The first week of the new year started with the price of BTC bidding up close to $46,000 as expectations of the spot BTC ETF approval play returned. However, on Wednesday, a rumor spread by one crypto analyst who claimed that the SEC could reject all the applications shocked traders and sent the price of BTC reeling by 10%, and crushed altcoin prices by as much as 30%.

The sharp fall in price was the biggest for altcoins in two years, with the liquidation amount also the highest. In the first hour alone, there were around $350 million worth of long positions liquidated as leveraged long bets piled up ahead of the ETF approval deadline. Over the next 12 hours, another $250 million longs were liquidated, taking a total of around $600 million long being liquidated within a 12 hour span.

While this amount certainly was not a very high number by bull market standards, it was the highest ever since the market started on its recovery this year.

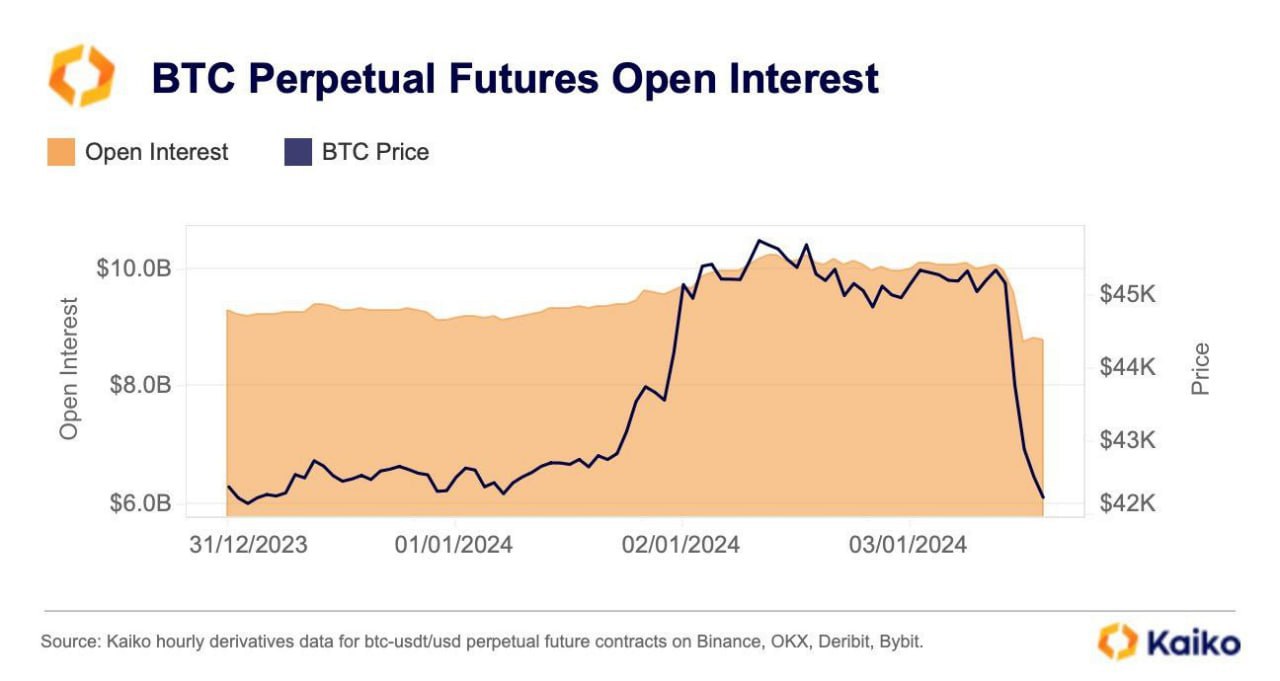

Many market watchers were perplexed by the rumor, when most intelligence had mentioned that the approval would likely be a “done deal”. Regardless of the motive behind the rumor, the big flush managed to reset funding rates and open interest (OI).

Open Interest fell by almost $ 1.5 billion in the aftermath back to before the ETF approval window hype. This flushing out of leveraged trades is important for BTC to be able to sustain a longer and healthier price increase.

Despite many rumors that the ETF was a “done deal”, traders remained cautious after the flush out. In fact, an increase in short positions have been observed as traders positioned themselves to front-run the “sell-the-news” trade. As a result of a tug of war between bulls and bears, BTC’s price coiled into a tight range, while flows were seen to be moving out of altcoins, causing yet another altcoin blood-letting over the weekend and into the fresh week, with most altcoins losing up to 30% off their ATHs hit barely two weeks ago.

