Expanding our support for clients in Latin America, we’ve added local bank transfers to the growing list of payment options available through our broker services in Argentina.

Argentine traders and investors can now deposit directly from their bank account and receive funds the same way, all without any additional fees.

Local bank transfers in Argentina

- Currency: Clients deposit in their local currency, which is converted to USD at the rate provided by the payment processor and credited to their wallet or trading account

- Min/Max Deposit: $10 to $15,000 per transaction

- Min/Max Withdrawal: $18 to $15,000 per transaction

- Fees: 0% on deposits

- Deposit Time: Typically processed within 15 minutes

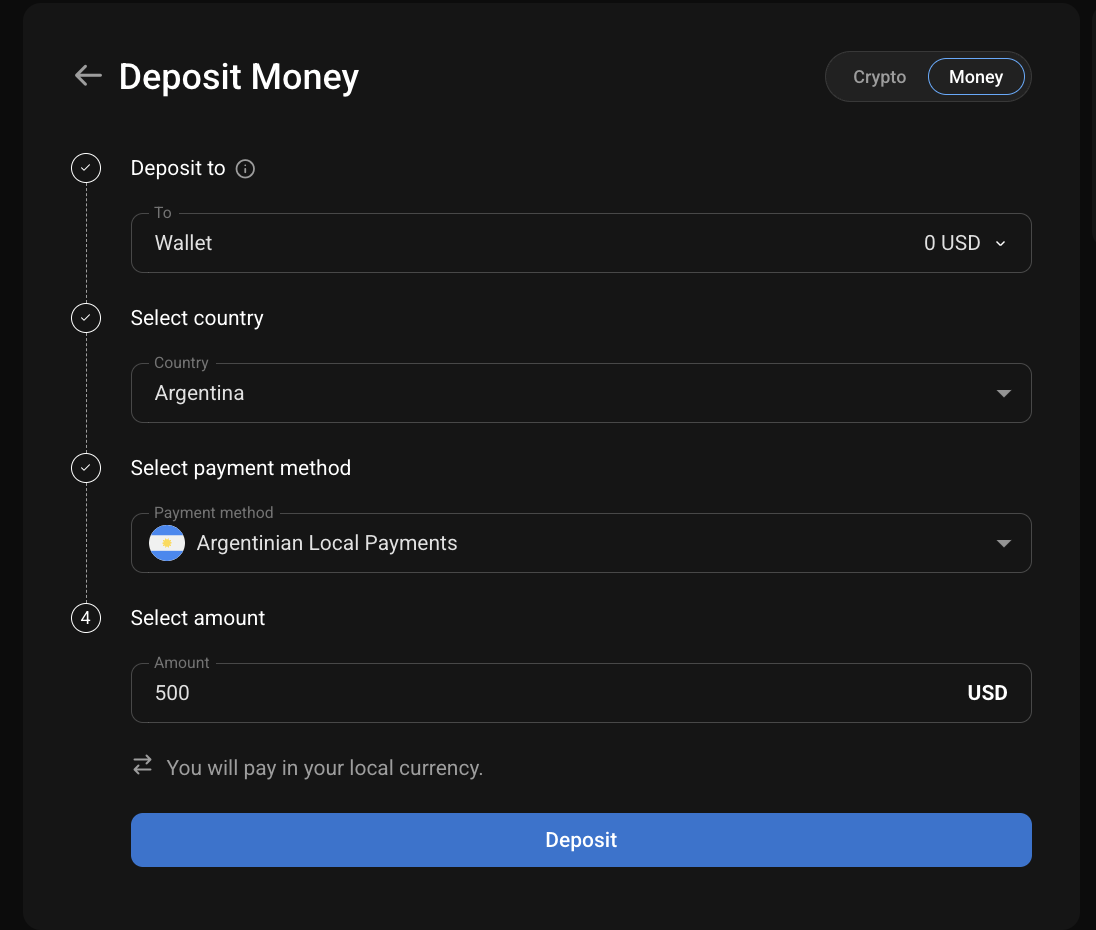

How to deposit:

- In the Wallet section, click Deposit next to your USD wallet.

- Select Argentina as your country, then choose Argentinian Local Payments as your method.

- Enter the deposit amount and choose where to send the funds (Wallet or preferred trading account).

- You’ll be redirected to a trusted provider page where you’ll see the amount in ARS and can complete the required information to proceed.

For step-by-step guidance, visit our Help Centre.

How to withdraw:

- In your Wallet, click Withdraw next to the USD wallet.

- Select the payment method previously used for a deposit.

- Add your bank account details and confirm the withdrawal.

Note:Any deposit method previously used will be automatically available to use for withdrawals. If you haven’t used this method before, you’ll need to make a deposit with it first.

Which banks are supported?

Local transfers can be made to and from banks across Argentina such as:

Banco Galicia, Banco Santander Río, BBVA Argentina, Banco Macro, HSBC Argentina, and more.

Make a Deposit

Your capital is at risk.

We’re continuing to expand our coverage of localised payment methods. Stay tuned for further updates designed to improve your experience with our broker services.

Please note that regional restrictions may apply to certain markets or features.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.