Last week’s Crypto market was more subdued, with pockets of activity. After recovering from a low of $66,000 on Monday, Bitcoin spent the week consolidating around $70,000, trading below the mid-March ALT of 73,750 for a second week. After the recent BTC/USD price swings, last week’s action reflected a calmer mood and a wait-and-see approach ahead of the new month, a new quarter, and Bitcoin halving event.

Bitcoin posted modest gains of 3.9% over the past week after posting modest losses over the past few weeks. Meanwhile, altcoins posted mixed performances. Solana outperformed with a 6% gain over the past week, and Ether rose 2.75%.

The rise coincided with record highs in Gold and US stocks amid expectations that the Federal Reserve would soon start cutting interest rates.

However, the risk off mood wasn’t evident across the board, with XRP a notable decliner following developments in the Ripple vs SEC case, which saw the latter requesting Ripple be fined almost $2 billion.

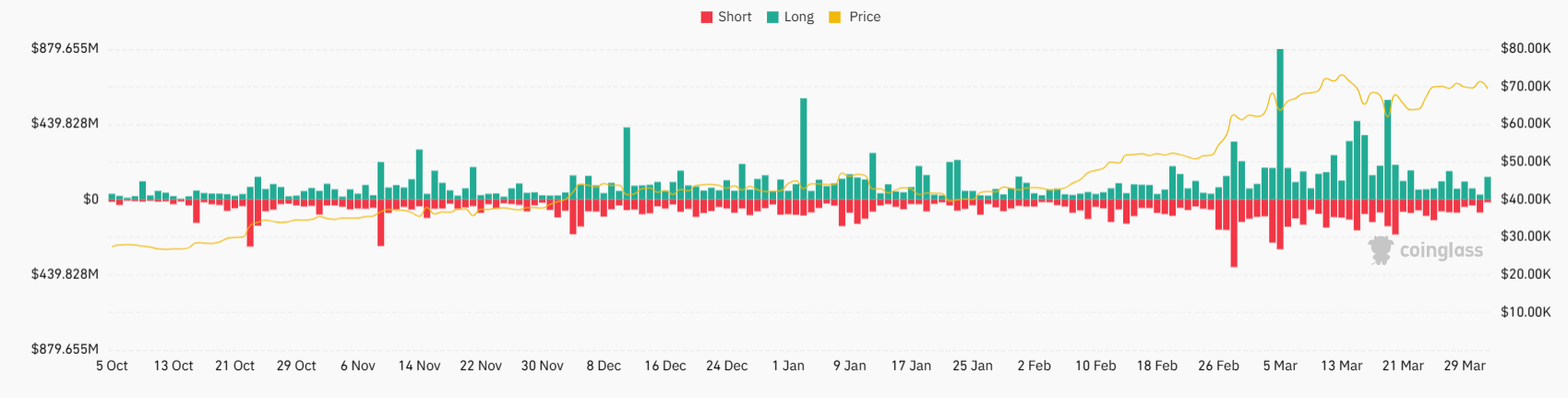

The Bitcoin liquidations chart shows that liquidation fluctuations have calmed significantly over the past week compared to the large spikes seen earlier in the month.

