Early last week, crypto was mired in news of 2 tranches of 5,000 BTC each being moved around. However, the BTCs did not end up in exchanges but went to other addresses, which possibly meant that those BTCs were sold via OTC to new hands. This was positive news in that the BTC not being sold at exchanges would not cause the market price of BTC to dip.

Further to this relief, the persistent negative funding rate also provided some support to crypto prices, letting BTC catch some breather back above $20,000 and ETH above $1,500.

New Whales Support BTC Price

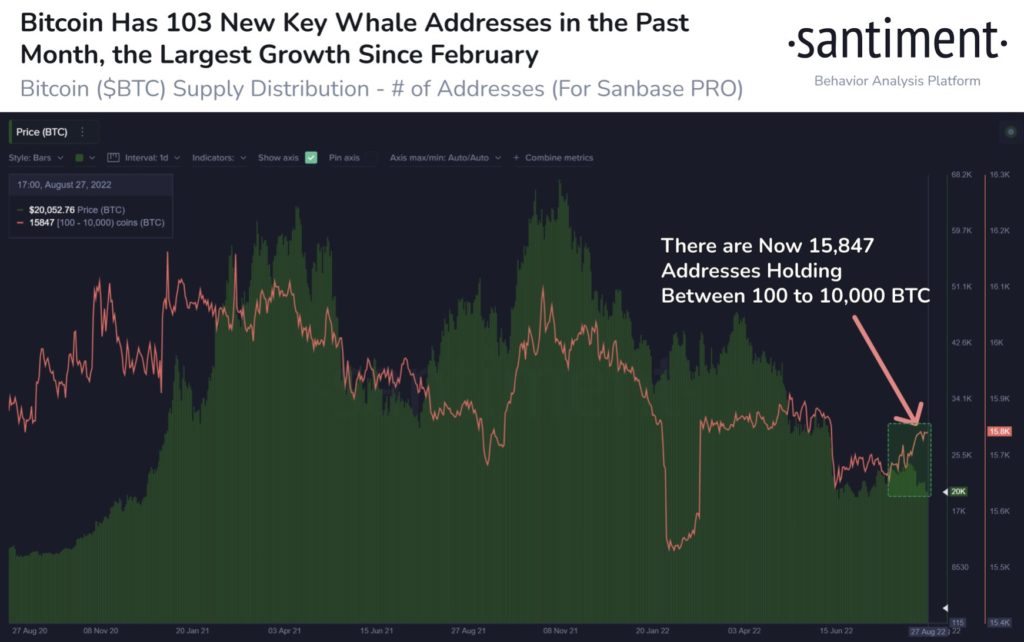

New whale accumulation also helped prices, with BTC welcoming 103 new whale wallets containing at least 100 BTC compared to the week before, showing that new dip buyers are still plentiful, mopping up BTC whenever a good opportunity avails.

