BTC broke ATH on Monday during the Asian trading session as FOMO ensued amongst the Asian community which tried to front run the spot ETFs by buying hugely in the futures market, leading to funding rates spiking to way over 130% per annum borrowing rates.

However, as the American session came on, the price of BTC retreated slightly as spot buyers were reluctant to buy at such a high price above $70,000. However, the price of BTC only managed a brief dip to $68,000 on Tuesday before its price recovered almost immediately back to around $73,000, once again led by traders who leveraged long to front run the spot ETFs.

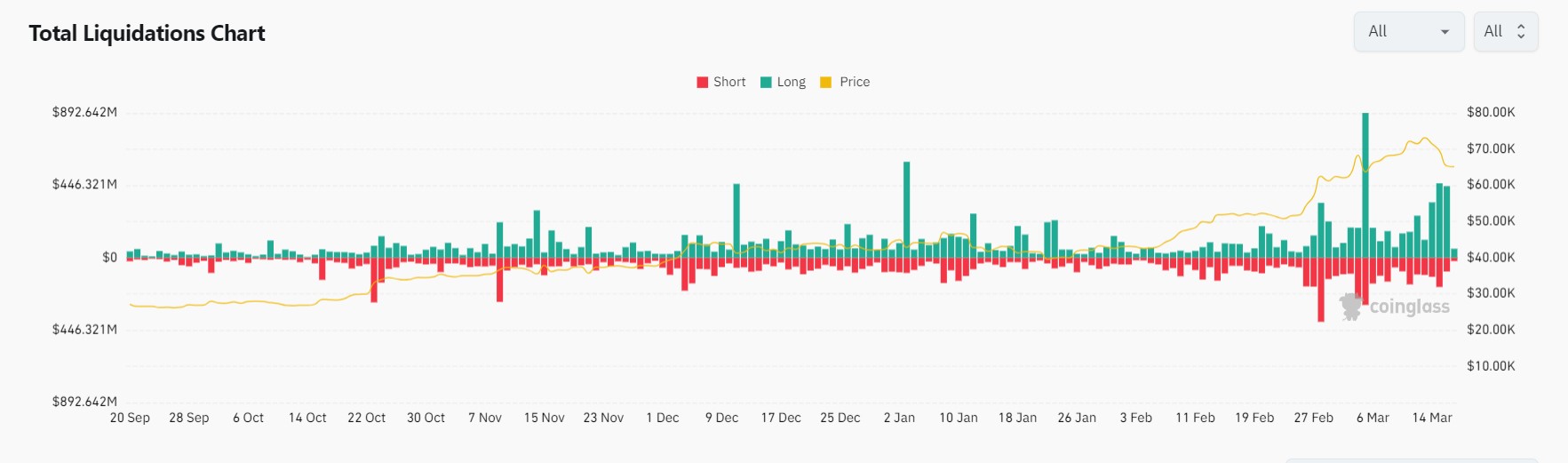

However, by mid-week, the inflows from the spot ETFs started to slow as the price of BTC remained stubbornly above $70,000, being fiercely bid higher by derivative traders as the funding rates returned to levels above 130% once again. Eventually, after the US PPI data came in way hotter than expected on Thursday, the price of BTC fell 10% in yet another flash crash, taking its price from $73,000 to $67,000. This time however, the dip in price was not as quickly and aggressively bidded up as in the previous similar occurrences. Eventually, over the weekend, the price of BTC dipped further to below $65,000.

The quick drop in the price of BTC dragged down altcoins, which had already been lagging BTC, to even lower prices. The sharp drop in prices managed to liquidate more than $1 billion in long positions over the four days.