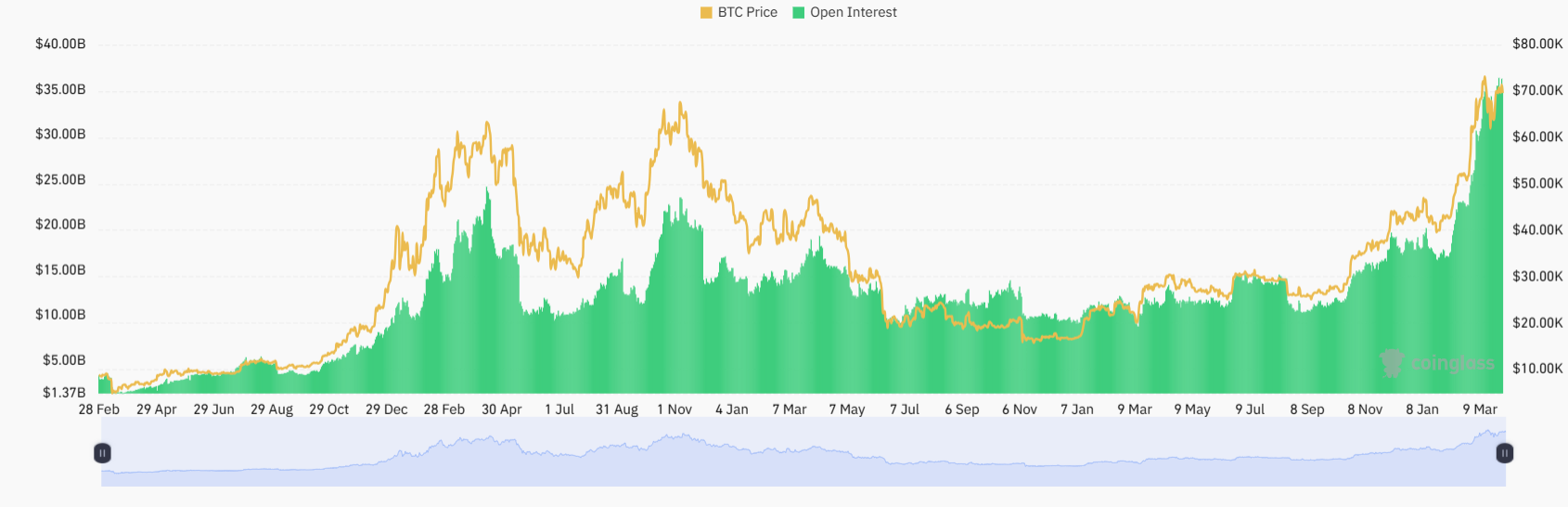

Bitcoin open interest hits a record high

Interest in Bitcoin derivatives has escalated throughout 2024, reaching new record highs. Data from Coinglass revealed that BTC futures saw an open interest (OI) of $36.33 billion last week, a new record high, equivalent to 539,430 BTC. This represents a significant milestone.

Since the start of the year, open interest in Bitcoin futures on centralized exchanges has been significant, more than doubling from $17.2 billion on January 1st of this year. This development comes in parallel to a massive increase in Bitcoin’s price.

Open interest at all-time highs suggests that bullish sentiment among traders around Bitcoin remains strong ahead of the halving event later this month. Binance, the world’s largest Cryptocurrency exchange, posted its highest BTC open interest of $8.4 billion to date.

Open interest, which measures the total value of outstanding Bitcoin futures contracts, reflects the increased investor sentiment and market activity. March saw monthly volumes exceeding $2.3 million across various exchanges, the highest since 2021.

The market mood has been boosted by the approval of Bitcoin spot exchange-traded funds by big industry players such as BlackRock. Over $12 billion in inflows have entered these BTC ETFs, having a positive impact on market dynamics.

Dogecoin rises as dormant wallets are revived

Meme coins led by Solana’s Dogwifhat soared, outperforming other niche areas such as DeFi and exchange tokens. The surge at the end of last week came as Bitcoin and Ether remained largely unchanged and amid speculation that DOGE could be used for the payment service of social app X. However, there has been no official communication from the company.

Bets on DOGE futures rose to $2 billion, which points to expectations of future price volatility with a bias toward long positions. The world’s largest meme coin, Dogecoin, rose 19% over the past week, with its market cap crossing $30 billion. DOGE has already risen 134% so far this year.

The 8th largest cryptocurrency, DOGE, saw significant gains after dormant whales reactivated and moved DOGE holdings back into circulation.

The chart shows that whale wallets containing 10 million to 100 million DOGE tokens have consistently boosted their holdings since March 15. The persistent accumulation saw these whales lift their collective holding by 1.40 billion DOGE over two weeks, worth around $280 million.

Interestingly, Dogecoin has managed to hold its own despite the allure of other tokens and has maintained its position as a key altcoin.

Dog-themed mem-coins rose on the beta bet to Dogecoin. WIF flipped PEPE to become the third largest meme token, rising above the $4 level.