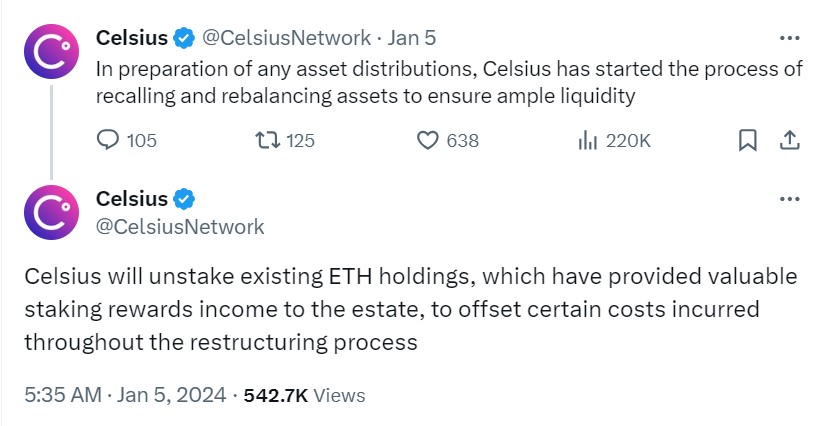

Celsius selling of ETH casting a dark cloud

Just as we had reminded before in our last report of 2023, the turn of the year immediately saw Celsius beginning to act with greater haste with regards to its asset sale to return funds to its creditors. The firm posted on its X.com feed that it would be unstaking its ETH in preparation to dispose of the asset so as to return cash to its creditors that have been owed ETH.

Immediately after the announcement, more than 540,000 units of staked ETH, which had been identified to belong to Celsius, had been unstaked from the Ethereum Beacon chain. To fully exit ETH staking will require around 14.5 days which means that we could be expecting a huge ETH dump around two weeks from now, unless Celsius manages to dispose of its ETH via the OTC route. However, traders are already beginning to front-run Celsius by selling their ETH beforehand, causing crypto sentiment to sour even in spite of the positive BTC spot ETF approval excitement.

Investors were once again reminded of the possible risks that could come in the first part of this year, which is the bankruptcy disposal of BTC and ETH by Celsius, which holds around $2 billion worth of BTC and ETH that it will need to dispose of, and of the estimated 165,000 units of BTC that Mt Gox will have to return to creditors. There is still no update as to how or when Mt Gox would be returning the bulk of the BTC, leaving a huge cloud of fear and uncertainty amongst crypto investors.

BTC adoption continues to grow

One thing to note about the Celsius and Mt Gox sale is that they are unrelated to the fundamentals of the crypto market, which have been improving. For long-term investors, the coming disposals are a fantastic opportunity for them to accumulate even more of their favorite crypto.

One category of investors that have continued to acquire more crypto regardless of market developments is the institutional investor.

