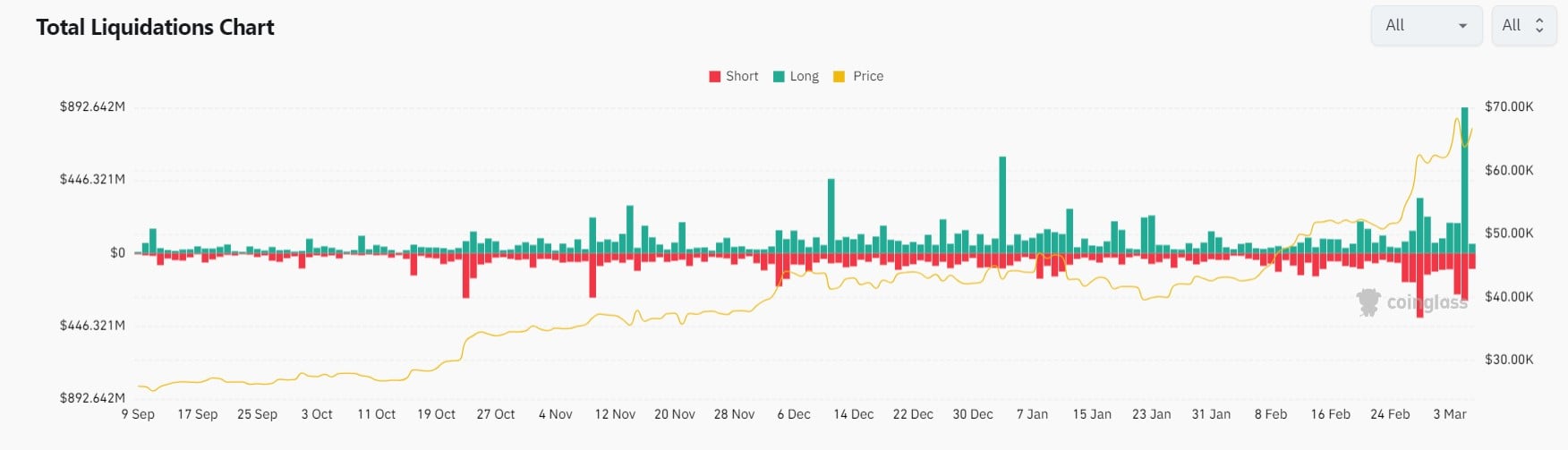

Last week’s crypto market was action packed, starting with a huge liquidation dump on Tuesday as the price of BTC briefly crossed $69,000 to hit a new ATH of $69,300 before plunging heavily in the subsequent hours to fall to a low of $59,000, clocking a 15% loss within just 5 hours.

The sharp drop liquidated more than $1 billion worth of long positions, which quickly flushed the rising funding rate from being overheated back to neutral by Wednesday, where buyers quickly appeared to make dip purchases on almost every coin on the market.

The aggressive purchases quickly erased all losses by Wednesday where the price of BTC consolidated around the $67,000 level, which speaks of immense strength in the price of BTC, which could eventually break its ATH within a short matter of time.

On Friday, the price of BTC once again crossed the $69,000 mark, hitting a fresh ATH of $70,000 before a glitch at Coinbase caused the price of BTC to plunge by 5%, dragging down other cryptos as well. However, the dip was very quickly bought up again, as the price of BTC knocked on the doors of $69,000 over the weekend.

It appears that there is a persistent seller above $69,000, which has been keeping the price of BTC contained within the $67,000 to $69,000 range over the week.

A check on on-chain reveals that the group of sellers that have been persistently selling near the ATH were short-term holders taking profit.

According to the spent output age bands above, most sellers of BTC in recent times were short term holders who only held their BTC for between 6 months to one year. This group of investors sold more than 18,000 BTC on Tuesday as the price hit $69,000, causing its price to plunge 15%. However, the longer term BTC holders who held BTC for more than one year did not sell any. This means that long-term holders, who are the main drivers of a sustainable BTC price trend, are still bullish on the price of BTC. It will be a matter of time that these short-term holders exhaust their BTC supply, which could eventually see the price of BTC finally cross $70,000 as the price action of BTC is showing resilience, putting in a much higher low with each selloff.

The bullish price action of BTC last week has come amid bullish news and macro developments, as major traditional financial giant funds like BlackRock announced that it plans to buy spot BTC ETFs through its Global Allocation Fund, which holds assets close to $18 billion.

With both the technical and fundamental picture reinforcing each other, this break upwards in the price of BTC appears to be just around the corner.

