Although the cryptocurrency markets offer numerous opportunities due to their volatility, they can also lead to significant fluctuations in profit and loss, causing uneasiness. Employing hedging strategies can mitigate some of the value swings in your Bitcoin and other crypto assets, enabling you to withstand them. Hedging Bitcoin and other cryptocurrencies are quickly done if you know the options available.

What is Hedging?

Hedging is a process where the trader tries to handle the volatility of the markets to hand onto a key holding for longer. It is a good process that investors should be aware of. This should be thought of as a risk management strategy. It is used to offset losses in investment by taking an opposite position in a related asset.

While the hedging strategy on a trade can limit losses, it will often also limit gains. This is because the two trades will work against each other, at least temporarily. The trader will then get rid of the second position as soon as the primary one starts to work in their favor again.

Why Hedge Cryptocurrency?

Hedging cryptocurrency positions makes sense if you want to hold onto a place for the longer term. For example, if you are looking to hold onto a position in Bitcoin for the next several years, there will be times when the market moves against you. In that case, you may take out a hedge to counteract the losses that you may have by holding Bitcoin. This allows the trader to keep those assets and avoid significant losses. Stock traders do this all the time in a variety of ways. For example, it’s common for a holder of a tech stock like Tesla to also buy puts (betting on a drop in price in the options market) for the NASDAQ 100. The idea is that even if Tesla loses some ground in the short term, the NASDAQ 100 should also fall – making that option pay the trader in the meantime.

How to Hedge Cryptocurrency?

Hedging cryptocurrency is relatively simple if done correctly. While there are some more consuming ways to do it, others take little time and effort. Furthermore, the crypto markets have evolved enough that the options continue to grow.

First, you will need to understand whether you will see volatility. If the market is tranquil, then there isn’t going to be a need to hedge under normal circumstances. However, when the markets get chaotic, you may wish to find a way to mitigate some of the losses. This is where hedging comes into the picture.

When hedging, you are simply putting on a position that works in the opposite direction of the main trade. You are looking to collect some profit from the secondary trade if the main trade starts to fail. While not always an exact science, it can certainly be beneficial.

What is a Hedging Strategy?

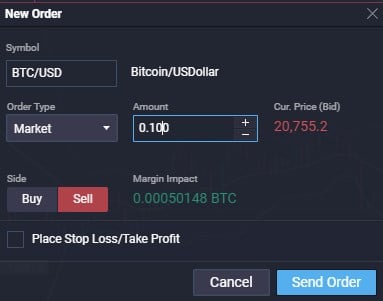

Order box on the PrimeXBT platform.

A hedging strategy works a lot like a trading strategy. The trader will determine how much of a position they need to hedge and when it is appropriate. For example, the trader may decide that if their Bitcoin position is dropping by a certain percentage in value, it is time to take steps to mitigate losses.

Other traders may use technical analysis to determine when to employ a strategy. Maybe they hedge a position every time Bitcoin drops below the 50-Day EMA. Perhaps it is based on Fibonacci retracement levels. It doesn’t matter what they use, just that they have a “trigger” to make it happen.

They will also have to determine the kind of hedge best suits their situation. This can vary greatly, and as a result, it is usually a process that must be defined well before putting money to work. The idea is always the same, though: mitigate at least some of the potential losses.

Types of Hedging Strategies

If you want stability in your portfolio, consider using a hedging strategy. However, you will also need to decide how to go about it and which one suits you the best. The options below are some of the most common ones.

Short Selling

Short selling is the process of profiting from falling prices. The most common form of shorting is done in the stock market, but it can also be done in the crypto markets. Some exchanges allow traders to short a coin with margin, which is done by borrowing cryptocurrency, selling that borrowed cryptocurrency to another trader, and hopefully repurchasing it at a lower price. At that point, the short sellers return the crypto to the original point of borrowing and keep the difference.

The biggest thing to remember is that there is interest that you will pay to borrow cryptocurrency or any other asset for that matter. Quite often, investors will make a certain amount of interest on longer-term holdings by lending them out.

Shorting Bitcoin in this trade could dampen some of the losses of longer-term holdings. For example, you may see BTC drop $10,000 during a pullback. However, if you hedged by shorting it in a separate transaction, you could gain something close to the $10,000 drop. Think of it as another form of risk management. You are gaining while the core holding is losing, and this is the essence of a hedging strategy that most longer-term traders use sooner or later.

