- Bitcoin recovers from a low of 58,400

- ETF bleed-out continues, hitting $1 billion in 10 days

- Mt Gox distributions to start next month

- German government Bitcoin sell-off

- Fed rate cut bets in focus

Bitcoin is attempting to push higher after posting its largest drop in two months on Monday. The losses come after Bitcoin saw its second-worst weekly decline of 2024 in the previous week. This reflects cooling demand for Bitcoin ETFs and uncertainty over US monetary policy.

Bitcoin tumbled as much as 8% on Monday, falling to a low of $58,400, marking its largest intraday loss since April 13. However, the price settled above 60k and recovered to 61,200 at the time of writing.

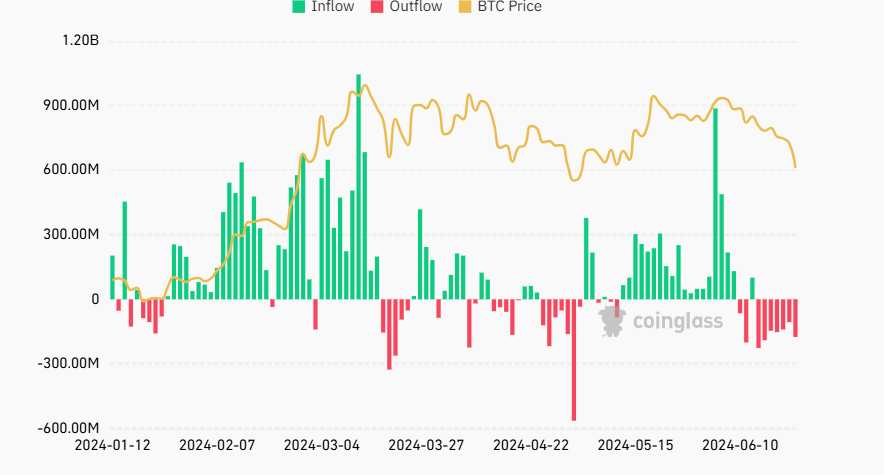

ETF bleed-out continues

The sell-off came as the cryptocurrency has been hit by two weeks of outflows from spot Bitcoin ETFs. Total spot Bitcoin ETF outflows were $174.5 million on Monday as the selloff bleeds into the new week. Bitcoin outflows have now exceeded $1 billion in the last ten days, with total outflows from Grayscale’s GBTC exceeding $18.4 billion since its inception. This current sell-off suggests that the early excitement surrounding the launch of spot Bitcoin ETFs appears to be waning, and Bitcoin institutional interest appears to have been falling together with global market uncertainty.

Mt Gox distributions & German government sell-off

The news of Mt Gox repayments has further influenced market sentiment. The defunct crypto exchange Mount Gox is preparing to return over 140,000 Bitcoin to victims following a 2014 hack. The payments are set to commence next month, with approximately $9 billion worth of Bitcoin and $50.8 million in Bitcoin cash ready for distribution after a decade-long wait.

The recent market jitters have been amplified by the German government’s significant Bitcoin sell-off. The government initiated the sale of a substantial Bitcoin stash seized from a movie piracy website, with 3000 Bitcoin sold out of the nearly 50,000 Bitcoin originally seized. This increased supply into the Bitcoin market contributed to the downward pressure on Bitcoin as market participants positioned themselves short.

Fed rate cut bets in focus.

Jitters in the crypto market also stem from doubts over when the Federal Reserve will start cutting interest rates from a 22-year high. The recent sell-off in crypto could be a warning sign for the broader risk appetite.

In the June Federal Reserve meeting, policymakers projected one rate cut in 2024, a downward revision from three rate cut forecasts just a few months earlier.

Investors will now look cautiously ahead to Friday’s inflation data, which could provide further clues about the timing of possible Fed rate cuts. Signs of sticky inflation could fuel bets that the Fed will keep rates high for longer, which bodes poorly for Bitcoin’s outlook. However, signs that inflation is cooling could spark a meaningful reversal in BTC as the market gains confidence that the Fed will cut rates twice this year.