The crypto market is subdued on Wednesday as the market rethinks the chances of an outsized Fed rate cut. This keeps the USD supported ahead of today’s US inflation data.

Bitcoin trades at around 61k, slightly up from the overnight low of 60.4k. However, it has been 1.5% lower over the past 24 hours and has fallen over 3% across the past 3 days. Ether has experienced similar price action, trading 1.9% lower, while SOL trades -1% lower.

Bitcoin and other cryptocurrencies have come under pressure amid resilience in the US dollar. The dollar trades at a seven-week high compared to its major peers as the market expects the Federal Reserve to adopt a more gradual pace to rate cuts.

The minutes of the September Fed meeting showed that policymakers supported the central bank’s 50 basis point cut last month but considered a more gradual pace appropriate going forward. This comes after strong payroll data last week saw the market wipe out bets for a 50 basis point cut in November.

Inflation is expected at 2 to 2.3%, and most current fashion is expected to remain sticky. The prospect of US interest rates being cut at a slower pace is less beneficial for liquidity and, therefore, for riskier assets. Meanwhile, cooler-than-expected inflation could help leave Bitcoin higher.

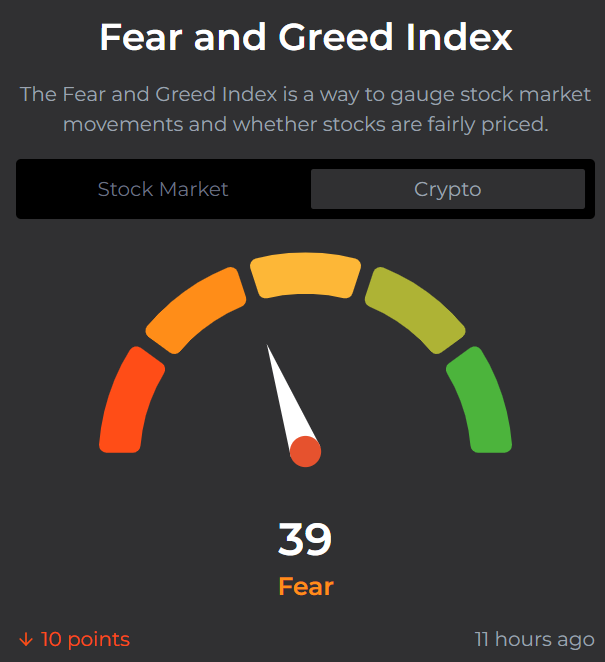

Crypto sentiment has soured, moving back into the fear zone (39), in contrast with the equities fear and greed index, which is in the greed zone (72). The S&P 500 and the Dow Jones reached record highs in the previous session.

Dogecoin to $1?

Dogecoin is underperforming Bitcoin today, trading 3% lower over the past 24 hours and having seen declines of 6% so far in October. The traditionally strong month for Bitcoin and cryptocurrencies has yet to materialize.

But things may start to look up for Dogecoin as it enters the next stage in its cycle. Several key analysts have predicted that Dogecoin will outperform Bitcoin in this market cycle owing to its historical performance and community-driven momentum.

Since Dogecoin was launched in 2013, the coin has consistently outperformed Bitcoin in each cycle. While Bitcoin saw most of its gains in its first cycle, the gains have decreased since then. On the other hand, Dogecoin has seen price gains in each successive cycle. In the 2018 bull market, Dogecoin rose 54000%, and in the 2021 null cycle, the price surged 54,800%. Should this trend continue, the bull run could surpass the previous two cycles. Even a modest gain of 500% could see Dogecoin reach $1.

Still, it is worth noting that Dogecoin has underperformed Bitcoin so far this cycle, with gains of 21% compared to Bitcoin’s 47%, and is still way below its all-time high of $0.70.