BTC/USD is inching higher after falling to a low of 56,750 yesterday, taking Bitcoin into a bear market.

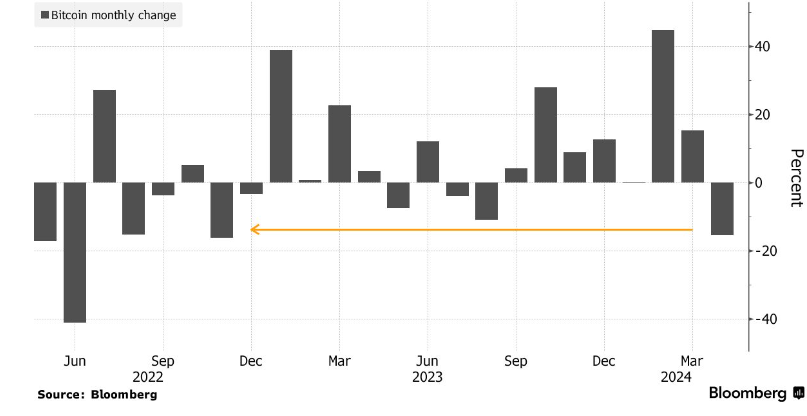

After Bitcoin fell over 12% in April, the selloff continued into May, with the cryptocurrency down over 20% from its record high in March, marking a technical bear market. Although Bitcoin still trades up 30% this year and is double where it was this time last year.

The selloff has extended beyond Bitcoin, with the altcoin market also experiencing a selloff. Ethereum has fallen just below 10% this week, while Litecoin has tumbled 5%.

Why has Bitcoin fallen this week?

Bitcoin has fallen over 8% so far this week, marking its worst weekly performance since August last year. On Tuesday, Bitcoin shed over 4% after the spot Bitcoin and Ethereum ETFs failed to impress investors on their debut.

Six crypto-related ETFs commenced trading on the Hong Kong exchange, and trading volumes were well below expectations. With a combined volume of just $11 million, this was a fraction of the $100 million volume that had been anticipated. Bitcoin ETFs made up $8.5 million of the volume.

The volume was also well below that of the US-based Bitcoin ETFs, which registered $655 million on the first day of trading on 11 January. Since their approval, the 11 Bitcoin ETFs approved in the US have experienced $12 billion in net inflows. However, inflows have slowed significantly in recent days, which has also weighed on the Bitcoin price. The 10 largest spot US Bitcoin ETFs are facing the biggest weekly outflow since their inception at the start of the year.

Fed still anticipates a rate cut over a rate hike.

Meanwhile, the latest Federal Reserve meeting may provide much-needed support for the BTC price. The Fed, as expected, left interest rates unchanged at 5.25%-5.5% and added that the central bank is in no rush to cut interest rates given sticky inflation and the resilience of the US economy.

Inflation has risen across Q1 of this year, proving to be more persistent than anticipated. Meanwhile, the jobs market has remained resilient, with wage growth adding to inflationary pressure in the first quarter.

Still, Fed Chair Powell quashed concerns that the Fed may hike interest rates further to control inflation and bring it back to the 2% target level. The market has interpreted the meeting as slightly more dovish than expected, with the market now pricing in 35 basis points worth of rate cuts this year, down from 29 prior to the meeting. While this is a modest change, it appears to have limited the losses in Bitcoin, which is attempting to edge higher.

Crucial weeks ahead

Bitcoin’s halving event has so far done little to support the Bitcoin price, as it trades down 15% since April 20. The coming weeks will be crucial for Bitcoin as the market. Should BTC ETF inflows continue to slow, the cryptocurrency market could become increasingly concerned over the demand outlook. Meanwhile, attention will also be firmly on economic data and the Fed for further clues over whether the central bank will cut rates this year and, if so, when.