- Bitcoin rises 23% in 2-weeks

- The market prices in a 100% chance of a September rate cut

- Supply overhang fears ease

Bitcoin prices rose on Wednesday, extending a recovery from a four-month low of 53,500 at the start of July. The price has risen for the past six straight sessions and has gained over 23% in two weeks, reaching a peak of $65,000 in trading today.

So, what has been driving this latest rally in Bitcoin, and could it reach fresh all-time highs?

Trump presidency speculation

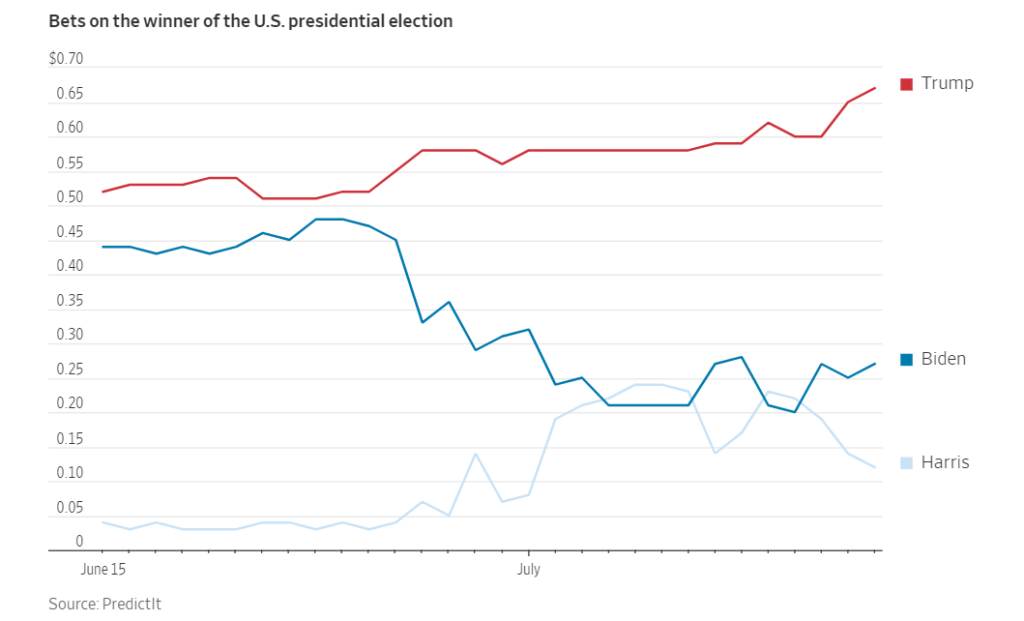

Bitcoin’s recovery has come mainly on the back of increased expectations that Trump will win the Presidential elections in November. The former U.S. President has maintained a pro-crypto stance throughout the election campaign and is also expected to speak at the Bitcoin conference in Nashville later this month.

President Trump has extended his position as favorite in the election later this year as the Republican National Convention kicks off. While the odds markets had begun shifting in favour of Trump following the debate with Joe Biden, odds accelerated after an assassination attempt on the ex-President at the weekend.

Furthermore, Trump’s decision to appoint Bitcoin holder and Ohio Republican Senator James Vance as vice president hasn’t escaped the markets. Vance has supported Bitcoin and digital assets since 2021 and began circulating a draft version of crypto legislation last month.

Fed rate cut bets rise.

Rising expectations that the Federal Reserve will cut interest rates in September have also boosted demand for Bitcoin and other risk assets. Cooler-than-expected inflation data last week and more dovish-sounding Federal Reserve chair Jerome Powell at the start of this week mean the market is now pricing at a 100% probability of a rate cut in September. Investors are also speculating whether the Federal Reserve could cut rates up to three times this year. A lower interest rate environment benefits risk assets such as crypto owing to the increased liquidity.

Supply overhang fears ease.

Optimism surrounding Trump’s possible re-election and expectations that the Fed will cut interest rates in September has overshadowed fears of a supply overhang. Such fears had pulled Bitcoin lower over the past few weeks.

While the German government has finished selling $2.3 billion of crypto, Mt Gox contributions are just starting. Defunct crypto exchange Mt Gox mobilized $2.8 billion worth of Bitcoin this week, moving it onto exchanges likely as part of its planned distribution to two creditors following a hack a decade ago.

ETF spot inflows hit a 6-week high

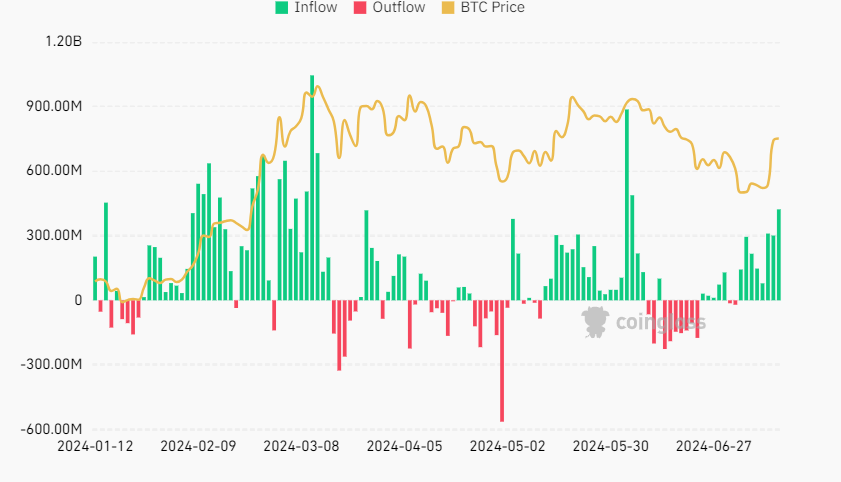

The latest developments and the cryptocurrency markets have helped fuel spot ETF inflows. Bitcoin ETF inflows recorded $422.5 million on Tuesday, the highest single-day tally since June 5th, which marked a seven-day winning run. The 11 approved funds have drawn in over $1 billion in just the last three days, highlighting investors’ confidence in Bitcoin’s price prospects.

The recovery in ETF inflows points to exhaustion and selling pressure and suggests that, with the supply overhang behind it, the crypto market is catching up on the sustained rally on Wall Street.