As the crypto market hits an all-time high, we’ve updated leverage levels across our platforms to offer greater flexibility and improved margin efficiency for our clients. While these changes are designed to support trading during periods of heightened market activity, it is important to remember that higher leverage also increases the potential for amplified losses. The updates are already live – here’s everything you need to know.

Here’s how this affects Crypto Futures

For smaller position sizes, leverage of up to 1:150x may be available, depending on the asset. Mid-sized positions may access leverage between 1:50x and 1:100x, while larger trades are typically subject to leverage in the range of 1:10x to 1:20x. BTC and ETH may reach maximum leverage of up to 1:200x, subject to platform conditions.

For more information, review trading conditions.

Changes to MT5 and PXTrader

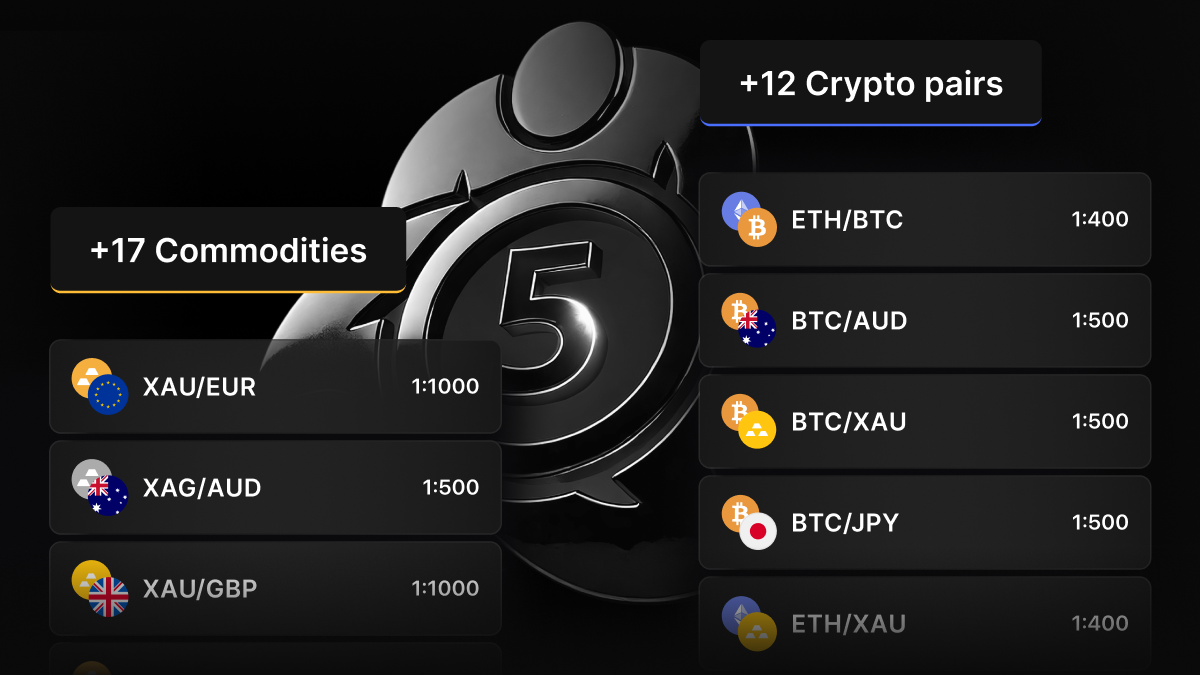

Leverage changes also hit MT5 and PXTrader, covering major forex pairs, precious metals, indices, and energy products. Forex majors such as EURUSD and GBPUSD now offer up to 1:1000x leverage on smaller positions. Even the largest volume bands, which traditionally had more conservative limits, have been adjusted and now allow for leverage up to 1:200x.

Gold and silver also received upgrades, with small trades now supported at 1:1000x and larger positions accessing up to 1:100x. Major global indices like the SP500, NASDAQ, and DOWJ now offer 1:200x leverage for smaller positions, while larger trades offer up to 1:50x.

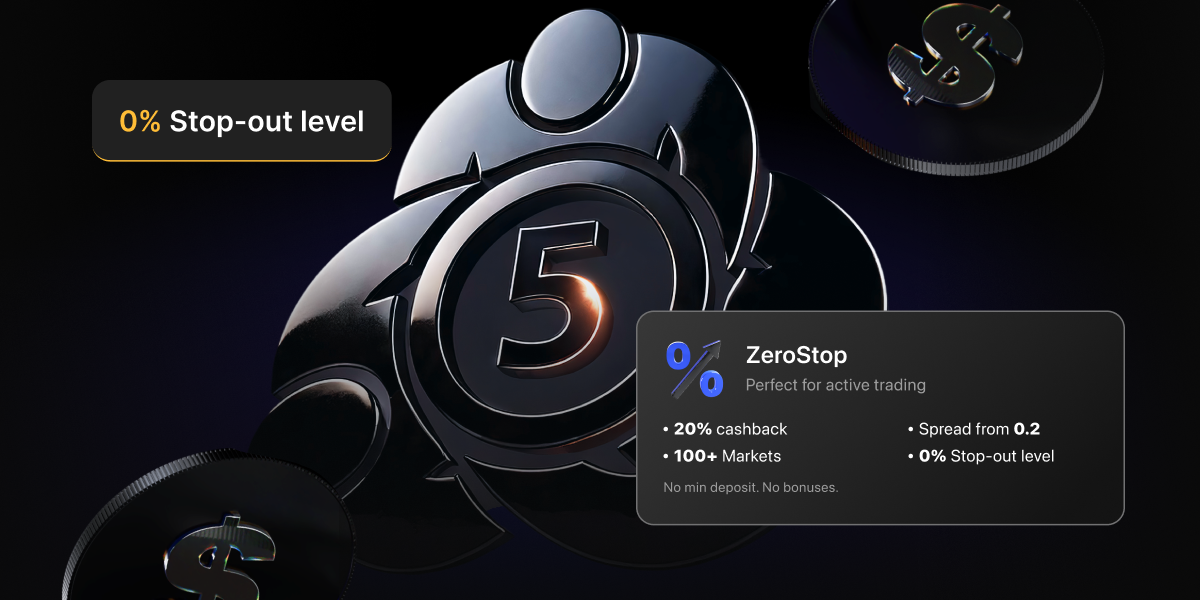

Crude and Brent oil were upgraded as well, with small position sizes now receiving up to 1:200x leverage and large trades reaching up to 1:20x. Our newly released Pro accounts offer even tighter leverage conditions for intraday trading.

How does this affect traders?

With volatility rising across altcoins and commodities, updated leverage tiers offer greater flexibility and more choices when managing your positions — especially for those exploring new instruments with cost-effective margin requirements that remain competitive with major exchanges.

And if you are qualified for a VIP tier, all of this stacks on top of your reduced fees.

Keep this in mind

Just a reminder – maximum leverage depends on the amount of the position you hold in a given instrument. Smaller positions generally enjoy smaller margin requirements, providing higher maximum leverage.

As the position in the instrument grows, maximum leverage will decrease to reflect the bigger risks. This ensures a fair, flexible risk-based approach to leverage. Always trade responsibly and employ risk management when trading on leverage.

All updates are already live – no opt-in required. Just trade like usual, with better margin and more firepower. Full details are available in the Fees & Conditions section or in your platform specs, if you want exact leverage tiers.

Trading involves risk.

Looking for more info?

Learn more about leveraged rules in our Help Center. If you need more information or assistance, you can reach out to us via our 24/7 chat on our support page, or write to us at [email protected].

Thank you for being a part of the PrimeXBT community.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.