It was a week of two conflicting reports as the non-farm payrolls (NFP) and ADP employment report showed two different sides of the employment situation.

While the ADP employment report released on Thursday showed employment slowdown in the private sector that is worse than expectation, the NFP came in better than expected.

On Thursday, the ADP report showed that private sector employment increased by just 128,000 in May, the slowest month of growth since the pandemic, and way below expectations of 300,000. To make things worse, this was a decline from the downwardly revised 202,000 in April, which was initially reported as a gain of 247,000.

However, on Friday, the NFP increased by 390,000 in May, above the 328,000 estimate. The unemployment rate held at 3.6%, while a more encompassing jobless rate edged higher to 7.1%.

The markets were confused, albeit weaker as traders worried that the stronger jobs number would make the FED more hawkish. This sentiment was echoed in the bond market, with the 10-year US Treasury yield edging higher to close above 2.9% after falling for two weeks.

All three US indices thus finished lower by the end of the week. The S&P fell 1.2%, while the Dow and the Nasdaq each lost nearly 1%.

Gold and Silver were flat, finishing the week right back to where they started. The main mover in the market was Oil, which has broken out strongly after a two-month consolidation.

EU leaders, in a meeting last Monday, finally agreed in principle to cut 90% of oil imports from Russia by the end of 2022, resolving a deadlock with Hungary over the bloc’s toughest sanction yet on Russia since the invasion of Ukraine three months ago. Oil jumped on the news, as worries of a tighter market already strained for supply amid rising demand ahead of peak US and European summer driving season could be made worse by the new sanctions.

The latest OPEC+ meeting for June ended with the cartel agreeing to increase output, with the boosts however, to include countries like Russia and Nigeria who are unable to raise production. In other words, the increase in output is mere lip service to appease the USA who has been urging OPEC+ to raise output for months.

As China lockdowns ease and the EIA reported a fall in US Crude Oil inventory again, the price of oil shot even higher near the end of the week, with Brent Crude now trading above $120, having gained 4.6% over the week. WTI Crude also moved higher, gaining 3.5% for the week to close at $118.85. Today, Oil prices jumped around 0.8% higher in Asian trading after Saudi Arabia announced that it would raise oil prices effective July. At this point, it would seem like only a recession will be able to bring down oil prices.

Cryptocurrencies, known for their high volatility, was stuck in a tight trading range again, not being able to sustain a move on either side. BTC ended the week at around $29,500 after failing to hold on to its early week gain which saw it move above $32,000. However, crypto prices have edged higher over the weekend after rumours emerged over large BTC buy walls seen at several crypto exchanges. BTC has since bounced back up to around $31,000 at the time of writing, while altcoins are seeing average gains of between 5% to 10% on Sunday. Whether this buoyancy can continue would depend on how the markets react when the US stock market returns.

Use BTC and US Indices correlationMiners Set Bearish Tone By Selling BTC

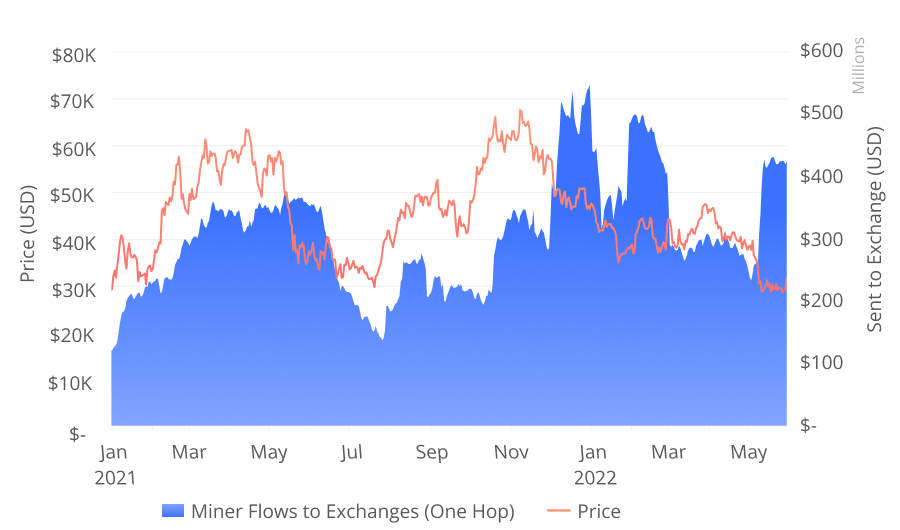

Miner flows to exchanges have reached their highest point since January, a sign that miners are trying to sell away their mined BTC. With the dip in BTC price, profitability of BTC miners is affected and many could be selling their BTC as soon as it is mined to pay operating expenses. Miners who have expressly revealed their sale include:

