Trading in aluminium refers to the purchasing and selling of the metal on the financial markets, frequently on commodities exchanges. With its numerous uses in building, transportation, packaging, and other industries, it is a common raw material and a significant trading commodity. It also is quite often in the center of a lot of technological advances.

Trading in aluminium is purchasing it at one price with the intention of selling it later at a higher price or offloading it at one price with the intention of repurchasing it at a lower price. Trading aluminium can be profitable using a number of tactics, including technical analysis, fundamental analysis, or a mix of the two.

Future contracts, which are standardized agreements to buy or sell a certain amount of aluminium at a set price and date in the future, are one of the main ways to trade the aluminium market. On commodity exchanges like the London Metal Exchange (LME) and the Chicago Mercantile Exchange (CME), future contracts are traded.

Aluminium can be invested in using exchange-traded funds (ETFs), which are investment funds that maintain a portfolio of physical metal or aluminium futures contracts, in addition to futures contracts. Investors can easily obtain exposure to the aluminium market through ETFs without physically trading future contracts.

In this article, we are going to explore the aluminium trading market, and how traders can profit from its moves.

Why Trade Aluminum? Aluminium Demand Keeps Growing

Due to its lightweight and corrosion resistance, aluminium is a material that is frequently utilized in the construction sector. Among other uses, it is utilized in windows, doors, roofing, and cladding. Because of this, pricing is very sensitive to economic factors.

Also, due to its lightweight qualities, which can increase fuel efficiency and lower emissions, aluminium is widely employed in the transportation sector. Along with other uses, it is utilized in vehicles such as cars, trucks, planes, and trains. Transport is one place where aluminum is used extensively.

Because it is robust, lightweight, and corrosion-resistant, aluminium is frequently used in packaging. In addition to other uses, it is utilized in food and beverage cans. Aluminum is utilized in electrical wiring and transmission lines because it is a good conductor of electricity. Also, due to its strength and corrosion resistance, aluminium is employed in many industrial applications, including machinery and equipment.

Trading aluminium in comparison to other commodities is a great way to play the global economy, as it is almost solely based on demand, unlike other metals like gold or silver, which can sometimes be related to wealth preservation more than actual demand. As a result, paying attention to China and its economy is vital.

Aluminium Trading Basics

In order to take advantage of the demand for aluminum, you need to know some of the basics. In this section, we will look at the starting points for investing the markets, from using an exchange, stock exchange, aluminium CFDs, and others for portfolio diversification.

What is the trading symbol for Aluminium?

Depending on the exchange and the nation where aluminum is traded, several symbols are used for the commodity.

- The symbol for aluminum futures on the London Metal Exchange (LME), the biggest auction for aluminium in the world, is “AL.”

- The symbol for aluminum futures on the New York Mercantile Exchange (NYMEX), one of the main futures markets in the United States, is “AL.”

- The symbol for aluminum futures on the Chicago Mercantile Exchange (CME), another significant futures exchange in the United States, is “AHC.”

What are the different ways to trade Aluminum?

In the financial markets, you can trade aluminum in a variety of ways based on your investment objectives, risk tolerance, and trading approach. Some of the most popular ways to profit from the aluminium metals markets are as follows:

Future contracts are one of the most widely used methods of investing aluminium and most commodities. Future contracts for aluminium are standardized agreements that reflect a predetermined amount of the asset at a predetermined cost and date of delivery. On markets like the London Metal Exchange (LME) or the New York Mercantile Exchange (NYMEX), future contracts can be bought and sold.

Investment vehicles called aluminum exchange-traded funds (ETFs) can be exchanged on stock exchanges and track the price of aluminum, and sometimes other metals. Without the need for actual delivery or storage of the asset, ETFs can offer exposure to the aluminum markets.

Additionally, you can buy the stocks of businesses that make or utilize aluminum. This can include mining firms, aluminum producers, or businesses that produce goods with aluminum.

