Bitcoin rallied on Thursday after the Federal Reserve cut interest rates, signaling the start of an easing cycle. This is only the third time in history that the Fed has started an easing cycle with a 50 basis point cut.

Bitcoin has risen almost 3%, breaking out above 60k to a high of 62.5k, a level last seen at the end of August. This, in turn, liquidated short Bitcoin positions across exchange order books. Coinglass data showed that liquidations across exchange order books for the 24 hours at the time of writing were $128 million.

Meanwhile, altcoins are also on the rise, with Ether trading almost 4% higher and Solana jumping 6%.

The Fed cuts rates by 50 basis points

Risk assets, including cryptocurrencies, have cheered the Federal Reserve’s bumper 50 basis point rate cut, which was at the upper end of market expectations. The first rate cut in four years takes the base rate to 4.75 to 5%. In addition to lowering interest rates from the 22-year high, the Fed also signaled the start of a rate-cutting cycle with more rate cuts to come.

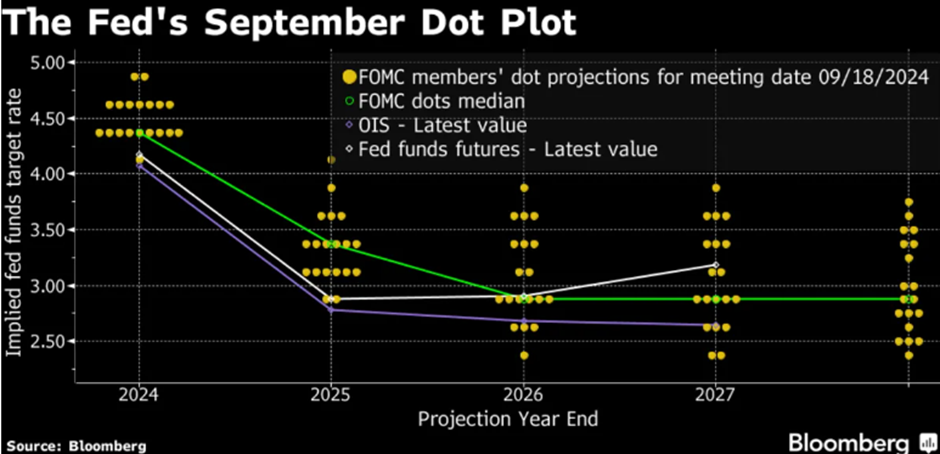

Along with its policy announcement, the Fed also released updated economic projections and its dot plot, which maps out policymakers’ expectations for where they see interest rates going over the coming month and quarters. Looking at the Fed’s dot plot, the U.S. central bank forecasts two more 25-basis-point rate cuts this year. However, it signaled slightly less easing next year.

So far, investors are looking past a less dovish outlook from the US central bank. Powell has said that the Federal Reserve will not be cutting rates to the ultra-low levels seen previously and that the central bank’s neutral rate will be much higher. This means that the medium—to longer-term outlook for interest rates could be higher than previously expected. And let’s not forget that ultra-low rates were a key component of the crypto 2021 bull run.

Heading into yesterday’s Fed meeting, there were concerns that a 50 basis point rate cut could spook markets, pointing to signs of economic trouble. However, the fact that risk assets such as stocks and Bitcoin have surged today suggests that the market hasn’t interpreted the move in this way.

Instead, the weaker U.S. dollar and the prospect of increased liquidity are pushing the largest digital currency towards 65,000.

A word of warning…

While the Fed calmed market worries over the economy’s health, it is worth noting that the only two previous occasions when the Fed kicked off its rate-cutting cycle with a 50 basis point cut were during crises, in 2001 and 2007.

This may mean that the buyers are happy to take the price higher for now. However, the slightest piece of disappointing data could revive recession fears and spark a sharp selloff.