Bitcoin has fallen below the key $80,000 mark on Friday, heading for a steep monthly loss as concerns over US tariffs drag on risk appetite and as the market awaits US inflation data.

The world’s largest cryptocurrency trades 8% lower at 79.4K at the time of writing and is set to drop 22% across February. It is trading down 27% from its record high of 109.5, reached after President Trump’s election victory.

The initial rally in Bitcoin was driven by optimism surrounding Washington’s pro-crypto stance. However, recent announcements of trade tariffs and a slate of weaker-than-expected data in the US, combined with the Bybit hack news, have dampened sentiment, resulting in a persistent downward trend over the past six weeks.

Yesterday, Trump warned that 25% tariffs on Mexican and Canadian goods would take effect as of March 4. In addition to the 10% levy already applied, a further 10% tax on China would be imposed. Trump also warned that trade tariffs on the European Union were coming.

Trade tensions have fueled market volatility across risk assets, including cryptocurrency and stocks, in the US again. The S&P 500 fell 1.6% yesterday, and the Nasdaq 100 closed 2.8% lower. US stocks, like Bitcoin, have given back all of this year’s gains, erasing the “Trump pump.”

Five-day crypto long liquidations are at $3 billion, highlighting the risks of trying to catch a falling knife.

Following a massive drop, Bitcoin is now at a crossroads. What next for BTC?

Is this the end for Bitcoin?

The near-term macro backdrop is providing reasons to be cautious, and BTC has fallen below its 200-day moving average—a key technical support that could pave the way for further losses. Moreover, the carry trade that hedge funds have been exploiting, a low-risk arbitrage trade between Bitcoin ETFs and CME futures, is unwinding. These factors are sending Bitcoin’s price into freefall.

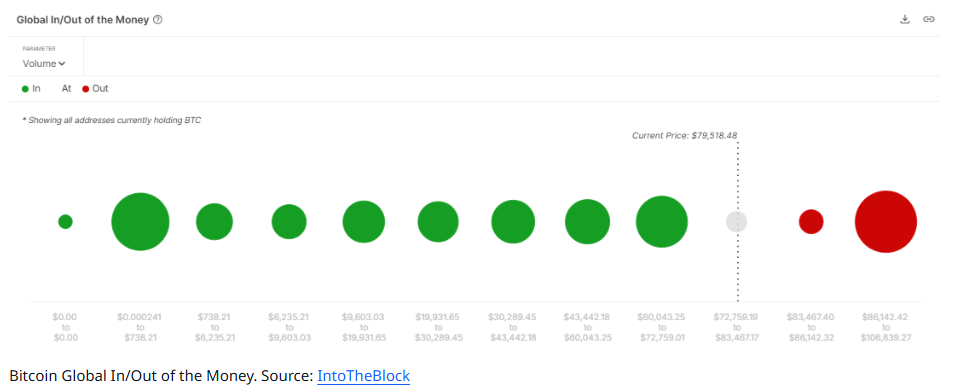

The carry trade could unwind further, resulting in more forced liquidations and further weakness until hedge fund positions are cleared. This isn’t the end of Bitcoin, but the price could fall towards $70k support level. At this level, 6.76 million addresses hold 2.64 million BTC tokens at the acquired price of $65,296. Therefore, this zone could prevent further declines.

Could BTC recover?

The weekly decline of 13% has pushed Bitcoin into oversold levels for the first time since August 2024. The last time Bitcoin was oversold—seven months ago—it resulted in a 33% price surge, lifting BTC from 49k to 64k in just two weeks. Should Bitcoin follow a similar trajectory this time around, it would boost the price to $110k.

This would require long-term holders to step in to absorb the selling pressure, and so far, they haven’t appeared. In fact, according to Santiment data, long-term holders or those holding over 10 coins sold 6813 BTC over the last 7 days. This month’s outflow has been the largest since July, suggesting that major holders could be less bullish for now.

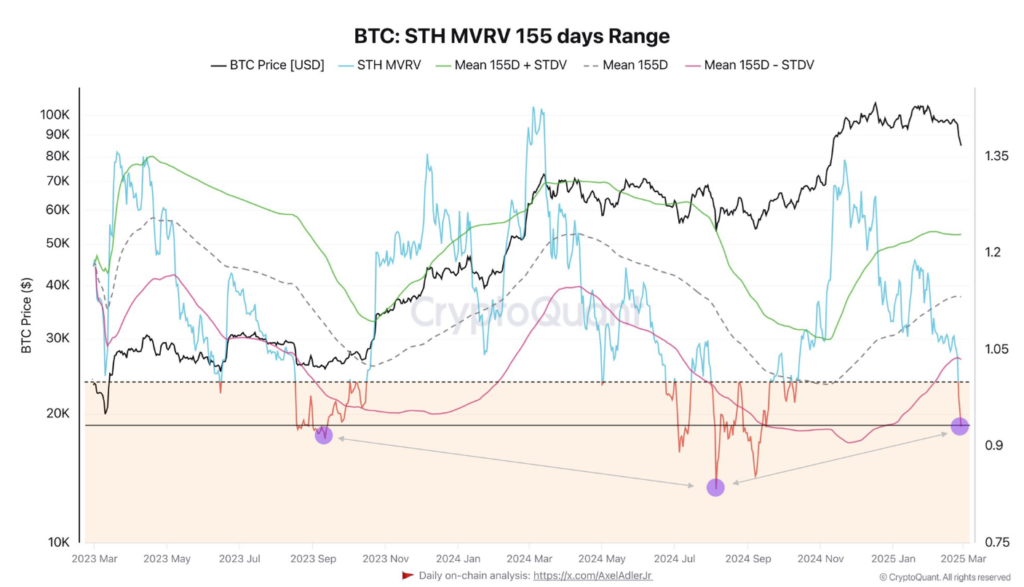

To assess when Bitcoin may recover, we could use CryptoQuant’s Bitcoin short-term holder market value to realised value (STH MVRV) ratio. This indicator, ranging over 155 days, shows whether short-term holders are in profit or loss. Currently, STH MVRV is approaching lower levels. Below 1, it suggests short-term holders are holding BTC at a loss, and historically, levels below 0.9 have aligned with Bitcoin price bottoms.

It’s worth remembering that a 30% correction within a Bitcoin bull cycle is not uncommon. In 2021, Bitcoin dropped 53% followed by recovery to new record highs. Sharp corrections can often occur before further bullish momentum returns. However, traders could remain cautious and not overleverage.