Bitcoin has fallen below 60,000, posting its largest decline since August.

Bitcoin, the largest digital asset, dropped more than 6% at one point today, marking the steepest daily drop since August 5th. However, some of that weakness has been retraced at the time of writing, with Bitcoin returning to the critical 60k psychological level.

The sell-off has not been restricted to Bitcoin; altcoins across the board are trading lower. Ether was down over 7% at its worst before paring some losses to trade back at $2500 at the time of writing.

Bitcoin price is back some of last week’s rally following Federal Reserve chair Jerome Powell’s clearest indication yet that the US central bank is set to cut interest rates from a 22 year high next month.

Interestingly, the sell-off is not being seen across many other risk assets. US stock futures point to a muted open and trade close to recent record highs.

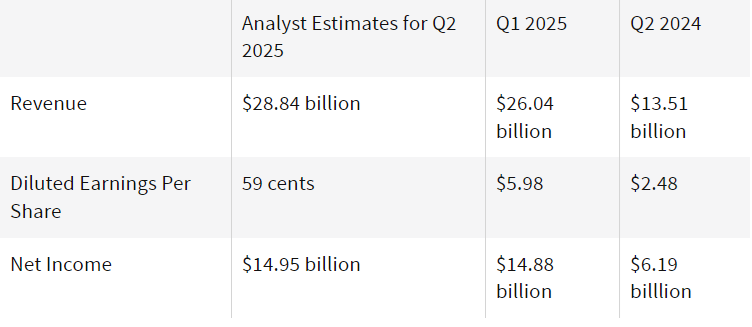

Nvidia earnings – what to expect?

Attention is now turning to the latest results from Nvidia, a bellwether for the AI theme, which helped lift global stocks to record highs. Consequently, Nvidia’s results, which are due to be released after the US closes today, could influence investor enthusiasm for all things AI as well as risk sentiment and demand for risky assets, including Bitcoin.

The market expects chip-making giant Nvidia and the AI darling of Wall Street to post revenue of $28.6 billion, more than doubling from $13.5 billion in the same period last year. While net income is also expected to more than double from a year earlier to $14.95 billion. There will be a sharp decline in EPS to $0.59 cents from $2.48 in the same quarter a year earlier, owing to the company’s 10-for-1 stock split.

These earnings could influence the broader market and impact AI coins such as FET, NEAR, and Render.

The fall in Bitcoin comes despite ongoing inflows into US spot Bitcoin ETFs and amid worries that the US government may be selling seized tokens.

Bitcoin Whale movement

Adding to concerns surrounding Bitcoin Whale Alert, a profile on X that tracks large crypto transactions using on-chain data posted news that 230k Bitcoin tokens worth $1.88 billion at the current price were transferred from a cold wallet to a crypto exchange finance. This movement opens the possibility of a large sale, given the large amount of Bitcoin that is now on exchange.

Across the year, Bitcoin is still up 39%, while ether is holding on to a smaller 7% gain. While August is usually a quiet month for cryptocurrency, this month has seen higher levels of volatility.