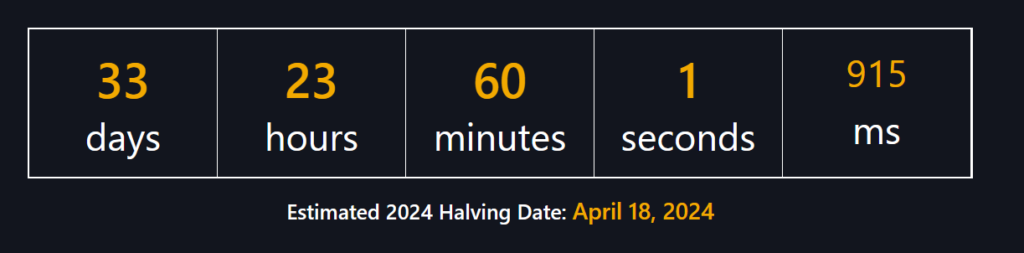

- The halving occurs when 210,00 are added.

- Increasing transaction volumes bring the date closer to 18 April

- This could change depending on volumes

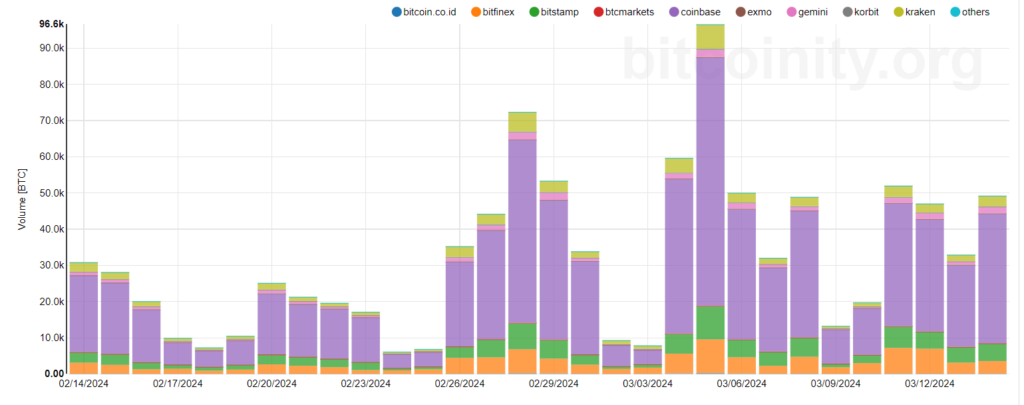

- Record trading volume of almost $100 billion

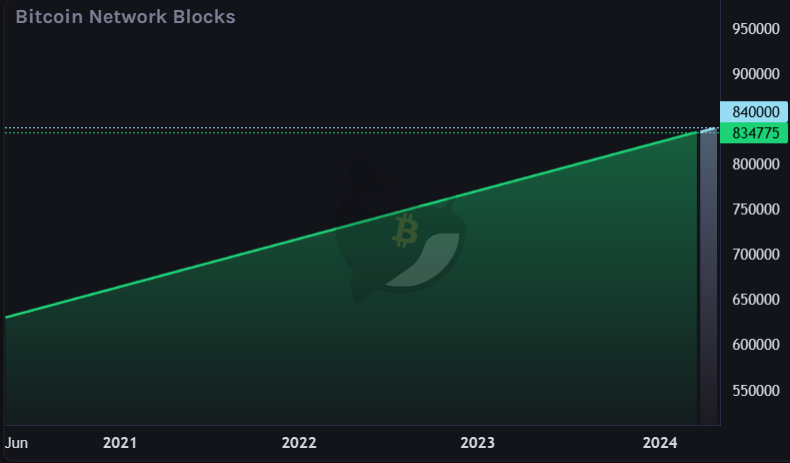

Bitcoin’s halving event occurs approximately every four years. After the halving, miners’ rewards will be cut from 6.25 bitcoins per block to 3.125 bitcoins, reducing the supply. Bitcoin’s halving event occurs when 210,000 blocks are added to the Blockchain.

The upcoming Bitcoin halving will be the fourth such event in the cryptocurrency’s history and will take place when the blockchain has reached a height of 840,000 blocks or after the network has processed 840000 blocks worth of transactions.

Source: Bitcoin Halving Countdown Live (watcher.guru)

At the start of the year, when Bitcoin’s price was around $42,000, the halving event was projected to take place on April 20. The latest data shows that the blockchain is at 834,693 at the time of writing, 5307 bocks below the 840,000 level.

Estimations now point to the halving taking place on 18 April, two days earlier than initially expected, although this isn’t set in stone and depends on the blocks added rather than a set date. For this reason, the date could change.

Why is the halving event expected earlier?

Bitcoin’s average transaction per block is around 2500. An increase in transaction volume is mainly attributed to a rise in trading volume. Following the ETF approval on January 11, which opened the door to institutional investors, Bitcoin demand and trading volumes have surged. High levels of volatility, including recent record highs, large drops, and one of the largest exchanges crashing, point to higher volumes and the network processing more transactions than usual.

Daily trading volumes

Source: https://data.bitcoinity.org/markets/volume/30d?c=e&t=b

According to CoinGecko data, the average daily volume until mid-February was $24 billion. This spiked to $52 million on January 11 when the SEC approved spot Bitcoin ETFs. However, this declined again over the following weeks owing to the heavy withdrawals from Grayscale Bitcoin Trust. As investors redeemed their shares, Grayscale sold the underlying Bitcoin back to the market. JP Morgan estimated that Grayscale saw $4.3 billion worth of outflows by the end of January.

However, since mid-February, the average daily Bitcoin volume has risen to $40 billion. Since the beginning of March, when Bitcoin started advancing toward fresh record highs, daily traded volumes have risen to $52 billion. At the time of writing, Bitcoin had seen 4 new record highs in six days amid insatiable BTC ETF demand, and Bitcoin saw a record $100 billion in trading volume on March 5.

Conclusion

The possibility of an accelerated move towards the halving event serves as an indicator of trader sentiment towards the asset.

Investors are watching the halving event closely, as BTC/USD has historically risen after the previous halving events. Bitcoin has increased in value after all three of the previous halvings.

A combination of factors such as increased trading activity, record ETF inflows, and soaring market volumes could mean that the halving could take place two days earlier than initially expected.

Sources

https://decrypt.co/221140/bitcoin-halving-sooner-than-you-think

https://data.bitcoinity.org/markets/volume/30d?c=e&t=b

Bitcoin Halving Countdown Live (watcher.guru)

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.