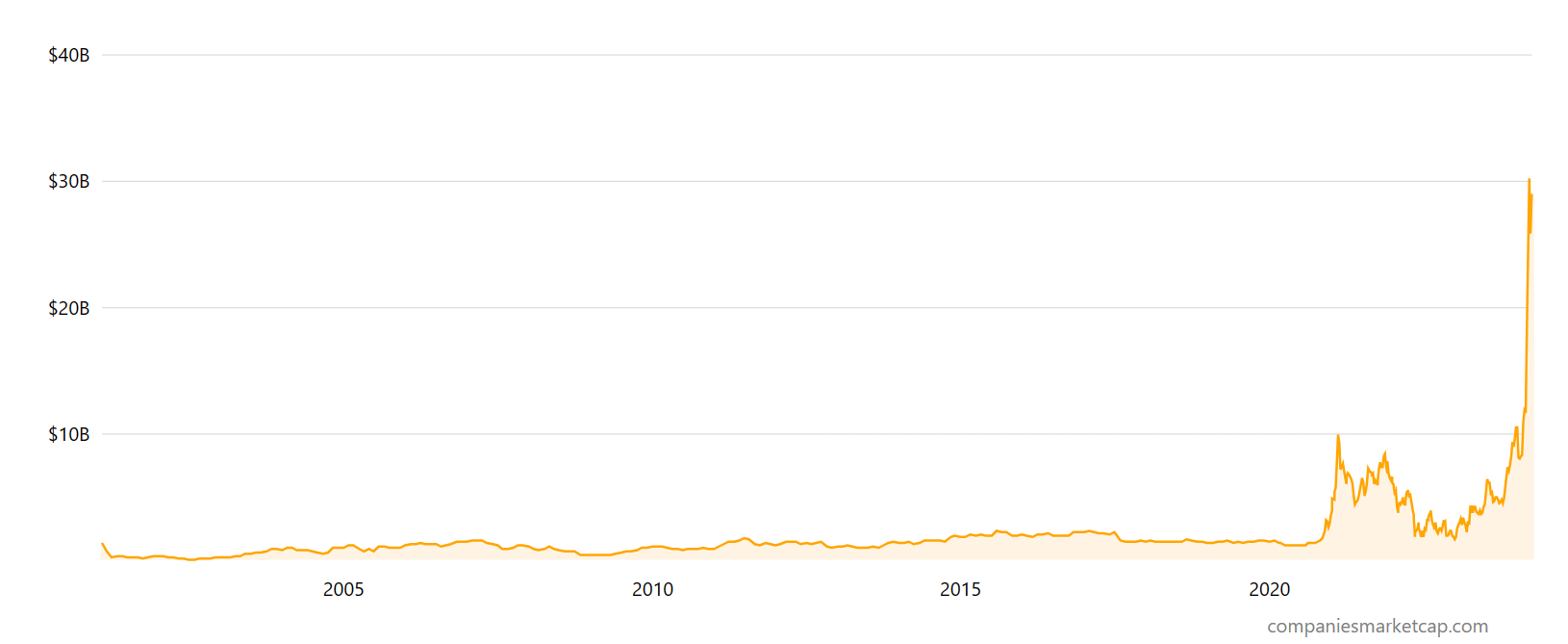

MicroStrategy’s market cap hits a record high

MicroStrategy, which had been tracking Bitcoin prices higher, saw its market capitalization reach a record high last week, crossing the $31.8 billion mark. This ranks it amongst the largest 606 companies in the world by market cap after the market cap almost tripled over the past month.

Despite the 11% drop on Thursday, the last day of trading last week, the share price of MicroStrategy, which is considered a proxy for Bitcoin, still gained over 10% across the week and 170% since the start of the year thanks to Bitcoin’s rise above 70,000. At the time of writing, the MSTR share price is trading close to $1700. It is one of the top-performing stocks across the first quarter

The rising demand for the stock comes as MicroStrategy buys up Bitcoin, which trades close to record highs. As of March 19, MicroStrategy owns 214,246 Bitcoins, taking its crypto stake to just under $15 billion. Its latest filing showed that its average purchase price was $35 160 per Bitcoin. Given the current price of around $70,000, MicroStrategy has doubled its investment in monetary terms.

It is worth noting that software analytics constitutes just 3% of the total value of the business, making MicroStrategy Bitcoin proxy play. However, with the new spot bitcoin ETFs, there is greater competition and less need for MicroStrategy as a Bitcoin proxy, raising questions over whether it’s overvalued.

Stocks & Gold hit record highs & USD holds steady around a 6-week high

The S&P500 and the Dow Jones rose to new all-time highs last week as the indices booked their fifth straight monthly gain. The S&P500 saw a quarterly gain of 10%, the best first-quarter performance since 2019. Meanwhile, the Dow rose 5.6% in its strongest quarter since 2021. The Nasdaq gained 9% in Q1.

The US indices have risen on AI optimism and expectations that the Federal Reserve will start to cut interest rates soon.

Gold also rose to a fresh all-time high on bets that the Fed will ease monetary policy soon.

Data released on Friday, when the US stock markets were closed for the Good Friday public holiday, saw US core PCE, the Fed’s preferred gauge for inflation, continue cooling to 2.8% YoY in line with estimates. This was a welcome reading after other measures of inflation had shown price pressures intensifying at the start of the year.

Federal Reserve Chair Powel said the figures aligned with expectations, keeping a June rate cut on the table. He reiterated that the central bank needs more evidence that inflation is cooling sustainably to the target 2% level.

According to the CME Fedwatch tool, the market is pricing in a 62% probability that the Fed will start cutting rates in June and expects three rate cuts across the year.

The stock market will react to the inflation data and Fed Chair Powell’s comments on Monday when it resumes trading after the long weekend.

Meanwhile, Gold rallied to a new all-time high, climbing above $2200 last week, ignoring persistent USD strength. Gold shrugged off comments from Fed Governor Christopher Waller, who said the Fed was in no rush to cut rates and that rates could remain high for longer than previously thought to bring inflation back to the 2% target.

His comments helped the USD recover in the second part of last week, recouping losses from earlier in the week.

Looking ahead, the US economic calendar is busy next week with a slew of data, including US ISM and non-ISM manufacturing PMI figures and US non-farm payroll data. Stronger data could see the market push back on rate cut expectations, bringing stocks and Gold lower and boosting the King USD further.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.