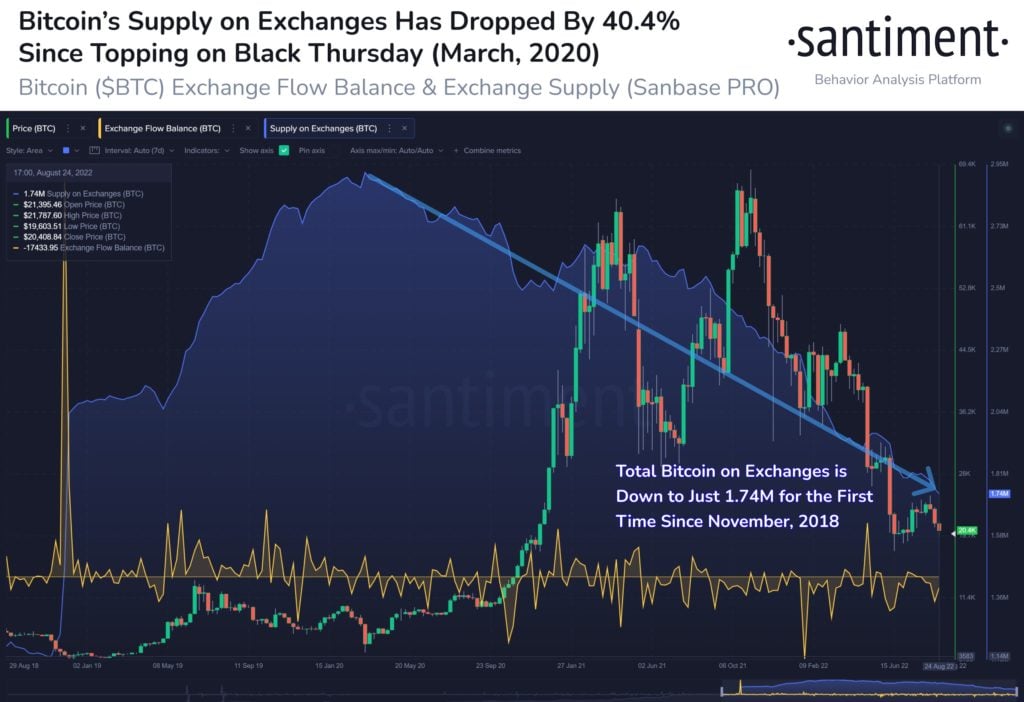

This string of new whale accumulation has been reinforced by a drop in the supply of BTCs on spot exchanges, confirming that buyers are continuing to use the dip to accumulate more BTC.

The number of BTC on exchanges has fallen to levels last seen during November 2018, which was at the middle of that bear market cycle, in line with our current status quo.

Interestingly though, while the end of the 2018 bear market was marked by an increase in BTC supply on exchanges, during this cycle, the supply on exchanges has been falling regardless of how price does. This shows a hodler trend which is consistently reducing the circulating supply of BTC available for trading. Will this trend cause BTC’s price in the next bull run to rise substantially more? Only time will tell.

How to buy crypto with Visa and MasterCard?

However, the price of BTC could not muster enough momentum to edge past $20,500 eventually, showing that bulls were lacking in strength in the midst of a declining macro-economic environment for the crypto market as global central banks press on with tightening monetary policies.

Could Mt Gox Send BTC to New Low?

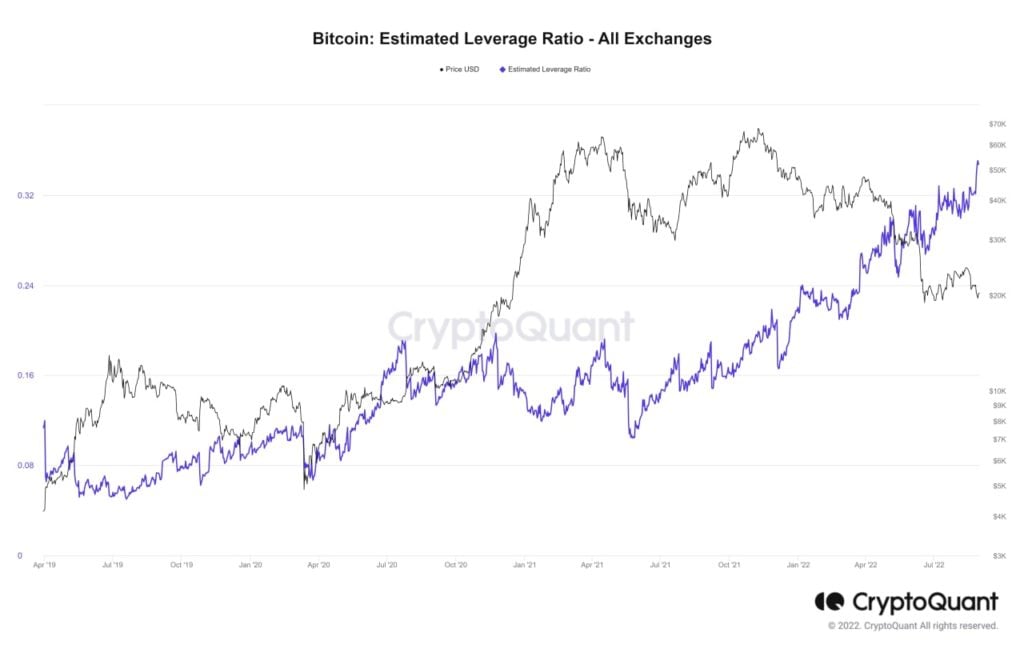

The BTC leverage ratio rising to yet another ATH is another not-so-healthy sign as it shows that traders are piling into derivative trading in the futures market, instead of the spot market which would have a more sustainable price impact. Excessive leverage in the market would make traders vulnerable to price squeezes as these unsustainable trades always get liquidated by sudden sharp price moves. In this case however, it is unknown which side most of the leverage trades are, hence it is not possible to determine if a long or short squeeze would materialize.

However, crypto prices retreated on Friday after the release of the US non-farm payrolls number, as the data showed a stronger-than-expected labor market. Fed Chair Powell had mentioned that the Fed would look at the jobs market and the CPI number to determine the magnitude of the rate hike in its upcoming September 21 meeting. Hence, this strong number has given Fed officials the greenlight to hike another 75-bps.

