Day trading is a dynamic approach to trading financial markets that involves opening and closing positions within the same trading day. This guide explores essential day trading strategies, their applications, and the risks involved, providing readers with actionable insights and practical examples.

Whether you’re new to day trading or refining your skills, understanding these strategies can help you navigate the fast-paced world of intraday trading while emphasizing risk management and a disciplined mindset.

Understanding Day Trading Strategies

Day trading strategies are structured methods that traders use to identify opportunities in financial markets. These strategies rely on real-time data, technical analysis, and market patterns to guide decision-making. Below, we explore some widely used strategies, highlighting their strengths, potential drawbacks, and practical applications.

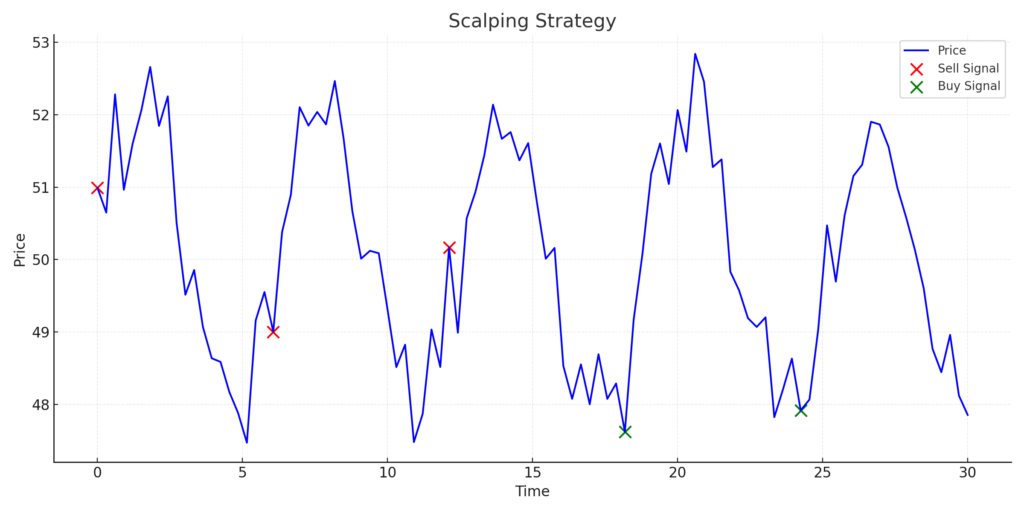

1. Scalping Strategy

Definition:

Scalping is a high-frequency trading strategy aimed at capturing small price movements within short time frames, often seconds or minutes. Scalpers execute multiple trades throughout the day, holding positions for seconds or minutes.

Key Components:

- Focus on highly liquid assets like major forex pairs or popular stocks.

- Use trading tools like the Relative Strength Index (RSI) to identify overbought and oversold levels.

- Set tight stop-loss and take-profit levels to minimize risk.

Example:

A trader notices the RSI on a 1-minute chart for EUR/USD has dropped below 30 (indicating oversold conditions). The trader enters a buy position and exits as soon as the RSI reaches 50, securing a quick, small profit.

Drawbacks:

- Scalping requires intense focus and rapid decision-making, which can be stressful.

- Transaction costs can erode profits due to the high number of trades executed.

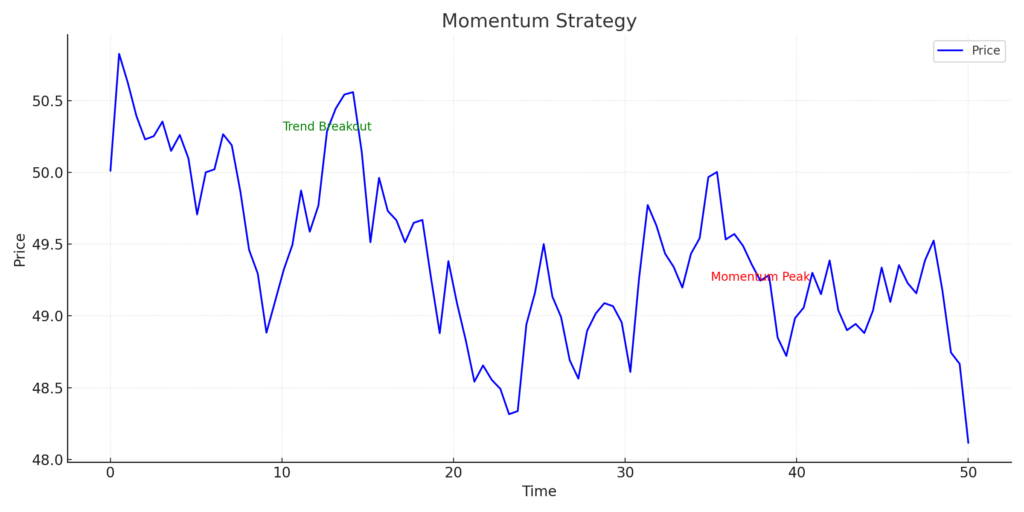

2. Momentum Trading

Definition:

Momentum trading involves taking advantage of strong price trends, entering positions in the direction of the movement.