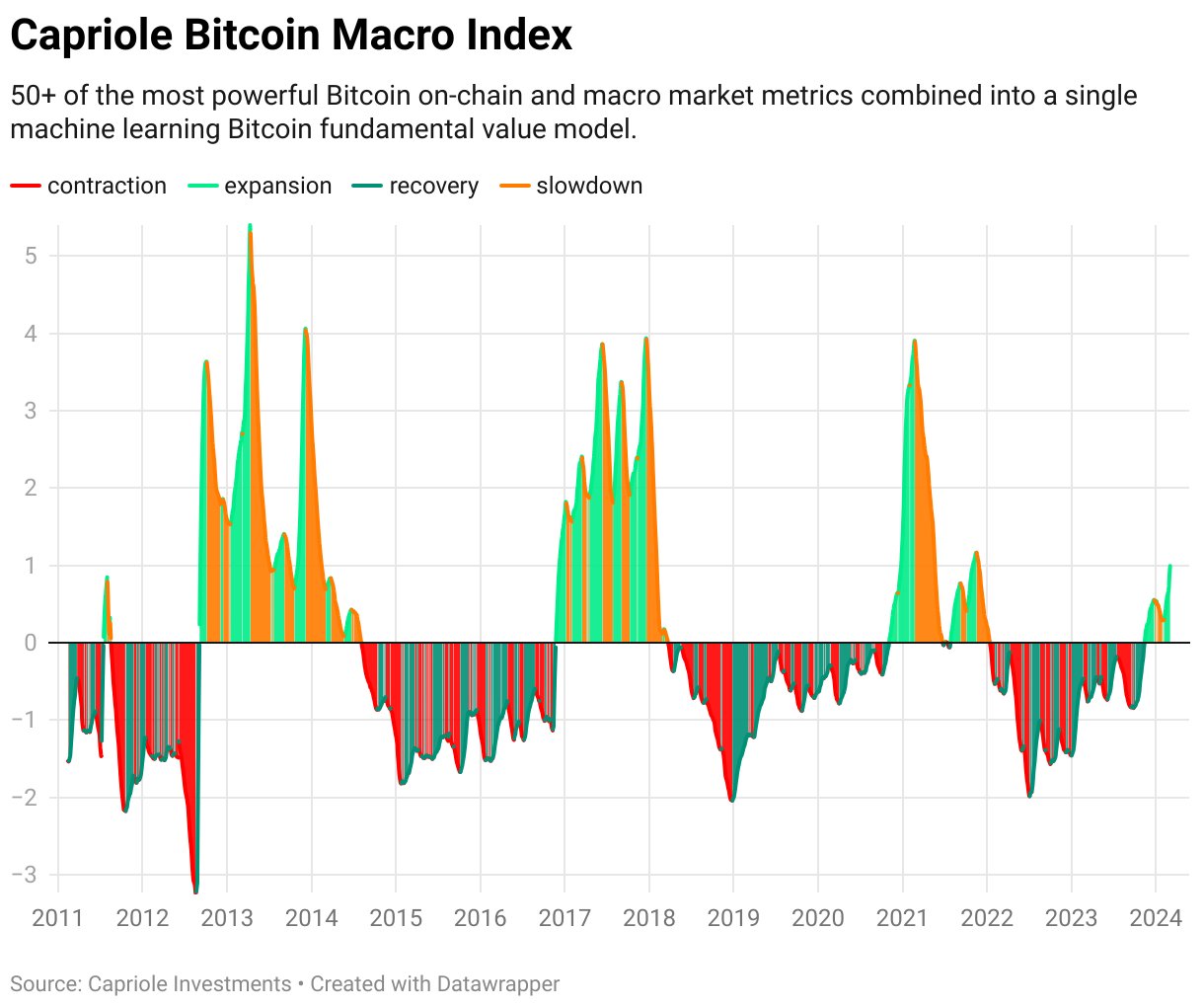

Marco Index suggests explosive BTC gains ahead

Not only are long-term investors bullish, even AI is bullish on the price of BTC going forward. According to an AI model that predicts BTC market cycle based on all on-chain and macro factors, BTC is currently in the expansion phase of its market cycle, which typically is followed by a period of rapid and vertical price expansion. This could mean that the price of BTC has much more room to move further north.