Core Scientific, the world’s largest BTC miner by hashrate, has already sold some of its mined BTC this year and plans to continue doing so. Previously confirmed to be a long-term holder, Riot Blockchain, has also reportedly sold nearly half of its mined BTC in April after having also sold a sizable amount in March.

Cathedra Bitcoin, in a May 30 statement, said it sold 235 BTC during the month in a move to raise liquidity and “insulate” itself from further price declines. The company also had a tough April, operating at 45% of expected hashrate throughout the month due to storms affecting its North Dakota site.

Marathon Digital, at its earnings call in early May had suggested that it may sell some of its BTC. Toronto-based Digihost, also said it sold off a portion of its mined BTC to help fund energy costs. Many BTC miners preparing to sell their more of their BTC would inadvertently put a downward pressure on its price.

As power cost continue to rise, and as the price of BTC remains weak, some miners may be forced to shut operations since the mined BTC is unable to pay for the operation. In time, this could affect BTC’s hash rate. In a nutshell, the situation revealed by BTC miners is not bullish.

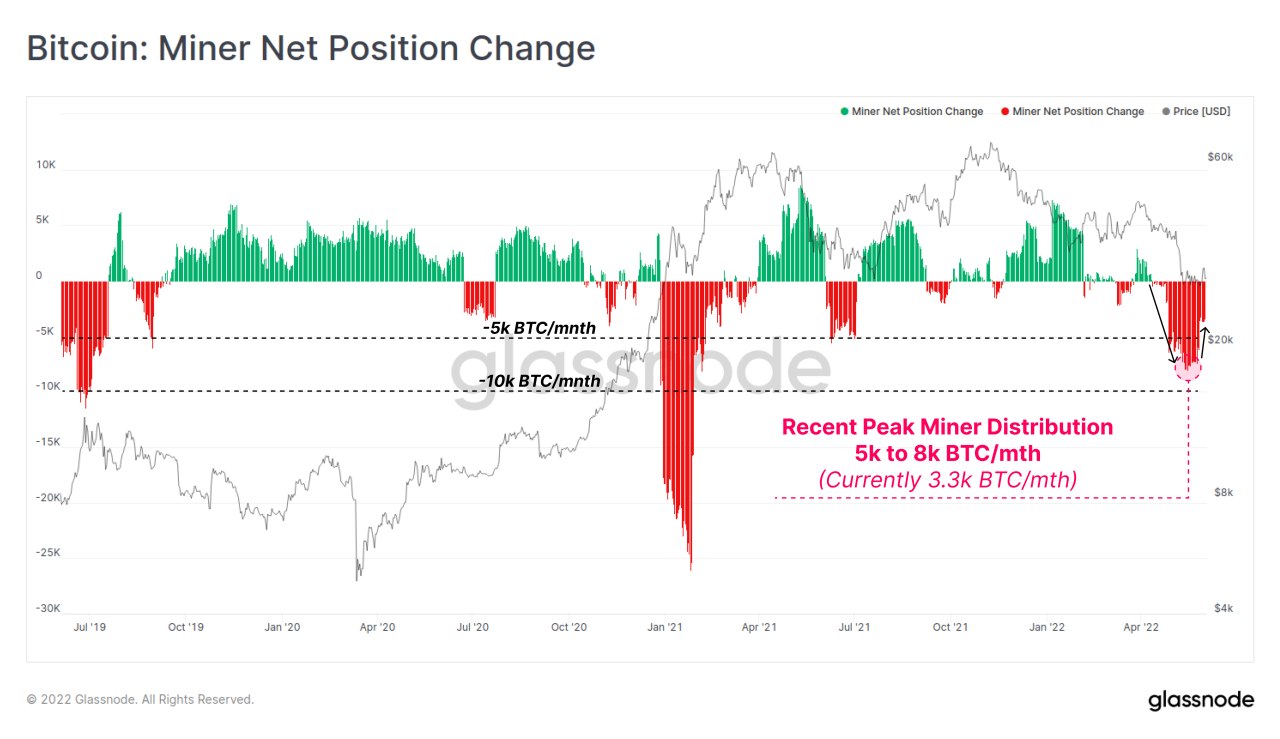

A look at the Miners Net Position Change proves that miners have been selling during the current consolidation, with peak selling of around 8,000 BTC in May. Moving into June, that pace of selling appears to be cooling off, with a projected 3,300 BTC being sold in June should their current pace continue.

That said, the miners selling currently could have a bigger psychological impact than actual price impact as their selling sizes is not big relative to the amount of buying in the market. Thus, BTC miners selling is negative because they are considered as “insiders” in the space, and not necessarily that the number of BTC they sell would be so large that it could crush the price of BTC.

BTC Accumulation Picks Up Pace

As mentioned above, buyers are absorbing whatever BTC supply miners are selling quite well. Even though it may be many months before the bull market resumes, dip buyers continue to mop up supplies of BTC.

From the UTXO Value Band of large BTC holders with more than 10,000 BTC, we can see that a mid-bear market accumulation trend is ongoing with these large whales, who are taking the market dip to buy more BTC. The rate of increase in the accumulation is even higher than that experienced in May 2021, and comparable with that experienced during the July 2014 to January 2015 period of bear market.

Once this rise in accumulation starts to reverse, when the whales finish accumulating and start to slowly sell, the market could resume its next bullish move.