On top of such a negative macro-economic factor that is pinning down the price of crypto, BTC is up against another setback as the date of the distribution of around 137,000 BTC from Mt Gox has been set to begin on September 15. While the papers have mentioned that the distribution would be in tranches and be expected to complete only at the end of this year, nothing has been said about how many BTC would be distributed per tranche. This unknown is giving crypto investors a new thing to be concerned about.

September 15 To Be Crypto Apocalypse?

Interestingly, the September 15 date happens to be the day of the ETH Merge as well. This coincidence has set off a series of conspiracy theories as to what would happen to the crypto market that day. Thus far, most theorists are bearish and expecting the crypto market to crash that day. However, as most experienced traders are aware, whatever that is most expected to happen often does not, and September 15 could turn out to be a non-event after all. That said, it may still be prudent for traders to mark out this date on your calendars.

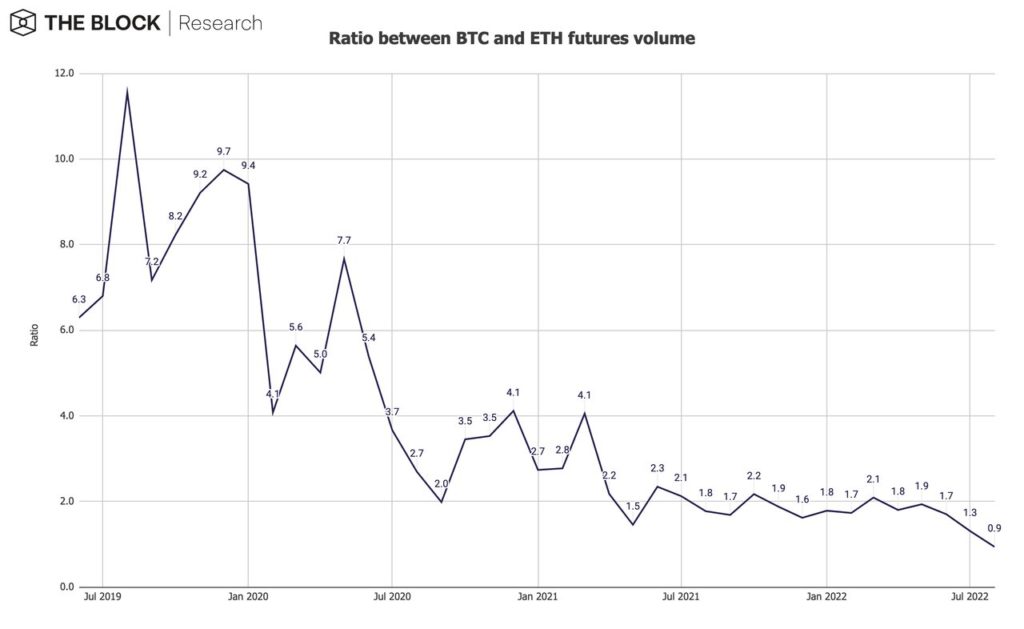

In terms of positioning and trading volume, as traders prepare for the upcoming “apocalypse” in ETH as it undergoes the Merge, futures basis as well as futures trading volume on ETH has surged, possibly because of traders staying long in the spot market to qualify for the forked tokens, while also hedging their bets against a price fall by shorting in the futures market.

The rush into this trade has gotten so intense that for the first time in history, the futures trading volume for ETH has surpassed that of BTC. With this trade so crowded, do not be surprised that something unusual happens on September 15 that causes a squeeze to happen.