Altseason in full swing with AI, meme and ETH-beta in play

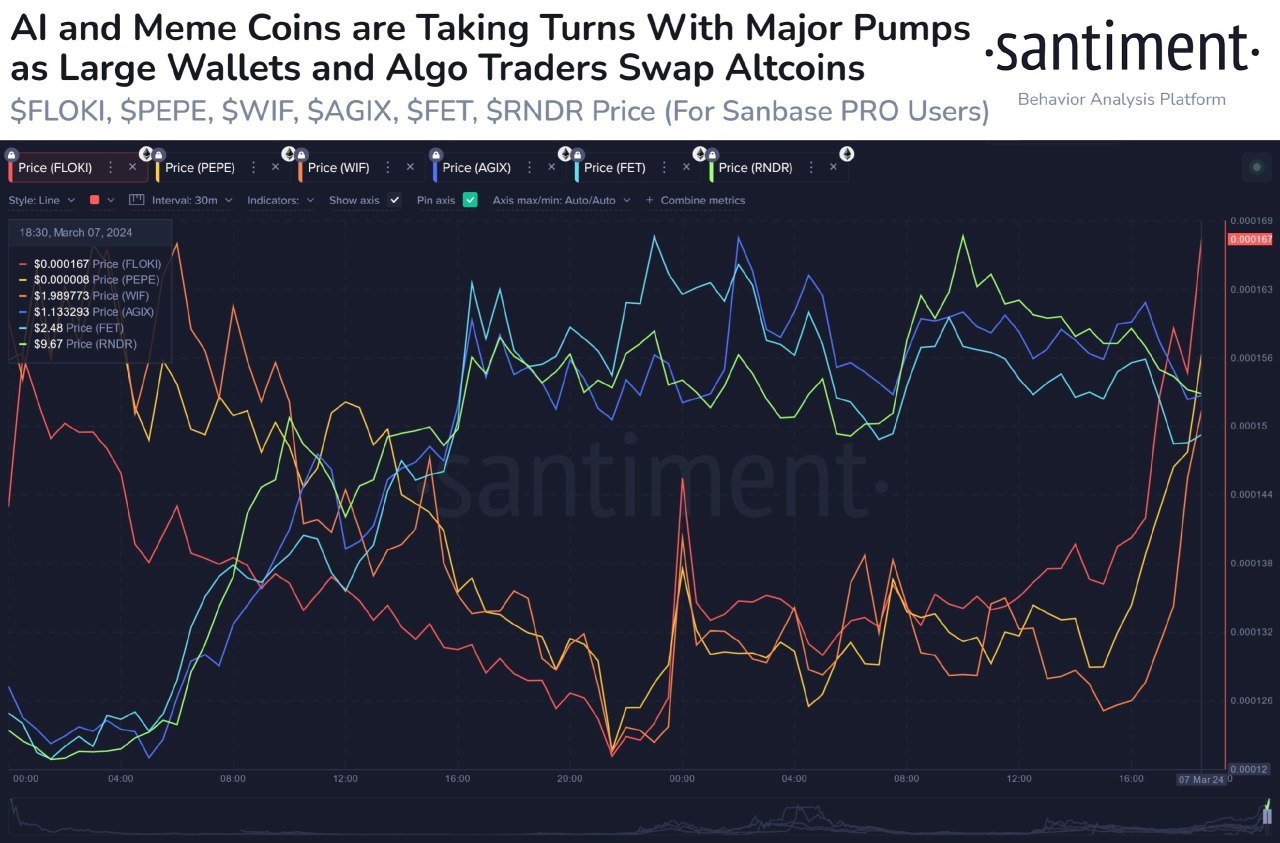

Influenced by the upcoming NVIDIA GTC AI 2024 conference that is to take place between 18-21 March, tokens in the AI sector rose by more than 30% on average as a whole last week as the rotational play moved away from memecoins into AI tokens. Popular AI names like RNDR, FET, and AGIX put in more than 40% gains even as AI tokens have been on a strong uptrend since the start of the year.

While memecoins retreated at the start of the week after raking in multiples in gains last week, action appeared to return to the sector after an almost 50% retracement in the very hotly traded coins that removed much of the over-leveraged traders. Memecoins like DOGE, SHIB, FLOKI, PEPE again saw significant price increases into the weekend as retail traders chased the popular names again in a bid for some quick profits.

This week, the daily rotation amongst the memecoins and AI coins could continue to power the market higher as these two sectors are easier for new retail market participants to understand and engage with. With the AI conference a week away, the play on AI coins could heat up again, even as the Dencun upgrade this coming Wednesday on 13 March may see some interest shift to the ETH L2s like MATIC, ARB, and OP.