CFDs are derivatives that let traders to opine on aluminum price changes without possessing the underlying asset. Leverage is a feature of CFDs that enables traders to manage larger positions with less cash.

Aluminium trading hours

The hours that you are trading aluminium are going to be determined by the aluminium products that you are involved in. This could be futures, stocks, or ETFs. The largest volume of trading aluminium occurs in London, at the London Metals Exchange.

Ring trading: The “Ring” trading session, which runs from 11:40 a.m. to 5:00 p.m. (London time) on weekdays, is the primary transactional period for aluminum on the LME. Traders physically congregate to the LME during this session to purchase and sell aluminum and other metals.

Kerb trading: On weekdays, from 1:00 a.m. to 11:40 a.m. and from 5:00 p.m. to 7:00 p.m. (London time), “Kerb” trading is another way to profit from aluminum and various metals on the LME outside of the Ring trading session. Aluminum and other raw materi can be speculated on electronically during the Kerb session, which is separate from the Ring session.

However, you can get involved on the Shanghai exchange, or even buy aluminium stocks in most countries around the world. For example, Alcoa is a huge beneficiary of aluminium demand, and the stock will often move up and down with aluminium prices.

What are useful indicators for Aluminium trading?

Traders utilize a wide range of trading indicators to aid in their decision-making. The following are some of the popular trading indicators:

Moving averages: This indicator displays the asset’s average price over a predetermined amount of time. Moving averages are used by traders to identify trends and probable levels of support and resistance.

Relative Strength Index (RSI): This oscillator gauges an asset’s price action strength by contrasting gains and losses over a predetermined time frame. It aids traders in identifying overbought or oversold conditions for an asset.

Bollinger Bands: A moving average with upper and lower bands based on standard deviations makes up the Bollinger Bands indicator. Bollinger Bands are used by traders to identify probable breakouts and reversals.

Stochastic Oscillator: Over a predetermined amount of time, this indicator compares the closing price of an asset to its price range. It assists traders in spotting possible trend reversals.

Fibonacci Retracement: Using horizontal lines, this indicator employs the Fibonacci sequence to identify potential locations of support and resistance. This indicator is used by individuals and firms to pinpoint potential entry and exit locations.

While each trader will have their own way to determine how and when to buy or sell, there are some common systems that many use. This may include using a Fibonacci retracement level in conjunction with a moving average at the same price. Commodity prices tend to be very reactive to technical analysis, so this makes a lot of sense.

What moves the price of Aluminium?

Numerous factors might affect the price of aluminum. The following are some of the most significant variables that can impact the price of aluminum:

Supply and demand: Just like with every other commodity, supply, and demand consideration have an impact on aluminum’s price. Price tends to increase when there is a deficit of aluminum supply in comparison to demand, and vice versa. Chinese demand plays a huge part in this equasion. If there is high demand, this is reflected in the pricing.

Production expenses: The price of aluminum may be influenced by the price of producing it, which includes costs for labor, raw materials, and energy. In order to preserve profitability, aluminum prices may rise if production costs rise. You should also be aware of storage costs as well, which most retail traders tend to overlook. Aluminium production is at the core of supply for any commodity exchange and those who would trade aluminum.

Economic aspects: The cost of aluminum can be impacted by factors such as interest rates, GDP growth, and inflation. The demand for aluminum tends to rise with strong economic development and low borrowing rates, pushing up costs.

Geopolitical factors: The price of aluminum can also be impacted by situations like policies, tariffs, and political unrest. For instance, if a nation slaps taxes on imported raw materials, domestic aluminum prices may rise as a result of diminished competition.

Exchange rates: Since aluminum is priced in US dollars, changes in exchange rates may also have an impact on aluminum prices. Aluminum prices may rise for consumers in other nations if the US dollar gains strength in relation to other currencies. This can be influential in a lot of major economies and importers, affecting demand.