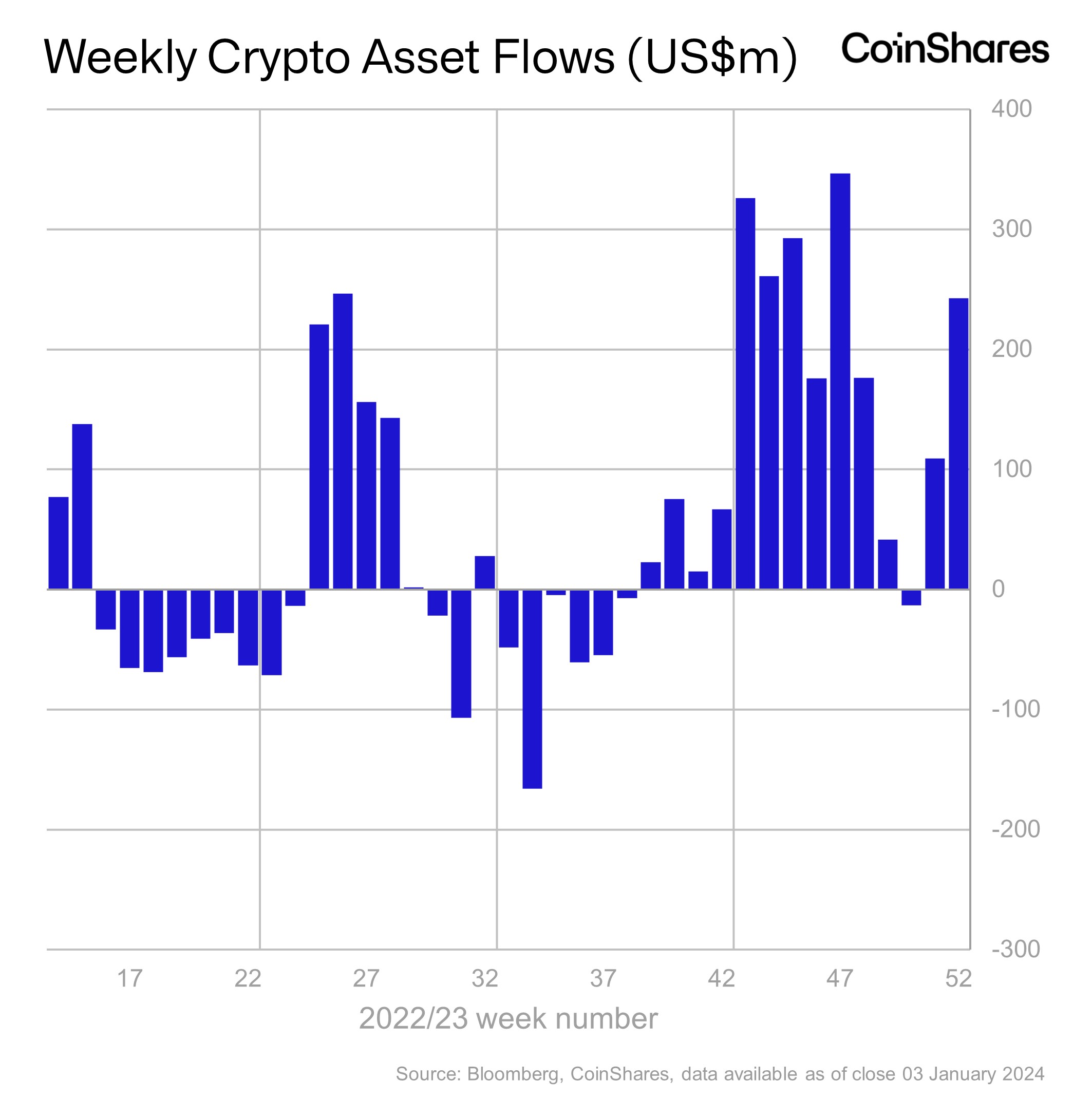

In the final week of 2023, another $243 million of funds went into crypto asset funds, with the inflow not stopping even during the year-end holiday season which historically had been a lull season. This is telling of the amount of interest in crypto assets by institutional grade investors, which has increased substantially in the final quarter of 2023.

Most of the inflows went to BTC, while amongst altcoins, SOL saw the highest inflow.

