The Forex market is one of the largest and most liquid in the world. It’s daily volume of Forex trading is a staggering $6.6 trillion.

Once you understand the Forex market structure and the main “players” of the FX market, you’ll understand why it sees this impressive daily volume of transactions.

But first let’s get the fundamentals out of the way. The Forex market loosely defines various institutions and markets on which currencies or their rates are traded.

Generally, Forex trading is done in pairs – so you will see them listed as EUR/USD (Euro/US dollar) for example. When you “buy” a currency pair, you’re buying the base currency i.e. EUR in this case and sell the quote currency USD in our example.

Currencies are traded by everyone from governments, institutional banks, corporations, used in hedge funds all the way down to retail traders, which is what I assume you are.

This is why daily Forex trading volume is so high.

Understanding how the biggest participants invest and trade currencies though can help traders, make more informed decisions and successful trades.

Because one of the biggest mistakes you can make is staking your trades against these “whales”.

A “whale” is an entity (person or company) that makes investments so large that they can move a market’s or asset’s price.

What is the Forex market?

The Forex market is a term that describes exchanges that allow spot Forex trading, a type of trading that allows you to trade currency prices without obligating you to own the underlying asset or the direct trading between currencies.

This includes both STP (straight through process) brokers and OTC brokers, these are decentralised exchanges that offer electronic brokering services, that usually make their revenue from the spreads they charge.

No matter the type of broker you work with foreign exchange transactions are always done in pairs, where you buy or sell the base currency and do the opposite to the quote currency or counter currency.

Currency pairs are usually displayed as EUR/USD or EURUSD (EUR means Euro and USD means US dollar). In the example, EUR would be the base currency and USD would be the quote currency.

Currencies are traded in huge volumes on a daily basis when performing cross-border transactions i.e. when different currencies are needed to purchase goods or services. Or due to huge speculative trades.

Just to give you an idea, the base unit of most Forex transactions is a standard lot, and standard lots are equal to 100,000 units of currency. This is a large amount which is why many brokers offer mini and micro lots which are 10,000 and 1,000 currency units respectively. Additionally, when Forex trading, you also tend to have access to leverage, which allows you to make a larger trade with less capital.

Currencies are the backbone, the circulatory and nervous system of the world’s economy, this why the Forex market sees these huge daily volumes and why it presents so many opportunities to its participants.

Key components of the Forex market

This is more or less true in any market structure, but the Forex market structure is composed (from largest to smallest) of a few major banks, electronic trading brokerages, medium and smaller commercial banks, retail market makers, hedge funds and commercial companies and finally retail traders.

Big, medium and small banks usually trade currencies among themselves through what is called the interbank market (you may hear the term used as a brokers selling point).

As you can gather, the larger the participants the easier it can move market prices – which is illegal to do on purpose for their benefit, but say Super-Mega Bank (a hypothetical bank for the sake of this example), decides to divest from its USD investments and wants to purchase CHF (Swiss franc) in anticipation of a bearish trend.

If this information is shared, this could cause the asset to drop, or just the pure volume of supply now available could also cause a significant downturn.

Remember? Supply and demand is one of the fundamental rules of the market. High supply or more supply means prices drop.

Currency pairs

Currency pairs are the products which are traded on the Forex market. Most retail market makers or retail brokers gain access to the market through banks, which are known as liquidity providers.

Currency pairs are separated into different “categories” called major, minors and exotics – and gain their name from being currency pairs composed of major currencies, major and minor currencies and major and exotics or any combination of those three categories.

Here are some examples to demonstrate:

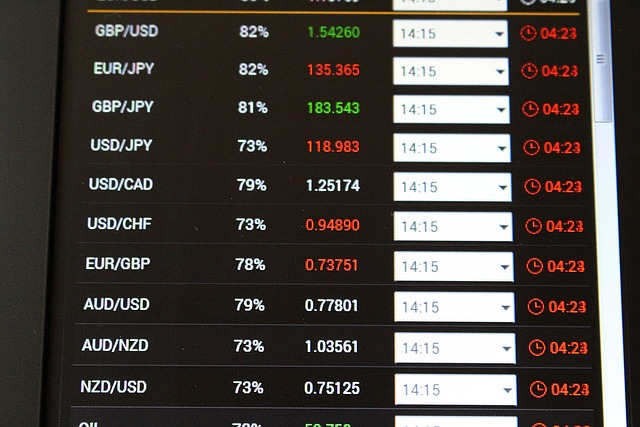

Majors: considered to be just seven, they include EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF, USD/NZD and USD/CAD. They are considered majors because they are the currencies of the World’s major economies.