US demand slows but MicroStrategy buys even more BTC

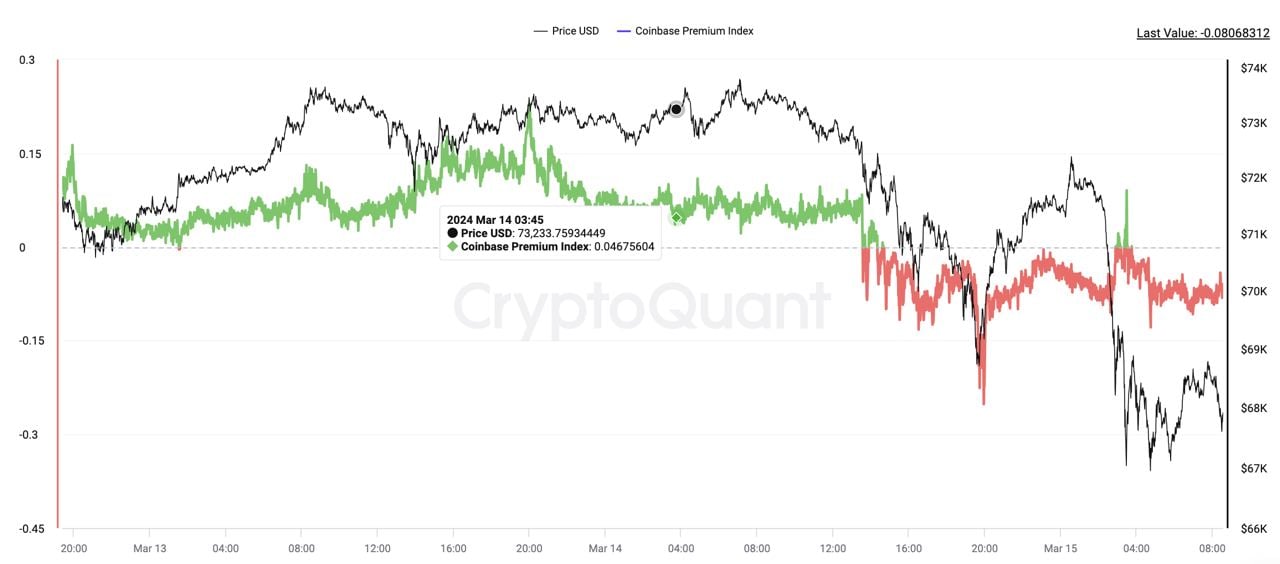

One possible reason for the slow recovery of BTC’s price since Thursday’s dip could be a result of slowing bids coming in from US investors.

As can be seen from the above diagram, the Coinbase premium, which shows the level of aggression from US buyers, has dipped from being positive to negative beginning on Wednesday. This dip demonstrated a slowing appetite from US buyers, which was evident in the spot ETF inflows, which dropped significantly from Wednesday after the price of BTC persisted above $70,000. This could imply that many BTC spot ETF buyers are price sensitive at a level above $70,000.

However, one particular BTC buyer remained unmoved by the higher price of BTC as the permabull went on a buying spree again. MicroStrategy announced that it had acquired an additional 12,000 BTC for $821.7 million using proceeds from the sale of its convertible notes and excess cash. It paid $68,477 per BTC for the latest purchase, and after this purchase, it currently holds a total of 205,000 BTC acquired for $6.91 billion at average price of $33,706 per coin.

However that was not all there was to it, the firm announced that it was raising another $500 million in debt offering to buy more BTC. The deal is expected to be completed this weekend, with the funds to be made available to purchase BTC this week. Should the fund raise indeed be completed over the weekend, then this new purchase could bring some support to the price of BTC at the start of this week.