BTC registers highest address growth since 2017

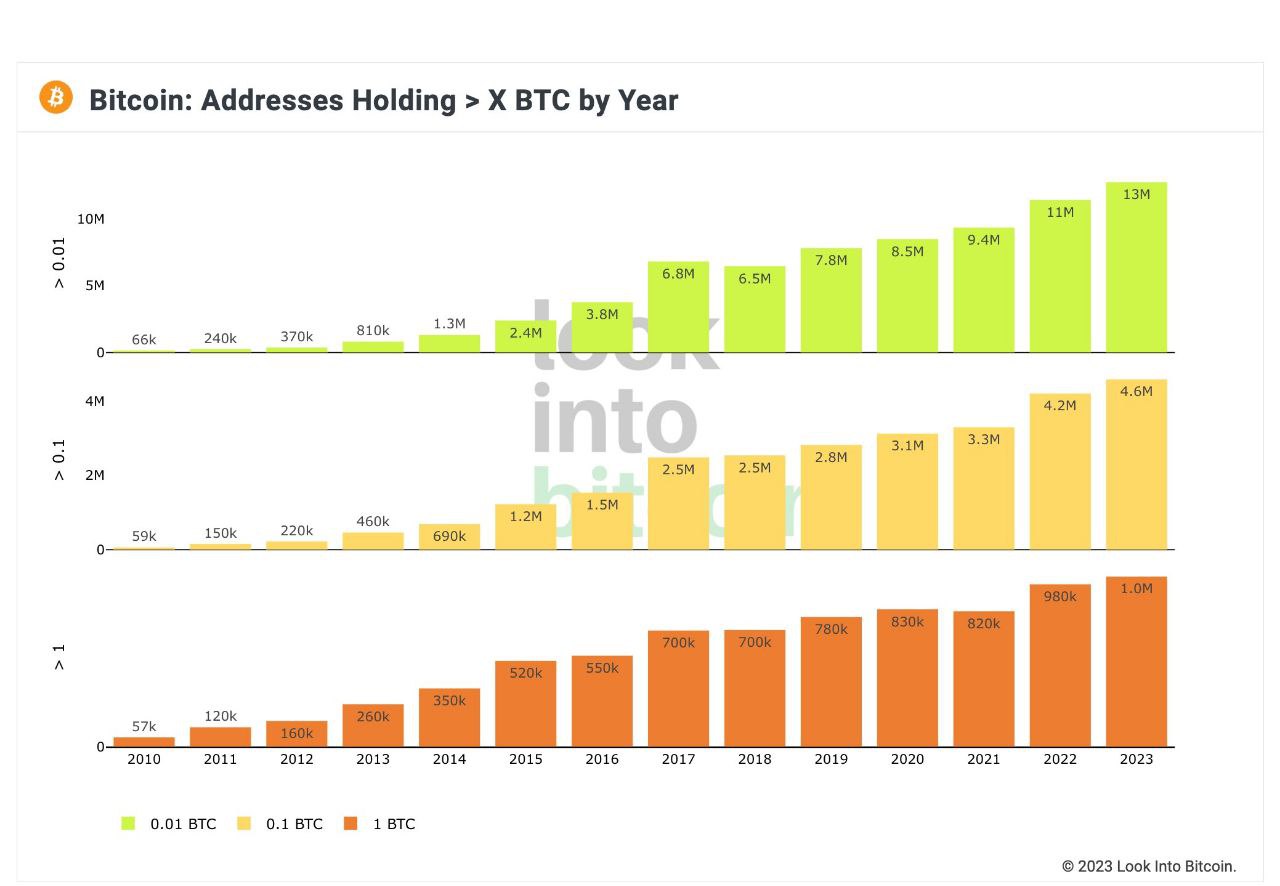

As the hype around the spot BTC ETF intensifies, smaller investors too have taken to start acquiring more of the asset. The number of addresses containing at least 0.01, 0.1, and 1 BTC grew significantly in 2023. In particular, the number of addresses with at least 0.01 BTC has undergone the largest increase since 2017, showing that small investors are entering the space at the fastest speed since mainstream media first spoke for BTC since 2017.

Once the spot ETFs are approved, the barrage of bankers promoting BTC as a legitimate investment will likely continue to increase the number of BTC buyers, be they big or small.

That said, the approval of the spot BTC ETFs may not necessarily bring the inflows immediately as investment managers will need time to prepare for entry. This lag time could give the smaller retail investor the opportunity to load the dips before the institutions which may only be able to enter the market a couple of months later due to their need for risk assessment and due diligence. However, the ETF products are expected to bring in another $5 billion to $20 billion worth of investments annually to BTC, which is expected to boost its price greatly in time to come.

Stocks retreat as dollar bid up in first week of the year

US stocks started the new year retracing as yields started to climb again. Despite FED minutes released which revealed that officials anticipated three 25-bps rate cuts by the end of 2024, the summary noted that there was a high level of uncertainty over how, or when that will happen, which gave investors some jitters.

Furthermore, better than expected private payrolls in the ADP on Wednesday as well as a blow out beat in the non-farm employment data on Friday also put a bid under the dollar, which was recovering after a late 2023 spate of declines. The stronger job reports sent US Treasury yields higher, with the benchmark 10-year rate touching a high of 4.103%. By the end of the trading week, the DXY dollar index was 1.1% higher against its peers.

Tension in the Gulf region with container shipping rates soaring has also resulted in a flight to the dollar which dampened investment sentiment, as rising shipping rates could cause the inflation rate to pick up, reducing the odds of more rate cuts this year.

Overall, investors have started the year on a more risk-averse tone, with all three major US stock indices ending their nine-week positive closes. The S&P and Dow dropped 1.52% and 0.59% respectively, while the Nasdaq suffered the biggest decline at 3.25%, its worst weekly performance since September 2023.

With the rise in the dollar, other asset prices declined in tandem, with Gold losing 1% and Silver falling by 2.8%. The outlier was oil, with tensions in the middle east and the rise in shipping rates bidding up the price of oil. Brent gained 1.8% while the WTI moved higher by almost 3%, becoming the best performing asset for the week as the crypto market experienced an unwinding due to uncertainty over the spot BTC ETF approvals and large incoming redemptions.

This week, attention would most likely be centered on BTC and crypto as the January deadline for the spot BTC ETF approvals come on Wednesday. Whether or not approval comes, heightened volatility is expected in the crypto market. As for the traditional financial markets, it will be a quiet week on the data front until Thursday where the US CPI data will be released, and on Friday, the US PPI data. Should the CPI record any hint of even a slight rise, the markets could react negatively.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.