Bitcoin fell last week, with risk assets falling across the board as the market weighed up hotter-than-expected US inflation data, intensified geopolitical tensions in the Middle East, and looked ahead to next week’s halving event.

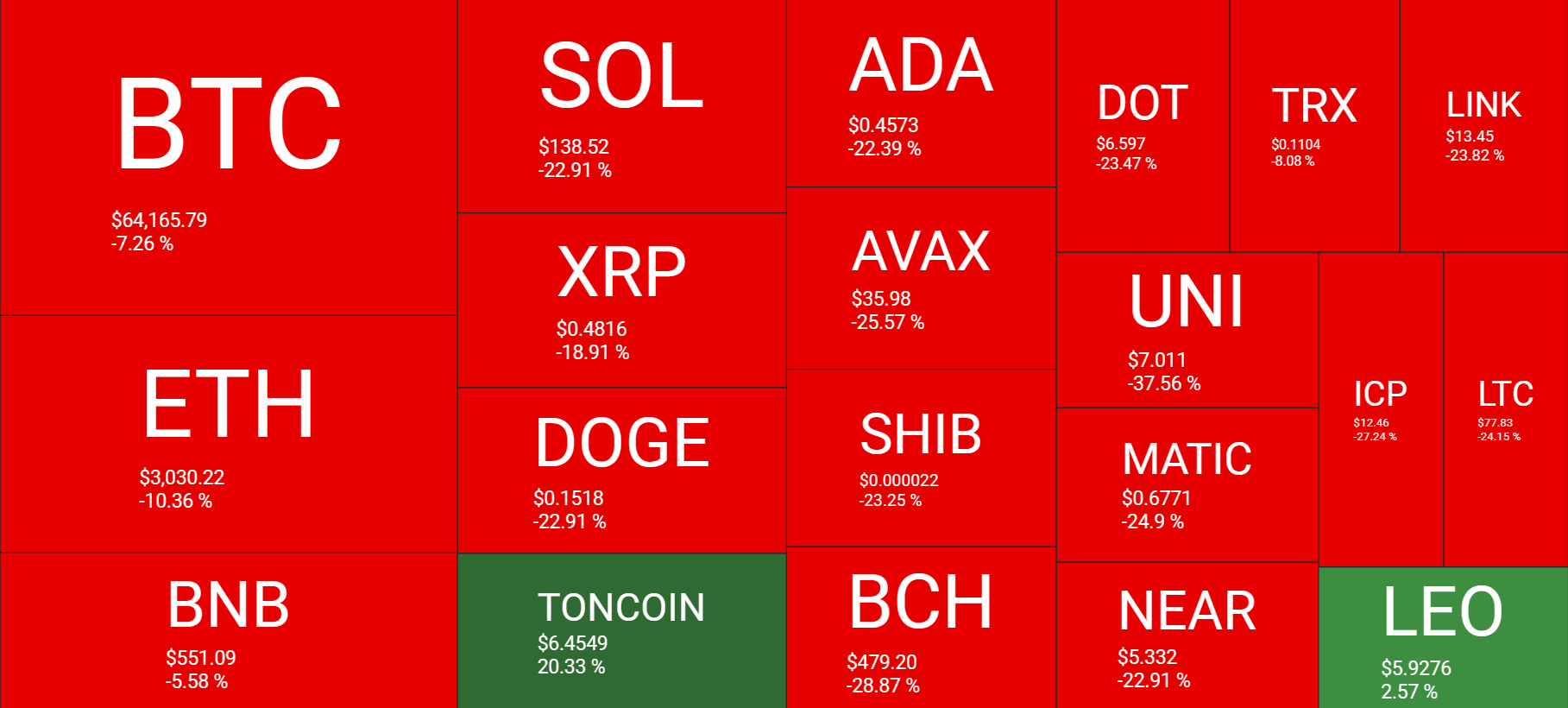

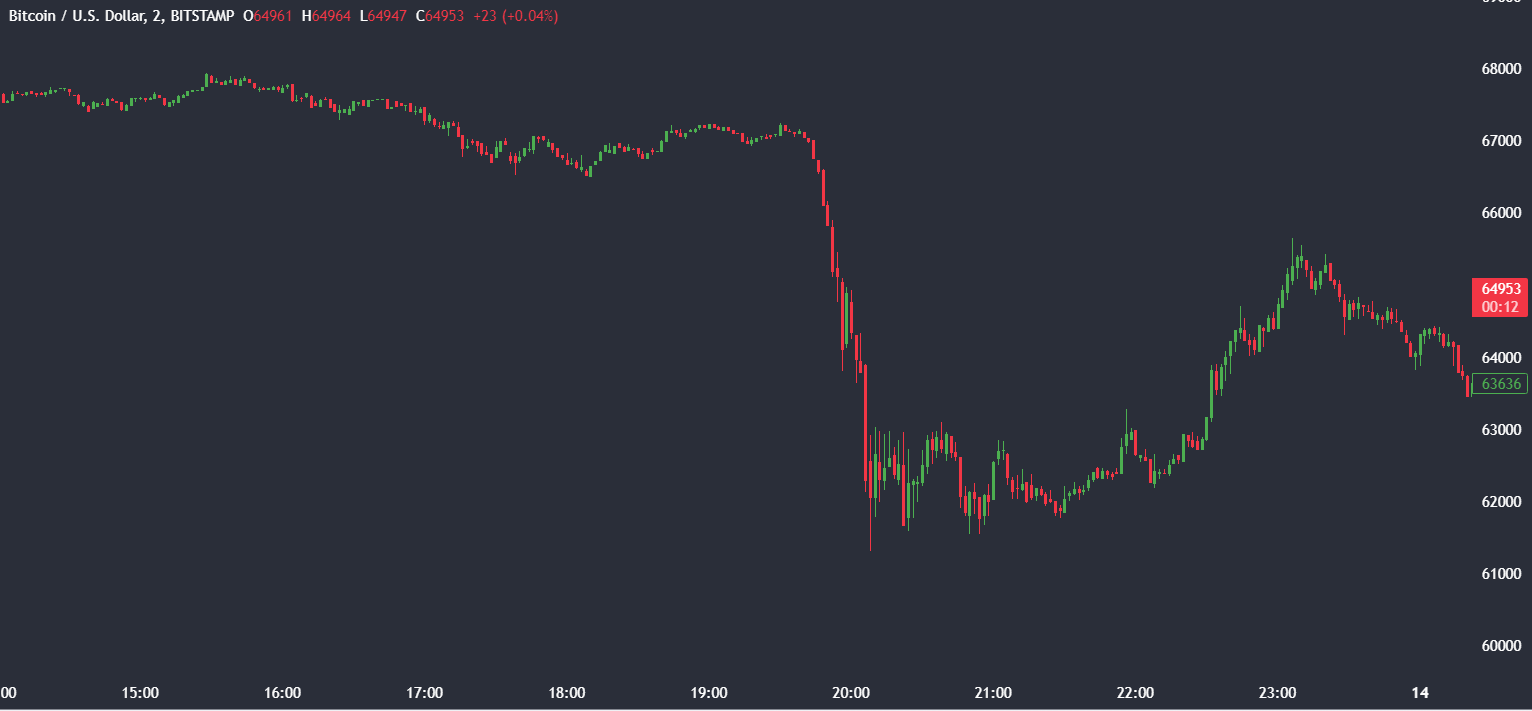

Bitcoin dropped 7% through the week. After rising to a peak of 72,750 on Monday, BTC/USD quickly gave back those gains, falling to a 3-week low of 61,300 on Saturday. The selloff was seen across the cryptocurrency space, with the heat map showing a sea of red, except for Toncoin and Leo, which booked gains.

While Bitcoin fell 7%, Ethereum dropped 10%. However, Uniswap and Bitcoin Cash saw the biggest selloff, which fell almost 30% as altcoins bled out.

