Bitcoin is rising for a second straight day, pushing above the 60k level and heading toward 61k as concerns over forced selling appear to have passed and there are growing expectations that the Federal Reserve will start reducing interest rates in September.

Selling pressure from concerns over token distributions by defunct crypto exchange Mt Gox, the US government, and the German government appear to be over. The Bitcoin price has shown more resilience to the latest and the last Mt Gox distribution, suggesting that the market already has these worries in the rear-view mirror.

Instead, liquidity and the US elections are likely to be the next significant drivers for Bitcoin.

Fed rate cuts would boost liquidity.

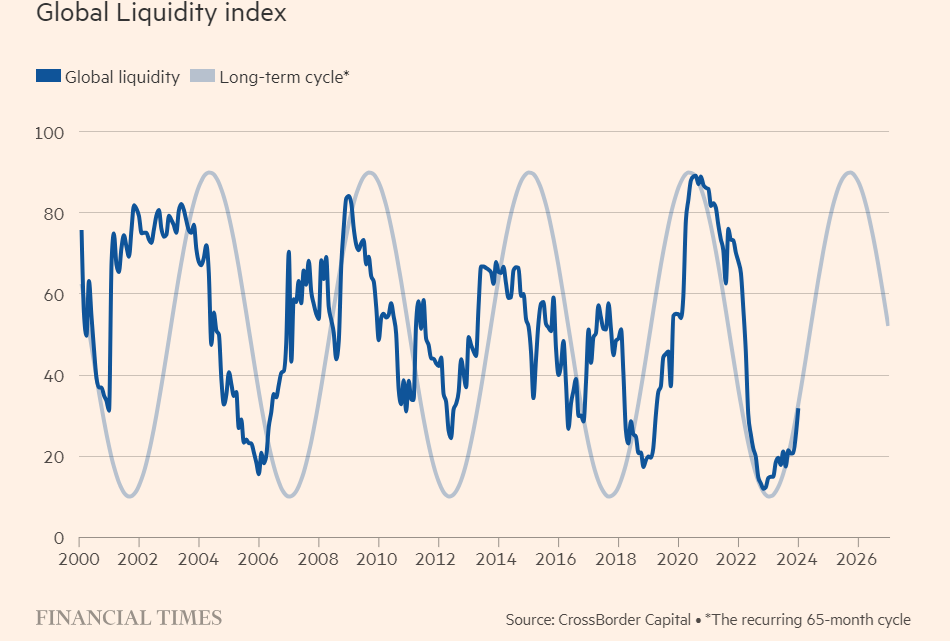

Major central banks are starting to cut interest rates, and the Federal Reserve is widely expected to kick off its rate-cutting cycle in September. Thus, liquidity is expected to improve. Liquidity is already showing signs of ticking up, which could help support a bull run in crypto and risk assets.

Attention this week is firmly on Federal Reserve chair Jerome Powell’s address at the Jackson Hole symposium on Friday. The market expects the Fed chair to signal a rate cut, although he is unlikely to outline plans or details explicitly.

Comments from Fed Chair Powell will come as inflation data showed that consumer prices continued to cool in July, dropping to their lowest level in three years, towards the Fed’s 2% target level.

According to the CME Fed Watch, the market is pricing in a 100% probability of a rate cut by the Federal Reserve at the September meeting and a 25% chance of a 50 basis point rate cut, down from 50% just a week earlier, as recession fears ease.

Stronger retail sales, jobless claims, and consumer confidence figures have calmed recession worries. Goldman Sachs has revised its expectations of a recession in 2025 downward to 20% from 25% previously.

As we move into 2025, central bank easing will likely produce a more pro-liquidity environment, which could help Bitcoin pass its all-time high.

US elections & Democrat convention

The other key catalyst for Bitcoin in the coming months will be the presidential election. The election result is not expected to impact macroeconomic conditions, which will likely hold for the next few years. However, Trump has proved himself a pro-crypto candidate, while Kamala Harris has disappointed crypto advocates and enthusiasts. Her failure to appear at the Crypto4Harris virtual event and her strategic silence on the subject are likely because she doesn’t consider it a major issue in the campaign.

With the Democratic convention taking place in the US, attention will be on the polls, the likelihood of a Kamala Harris presidency, and what that could mean for crypto.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.