CFD trading

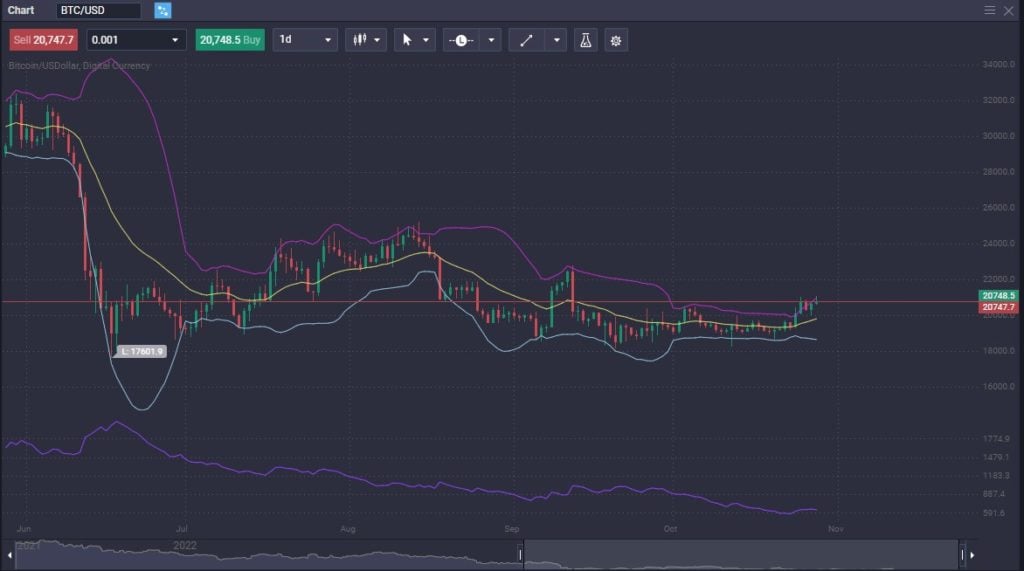

Bitcoin trading at PrimeXBT.

CFDs, or contract-for-difference, are financial derivatives that feature an agreement between two parties to speculate on the price of an underlying instrument. For example, if you believe a coin’s price will go higher, you buy it on the CFD market. When you decide to take a profit or exit with a loss, the difference between the opening and closing price is settled via cash between the two parties. The significant advantage of CFD markets is that you do not need to bother with custody of cryptocurrency, nor do you need to “borrow” any.

The shorting of BTC/USD in the CFD market would work the same as shorting the Bitcoin market but without many hassles. The above example would work in a very similar manner. You can practice risk management using CFD markets in almost any amount you need.

Futures

You can use futures contracts to hedge as well. The futures contract will be a standardized amount and transparent. The futures market will match up a buyer and seller and essentially track your market’s future expected price. Each futures contract will have an expiration date, so it is a bet on the future price of Bitcoin or another asset at a specific time, such as “March 2023.” There are Bitcoin futures traded on the major futures exchanges and other broker exchanges.

If you are worried about Bitcoin or any other coin you own falling, you could short the futures market for that coin. (It should be noted that only some coins have a futures market available.) If Bitcoin falls, you collect the gains from the futures contract short of offsetting the losses on the longer-term holding. If the futures contract goes against you, it is closed, and the profits from the longer-term holding offset the losses from the futures trade. While you lost a bit on the futures position, the risk management aspect worked fine, offsetting potential problems.

Perpetual Swaps

Perpetual swaps work almost precisely like futures contracts, with the main difference being that there is no expiry. They offer the exact contract sizes and leverage, allowing the trader to take advantage of more prominent positions than their account would typically support as futures do. However, it just runs in perpetuity instead of betting on a price and worrying about reestablishing positions every time the contract expires.

Options

Options trading allows the trader to bet on a price in the future with a specific amount of money. For example, you may wish to protect your longer-term Bitcoin holding via the options market. You buy a put option, meaning you are betting that the market may fall; if it closes below the “strike price,” you get paid. However, if it does not, your initial investment in the option is worthless. In other words, you can only lose so much.

Some traders will also sell options, collecting premiums. However, selling options can – in theory, lead to massive, if not unlimited, losses.

Conclusion

Hedging a longer-term position is one way to protect your account or a form of risk management. The longer-term trader or investor looking to hang onto Bitcoin occasionally has to deal with a certain amount of volatility, as crypto is noisy. The crypto markets can pay off handsomely, but the pullbacks can be brutal at times as well.

Mitigating short-term losses can also allow your portfolio to continue to grow steadily, which is the goal of most professionals. It’s not about trying to time the market perfectly; it is about protecting yourself from steep losses. However, while the hedge can pay off, it shouldn’t be considered a profitable endeavor, just an insurance policy.

There are many different ways to do it, but the flexibility of CFD markets is one of the significant benefits that hedging traders should take advantage of. The available leverage also makes it one of the cheaper choices for traders, and this market is ideal for most.

What is a hedge in crypto?

A hedge in crypto is a trade in the opposite direction of a longer-term holding used to offset any potential losses. The trader can use various financial instruments, including CFDs, futures, options, perpetual swaps, borrowed crypto, etc.

How does hedging work?

Hedging works by taking a trade that works in the opposite direction of your longer-term trade. The idea is that you will gain on the hedge while losing on the longer-term trade. However, the wall should offset some or more of the losses.

How do I hedge my crypto portfolio?

While there are many ways to do it, the most ideal is through the CFD market, as you can get leverage and get in and out quickly. The market offered at PrimeXBT allows you to hedge an existing position with enough leverage to make it cheaper than buying or selling spot cryptocurrencies. Furthermore, the risk management benefits of being able to size with precision in the CFD market should not be underestimated.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.