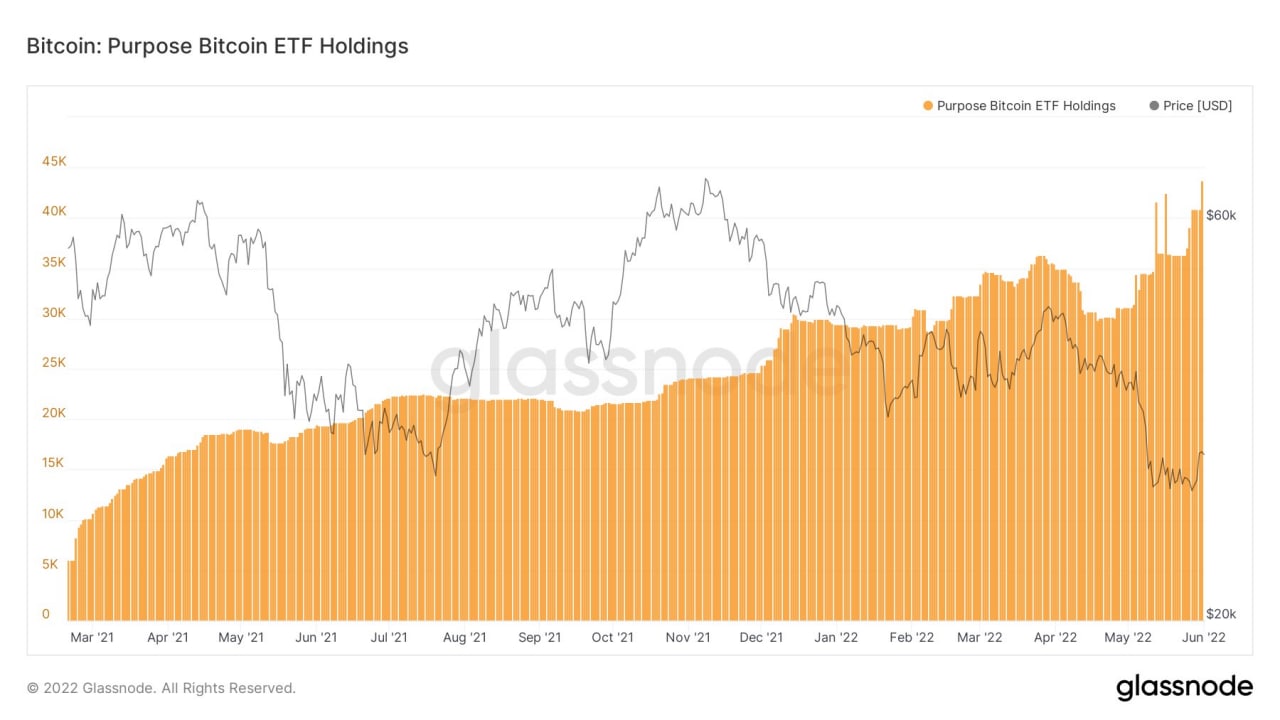

Another buyer of BTC in the dip is from Canada – the Purpose BTC ETF. The ETF has continued to add BTC into June, with the total AUM now at a historical high of 43,700 BTC.

BTC Entering Capitulation Zone

As the battle between bulls and bears continue, it is a good idea to analyse the long-term holder SOPR, which plots the profitability of BTC sellers. The current price weakness has caused some LTHs to begin selling at losses, which is historically a good gauge to determine whether a period was a good long-term buy. A SOPR of below 0.8 is typically viewed as a good entry point, while a SOPR level of around 0.5 would signal a bottom. As the diagram suggests, the current SOPR has just begun to fall below 0.9 and looks on track to be heading lower. Thus, this may suggest that the best entries would be within the coming one year as the SOPR has a record of staying in the “attractive” zone for up to one year after falling into the zone.

