The week in crypto started with a bang, with the price of BTC continuing to break higher immediately once the traditional markets opened on Monday as the spot BTC ETF flows increased to a $600 million average per day, $100 million higher than the $500 million average seen in the week before. This shows that the supply shock is intensifying, with at least 10,000 BTC being lifted off circulation by the ETF buyers everyday, while miners could only produce 900 BTC a day, which will be further reduced to only 450 a day after the halving. With the halving just a month away, this FOMO to buy has manifested itself very strongly last week, as upon the break of the $53,000 resistance on Monday, the price of BTC went vertical, surging around 20% only over a couple of days.

To add to the FOMO, BTC Permabull, MicroStrategy, last week revealed again that it has acquired an additional 3,000 BTC for $155 million at an average price of $51,813 per coin. As of 25 February, MicroStrategy holds 193,000 BTC acquired for around $6.09 billion at an average price of $31,544 per coin. Interestingly, the price of BTC did not dip as was customary after each MicroStrategy purchase announcement in the past. The price of BTC continued to surge on Wednesday until BTC hit $64,000 before an outage at several crypto exchanges caused a flash dip to occur, dropping the price of BTC from $64,000 to a low of $58,000. The huge volatility on both sides liquidated around $350 million worth of both long and short positions, one of the highest amounts of liquidation in recent times.

Another key phenomenon of last week’s trading was the surge in the price of several older memecoins, led by DOGE, which surged by more than 50% last week. The move by DOGE led to a series of large price increases by all other memecoins, which saw up to 100% price increases within a couple of days as the memecoin pumps start to bring in a new batch of retail investors, which have largely been missing in action throughout the BTC rally last year.

As it is, at the start of this new trading week, BTC’s price is attempting to break the recent high of $64,000. Should last week’s momentum persist into this week, we are likely going to see a new ATH achieved this week.