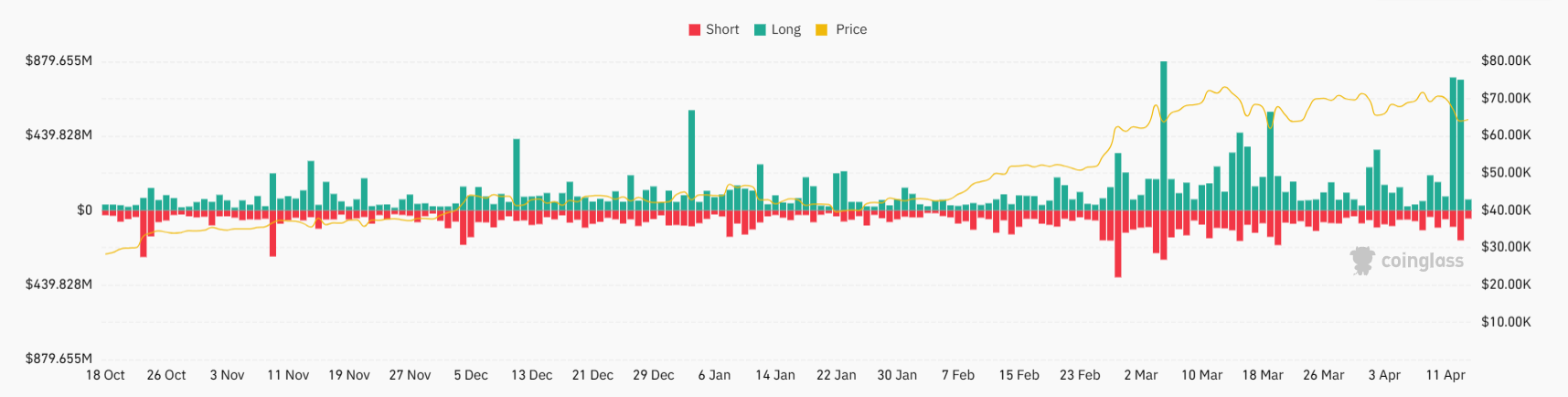

Liquidations

Bitcoin briefly dropped by the most in over a month, triggering a string of liquidations in speculative crypto positions. Data from Coinglass showed that around $780 million worth of bullish crypto and bets had been liquidated in the past 24 hours. This marks the most significant drop in a month after financial assets were unnerved on Friday by a flare-up in geopolitical risks. As the cryptocurrency moved with its correlation to risk assets, a slight decline quickly turned into a sharp fall in liquidations.

Caution amid elevated Israel – Iran tensions

US inflation rose for a third straight month, coming in above forecasts, casting doubts over the Federal Reserve’s ability to cut rates anytime soon. Following the data release, the USD rallied to a five-month high, and risk assets such as cryptocurrencies and equities came under pressure. The prospect of high interest rates for longer means financial conditions will remain tighter.

In addition to inflation data, concerns over geopolitical tensions escalating in the Middle East also hit risk sentiment on Friday. They knocked Bitcoin, the only market open, further over the weekend.

Tensions between Iran and Israel ramped up this weekend after Iran launched attacks against Israel. Bitcoin fell on the news before pairing some of those losses. There was no loss of life and limited damage, this was more of a symbolic move by Iran.

US President Biden’s comment that he would not support any Israel counterattack appears to have calmed the market, with Bitcoin recovering from its low and back above 65,000. The market will be watching closely to see whether Israel responds and if there is a further escalation that could hit risk assets such as cryptocurrencies and equities. Meanwhile, gold surged to a record high on Friday on safe-haven inflows.