ETH Exchange Reserves Rise A Sign For Caution

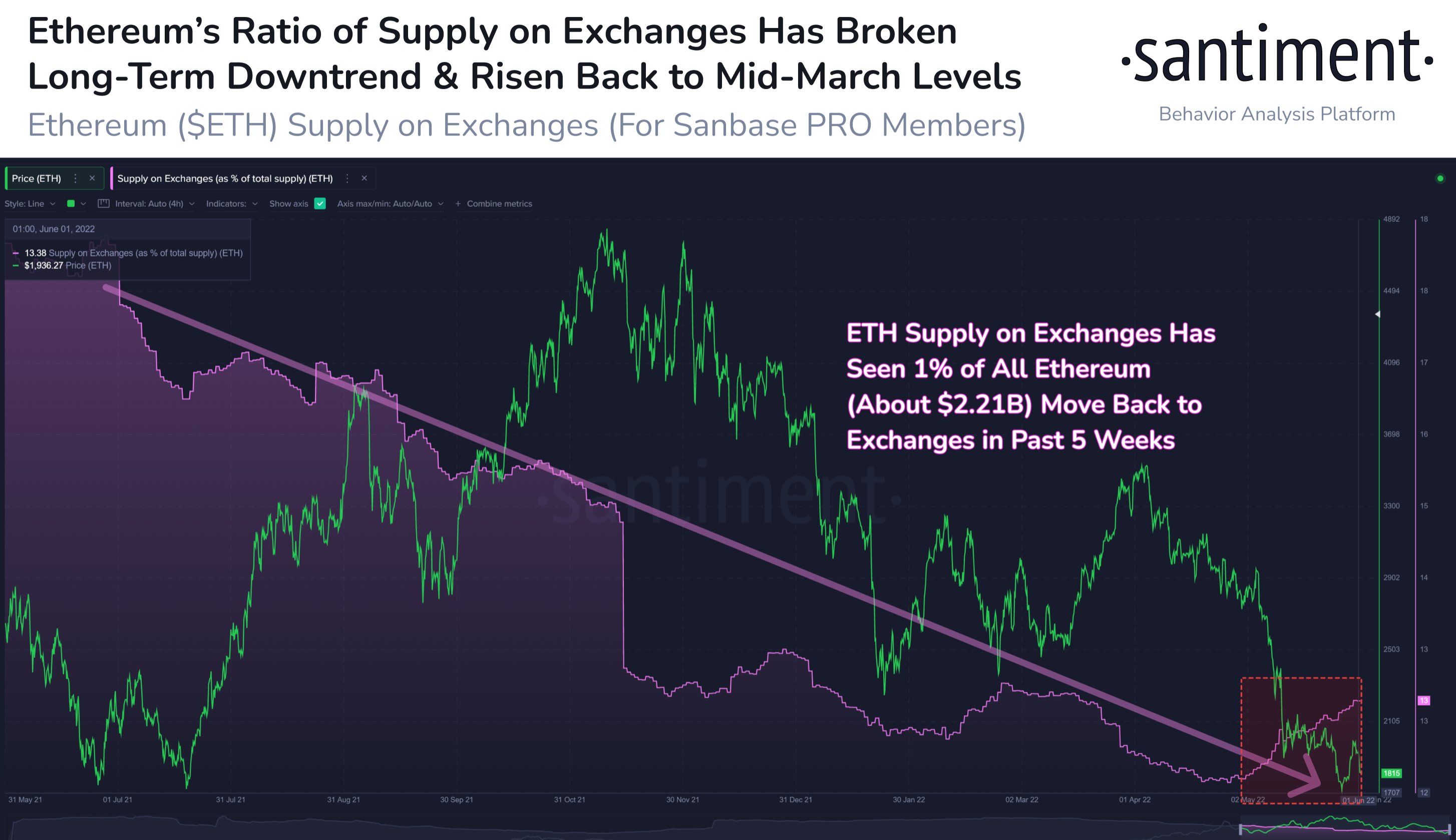

While LUNA had to dump more than 80,000 BTC which crashed its price, the related loss of faith in DeFi gave ETH an even bigger damage, as ETH tanked around 29%, much more than BTC’s 16% fall in the month of May.

After a long period of falling exchange reserve, ETH saw deposit inflows to exchanges beginning early May. The 2-year downtrend of ETH reserves at exchanges was finally broken in May after around $2.21 billion worth of ETH moved back to exchanges, which coincided with a large fall in the price of ETH. As the ETH reserve on exchanges continues to climb even after a large fall in price, more downward pressure could be forthcoming as this shows that a consistent number of ETH has been sent to exchanges in preparation for sale.

TRX Becomes Safe Haven While SOL Gets Battered Due To Another Breakdown

Tron has gained 45% in TVL in the last month and is currently ranked third behind ETH and BNB. In contrast, other blockchain TVLs have fallen by 30% to 60%. The reason why Tron chain is making good traction is due to USDD, an algorithmic stable currency launched by Tron.

Tron’s native token TRX has seen its value rise in tandem with the TVL. According to data, TRX is trading for $0.08 after rising by over 24% within the last 30 days, even as the rest of the market continues to dip. The USDD stablecoin is different from Terra’s UST in that while TRX needs to be burnt to mint USDD, there is no corresponding mechanism that permits the TRX token to be sold for redemption of USDD, which was the mechanism in UST that killed the price of LUNA. Hence, TRX could continue to see inflows as a defensive play as more investors may stake their USDD to gain some yield during this market downturn. However, investors into the Tron stablecoin may need to be aware that there could still be a chance it could blow up when stablecoin regulation by various countries come into force later this year.

While TRX has appeared to be a key beneficiary of the market downturn, another wildly popular blockchain has got its native token nosediving last week due to yet another breakdown.

SOL suffered a major global outage again last Wednesday, its second in a month, resulting in the network halting its activities temporarily. The network outage lasted for nearly four hours and caused the price of SOL to dump 13% in just 12 hours. While the network has resumed running again, the price of the SOL token has not recovered and may continue to drift lower as both investors and users who have lost confidence in the project leave the SOL ecosystem.

