Understanding Forex Trading and CFDs: Trade Without Owning Currency

Forex trading unlocks a world of opportunities, allowing traders to engage with global currencies 24/5. Unlike stock or futures markets, Forex operates in a decentralized manner, enabling traders to capitalize on fluctuations in interest rates, economic trends, and risk sentiment without geographical limitations.

By mastering Forex trading, you gain insight into macroeconomic trends, bypassing the intricate microeconomic details that typically affect stocks or options. The Forex market’s fluidity and accessibility make it one of the most appealing financial markets worldwide.

How the Forex Market Works: A Beginner’s Guide

Unlike centralized stock exchanges, the Forex market functions via an over-the-counter (OTC) system, where global banks act as liquidity providers. These institutions set bid and ask prices for currency pairs, allowing retail traders to participate through brokers who bridge the gap between traders and the interbank market.

With Forex operating around the clock, traders can execute strategies across different sessions—Asian, European, and North American—leveraging global market fluctuations.

Most retail traders will have to access the currency markets via a broker, as the size necessary to trade with the major banks is far out of the reach of almost all retail traders.

Ways to Trade Forex: Choosing the Right Approach

Institutional vs. Retail Trading

Institutional trading—conducted by central banks and hedge funds—moves the largest volumes. However, individual traders access the market through two primary methods:

- Trading Forex CFDs (Contracts for Difference)

- Using a Forex broker

Each approach has unique benefits, but CFD trading offers significant advantages, including leverage, lower capital requirements, and the ability to go long or short easily.

What Are Forex CFDs? Trade Without Owning Currency

Contracts for Difference (CFDs) allow traders to speculate on currency price movements without owning the asset itself. For example, instead of purchasing €100,000 physically, you enter a contract that settles the difference in price when the trade closes.

Key Advantages of CFDs:

- No need to take physical delivery of the currency

- Trade both rising and falling markets

- Access leverage to amplify gains (and manage risk carefully)

- Diversify with CFDs on indices, commodities, and crypto via platforms like PrimeXBT

How Forex Brokers Work: Accessing the Currency Market

Forex brokers act as intermediaries, offering trading platforms where you can speculate on currency pairs. Some, like PrimeXBT, provide additional CFD instruments across commodities, crypto, and indices, expanding your opportunities beyond Forex alone.

Choosing a Currency Pair: How to Start Trading Forex

When you are trading Forex, you will need to choose a currency pair to focus on. Some traders will trade just one currency pair overall, but there is a whole world of good opportunities in the Forex markets. Because of this, traders will use a methodology or system to place trades and look for currency pairs that offer those setups.

Once they identify a potential trade, they will then typically markup their chart to see where they want to enter, exit, or admit defeat. The currency pair that you choose can have a significant amount of influence on where you place protective and take profit orders.

Types of Forex Pairs: Majors, Minors, Exotics, and Regional Pairs

Forex pairs can be categorized into four different types. Each will act a bit differently and will have different volatility characteristics.

- Major pairs: Major pairs constitute about 80 to 85% of all Forex trading. Major pairs all have one thing in common: the US dollar. This category includes the Euro versus the US dollar (EUR/USD), US Dollar versus the Japanese yen (USD/JPY), British pound versus the US dollar (GBP/USD), US Dollar versus the Canadian dollar (USD/CAD), US Dollar versus the Swiss franc (USD/CHF), Australian dollar versus US dollar (AUD/USD), and New Zealand dollar versus US dollar (NZD/USD).

- Minor pairs: Minor pairs include a mix of the major currencies but without the US dollar. Some examples might be the EUR/GBP, EUR/CHF, and GBP/CAD.

- Exotic pairs: Exotic pairs will feature one major currency against a currency from a smaller economy. This could be pairs such as the US dollar versus the Mexican peso (USD/MXN), British pound versus Hungarian Forint (GBP/HUF), and US dollar versus South African Rand (USD/ZAR).

- Regional pairs: Regional pairs are defined by belonging to the same geographical region. These are typically smaller economies that do a lot of commerce with each other. This would include AUD/NZD, Singapore dollar versus the Japanese yen (SGD/JPY), and Korean won versus the Japanese yen (KRW/JPY).

