With Bitcoin trading at two-year highs and the US Presidential elections just months away, attention on cryptocurrency donations to political campaigns will be more focused than ever.

- Cryptocurrency firms ramp up political donations

- US primaries this week will test the crypto industry’s influence

- Sam Bankman-Fried donated over $100 million to political campaigns

Crypto firms ramp up political donations

Crypto firms have significantly increased the amount they pay in political donations in recent months as sentiment in Washington toward the industry sours and regulatory challenges rise. This increase in the cryptocurrency industry’s engagement with the political process highlights a shift in strategy and increased efforts to shape the political and regulatory landscape for the sector.

Companies and major players such as Coinbase, Circle, and a16z, Andreessen Horowitz’s crypto investment arm, are directing more funds towards electing pro-crypto legislators and influencing bills in Congress ahead of the Presidential elections later this year.

At the end of last year, those three companies paid $78 million into Fairshake, a federal super political action committee (PAC) that accepts funds from firms or individuals to spend on elections and directed at pro-crypto leaders.

We are seeing a marked change in the amount that the industry is putting towards pro-crypto leadership, which is considered an investment for these players. Fewer restrictions and looser regulation mean a greater possibility to expand.

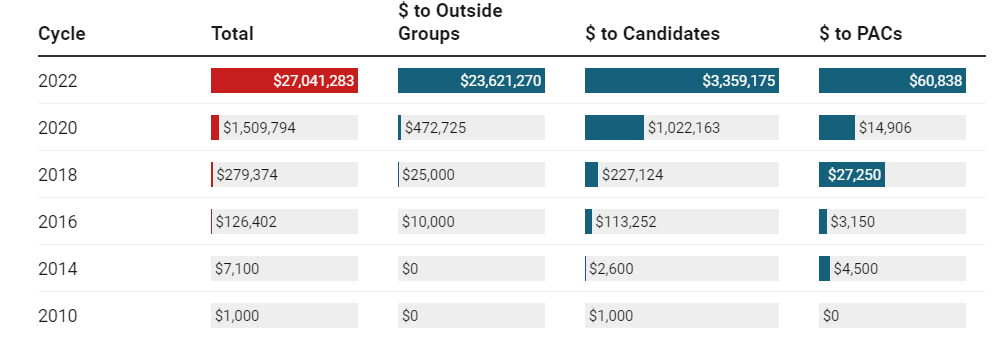

According to Opensecrets, the crypto industry has contributed $59.2 million towards the 2024 election, up from $27 million in the 2022 mid-terms to just $1.5 million in the 2020 Presidential election.

US primaries & crypto influence

Evidence is building that the crypto industry is jumping headfirst into the US Presidential elections, spending millions of dollars ahead of this week’s Super Tuesday primary contests in California, Texas, and Alabama.

How the crypto-friendly candidates perform will provide clues over how much influence the crypto industry has on voters ahead of the race to the White House in November.

According to Opensecrets, a research group that monitors money in US politics, super PACs such as Fairshake, Protect Progress, and Defend American Jobs have spent around $13 million on Tuesday’s primaries, money which the likes of Coinbase and the Winklevoss brothers have funded.

One example of how those funds are being spent is on a key target, Democrat Katie Porter, who is running for Senate. So far, Fairshake has spent $10 million attempting to convince the electorate not to vote for her through mediums such as state TV and digital media.

Porter has a black cross against her name from the Crypto firms after joining Senator Elizabeth Warren in her crackdown on the industry.

Meanwhile, Protect Progress has spent over $1.5 million backing Shomari Figures, a Democrat running in Alabama’s congressional district race. Figures has pledged to stimulate innovation and technological advancements while embracing digital aseets.

These are just two examples of many and highlight that candidates showing an openness to digital assets and those that call on Congress to take supportive policy action are in line to receive more funding from super PACs.

However, it is also worth remembering that the crypto industry’s interest in this year’s Presidential elections comes with Sam-Bankman-Fried’s conviction of stealing customers’ money still fresh in the memory of many. US prosecutors alledge he used that money to donate over $100 million to US political campaigns. This should serve as a cautionary tale.

Sources

https://www.ft.com/content/b8c081d2-2613-4199-8579-120e313626d6

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.