Nerves before Bitcoin halving

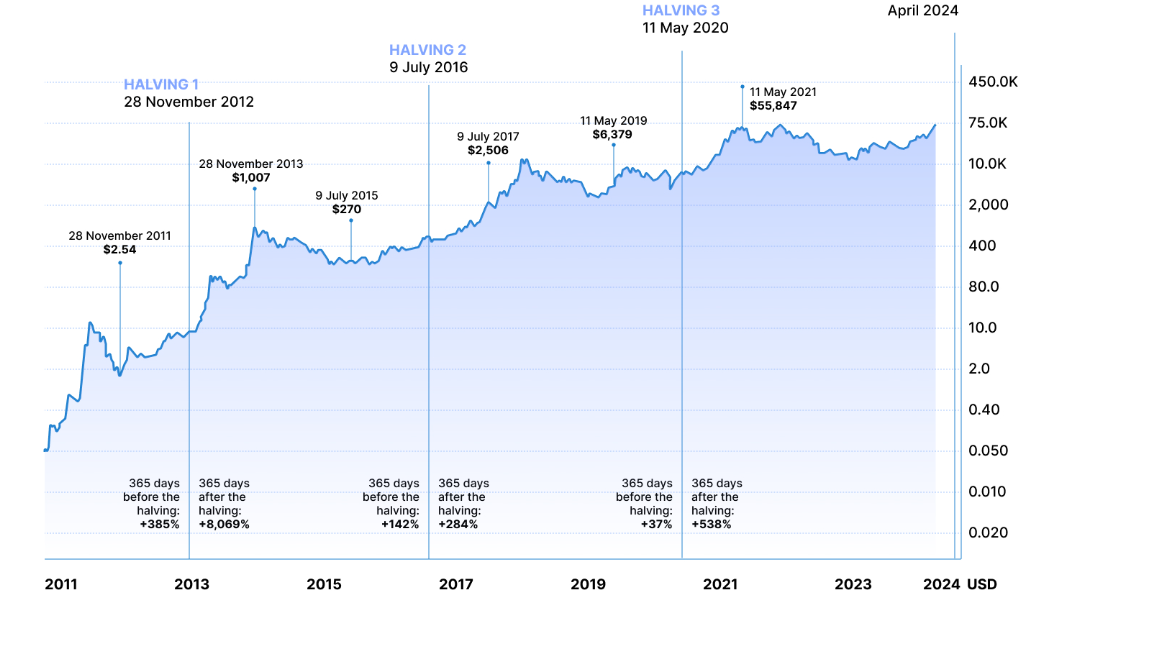

The fourth Bitcoin halving is less than a week away. As with the previous three halving events, it will reduce Bitcoin rewards for miners by half. This time, the reward will fall to 3.125 BTC, down from 6.25 BTC. While considering the price action surrounding past halving cycles can offer some insight into the potential price action, the market’s dynamics have changed with the approval of US spot Bitcoin ETFs.

The multi-billion dollar net inflows in three months have altered the landscape. Major institutional players can now be exposed through ETFs, so Bitcoin’s response to the upcoming halving event could differ from previous cycles.

Interestingly, according to data on sentiment, social media mentions Bitcoin, so the amount people are talking about the cryptocurrency has fallen over the past 30 days, down 22%. This is most likely due to all the hype and chatter around the all-time high, which was happening in early March leading up to the peak, but could also be due to rising uncertainty surrounding Bitcoin. The Bitcoin price action shows a 6% decline over the past 30 days, although most of that selloff has been over the past 7 days.

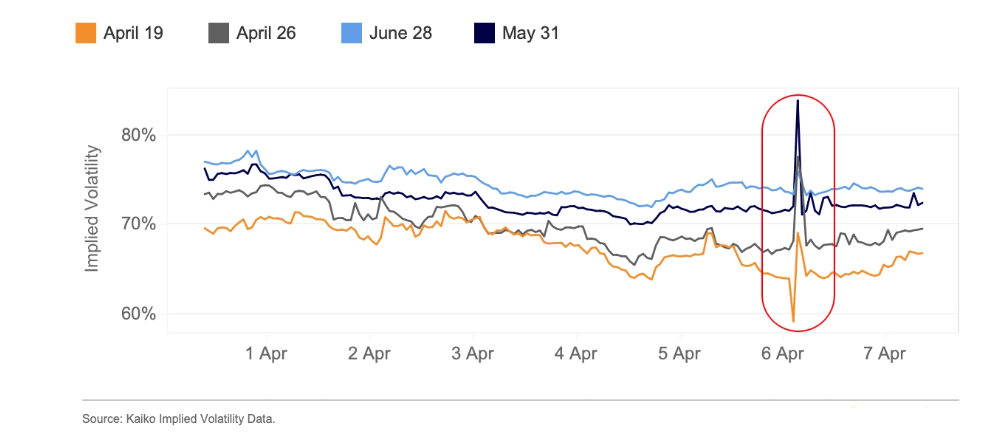

One of the options markets’ closely watched indicators is flashing signs that speculators are getting nervous ahead of the Bitcoin event.

Implied volatility for Bitcoin options jumped, reversing a downward trend in the prior week.

