The fixation on short-term spot-Bitcoin ETFs has Bitcoin on track to lose over 4% this week, extending the selloff from last week and setting the cryptocurrency up for losses of over almost 20% since its 49k high when the SEC approved the spot Bitcoin ETF.

Key Takeaways

- SEC’s approval of ten spot Bitcoin ETFs did not boost the market; instead, it coincided with a notable downturn in Bitcoin’s value.

- Significant ETF outflows, especially from Grayscale’s ETF, contrasted with overall net inflows, indicating mixed market reactions.

- Macroeconomic factors and Federal Reserve’s hawkish stance have reshaped rate cut expectations, impacting Bitcoin’s price.

- The market may be misjudging the short-term effects and long-term potential of spot BTC ETFs.

Why is Bitcoin falling?

Two weeks ago, the Securities and Exchange Commission approved ten spot Bitcoin ETFs, and so far, it hasn’t been the watershed moment that the sector was hoping for. While spot Bitcoin ETFs are not the BTC/USD market, ETF-related news has grabbed the headlines over the past few weeks and influenced the BTC/USD price. The market has continued to respond to spot BTC ETF trends, with net outflows pulling Bitcoin lower.

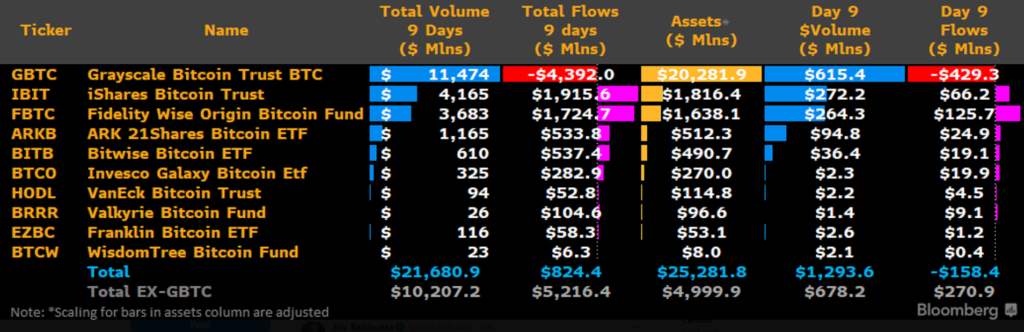

ETF Net Outflows on Day 9

While the Grayscale ETF has experienced outflows since the start, the other ETFs saw a positive start to trading, resulting in combined net inflows. However, that changed this week, and the spot-bitcoin ETFs saw combined negative flows for the first time.

According to Bloomberg Intelligence, on Day 9, the 10 spot bitcoin ETFs saw a combined net outflow of $158 million as flows into Blackrock’s ETF slowed. Blackrock’s IBIT has been the most in-demand of the ETFs, holding over 40,000 bitcoins as of January 24, double what it held a week earlier. However, demand has slowed, adding 1663 tokens on Wednesday, its lowest daily addition since starting, and down significantly from 8705 on January 17.

Meanwhile, Grayscale’s Investment Bitcoin Trust ETF has continued to weigh the group down, with $429 million leaving the fund on Day 9, although this was the slowest pace of outflows.

It is worth keeping in mind that daily flows can be volatile. However, CoinDesk data painted a similar picture, with combined spot ETFs holding 18,000 fewer Bitcoin tokens this week compared to the previous week. Meanwhile the weakest performer, Grayscale ETF, saw its total bitcoin in trust drop from 592,098 to 523,516.

However, looking at the bigger picture, according to Bloomberg data, overall spot-Bitcoin net inflows have stood at $824 million since the funds launched on January 11.

Will the Bitcoin sell off ease?

While the heavy outflows from Grayscales are dominating at the moment, we could expect this to taper off, and over the medium term, inflows to the likes of Blackrock’s IBIT and Fidelity’s FBTC could then dominate.

The worst of the profit-taking at Grayscales could be over, and the selloff is starting to ease, which will likely ease the downward pressure on Bitcoin.

There is a sense that the market overestimated the short-term demand and impact of the spot BTC ETF, which is why we are seeing the selloff in BTC/USD. However, there is also a sense that it is underestimating the long-term impact of spot BTC ETFs, which could help drive the recovery of Bitcoin.

Fed Rate Cuts

While ETF flows have been under the spotlight, the macroeconomic backdrop continues to play a role in driving BTC/USD. A series of stronger-than-expected US data combined with hawkish comments from Federal Reserve officials have seen a steep revaluation of rate cut expectations. The market is no longer expecting a rate in March, and BTC/USD has been reacting to this. Attention will now turn to the Fed meeting next week for further clues over when the central bank could start cutting rates.

Sources

Braun, H. (2024, January 25). Bitcoin ETF Flows Show Negative Trend For First Time Since Launch. CoinDesk. Retrieved January 26, 2024, from https://www.coindesk.com/markets/2024/01/25/bitcoin-etf-flows-show-negative-trend-for-first-time-since-launch/

Bitcoin ETF Tracker. (2024, January 26). Blockworks. Retrieved January 26, 2024, from https://blockworks.co/bitcoin-etf

Strack, B. (2024, January 25). Spot bitcoin ETF net outflows hit highest level yet on day 9 of trading. Blockworks. Retrieved January 26, 2024, from https://blockworks.co/news/bitcoin-etf-outflows-trading-day-9