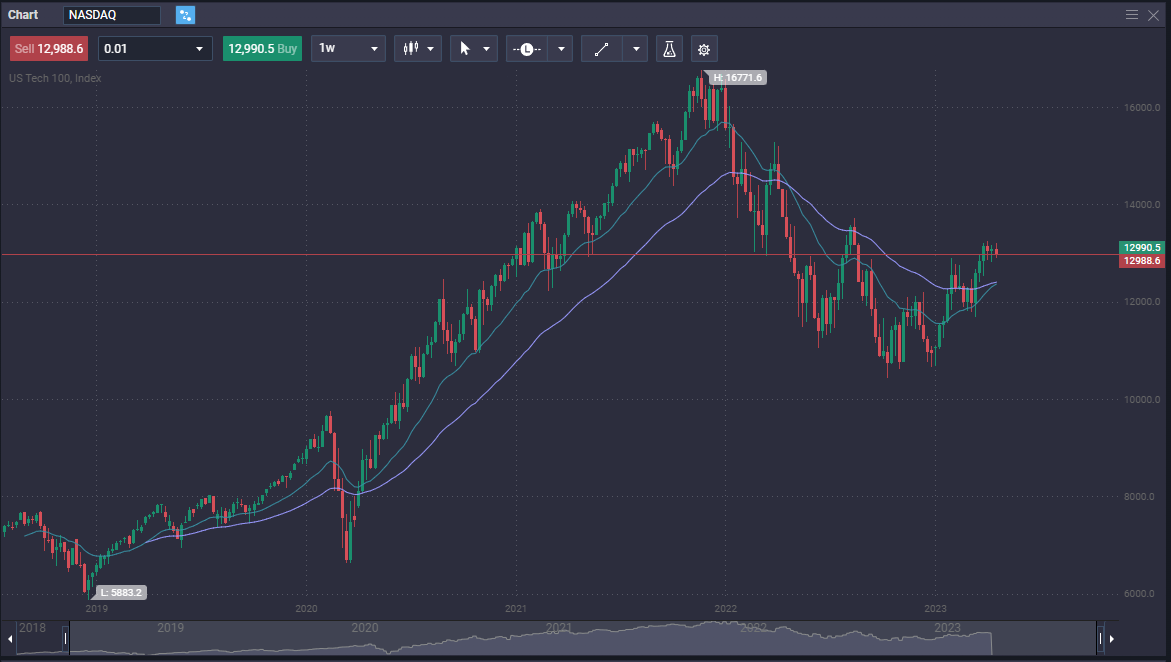

When aluminum prices reached previously unheard-of heights in 2006, the price of the material surged higher. A multitude of factors caused the price of aluminum on the London Metal Exchange (LME) to increase from over $1,500 per metric ton in early 2006 to approximately $3,000 per metric ton by the end of the year.

One significant aspect was the rising demand for aluminum in China, which at the time was going through a rapid period of economic growth and modernization. As a result, there was an increase in demand for aluminum for use in buildings, transportation, and consumer goods in that country, which had the lion’s share of demand.

There were supply-side limitations that reduced the amount of aluminum that was offered on the markets at the same time. Some of these limitations included labor unrest in important producing areas, capacity limitations at smelters, and supply chain interruptions brought on by traffic jams. Pricing can be influeced from port closures, etc. The supply chain issues after the COVID-19 lockdowns were an example of how fragile supply chains can be at times.

In addition to these elements, the price increase was also influenced by growing energy expenses, notably those associated with electricity, a crucial ingredient in the manufacture of aluminum. Simply put, the cost to produce aluminium was also a reason for the pricing to continue rising.

How to Start Trading Aluminium

Before you start trading aluminium, there are a few things that you need to know about the process. There is more than simply just betting on aluminium pricing. You need to have access to financial instruments to take advantage of the demand for the raw material.

Open a live trading account

Find a trustworthy broker that provides the services you require by doing some research. Take into account elements like costs, trading platforms, customer service, and security.