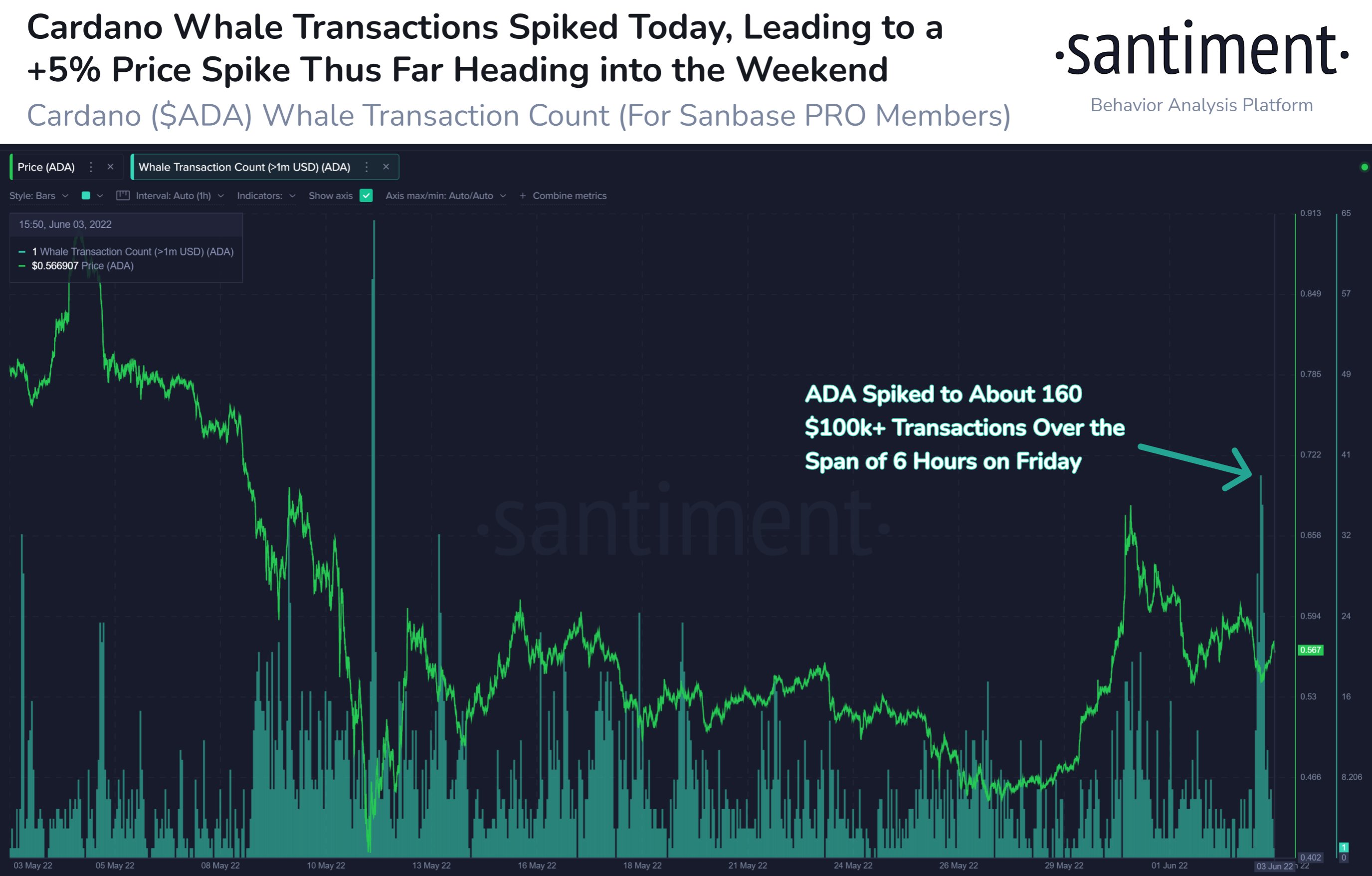

On the other hand, another popular token that many critics said would die, ADA, saw a price rise on Friday after a series of large whale transactions within a span of 6 hours. The last time whales accumulated ADA hugely on a downswing in May, prices jumped 28% in the span of 18 hours.

Crypto Regulations Start Streaming In

As expected, countries have started regulating cryptocurrencies. Early week came good news from Russia that it would allow the use of cryptocurrencies for international payment, but not for domestic payments.

Then, on Friday, came news out of Japan, where its parliament passed a bill that clarified the legal status of stablecoins, defining them as digital money. According to the new law, stablecoins must be linked to the yen or another legal tender and guarantee holders the right to redeem them at face value. The legal definition effectively means stablecoins can only be issued by licensed banks, registered money transfer agents and trust companies. The status however, has failed to address existing centralised stablecoins from overseas issuers like Tether, or their algorithmic counterparts, which will likely not come under the purview of the law and their users may thus not have protection by the state.

The USA and the EU are the next highly expected regions that will impose tougher stablecoin regulations.