How to Analyze the Forex Market: Tools and Strategies

Smart traders don’t gamble—they follow a structured approach based on analysis. The two primary methods of Forex analysis are:

1. Technical Analysis:

- Focuses on price action, trends, and chart patterns

- Uses indicators like moving averages, RSI, MACD, and Fibonacci levels

- Aims to pinpoint entry and exit points based on historical price behavior

2. Fundamental Analysis:

- Evaluates macroeconomic indicators such as GDP, employment rates, inflation, and central bank policies

- Considers global economic trends and geopolitical events

- Helps traders gauge long-term market direction

Pro Tip: Most successful traders combine both technical and fundamental analysis to form a well-rounded strategy.

Building Forex Trading Plan

A structured trading plan prevents emotional decision-making and increases consistency. Key components of a winning plan include:

- Defining your risk tolerance: Set a maximum risk per trade (e.g., 1-2% of your account balance)

- Choosing your preferred trading style: Scalping, day trading, swing trading, or position trading

- Setting clear entry/exit rules: Use backtesting to validate your strategy

- Applying proper risk management: Implement stop-loss and take-profit levels

A solid plan ensures long-term sustainability in Forex trading.

How to Choose the Best Forex Trading Platform

Selecting a reliable trading platform is critical. PrimeXBT stands out by offering:

- A powerful web-based trading terminal with advanced charting tools

- Access to multiple asset classes, including Forex, crypto, commodities, and indices

- Leverage trading for increased flexibility

- Copy-trading: Follow successful traders and automate your trades

- Crypto deposits for easy fund transfers

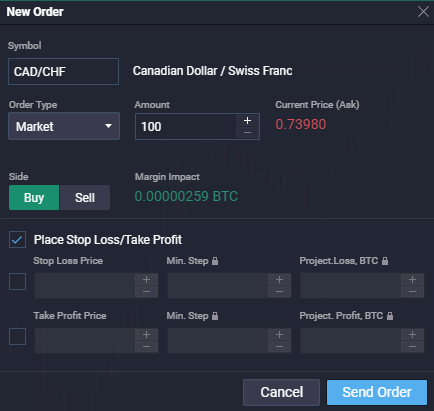

Executing Your First Forex Trade: Step-by-Step Guide

Risk management is the number one priority for long-term success in Forex. Essential tools include:

Stop-Loss and Limit Orders:

- Stop-loss orders: Automatically close a trade if the price moves against you

- Limit orders: Lock in profits by setting an automatic sell/buy level

Using these orders helps prevent emotional decision-making and protects your capital.

Managing Risks in Forex Trading: Protecting Your Investments

Managing risk is your top priority when trading Forex, or any other financial market for that matter. The markets can suddenly move in one direction or the other, and it isn’t always favorable. Because of this, taking precautions is the best thing you can do to prolong your trading career.

Stop-Loss and Limit Orders: Essential Forex Tools

What is a stop-loss order?

A stop-loss order is an order that tells the broker to get you out of a trade if a specific price is hit. This is to protect your account in the event of a wrong prediction on price movement. You should never place a trade without a stop-loss order, as it will limit losses.

The stop-loss order is placed at a point where you admit your trade idea hasn’t worked out. As the markets are open 24 hours, there are times when you won’t be able to watch your trade, so the stop loss will mitigate risk.

What is a limit order?

A limit order is an order that you give to the broker as an instruction to sell a currency pair at the market price once it reaches a specific target. This means that they will get you the best price available, once a level is touched. This is an order that is used to take profit on a trade that has worked out in a trader’s favor.

This is optional because some traders believe and hang onto the longer-term trend. Regardless, it is an option that you have on our platform at PrimeXBT.

