The rally across the crypto market has continued all this week, showing little signs of the bullish momentum slowing. The emerging asset class has been among the top-earning assets during the calendar year thus far across all financial markets, reviving interest in the crypto space.

Low prices combined with renewed interest and strong financial upside has made the cryptocurrency asset class especially interesting to investors seeking to move profits from other markets as they lose steam in the new year.

Here’s a full look at the current state of the crypto market, complete with updates for Bitcoin, altcoins, decentralized finance, and the week’s biggest news stories.

Bitcoin Below Trend But Bullish Future Outlook

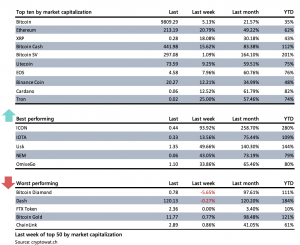

All this week, Bitcoin has pushed higher in its 2020 rally from lows in the $6,000 range. The leading cryptocurrency by market cap grew by another 5% last week, up 21.57% in total last month. Year-to-date, Bitcoin gains have reached 35%.

Even with the surge, Bitcoin is the worst-performing crypto asset out of the top ten cryptocurrencies by market cap, and in most cases, brought only half the ROI of the rest of the bunch.

Bullish momentum caused Bitcoin to form a Golden Cross of the 50-day moving average and the 100-day moving average, which typically tells investors that the asset is entering an uptrend and is a buy signal.

Bitcoin has to deal with strong overhead resistance at $10,000 before it can continue to move higher – an incredibly important level from a psychological perspective. It’s the level that caused extreme FOMO back during the cryptocurrency bull run of 2017. After Bitcoin broke this level back then, it reached $20,000 just a month later.

Despite the growing price of Bitcoin, the cryptocurrency is below where its historical trend would suggest. According to data, the historical trend indicated that Bitcoin should be valued somewhere around $11,900 today. The crypto asset is currently trading at roughly $2,000 below that valuation.

The highly-cited Bitcoin “Stock-to-Flow” model is pacing along with current Bitcoin prices, but according to the model, after Bitcoin’s upcoming halving in May, Bitcoin price valuations immediately jump to as high as $100,000 per BTC due to the reduction in BTC flow into the market through miner blockchain rewards.

However, the long-term growth trend suggests that the valuation provided by the Stock-to-Flow model is far too high, and instead provides a more realistic target of around $13,000.

The Return of Altcoin Season: Money Flows From ETH, XRP, etc. to Small Cap Alts

The holiday season is now long over, and it is now time for alt season according to the ROI the alternative crypto assets have brought investors in 2020 thus far.

All altcoins in the top ten cryptocurrencies by market cap easily outperformed Bitcoin by a wide margin over the last month. When this happens, crypto investors refer to it as something called an “alt season.”

Ethereum more than quadrupled Bitcoin’s gains during the last week, with XRP close behind. Last week’s top crypto in the top ten by market cap was Tron, the cryptocurrency project founded by Justin Sun.

While the “large-cap” altcoins like Etheruem, XRP, and others from the top ten faired better than Bitcoin, and while last week’s best-performing assets were mid-cap altcoins, this week small-cap altcoins were the rising stars of the crypto market.

ICON rose by over 250% the past month, with over 90% of the gains during the last week alone.

Altcoins traders point the profit flowing from Bitcoin, through large caps, then through mid-caps, and eventually through small caps before the cycle repeats.

Now that small caps have pumped, could more profit be put back into Bitcoin, helping it push through resistance?

Crypto Market Sentiment Tips Further Toward Extreme Greed

There should be little surprise that sentiment across the market is rising alongside the price of most cryptocurrencies.

Traders are becoming even more bullish on Bitcoin, as trading volume continues to rise alongside valuations. Volatility has been ranging for over two months, suggesting that an extremely explosive move may be ahead. The lack of volatility signals healthy price growth, according to data.

CME trading volume is also growing, suggesting institutional traders are becoming more and more interested in Bitcoin. Daily volume has increased over 250% in January alone.

However, this is still a flash in the pan compared to the demand from the retail crypto trading market.

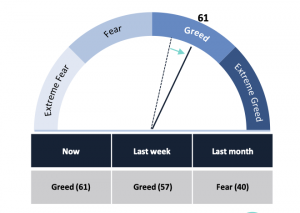

Rising prices have pushed the Crypto Market Fear and Greed Index further toward “extreme greed” but is still square in the middle of the “greed” gauge. This could suggest that the market could rise a lot more before “extreme greed” is reached.

Once the market reaches levels of extremes in either direction, it often suggests a reversal is near. It plays into the famous Warren Buffet quote to be “fearful when others are greedy and greedy when others are fearful.”

DeFi and Stablecoin Dominance

Further demonstrating the growth and adoption across the crypto space, is the significant progress made in the decentralized finance space and with stablecoins.

DeFi has now reached a milestone of over $1 billion in crypto assets locked away – marking a 300% spike since the start of 2019 when the trend first caught fire.

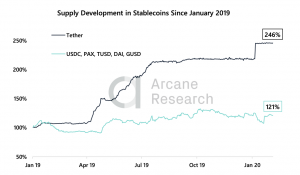

Tether has not only maintained but has grown its dominance in the stablecoin market, attributing for up to 83% of the total stablecoin market cap, up from 69% in Jan 2019.

The Tether supply itself has risen by as much as 246% in the same period, suggesting that the crypto market has restored the confidence it had in the asset as a safeguard against falling prices and volatility.

This Week’s Biggest News Stories in Crypto

Bitcoin Transaction Values Reach Highest Level Since Crypto Bubble

The strength of the Bitcoin blockchain, in theory, can be measured by the number of transactions and the value being transmitted across its network. That total cumulative value has now achieved a new, two-year high, reaching an estimated $3.5 billion – valued in USD – worth of BTC transacted across the Bitcoin blockchain.

Lightning Labs Raises $10M For Funding Second-Layer Bitcoin

The Jack Dorsey-backed Lightning Labs has raised $10 million in a Series A fundraising round. Funds will go toward launching the platform’s first paid service for merchants who are looking to accept Bitcoin via the Lightning Network.

Mastercard Ditches Facebook Libra After Regulatory Concerns

Looking to keep its nose clean in the face of United States government regulators, Mastercard is the latest company to distance itself from the Facebook Libra cryptocurrency project, citing concerns over compliance and how association may impact the brand.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.