Bitcoin is holding steady at 62k in quiet trade as investors awaited further clues over US interest rates from the Federal Reserve and inflation data.

Bitcoin prices have struggled to gain traction this week and still trades lower across October, a historically bullish month for the cryptocurrency. The digital coin has struggled as investors lower expectations of aggressive rate cuts by the Federal Reserve in the coming months. This has, in turn, boosted the USD, which trades at a seven-week high against its major peers.

FOMC minutes & inflation data

Attention is firmly on the Federal Reserve’s September meeting minutes, which are released later. The Fed cut rates by 50 pace points in the September meeting and announced the start of its rate-cutting cycle. The market will be keen to gain further understanding as to why the Fed opted for an outsized cut.

Strong nonfarm payroll data released last week and other data releases have highlighted resilience in the US labour market and, more broadly, the economy, raising questions over the Fed’s ability to cut rates aggressively.

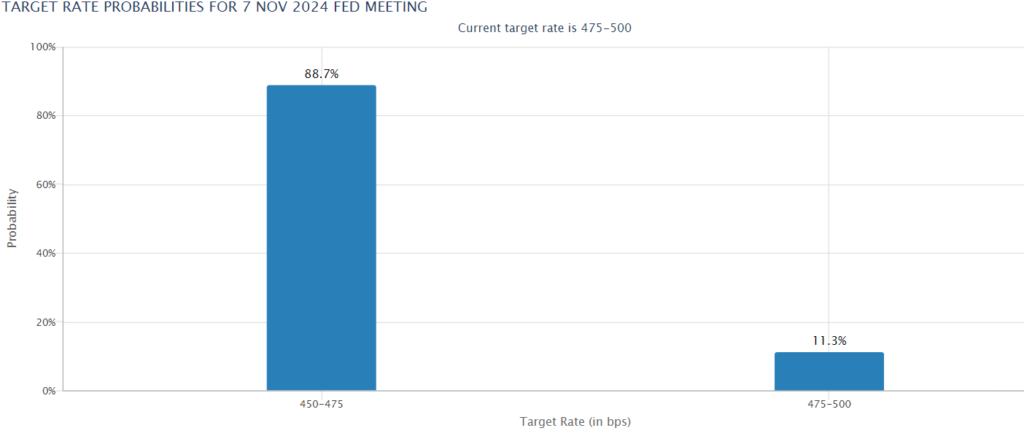

According to the CME Fed Watch, traders are pricing in an 89% probability that the federal cut rates by 25 basis points in November and an 11% probability that the Fed will leave rates unchanged. This is quite a turnaround from a 60% probability of a 50-basis point rate cut expected just over a week ago.

US inflation data will also be released on Thursday and could provide further clues about the Feds’ pace of rate cuts. A low interest rate environment benefits riskier assets such as cryptocurrencies and stocks.

Even if the Fed does move gradually to cut rates, rates are still expected to be reduced, which supports the outlook for Bitcoin over the medium term.

US to sell Silk Road Bitcoin.

Bitcoin is also under pressure amid a notable legal development: the US Supreme Court has declined to review an appeal over the ownership of 69,370 bitcoins, worth around $4.4 billion at today’s price, originally confiscated from the dark web Silk Road marketplace.

The Supreme Court’s decision allows the US government to proceed with selling the seized assets, concluding the legal battle.

The sale of such a large quantity of Bitcoin has sparked some concerns over the possible impact on Bitcoin’s price. This isn’t the first time the market has had to deal with a large influx of supply. Earlier in the year, the German government sold confiscated Bitcoin and Mt Geox distributions, which put pressure on the Bitcoin price.