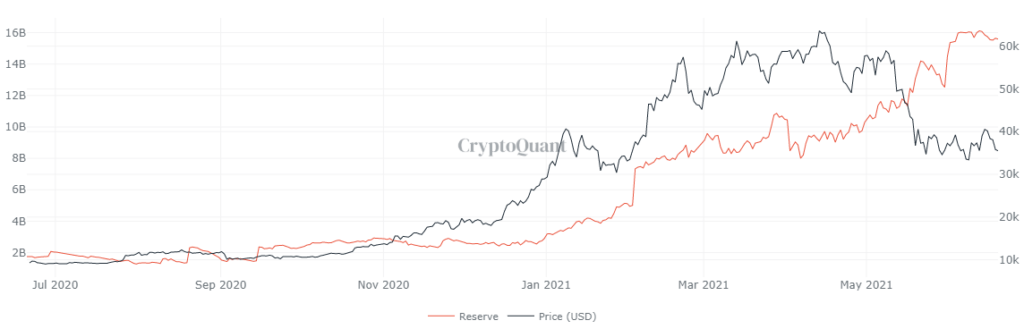

Traders Prefer Safety As Stablecoin Reserves Remain High

Altcoins continue to get battered as BTC dominance continues to increase with even a weak-looking BTC seeming to offer better protection to investors than holding onto altcoins. BTC dominance rose 1 point from 44.50 to 45.50 last week. While increasing at a lesser intensity compared with two weeks ago, this still speaks of traders finding safety in the King of Cryptos.

Other than BTC, traders are also finding safety in stablecoins. Stablecoin Exchange Reserves continue to hover at heightened levels, with almost $16 billion of crypto-native funds sitting on the side-lines in the form of stablecoins while traders await for a clearer signal as to where crypto prices could be headed before taking the plunge back into the market.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.