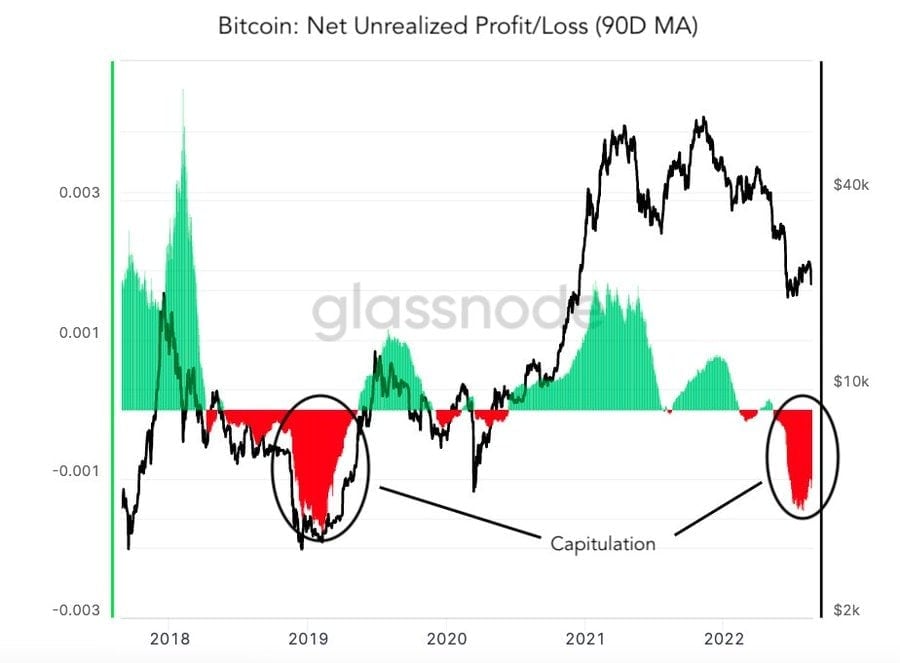

BTC NUPL Nearing 2018 Peak Loss

After mulling on conspiracy theories, let us come back to reality and examine facts.

On a longer-term perspective, the BTC net unrealized profit-loss indicator is showing that long-term holder loss is nearing levels last seen during the worst drawdown in the 2018 bear market. This could imply that BTC is nearing its cyclical bottom, which may be just inches and weeks away. While it is possible that BTC holders may not realize as bad a loss as the 2018 cycle, the current net unrealized loss needs to continue reducing for another couple of weeks before we can say with more confidence that the current downtrend could be over.

While the crypto market remains locked in range searching for a direction, traders who are at a loss as to what to trade could consider trading in the traditional asset classes as some solid moves were seen in the equities as well as currency markets. These asset classes are available on the PrimeXBT platform too and you can trade them the same way you would trade crypto.

USD/JPY Thrusts Above 140, Highest in 24 Years

Coming off the heels of the hawkish Fed, US stocks dipped again since the beginning of last week, with the non-farm payrolls beat on Friday not giving any respite to the markets. This was the third consecutive week of declines for the US stock indices.

The Dow and S&P lost roughly 3% and 3.3% respectively, while the Nasdaq fell 4.2%, losing for the sixth consecutive session. Investors displayed uncertainty ahead of the Labor Day long weekend after the non-farm payrolls showed that the US economy added 315,000 jobs for August, a tad above consensus estimate of 295,000.

While the number was a beat, it was not significantly above consensus, which caused the USD to dip slightly as traders closed positions ahead of the long weekend. Yields dropped a tad and the DXY dipped from the week’s high of 110 to 109.60, although they are still much higher than at the beginning of the week.

The USD was still the king of the week, gaining against most of its peers. The USD/JPY pair broke the 139.60 previous high and was shooting towards 141 before profit-taking after the NFP release brought it back down to close the week at 140.20. Despite the slight pullback, this level is the highest since September 1998 and underpins the interest rate disparity between the USA and Japan, which is still adopting an accommodative stance towards interest rates, causing the yen to weaken against most of its other currency counterparts.

This week, attention could move to the EUR/USD as the ECB is widely expected to hike rates in its policy meeting this Thursday. The EUR/USD could get a temporary respite from falling against the USD should the ECB hike more than expected. However, with the European economies almost coming to a halt due to the massive power crisis that they are facing, any bounce in the EUR/USD could be short lived.

Needless to say, Gold and Silver dipped as the USD rose. Gold lost 1.8% and Silver dropped 5.55% after renewed lockdowns in China again sparked fears of a widespread slowdown in global economies. Both metals are a tad weaker in this new week even as the USD remains on the softer side.

The China lockdowns did even more damage to Oil than they did to Silver, which lost a whopping 7% average last week. Brent lost 6.5% and the WTI slid 7.5% even after factoring in their early week rises as the fear of a global slowdown brought oil prices back lower again. US Crude Oil inventories reporting a surprise increase in the middle of last week also did not help prices. This week, however, Oil’s direction could depend more on supply side factors as OPEC+ meets on September 05 to decide on oil production quotas. Oil is slightly higher at the open of Asian trading today in anticipation of possible production cutback news out from the meeting, gaining around 1.6%.

In this holiday shortened week, economic figures out of the US are not as critical, but the CPI numbers set for release on September 13 will be widely scrutinized as that is the last important set of numbers the Fed will be watching before its September 21-22 interest rate meeting. Coupled with the September 15 key date for the crypto market, traders may not need to wait long to experience excitement as the calendar appears to be shaping up for a volatility filled week of September 12 after this week comes to an end.

With funding rates in crypto remaining slightly skewed to the positive side, there could be a chance that the price of crypto starts dipping even ahead of next week as tense traders exit the market. However, clarity in the crypto market’s direction may only come after Tuesday when the US traditional markets return from Labor Day.