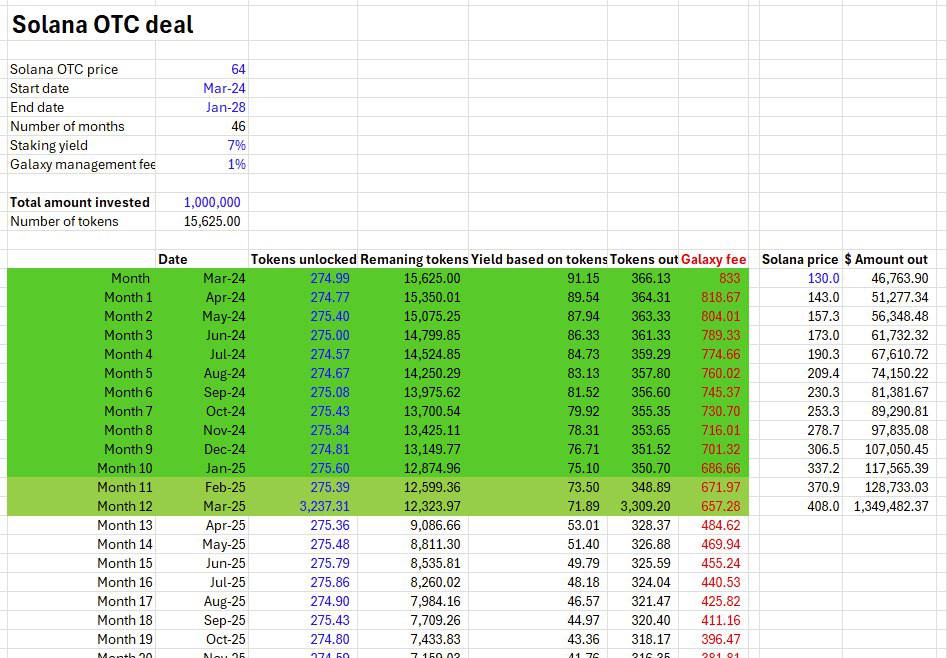

Pantera’s bid on FTX estate’s SOL sparked buying frenzy

Other than AI and memecoins, several Layer-1s also saw remarkable price increases. Newer blockchains like SEI, SUI, APTs all put in double digit returns. However, the main attention was on SOL, where it was reported that Pantera Capital was raising funds to buyout the SOL that the FTX estate had held in vesting. The below diagram highlights the portion of the SOL tokens that is of interest to Pantera, which will include up to the SOL that will be unlocked till March 2025, which is the bulk of the SOL token unlocks that the market was worried that the FTX estate would dump.

Market participants have calculated that Pantera would need SOL’s price to reach $260 per token in order to breakeven for the deal, which implies that a famous crypto hedge fund like Pantera thinks that the price of SOL will reach at least $260 by the end of this market cycle.

The news immediately brought about a buying frenzy on SOL, which took its price higher by 20% also late last week.

Precious metals surge on weakening dollar, stocks mixed

FED Chair Powell gave a neutral-to-dovish testimony last week at its Congressional hearing, which helped ease some worries of the FED not cutting rates this year. Basically, Powell mentioned that should the economy go the way that is expected, there will be rate cuts later this year, essentially reassuring investors that rate cuts would be forthcoming.

This reassurance, coupled with weaker economic data released last week, caused the dollar to weaken and the risk-on sentiment to continue.

The ADP private employment data missed estimates, coming in at a lower 140,000 against expectation of 149,000, while the ISM manufacturing index also came in below expectation – both data points depicting slowing economic activity, which usually causes inflation to ease.

While the non-farm payrolls released on Friday increased by 275,000, exceeding the expectations of 200,000, the unemployment rate for February rose to 3.9%, with expectations at 3.7%, indicating a weaker labor market.

While the dollar fell on the bad economic news, losing 1.06% for the week, the bad news served stocks and risky assets very well, with both the Nasdaq and the S&P putting in yet another ATH. At the end of the week however, profit-taking on Nvidia stock pulled equities off their highs, with the Nasdaq closing the week with a loss of 0.93%, the S&P dropping 0.26%, and the Dow losing 1.17% for its worst week since October 2023.

Gold on the other hand, benefited from the dollar weakness, putting in a remarkable 4.6% gain for the usually slow moving metal. Silver too, made an impressive move, rising by 5.13% for the week. Oil prices moved lower, however, with Brent losing around 2% and the WTI dropping 2.6%.

On the forex front, BoJ chief Ueda gave an advance warning that Japan’s ultra loose monetary policy may be coming to an end, sending the yen much higher and causing a frenzy of repositioning on the yen carry trade. This buying of yen against its major trading pairs, especially the dollar, was partly another reason why the dollar fell sharply last week.

However, over in Europe, the ECB surprisingly hinted at a June rate cut as the bloc cut its inflation forecast. While holding its rates steady at last Thursday’s meeting, the ECB presented a more benign picture on inflation, with the forecast for the year brought to an average 2.3% from 2.7%, giving it room to start cutting rates from June.

This week, the clock shifts forward by one hour in the Americas as the daylight savings time takes effect. For important US economic releases, Tuesday sees the release of the CPI, while Thursday will see the release of the PPI and retail sales numbers.

For the crypto market, the ETH Dencun upgrade on Wednesday will be the most keenly watched event, other than the AI conference that will be coming up on 18 March.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.