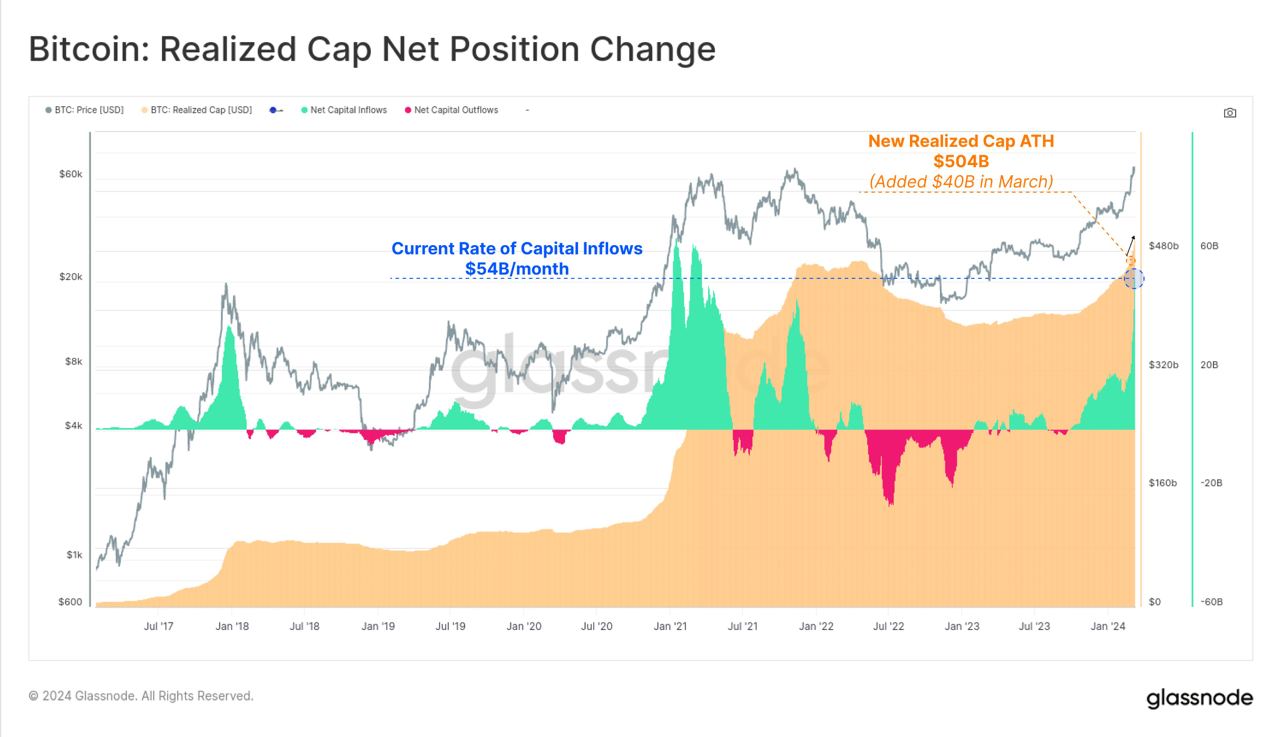

BTC realised cap increasing at fastest pace ever

Even though the price of BTC retreated sharply due to the flushing out of overleveraged positions, there is no doubt that the current cycle is witnessing the most aggressive spot accumulation of BTC. With such aggressive cash purchases, the BTC realized cap is currently increasing at a rate of $54 billion a month, at its fastest pace ever, with its current realized cap approaching levels last seen during the run-up in early 2021 when the current bull market cycle has merely just started. This highlights just how significant the capital inflows have been for BTC, with the increasing demand fast sending the valuation of BTC much higher at a time when its new supply is going to be reduced by 50% once the halving occurs. Thus, even though there is a short-term pullback in the price of BTC, its fair value is continuously increasing, which means that over the medium to longer term, the price of BTC ought to still be moving higher.

Nvidia conference could ignite AI tokens

Some altcoins have taken BTC’s pullback as a chance to move higher, as can be seen in the price of SOL, AVAX, BNB and SEI, which have shown remarkable recoveries back to their highs before BTC’s big dip on Thursday. This shows that funds may have begun to rotate from BTC into altcoins, which could provide for good earning potential in altcoins.

