As 2022 was a bad year for Bitcoin, 2023 was equally as good. Could 2024 see Bitcoin extend its uptrend? And will volatility pick up to more historical levels?

Key Takeaways:

- Bitcoin is in a bullish phase of its 4-year cycle due to reduced supply and increased demand from halving events.

- Historical data suggests Bitcoin’s price is following previous market cycles, but past performance doesn’t guarantee future results.

- In 2024, factors like a Bitcoin ETF and Federal Reserve rate cuts could drive Bitcoin higher, but regulatory challenges and security risks may pose threats.

- Volatility could rise as Bitcoin remains in a bull market, potentially leading to a rollercoaster ride for investors.

Bitcoin appears to have entered the most bullish period of its 4-year cycle

2022’s Bitcoin winter is firmly in the rearview mirror, and the cryptocurrency appears to have entered the most bullish period of its 4-year halving cycle.

Every four years, the amount of Bitcoin paid out to miners is halved. A halving event influences BTC price due to a simple matter of supply and demand. If there are fewer bitcoins being made available, the price should rise as long as demand remains at least constant. Furthermore, miners will only have half as many BTC available to sell to cover operational expenses, meaning reduced selling pressures.

Bitcoin has historically moved through three stages each cycle:

Crypto Winter (Bull market peak to bear market trough)

| Start date | End date | Weeks | Price move % |

| December 2013 | December 2015 | 58 | -86% |

| December 2017 | December 2018 | 52 | -84% |

| November 2021 | November 2022 | 52 | -78% |

Crypto Spring (Bear market trough to Bitcoin halving)

| Start date | End date | Weeks | Price move % |

| January 2015 | July 2016 | 78 | 377% |

| December 2018 | May 2020 | 74 | 348% |

| November 2022 | April 2024 | 72 | 191% (so far) |

Crypto Summer (Bitcoin halving to bull market peak)

| Start date | End date | Weeks | Price move % |

| July 2016 | December 2017 | 74 | 2873% |

| May 2020 | November 2021 | 78 | 615% |

| April 2024 | ? | ? | ? |

Bitcoin price is on track to continue the historic pattern

So far, the data suggests that the price is on track to continue the historic pattern. The chart below shows that Bitcoin’s price performance is tracking the previous market’s cycle. It is worth noting that past performance is not necessarily an indicator of future moves.

Bullish & bearish drivers

While history has shown that having events is a bullish catalyst for BTC, this could be amplified in 2024. This is because the halving event happened in the same year and just a few months after the Securities and Exchange Commission approved the spot Bitcoin ETF, and the Federal Reserve is expected to start cutting interest rates. Both of these events are expected to be bullish for the crypto-currency over the medium term.

The combination of these three events -halving, spot ETF, and Fed rate cuts, could mean that BTC could be in line for a stellar year. However, there could also be some bumps along the way. Tighter regulation, hacks, and fraud at crypto institutions, which have been too familiar across the years, could act as bearish catalysts for the Bitcoin price.

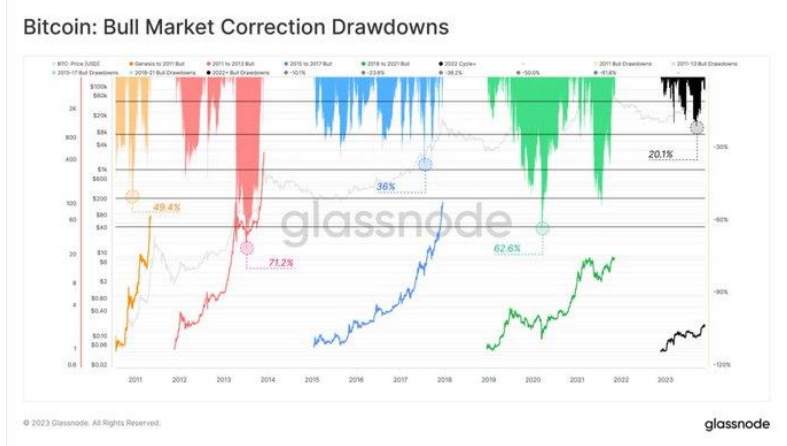

Potential for greater volatility to come

Bull markets can still see significant pullbacks while remaining in a bull market and before reaching the peak. Historically these drawdowns have ranged from 40% to 60% before the price continued higher to the bull market peak. The current cycle has only seen a 20% pullback so far, so there is the potential for greater volatility and more of a rollercoaster ride to come.

Sources

HANCOCK, D. (2024, January 31). Is the Bitcoin 4-Year Market Cycle Real? Benzinga. https://www.benzinga.com/money/is-the-bitcoin-4-year-market-cycle-real

Kelly, K. (2023, December 6). Bitcoin and the Predictability of Crypto Market Cycles. Coindesk. https://www.coindesk.com/markets/2023/12/06/bitcoin-and-the-predictability-of-crypto-market-cycles/

First1Bitcoin. (2023, May 22). Bitcoin :Bull market correction Drawdown. Binance. https://www.binance.com/en/feed/post/549616

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.