Minors: these are pairs composed of the major currencies minus the US dollar, like JPY/CAD or EUR/GBP, or crosses involving the Australian dollar or Canadian dollar.

Exotics: Exotic pairs usually involve a major currency and a currency with low liquidity. An example would be USD/ZAR (US Dollar, South African Rand), GBP/SGD (Pound Sterling, Singapore Dollar) and EUR/MXN (Euro, Mexican Peso).

Each type of pair has their own characteristics – majors tend to have smaller daily movements and factors that affect their rates are covered well in the mainstream media. This makes them a good asset for new or inexperienced traders.

Minors tend to also have the same properties as majors – since they are composed of major currencies minus the US dollar.

Exotics have much more significant daily movements but can be subject to illiquidity, making their spreads more expensive and the risk of slippage much higher. They are generally used by more experienced traders who are well verse in technical analysis.

Trading sessions

The Forex market, unlike other financial markets, is technically open twenty four hours a day, five days a week.

And this twenty four hour cycle is broken up into four session known as the European or London session, the U.S. or New York session, the Asian or Tokyo session and the Australian or Sydney session.

London session – 7:00 am to 4:00 pm UTC

New York session – 1:00 pm to 10:00 pm UTC

Sydney session – 9:00 pm to 6:00 am UTC

Tokyo session – 2:00 am to 9:00 am UTC

As you can see some of these sessions overlap and this is the benefit of this Forex market structure. During this time trading volume increases exponentially.

Another benefit is that news that may be released during an earlier session can be used to trade during a succeeding session.

Forex brokers

Forex brokers offer their clients access to the the currency market. Although one of the lowest tiers of the Forex market structure, they still play a significant role in market movements, due to the multiple albeit smaller transactions they execute.

There are many different types of Forex brokers:

- NDD or No dealing desk brokers

- DD or dealing desk brokers (which are usually referred to as Market Makers)

- Market makers

- ECN or Electronic brokers

Each broker has its own ways of executing orders, either by sending it directly to their liquidity provider to execute, or by executing the orders themselves (some brokers match sellers to buyers if they have the liquidity or volume to do so).

Market makers will often offer fixed spreads which are beneficial to new traders as it allows them to calculate their costs upfront.

This may be a disadvantage for advanced traders though, as they may prefer to place trades when floating spreads are lowest (usually when liquidity is high).

Although their volume of transactions may be lower compared to their institutional counterparts, the movements of their clients can affect market sentiment.

Market participants

As mentioned previously, the leading participants in the Forex market structure are major banks which may include central banks, have enough volume of transactions to actually move the market.

Of course, after that tier, you have the electronic brokering services and dealing.

Medium-sized and small banks are in the middle of the Forex market structure, and although they do not have the capital to move markets, they can, like retail brokers, affect market sentiment and sentiment in turn cause both positive and negative price trends.

Retail traders

Traders are the lowest rung on the Forex market structure ladder. Although they do not have the capital to move the markets, they do sometimes have the numbers to move the sentiment needle.

This is when you can see price action test support and resistance levels, a bullish trend or a bull market.

But remember that retail numbers usually just amplify an already developed bull market or bullish trend or may not affect the markets at all.

This is why retail clients tend to follow big movements, to avoid staking their trades against bigger participants.

Institutional traders

Institutional traders, not only trade for big banks but also for large institutional clients with huge accounts, available credit and funds.

These are traders that may actually move the market by trading for central banks, hedge funds, loan associations and other large capital entities.

Central banks

By adjusting interest rates, central banks control currency values—either raising them or letting them fall. Generally increased demand for money is what dictates the amount of currency issued by central banks which will enter the market.

Forex traders meticulously scrutinise central bank announcements, refining their strategies in response to these policy changes.

Here’s an example for your consideration: central banks exert influence on the open market, engaging in the purchase and sale of securities to change the money supply.

This monetary balancing functions like a seesaw, subtly altering interest rates and creating reverberations throughout currency market.

Additionally, quantitative easing (QE) serves as an advanced maneuver, wherein central banks infuse liquidity (i.e. print money) into the financial system, deftly manipulating the dynamics of currency prices. It is a delicate balancing act; however, on occasion, the surge in money supply can awaken the specter of inflation, eroding the value of a currency.

This is why central banks have such a pivotal role in the Forex market structures.

Market mechanics

Bid and ask prices

Bid and ask prices are very important concepts when trading the foreign exchange market. The bid price represents the maximum a buyer is willing to pay, while the ask price reflects the minimum a seller is willing to accept. This spread, the difference between these prices, is how brokers make their profit.