Implied volatility rises when traders are usually willing to pay more to protect existing positions or to speculate on possible price moves either up or down.

Implied volatility on contracts expiring over the coming two weeks has risen from 59% to 71% in just two days, suggesting expectations for near-term volatility.

Bitcoin ETFs could be approved in Hong Kong

Hong Kong regulators are expected to approve the first set of applications for spot BTC ETFs next week, meaning the product could be ready to start trading this month.

This would be just days before the Bitcoin halving event, which is set to cut the issuance rate of BTC.

The potential approval could attract more buying demand for Bitcoin by offering exposure to retail and institutional investors in Hong Kong.

The approval of spot ETFs in Hong Kong could catalyse Bitcoin’s rally after its initial approval. Hong Kong-based ETFs will only add to institutional demand and inflows already created by US ETFs.

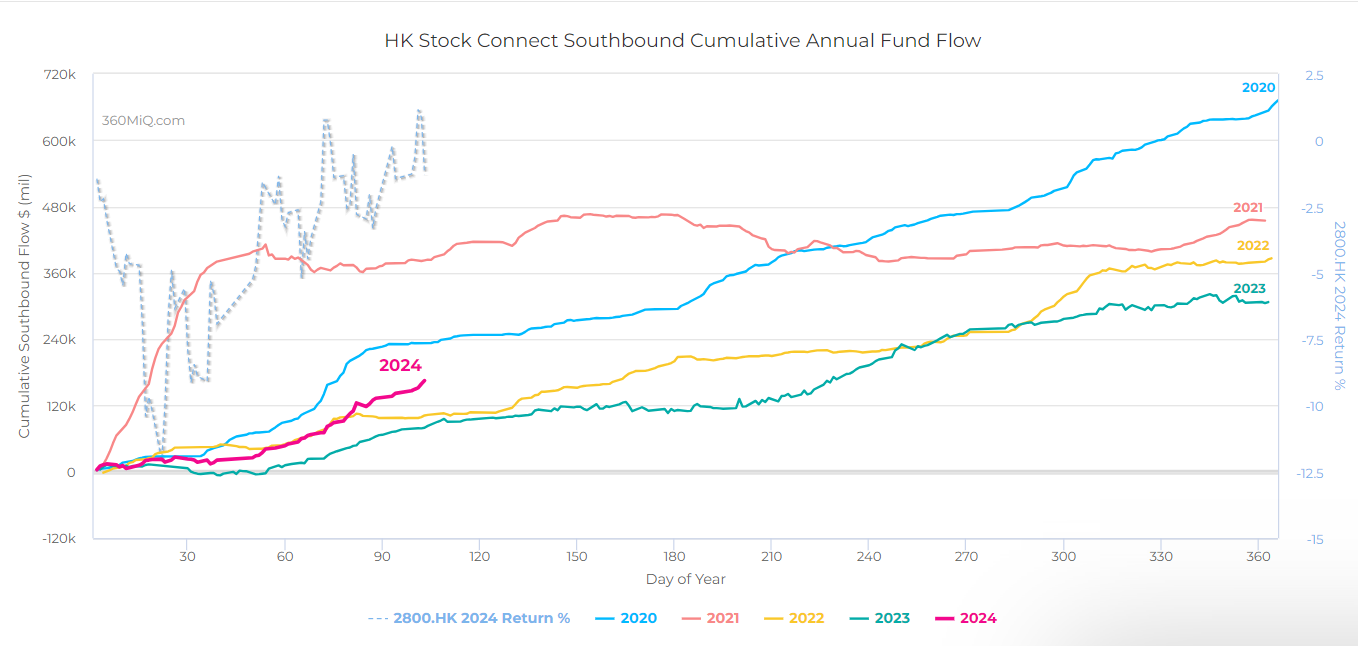

This investment vehicle could unlock up to $25 billion in demand for Chinese investors via the Southbound Stock Connect program. The Southbound Stock Connect allows mainland Chinese investors to access eligible shares listed in Hong Kong.

According to data from 360MarketIQ, flows in the past three years have fallen and fallen short of the limit of $15 to $25 billion, meaning that there is a potential in quota left for bitcoin ETF investment flows without restriction.

