- Bitcoin is flat but set for weekly & monthly losses

- Trump -Biden debate, no mention of crypto

- Biden, Trump-inspired meme coins tumble

- US core OCE inflation data up next

- Mt Gox distribution concerns weigh

Bitcoin edged lower on Friday and is on track to fall over 4% throughout the week, marking the third straight weekly decline.

Sentiment is struggling after the Trump-Biden debate yesterday. It is also on edge ahead of key US inflation data, which could provide further clears over when the Federal Reserve will start to cut interest rates. Meanwhile, Mt Gox liquidation concerns persist.

Trump – Biden debate – no mention of crypto

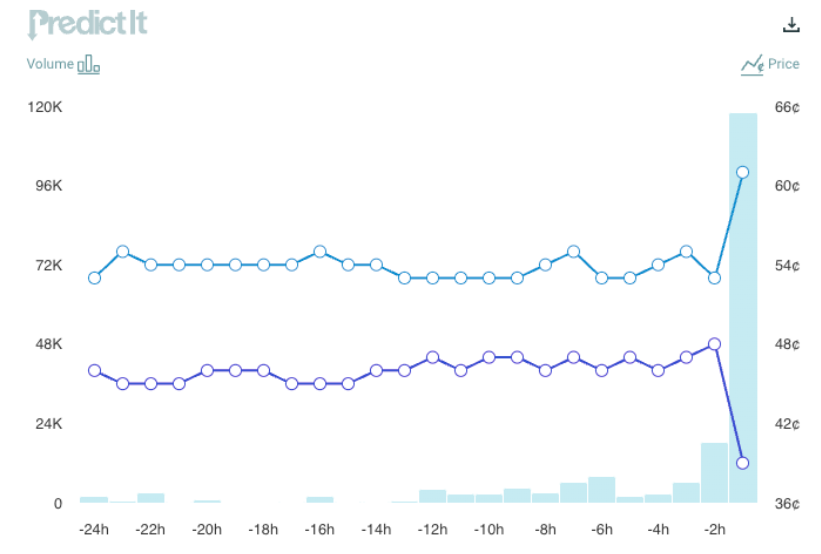

The price of Bitcoin is struggling to find direction after the presidential debates kicked off on Thursday. Donald Trump extended his lead over President Joe Biden in the predictions market after Biden’s performance reignited concerns among Democrats about the president’s fitness for another term in offer in office.

The two leaders mostly debated issues related to the economy, wars, and immigration. Neither spoke about cryptocurrency, and the moderate did not raise the topic. The lack of a mention appears to have dampened sentiment towards cryptocurrency.

Meme coins inspired by U.S. President Joe Biden and Donald Trump fell sharply as the pair battled it out. According to CoinGeko, the Make America Great Again-themed Trump token fell 24%, and BODEN was even harder hit, falling over 53% from its 27 June high. Meanwhile, SuperTrump and Baby Trump also tanked double digits across the debate.

Despite not being mentioned in the debate, cryptocurrency has been a hot topic in the election campaigns. Earlier this month, Trump said he would end Biden’s war on crypto should he be elected president in November. Earlier in the year, Trump also said on social media that he would make the USA a global leader in terms of crypto technology. With this in mind, a Trump win could be considered beneficial for Bitcoin.

Data from the Prediction markets platform showed that Trump’s odds of winning the presidency increased substantially while Biden’s chances tumbled.

How will US inflation data move Bitcoin?

Meanwhile, strength in the dollar, which is trading at a two-month high, is keeping gains limited in cryptocurrencies as the market waits for core PC data later today. This is the Federal Reserve’s preferred gauge for inflation.

Economists expect core PCE to ease to 2.6% annually, down from 2.8% in April. However, this is still considerably above the Federal Reserve’s target 2% level. Signs of sticky inflation could encourage the Federal Reserve to keep interest rates high for longer, which bodes poorly for crypto prices, given that the sector usually performs well in a low-rate, higher liquidity environment.

Mt Gox distributions

The upcoming distribution of tokens, which were stolen from the defunct Mount Gox exchange a decade ago, appears to be a big point of concern for Bitcoin. Liquidators for the exchange have indicated that the re-distribution of stolen Bitcoin and Bitcoin cash will begin in early July. Worries over an increased Bitcoin supply have weighed heavily on Bitcoin prices this week, putting the largest cryptocurrency on course for a 9% fall in June.