Leverage and margin

Leverage is a powerful tool that allows foreign exchange market traders to control larger positions with a fraction of the capital. It can amplify both the potential for profit but also heightening risk. It’s crucial for traders to understand and manage leverage judiciously.

Spread

Spread, the cost of executing a trade, is basically the broker’s fee. Understanding these intricacies allows Forex traders to navigate the market with precision, while making informed decisions and using robust risk management.

Types of Forex markets

In the expansive landscape of the foreign exchange market, participants engage in various types of transactions, each catering to distinct trading needs and market conditions.

Spot Forex involves the immediate exchange of currencies at the current market rate, providing quick settlement.

Forwards entail agreements to trade currencies at a predetermined future date, allowing participants to hedge against volatility.

Futures, standardised contracts traded on exchanges, lock in future currency rates, offering a transparent and regulated environment.

These types of Forex transactions provide diverse avenues for traders and investors to navigate the intricacies of the global currency market.

Spot market

Forex spot transactions involve the direct exchange of currencies at the prevailing market rate. This immediate settlement distinguishes spot trading, providing participants with real-time execution and contributing to the dynamic nature of the foreign exchange market.

Forwards market

Forex forwards involve agreements to trade currencies at a predetermined future date. This provides traders with a tool for managing risk and hedging against potential volatility.

Futures market

Forex futures are standardised contracts traded on exchanges, allowing participants to lock in future currency rates. They provide transparency and a regulated environment for currency trading.

Trading platforms

Trading platforms are interfaces where financial instruments are bought and sold. These software applications offer real-time market data, analysis tools, and execution capabilities, empowering traders to navigate the dynamic world of financial markets efficiently and securely.

MetaTrader 4/5

MetaTrader 4 and 5 are renowned trading platforms, offering a sophisticated interface and robust features. MT4, widely adopted, provides efficient charting tools and automated trading capabilities. MT5 expands on this with additional timeframes and an economic calendar. Both platforms support diverse assets, making them go-to choices for traders worldwide.

Proprietary platforms

There are numerous proprietary platforms, but few combine the breath of functions and exceptional trading conditions like PrimeXBT’s.

Not only are the conditions amazing, but the PrimeXBT platform offers you an astounding level of choice and control.

Set your preferred type of order, copy trade or buy Crypto. The company gives you access to Crypto, Forex and CFD trading, all in the same platform.

Regulation and compliance

Regulation and compliance are paramount in the Forex market to ensure fair practices, protect both investors and the market at large. Regulatory bodies, such as the SEC and FCA, enforce rules that brokers must adhere to, promoting transparency, security, and ethical conduct. Traders should choose regulated brokers to mitigate risks and ensure a trustworthy trading environment.

Regulatory bodies

- SEC (Securities and Exchange Commission): Regulates securities markets in the United States, including Forex.

- FCA (Financial Conduct Authority): UK regulatory body overseeing financial markets, ensuring integrity and consumer protection.

- ESMA (European Securities and Markets Authority): EU-wide authority promoting consistent financial regulation, safeguarding investors and market stability.

The risks involved

Forex trading entails inherent risks, including market volatility, leverage amplification, and susceptibility to economic and political factors. Traders must navigate these dynamics with informed strategies for success.

Market risk

- Volatility: Forex markets can experience rapid and unpredictable price movements.

- Leverage risk: amplifies both gains and losses, necessitating careful management.

- Interest rate fluctuations: central bank decisions can impact currency values.

- Political and economic events: global events can lead to abrupt market shifts.

- Lack of regulation: unregulated markets may expose traders to fraud and manipulation.

Leverage risk

Leverage in Forex can amplify market movements, both positive and negative ones. Traders should exercise caution, as excessive leverage can lead to significant financial exposure.

Strategies for trading

Fundamental analysis

Fundamental analysis in Forex involves evaluating economic indicators, central bank policies, and geopolitical events to predict currency movements. It aids traders in making informed investment decisions.

Technical analysis

Technical analysis in Forex involves studying price charts, patterns, and indicators to forecast currency movements. Traders use historical data to identify trends and make strategic trading decisions.

Conclusion

In conclusion, understanding the intricacies of the Forex market is crucial for traders navigating this vast financial landscape. From the structure and key players to market components and risk factors, the knowledge gained empowers traders to make informed decisions.

Fundamental and technical analyses, coupled with awareness of regulatory aspects, contribute to a well-rounded approach. Leveraging trading platforms, such as MetaTrader 4/5 or proprietary options like PrimeXBT, enhances control and choice.

As risks are inherent, it’s imperative for traders to implement sound strategies, considering market dynamics, leverage wisely, and staying abreast of global events. In the dynamic and ever-evolving world of Forex, informed decisions are the cornerstone of successful trading.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.