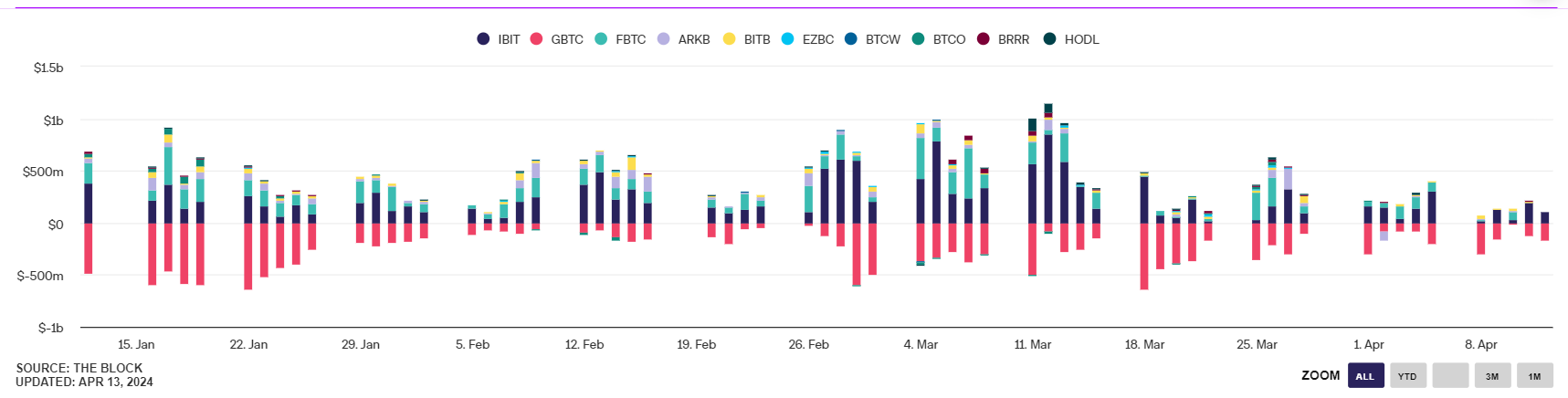

The news comes as US Spot Bitcoin ETFs saw cumulative trading volume surpass $200 billion this week, just three months since its approval. US spot BTC ETF trading volume has nearly doubled in the last month after trading volumes crossed $100 million on March 7.

Overall, flows to the spot Bitcoin ETF have slowed since peaking at daily net inflows of $10.5 billion on March 12. Grayscale continues to see net outflows.

Toncoin outperforms

Toncoin, the cryptocurrency developed by Telegram, has been a standout performer this week, gaining ground while other meme coins have fallen sharply. Over the past seven days, it has surged over 35% and booked 190% YTD gains.

The surge in interest in Toncoin has pushed its market capitalization upwards to above $19 billion. This makes Toncoin the 10th largest cryptocurrency by market cap.

Recent interest in Toncoin has come as Telegram introduced a new ad payment system supporting Toncoin payments. This has boosted demand for Toncoin and sentiment towards the coin.

Rumors of a potential IPO for Telegram have added to the bull case for Toncoin. According to a report by Business Insider, potential investors have offered the company a $30 billion valuation.

Stocks steady after last week’s loss, earnings season ramps up

Stocks fell sharply last week after US inflation data came in hotter than expected and on worries over escalating geopolitical tensions in the Middle East.

At the start of the new week, the market mood is still jittery after weekend news was dominated news of tensions between Israel and Iran.

The risk off mood appears to have been calmed by U.S. President Joe Biden telling Israeli Prime Minister Benjamin Netanyahu that the US will not take part in a counteroffensive against Iran. These comments appear to have eased market fears at the start of the new week.

Oil prices are trading lower in Asia, but WTI still trades up 19% year to date. Further increases in oil towards $100 a barrel is going to be unwelcome news from central bankers as they battle inflation.

While geopolitical politics is likely to set the tone for the week, there is plenty of economic data for traders to watch, including China’s Q1 GDP and UK inflation.

US earning season is also underway after banks JP Morgan, Wells Fargo, and Citigroup disappointed investors on Friday. This week, Goldman Sachs, Bank of America, and Netflix are among those updating the market.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.