Key Components:

- Look for assets with increased trading volume and significant price movement.

- Enter positions or trades after a breakout or continuation of a trend.

- Use profit targets based on support or resistance levels.

Example:

A stock surges after a strong earnings report, breaking past its previous resistance. The trader enters a long position and sets a stop-loss just below the breakout level. The position is closed as the price approaches the next resistance level.

Drawbacks:

- Momentum can fade quickly, leading to unexpected reversals.

- Success depends on precise timing and identifying genuine trends versus false signals.

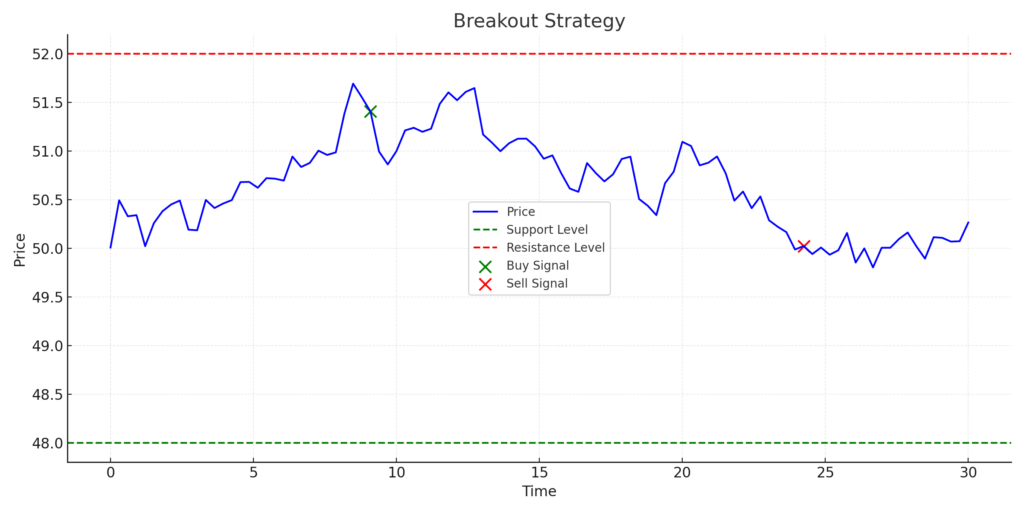

3. Breakout Trading

Definition:

Breakout trading targets price movements when an asset breaks through well-defined support or resistance levels, often leading to increased volatility.

Key Components:

- Monitor historical support and resistance levels.

- Use volume spikes as confirmation for a breakout.

- Place stop-loss orders below support or above resistance to manage risk.

Example:

Bitcoin breaks above a key resistance level at $30,000 with a volume surge. A trader enters a long position, sets a stop-loss below $30,000, and exits as the price nears $32,000.

Drawbacks:

- False breakouts can result in losses if trades are not confirmed with additional indicators.

- This strategy requires patience and careful timing.

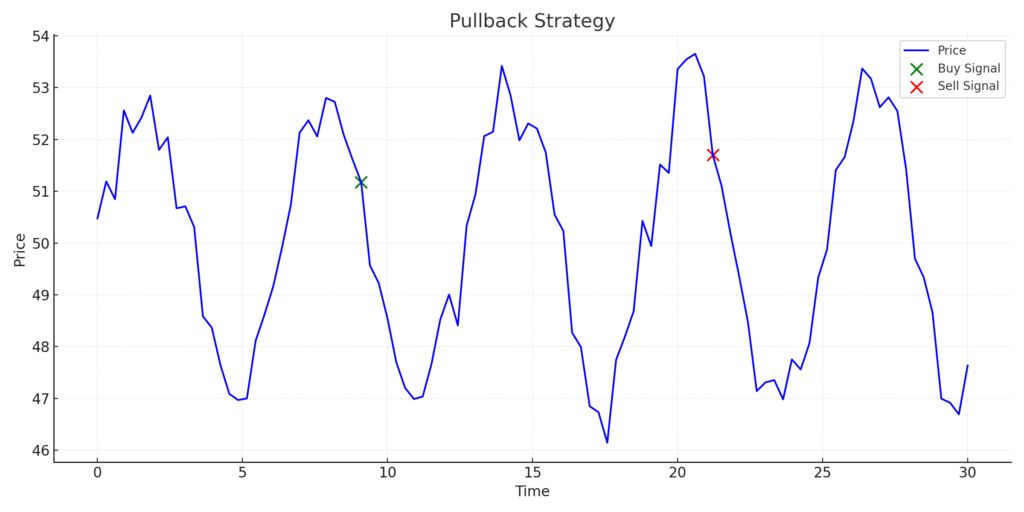

4. Pullback Strategy

Definition:

This daytrading strategy focuses on entering trades during temporary price retracements within a prevailing trend.