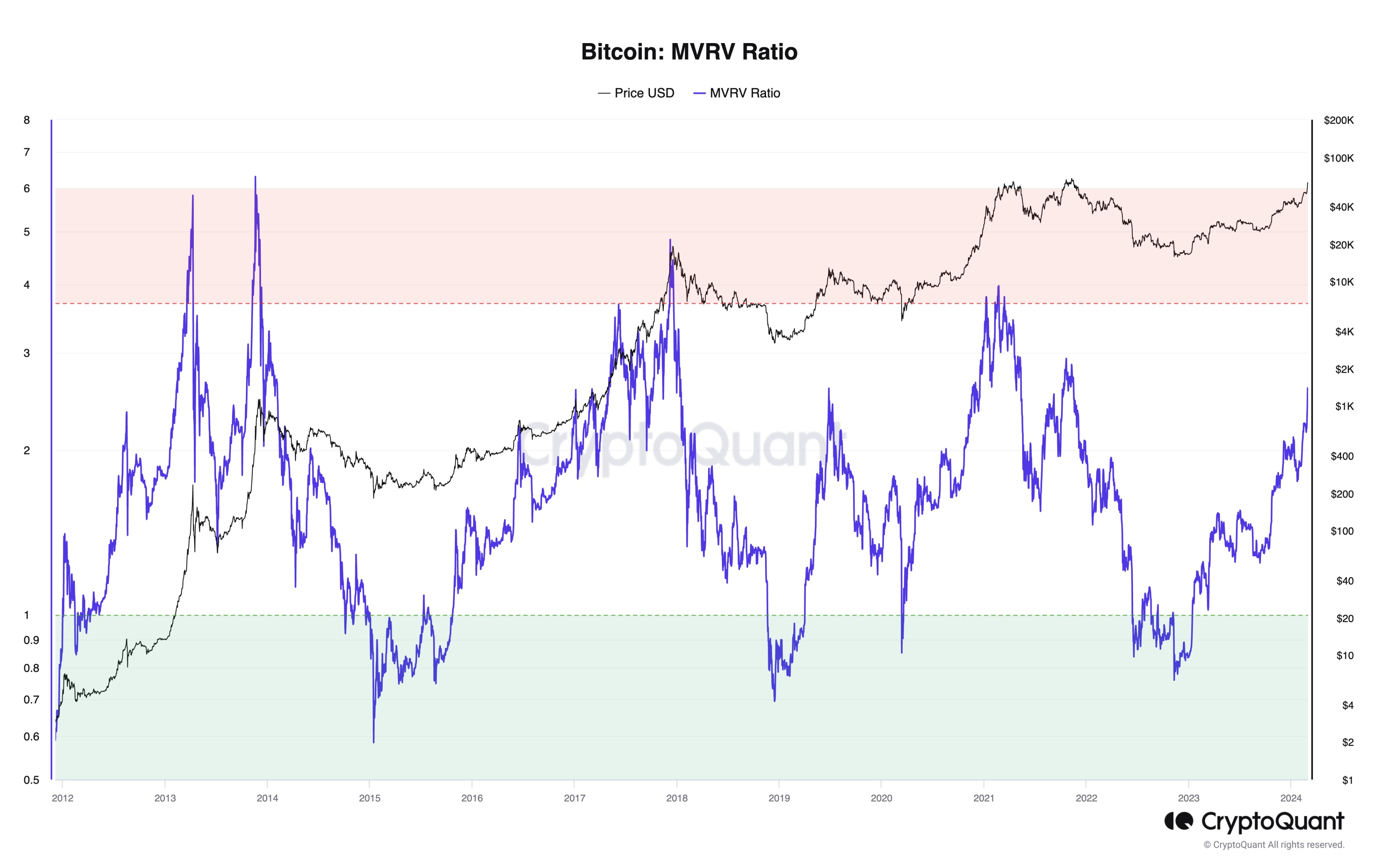

BTC MVRV ratio suggests huge run imminent

Even as the price of BTC shoulders on without a deep pullback, a check on the BTC MVRV ratio suggests that we are still far from a blow off top, as the MVRV ratio has only reached a reading of 2.5. Historically, BTC has only fallen off its top when the MVRV was around a reading of 5.

In November 2020, when the BTC MVRV was at 2.5, the price of BTC was at $18,000. BTC then proceeded to start its parabolic run and finally hit its previous ATH when the MVRV hit a reading of 4. In other words, this BTC rally may still have a lot more room to go, albeit there may be some short-term large pullbacks in between, which would then provide for good long opportunities.

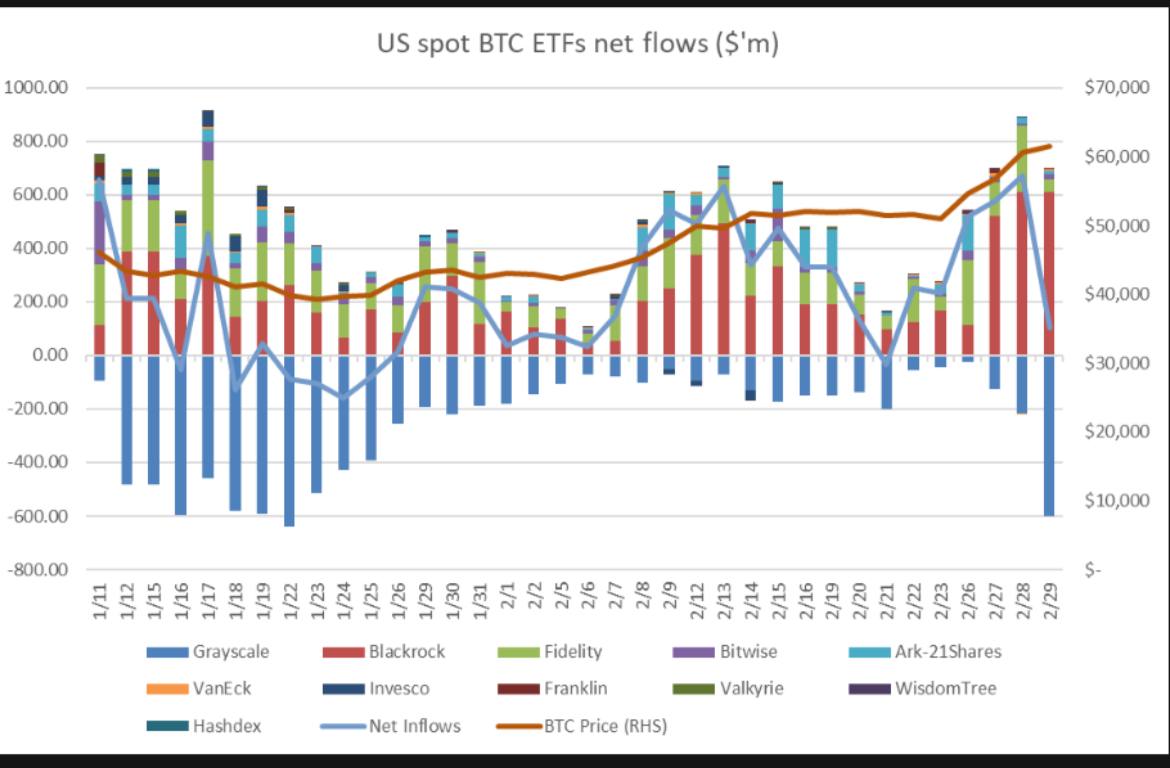

GBTC sales may throw a spanner in the works

While all has been good news for BTC, note that towards the end of last week, after basically not selling any BTC from its GBTC ETF, Grayscale clients have begun to sell their BTC stash in higher denominations again. As can be seen in the below diagram, at the initial stages of the trading of the GBTC ETF, there was a huge outflow from Grayscale, which was the main culprit that sent the price of BTC plummeting from $50,000 to $$38,000. The price of BTC only managed to recover in February after the amount of BTC Grayscale clients were selling dwindled. However, that trend may be picking up again, as Thursday saw an outflow of $600 million, while on Friday, it saw an outflow of $493 million. How the price of BTC performs this week may hinge on how much BTC Grayscale sells, as the demand from Blackrock has been somewhat consistent, at around $500 million per day. However, that amount was reduced to just $200 million on Friday. Could the strong demand from the spot ETFs be cooling off? While there is no way to know in advance, it is important for traders to take note of the ETF flows so as to have a general feel of whether there is stronger spot demand or supply.