Forex Trading Example: Profits and Losses Explained

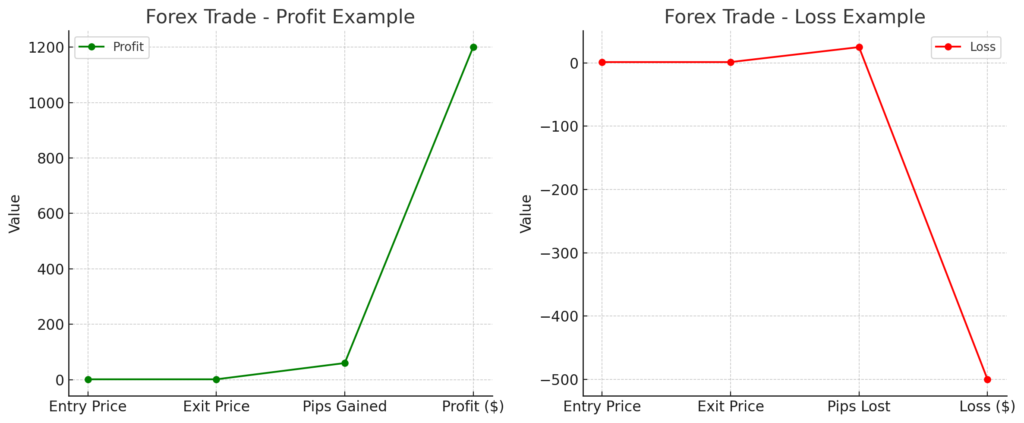

Winning Trade Example:

You short GBP/USD at 1.35100 with 2 standard lots.

- Trade closes at 1.34500 (60 pips gain)

- 60 pips x $20 per pip = $1,200 profit

Losing Trade Example:

You enter at 1.35100, but price moves against you to 1.35350.

- Trade loses 25 pips

- 25 pips x $20 per pip = $500 loss

Knowing how to calculate gains and losses is essential for proper trade planning.

| Price of GBP/USD | 1.351150 |

| Bid/Ask price | 1.35100 / 1.35130 |

| Trade | Sell @ 1.35100 |

| Trade size | 2 contracts (£ 100,000 per contract) |

| Margin | £ 400.00 |

| Commission | 0.0001% (£0.20) |

| Other | Funding fees if held overnight |

| Example 1 | Sell @ 1.35100 1.35100 – 1.34500 = 60 point gain 20 x 60 = $ 1200 profit |

| Example 2 | Sell @ 1.35100 1.35100 – 1.35350 = 25 point loss 20 x 25 = $ 500 loss |

Why Trade Forex with PrimeXBT? Benefits and Features

PrimeXBT offers the world at your fingertips, as the various instruments offered will allow the trader to take advantage of global trends, correlations between markets, and a whole host of opportunities.

- Trade on margin: The ability to trade on margin at PrimeXBT means that you can make larger profits with smaller deposits.

- Crypto deposits: PrimeXBT allows you to deposit and use crypto, offering the possibility of growing the value actively or passively.

- Online trading platform: The platform that PrimeXBT uses is state-of-the-art technology that can be accessed anywhere with an Internet connection and a web browser.

- Copy-trading: PrimeXBT offers a copy trading service, where novice traders can follow the trades of more experienced and successful ones.

- Earn interest: With your deposited crypto, you can earn interest at PrimeXBT by staking, offering the opportunity to make money not only by trading but passively.

Final Thoughts: Mastering Forex Trading in 2025

Forex trading presents limitless opportunities for those who approach it with discipline, analysis, and a solid strategy. Whether you’re a beginner or an experienced trader, platforms like PrimeXBT provide the tools and flexibility needed to navigate the dynamic Forex market successfully.

How much money do I need to start trading forex?

At PrimeXBT, we accept Bitcoin deposits. To trade Forex CFDs with us, the trader needs to deposit just 0.00005 BTC to get started. If you do not have any Bitcoin, you can buy it on our website.

What do I need to start trading Forex?

The first thing you need is a broker like PrimeXBT. This allows access to the markets. After the simple sign-up process, you then will deposit to your account to get access to the currency markets.

Can anyone trade Forex?

Basically yes. However, there is a list of countries that aren’t allowed to trade at PrimeXBT, due to local regulations. These include the United States of America, Japan, St. Vincent and the Grenadines, Canada, Cuba, Algeria, Ecuador, Iran, Syria, North Korea, Sudan, United States Minor Outlying Islands, American Samoa, and the Russian Federation.

What is a good Forex trading strategy?

A good Forex trading strategy is profitable obviously. That being said, not all trading systems will work out for all traders. For example, the most important thing is that it is a trading system is one that you are comfortable with. This can be accomplished by backtesting and knowing that the system is not only profitable but how it behaves over the long term.

What currency pairs move the most?

As a general rule, currency pairs to have the widest spreads tend to be the ones that move the most. Exotic pairs are without a doubt some of the most volatile pairs out there, but when it comes to more common pairs, the pairs that feature the Japanese yen tend to be the biggest movers.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.