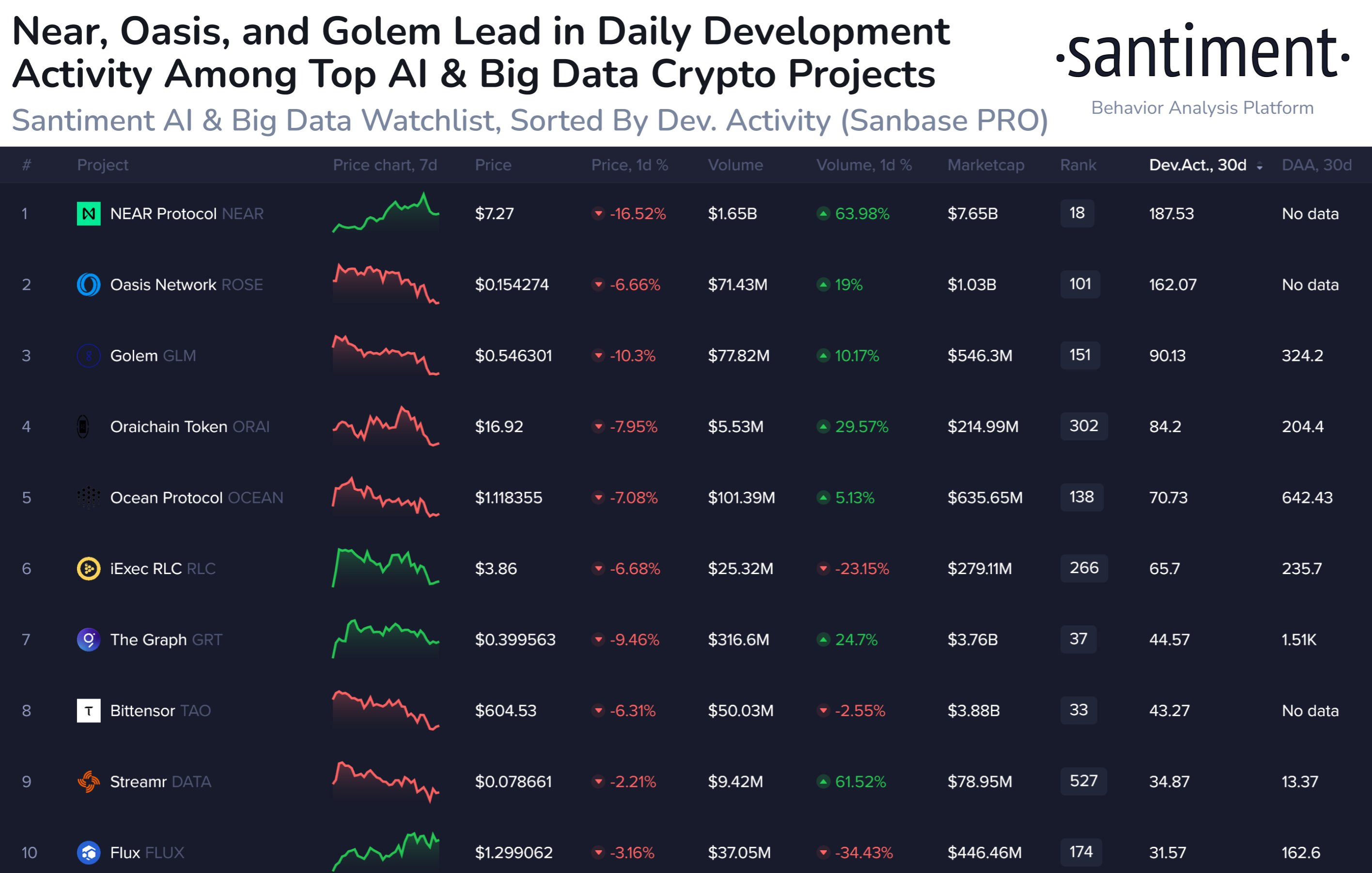

Other than the above coins which are showing good promise, another market segment could provide for interesting trading opportunities this week – AI coins. This week, from Monday to Thursday, Nvidia will be hosting its GTC conference, which will strongly focus on the subject of AI. As such, AI and AI related coins could see some love from market participants as the hot money moves in to capitalize on the event.

Week of central bank meetings spurs caution

Last week’s release of hotter than expected inflation numbers spooked traders, who took the opportunity to take some money off the stock market ahead of the FED meeting this week. First, on Tuesday, the CPI numbers came in higher than anticipated, while Thursday’s PPI numbers were a bombshell, way exceeding the hottest expectation.

The inflation numbers creeping up again has gotten the attention of JP Morgan CEO Jamie Dimon, who even urged the FED to wait past June before cutting interest rates, arguing that the central bank needs to shore up its inflation-fighting credibility. With the possibility of a June rate cut appearing less likely, investors sold stocks, leading to the second weekly loss in the S&P, which shed 0.13% by the end of the week. The Dow inched lower by 0.02%, and the Nasdaq slipped 0.7%.

The dollar gained 0.68% and Gold retreated by 1.13% as investors braced themselves for a period of stronger dollar again should the FED indeed turn more hawkish. Silver however, denied the odds and rose 3.25%, while oil also ended the week higher by around 4%.

This week, the FED will be meeting on 19-20 March, where fed funds futures are pricing in a 99% likelihood of the central bank keeping interest rates unchanged. However, market participants will be waiting on FED chair Powell’s take on the latest higher than anticipated inflation numbers. Should Powell’s comments be more hawkish than what the market likes, we could expect a selloff in risky assets.

Other than the FED, a series of other central banks will also be having their monetary policy meetings. First to meet will be Japan and Australia respectively on Tuesday. The yen has been in focus lately as the Japanese central bank has telegraphed that it will be dialing back on its ultra loose monetary policy. After that, the FED will announce its policy on Wednesday, while the UK and Switzerland will be having their meetings and policy announcements on Thursday.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.