BTC/USD extended gains on Wednesday, lifting the market cap above the $1 trillion threshold for the first time since December 2021. Putting this into context, the Bitcoin market cap is now at a level of global tech giants such as Meta and is double that of EV maker Tesla. Meanwhile, Bitcoin’s 22% year-to-date rally has helped lift the market capitalization of digital assets to $2 trillion for the first time since April 2022, according to data from CoinGeko.

Key Takeaways:

- Bitcoin’s market capitalization rises to $1 trillion after a 22% rally in BTC/USD YTD

- Sector-specific factors have driven gains

- ETF net inflows

- Optimism surrounding the upcoming halving event

- Chinese New Year Seasonality & light volumes

The numbers

Given the circulation supply of 19,627,706 BTC, the cryptocurrency reached the $1 trillion market cap level when the price traded at $50,948. The price scaled beyond $51,000 to a high of $51,939, rising for 10 of the past 11 days.

What is driving BTC to fresh 2-year highs?

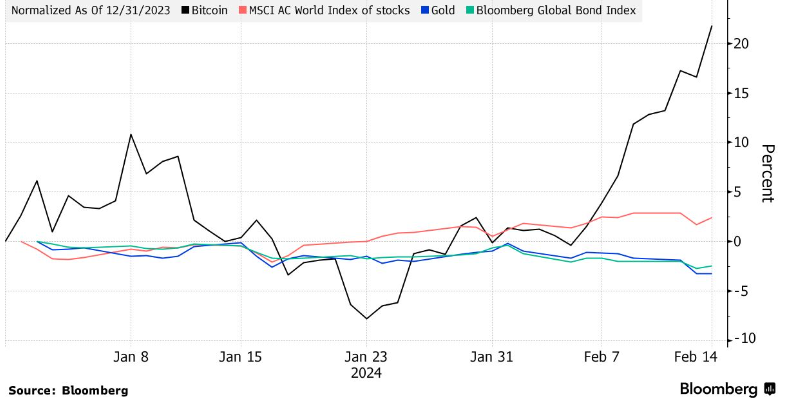

Sector-specific factors have been driving Bitcoin higher, helping BTC/USD to outperform global stocks this year.

These factors include:

ETF net inflows

Much of the recent rally can be attributed to the Securities and Exchange Commission’s approval of and the launch of spot Bitcoin ETFs.

Data released by CoinShare this week showed that inflows into spot Bitcoin ETFs were ahead of outflows, resulting in net gains. Outflows from Grayscale Bitcoin Trust have lowered significantly. Since launching just over a month ago, net inflows of $2.8 billion have been achieved, with $1.1 billion coming in the last week alone amid increasing movement of institutional money into the asset class.

As inflows increase, ETFs effectively take Bitcoin out of circulation, driving a supply shock. As ETFs buy more outstanding supply, the Bitcoin price could become more closely correlated to ETF inflows.

Bitcoin Halving

Optimism surrounding the Bitcoin halving event in mid-April also drives BTC/USD demand. Halving cuts the quantity of Bitcoin rewards miners receive for verifying transactions on the blockchain. The event, which occurs every four years, reduces supply and historically has acted as a support for Bitcoin prices, with fresh all-time highs often reached in the years following the halving event.

Seasonality

Sentiment towards Bitcoin is typically positive around the Chinese Lunar New Year holidays, which are taking place in Asia. The cryptocurrency tends to move higher in this period amid light trading volumes.

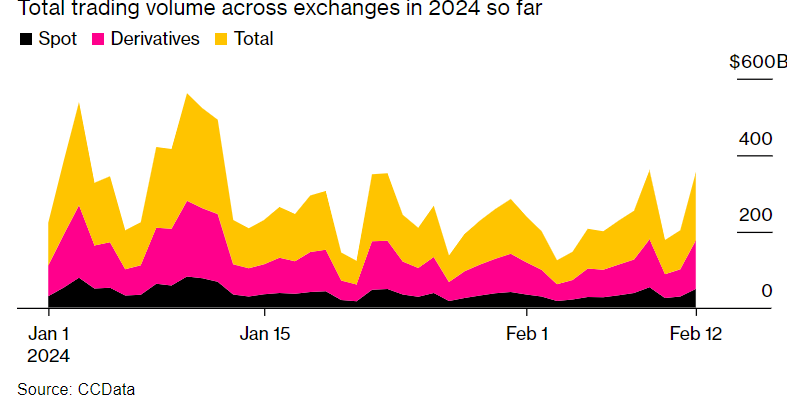

The average daily trading volume in the crypto market has fallen to $113 billion from $149 billion in January, according to data from CCData, likely owing to the Chinese New Year. Light trading volumes can often exacerbate price movements in either direction.

Conclusion

Bitcoin has rallied 22% year to date, rising above $50,000 to an 18-month high, boosting the market capitalization above $1 trillion. Sector-specific factors such as ETF net inflows, optimism surrounding the upcoming halving event, and seasonality around the Chinese Lunar New Year have helped drive the market cap to a similar size to that of Meta’s.

Sources

Crypto Market Value Climbs Back Above $2 Trillion Amid (BTC) Bitcoin Rally – Bloomberg

Bitcoin (BTC) Hits $50,000 Milestone With Help From Chinese New Year – Bloomberg

Bitcoin euphoria is back as investors prepare for the quadrennial ‘halving’ | CNN Business