ETH L2s could steal the show this week

While altcoins have mostly been on the backseat with the exception of memecoins, the ETH narrative could pick up again as we approach significant ETH milestones.

With the spot ETH ETF talks heating up after the spot BTC ETFs have so far led the price of BTC much higher, attention has started to shift to ETH as more purchases of ETH were seen taking place since February. However, another segment of ETH could come under the spotlight soon as the Dencun upgrade, which could lower the gas fees of ETH L2s by 90%, is fast approaching as we move nearer the date of launch, which is scheduled to be on 13 March.

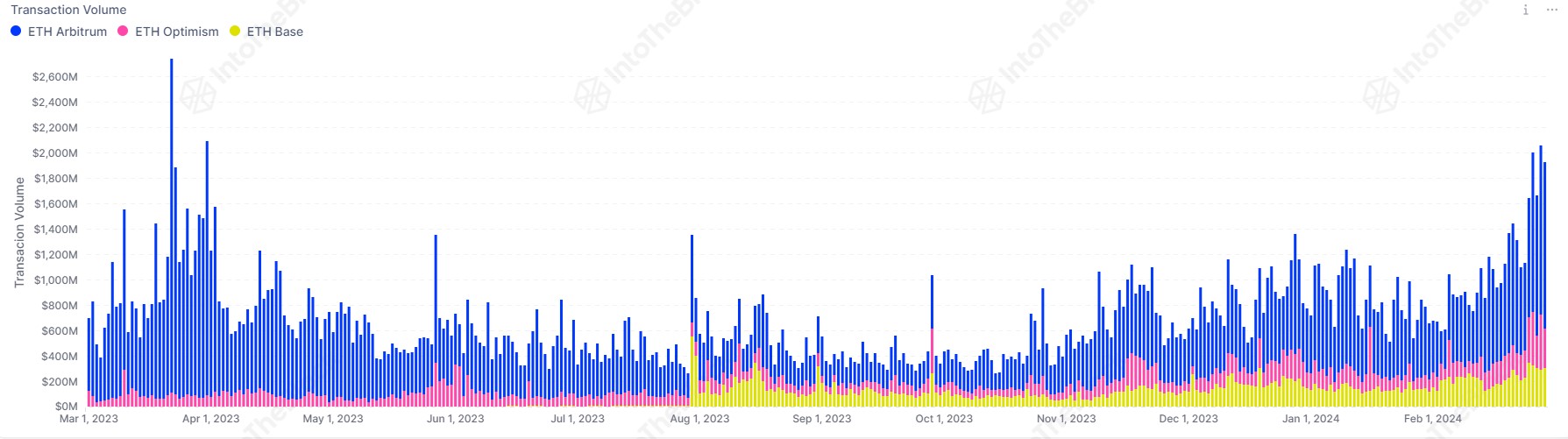

Furthermore, with the increase in trading interest, as well as the surge in memecoin trading in recent times, transaction volumes on ETH L2 networks have increased by 91% since the beginning of the year, indicating significant growth. This increase in volume could benefit the price of L2 coins like ARB, OP and MATIC in due course.

Tech-led bullish sentiment leads stocks to historical highs

The core PCE index released on Thursday increased 0.4% for the month and 2.8% from a year ago, which was in line with expectations. Headline PCE, which includes food and energy categories, increased 0.3% monthly and 2.4% on a 12-month basis, compared to respective estimates for 0.3% and 2.4%.

The benign PCE numbers that have come in on the back of higher CPI and PPI was a consolation for investors, who had begun to worry if inflation would start to climb again. Thursday’s number gave investors a sigh of relief, which led stock prices higher again to close off the month of February on a high note, clocking in their fourth monthly gain.

For the month of February, the Nasdaq led the pack with a 6.12% gain to close at its highest level since 2021. The S&P climbed 5.17%, while the Dow added 2.22% for its first four-month winning streak since May 2021.

Even on Friday, the Nasdaq continued to power on, surging 1.14% to 16,274.94, notching a new ATH of 16,302.24. Chip making giant Nvidia, which has led the tech rally by surging more than 260% over the last 12 months, was up another 4% on Friday.

For the week, the Nasdaq added 1.74%, while the S&P advanced 0.95%. However, the Dow lost around 0.11%. The dollar ended the week flat, while Gold rose 2.45%. Silver gained 1%. Brent rose 3% while the WTI rose 4%.

This week will bring data from the Department of Labor in the USA, with the ADP private sector payrolls on Wednesday and the non-farm payrolls on Friday. Thursday will see the ECB monetary policy meeting, as well as testimony from FED Chair Powell at the Semi-Annual Monetary Policy Report before the Senate Banking Committee in Washington DC.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.