Bitcoin is rising, boosted by the risk-on mood across the broader financial markets following a fresh round of stimulus from China and ahead of a speech by Federal Reserve chair Jerome Powell later today.

Additional China stimulus & Fed Powell to speak

Beijing promised to further support fiscal spending and revive growth, adding to several measures announced earlier in the week, fueling a broader risk appetite.

The timing of China’s bazooka stimulus plans is important. The Federal Reserve starts its interest rate-cutting cycle with a bumper 50 basis point rate cut, and the market is pricing in a 60% probability of another 50 basis point rate cut in the November meeting.

Attention is now squarely on Federal Reserve chair Jerome Powell. He will give a prerecorded speech at the 10th annual U.S. Treasury Market Conference. The market will scrutinise his comments for clues about the health of the US economy, and it’s likely that we’ll hear of another outsized rate cut.

Kamala Harris – the tech-friendly President

Meanwhile, Democratic Presidential nominee Kamala Harris reportedly said at a fundraiser event that she’ll be a tech-friendly president who encourages innovative technology such as AI and digital assets. These comments were notable because they were the first time that Kamala Harris had publicly remarked about crypto.

Positive marks suggest that Harry said the administration could adopt a more supportive approach to crypto than the current Biden administration.

A combination of supportive comments from Kamala Harris, the US, the world’s largest economy, moving to a lower interest rate environment and stimulus measures in China means the path of least resistance is likely to continue to the upside for riskier assets such as Bitcoin and US indices. The S&P 500 is down, and the Dow Jones trades at record highs.

While the broader risk environment is lifting cryptocurrencies, certain coins are outperforming.

Why is NEAR rising?

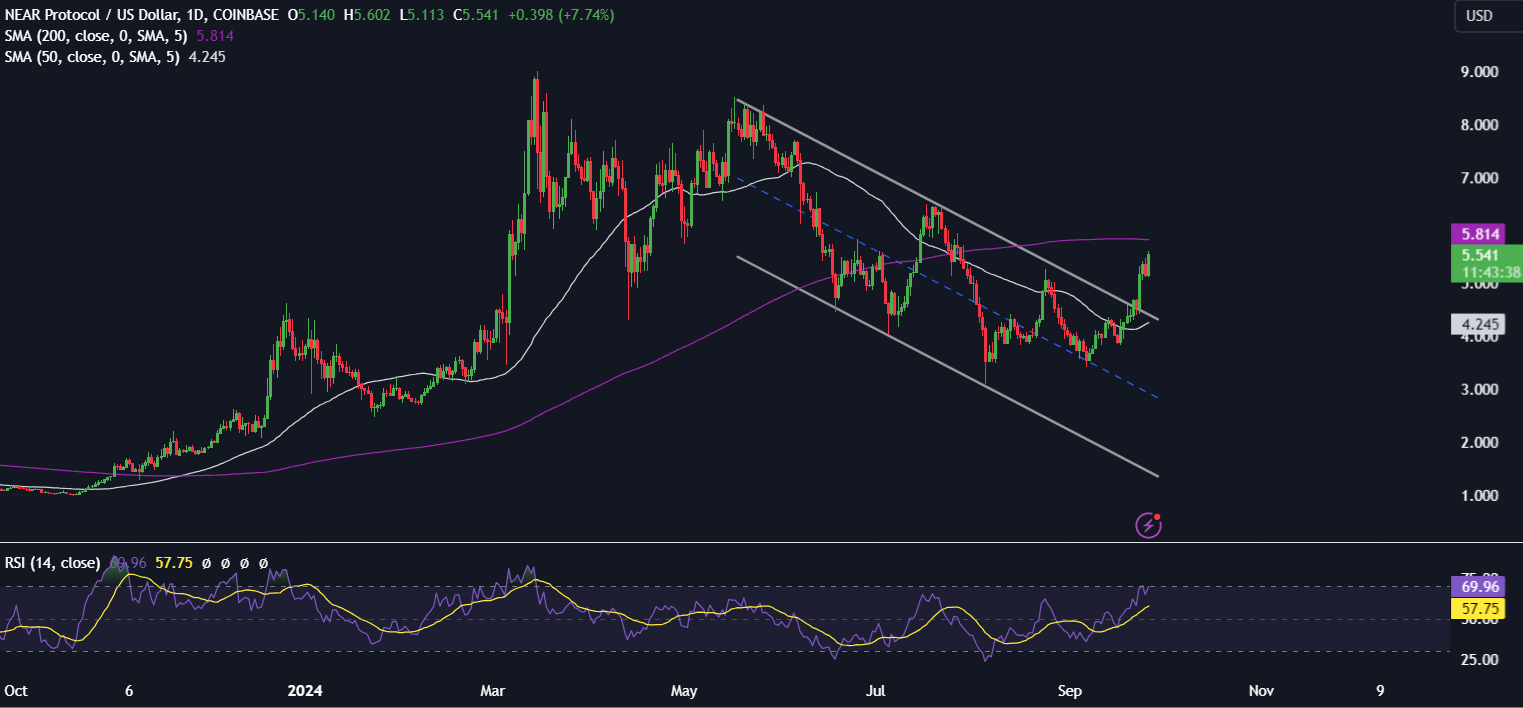

NEAR, the AI-focused token is trading over 7% higher at the time of writing as it approaches a key resistance level in the form of the 200 SMA. NEAR jumped 37% in September and is up 18% so far this week.

NEAR is not alone. AI-focused token peers such as RNDR and LAO have also outperformed in September, traditionally a bearish month for crypto.

The rally comes as the AI trade is revived in the stock market, with Micron Technologies surging 15% on upbeat revenue guidance and chip demand.

Why is TON rising?

TON is also extending a rebound from a 6 month low reached earlier this month. The Open Network is rising as it prepares for increased demand as Hamster Kombat expands its user base. The TON blockchain asked validators to stand ready to onboard millions of new users from Hamster Kombat, the Web3 game, as users begin minting Hamster Kombat tokens on the blockchain.

The Telegram-based Hamster Kombat hosts 100 million monthly active users and is the third fastest-growing app in history. It has onboarded 150 million users, surpassing Pokémon Go and Meta threads.