Key Components:

- Identify pullbacks using Fibonacci retracement levels or moving averages.

- Confirm the trend continuation with indicators like MACD.

- Use tight stop-loss orders to limit risk if the trend reverses.

Example:

A stock in an uptrend retraces to the 50% Fibonacci retracement level. A trader enters a long position, sets a stop-loss below the retracement level, and exits when the price reaches a new high.

Drawbacks:

- Pullbacks may turn into trend reversals, leading to losses.

- Requires precision in identifying retracement levels

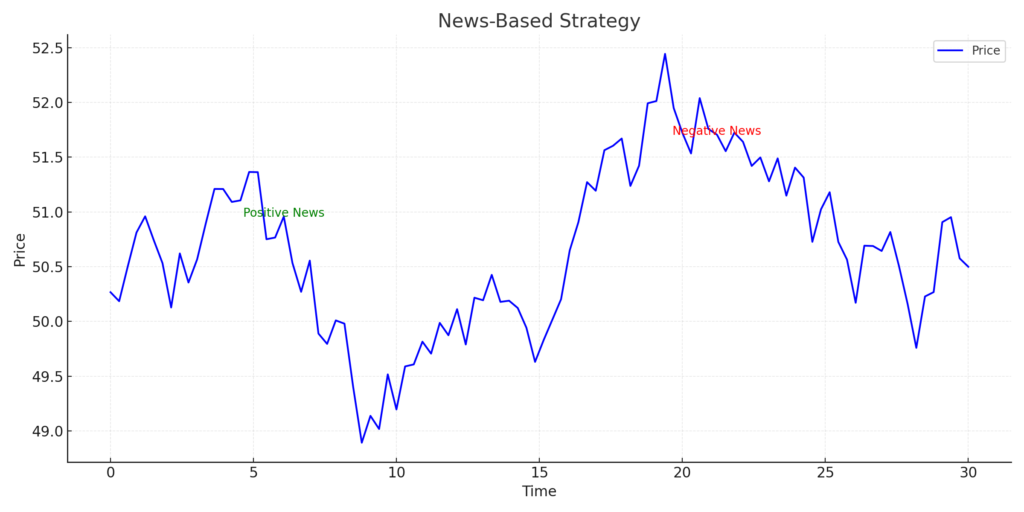

5. News-Based Trading

Definition:

News-based trading leverages the volatility caused by major news events, such as earnings reports or economic announcements.

Key Components:

- Track news and economic calendars to identify impactful events.

- Trade immediately after news is released, focusing on assets with high trading volume.

- Use tight stop-loss orders to mitigate risks from sudden market reversals.

Example:

After a central bank announces an unexpected interest rate hike, the USD strengthens. A trader short-sells EUR/USD and closes the position once the initial reaction subsides.

Drawbacks:

- Markets can react unpredictably to news, making this strategy risky.

- Success depends on quick decision-making and reliable information.

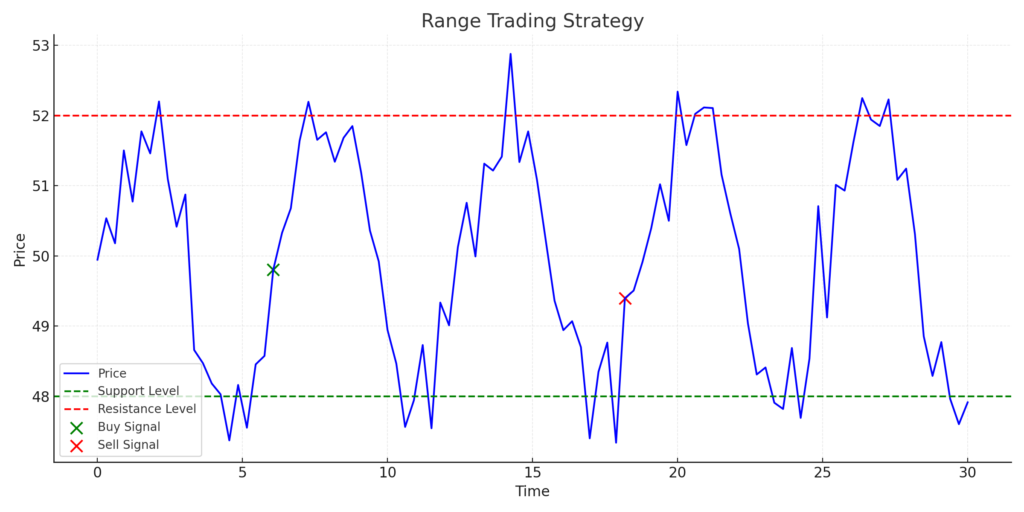

6. Range Trading

Definition:

Range trading involves capitalizing on price movements within well-defined support and resistance levels, avoiding trends.

Key Components:

- Identify assets with clear support and resistance levels.

- Use oscillators like RSI to confirm overbought (sell) or oversold (buy) conditions.

- Avoid entering positions during potential breakout scenarios.

Example:

Tesla stock trades between $800 (support) and $850 (resistance). A trader buys at $800 and sells at $850, repeating the process until the range is broken.

Drawbacks:

- Breakouts can lead to unexpected losses.

- This strategy is less effective in trending markets.

The importance of Risk Management in Day Trading

No day strategy or any other trading strategy is complete without risk management. Here are essential techniques:

- Position Sizing: Limit risk to a small percentage (e.g., 1-2%) of your trading capital per trade.

- Stop-Loss Orders: Protect against significant losses by setting predefined exit levels.

- Emotional Discipline: Avoid letting fear or greed influence your decisions.

Selecting the Right Platform for Day Trading

Choosing the right trading platform is a critical step in implementing day trading strategies effectively. A reliable platform should offer diverse asset classes, advanced trading tools, and user-friendly features to support traders at all levels.

PrimeXBT, a leading multi-asset broker, provides access to a wide range of financial instruments, including forex, stock indices, commodities, CFDs, and cryptocurrencies—all from a single account. This flexibility enables traders to diversify their strategies and adapt to various market conditions seamlessly.

To support strategy development and refinement, PrimeXBT offers robust technical analysis tools. These tools empower traders to test and apply the strategies outlined in this guide, such as scalping or breakout trading, in real-time market conditions.

For those new to day trading or looking to practice risk-free, PrimeXBT provides free demo accounts, allowing traders to hone their skills and build confidence before committing real funds. Additionally, its privacy-first approach, which eliminates the need for KYC during account setup, ensures that personal information remains secure—a significant advantage, particularly for crypto traders.

PrimeXBT also prioritizes continuous learning, offering a wealth of educational resources, including guides and training materials. Its intuitive and customizable interface is designed to meet the needs of both novice and experienced traders, making it a versatile platform for day trading.

Conclusion – Day Trading Strategies

Day trading success lies in mastering proven strategies, staying disciplined, and managing risks effectively. Whether you’re scalping for quick profits, trading breakouts, or reacting to news events, having a systematic approach is essential. Practice these strategies with a demo account and refine them before committing real capital.

Remember, consistent profits come with time, experience, and continuous learning. Start small, stay focused, and evolve as the markets do.

Important Disclaimer: Day trading involves significant risks, and it’s crucial to approach it with caution. Never trade with funds you cannot afford to lose, and always prioritize risk management strategies. Practicing with a demo account and referring to educational resources like this guide will help you build the necessary expertise before trading with real capital.

What is day trading, and how does it work?

Day trading involves buying and selling financial assets like stocks, cryptocurrencies, or forex within a single trading session. The goal is to profit from small price movements using short-term strategies and technical analysis tools. Unlike long-term trading, day trading focuses on quick, high-frequency trades for consistent gains.

What are the best indicators for day trading in 2025?

Some of the most effective indicators for day trading in 2025 include:

RSI (Relative Strength Index): To identify overbought or oversold conditions.

MACD (Moving Average Convergence Divergence): For spotting trend reversals.

Bollinger Bands: To measure volatility and identify breakout opportunities.

Parabolic SAR: To determine stop-loss levels and track trends.

What are the key tips for beginner day traders?

Beginners should follow these essential tips:

Start small and never trade more than you can afford to lose.

Focus on risk management by setting stop-loss orders and diversifying trades.

Trade during high-volume times, such as market opens and closes.

Learn to interpret charts and use technical analysis tools effectively.

Why is PrimeXBT a good platform for day trading?

PrimeXBT offers a wide range of trading instruments, including forex, cryptocurrencies, and commodities, with up to 1000x leverage. The platform provides built-in technical analysis tools, free demo accounts for practice, and a user-friendly interface ideal for both beginners and professionals. Additionally, there’s no KYC process, ensuring privacy and quick registration.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.