After deciding on a broker, you must fill out an account application. Typically, this entails disclosing personal data like your name, address, birth date, and social security number. Additionally, you can be asked for information about your career and finances, including your salary and net worth.

Brokers must confirm the identity of their clients in order to adhere to anti-money laundering legislation. A copy of your government-issued ID or passport may be required, along with extra paperwork like a utility bill or bank statement.

You can begin trading as soon as your account has been paid and your identification has been confirmed. For managing your money, your broker will give you access to a trading platform and other resources.

Make a deposit

You must fund your account before you can begin trading after your application has been granted. Numerous funding options, including wire transfer, ACH transfer, and credit/debit card, are typically provided by brokers. Even cryptocurrency deposits are available with PrimeXBT, giving traders more options.

Create a risk management strategy

The importance of risk management is something that cannot be overstated. Simply put, if you are trying to make money, the first priority is to protect your account. You must have a point where you exit a position.

If the trader loses 10%, it takes an 11% gain to make the account go back to break even. If the trader loses 20%, then a return of 25% is necessary to recover the losses. However, if the trader loses just 1% on a trade, it just takes a 1.01% gain. This shows how important it is to keep losses small.

Monitor your trades

It is important to monitor your trades, as the markets can be quite volatile. Important news coming from places like China can cause sudden movements, and therefore you must stay on top of your trades. Moving stop-loss orders to breakeven as the market moves in your direction is a start.

Notice where the next barriers are facing your position. As your trade overcomes these barriers, make sure to protect your profits if possible. Just as important is to make sure you don’t allow losses to get out of control.

Aluminium Trading Strategies

There are a lot of different ways to profit from aluminum, and of course a lot of different ways to approach the markets. The trader can look to technical analysis, fundamental analysis, and even use news releases to place postions. While there is no “one size fits all approach”, there are some basic building blocks to consider:

Technical analysis is a tool used in finance to evaluate and predict price movements by looking at historical market data like price and volume. In order to find prospective trading opportunities and advantages, this study involves visually assessing and projecting pricing movements based on previous patterns and statistics. Technical analysts continuously determine the fair market value of assets based on their belief that all market participants’ cumulative actions appropriately represent all relevant facts.

Fundamental analysis is a methodology used to evaluate the intrinsic value of a security by examining its financial and economic factors. It involves studying the financial statements, industry trends, and macroeconomic conditions to determine intrinsic value, which should be reflected in future pricing.

The primary goal of fundamental analysis is to identify undervalued or overvalued securities or assets and make investment decisions based on the long-term potential of a the markets. Fundamental analysts believe that the markets may undervalue or overvalue an asset at any given time, and it is the role of the analyst to identify these opportunities.

The Bottom Line

We have discussed trading in aluminium and its significance as a common raw material and trading component in the building, transportation, packaging, and other industries. Trading in aluminium is profitable using tactics like technical and fundamental analysis or a mix of the two.

There are various ways to invest, such as future contracts, ETFs, trading aluminium stocks, and CFDs. There are also highlights popular trading indicators and factors that impact aluminium prices, such as supply and demand, production expenses, economic aspects, geopolitical factors, and exchange rates.

Learning how to start trading aluminium, including opening a live trading account, depositing funds, creating a risk management strategy, and monitoring trades is your first step. Finally, looking into different aluminium investment strategies, including technical and fundamental analysis will be up to the trader to determine the best route forward. Nonetheless, even if you don’t chose to trade aluminum, it is worth keeping an eye on, as it can give a “heads up” to economic expectations globally.

Is Aluminium good for trading?

It can be a great way to bet on the overall economy. Chinese demand is a major driver of price, so this is also worth paying close attention to. Paying attention to the movement at both the New York mercantile exchange and the Shanghai futures exchange makes sense. Pricing differences can lead to arbitrage opportunities as well.

Can I trade Aluminum online?

Yes. You can get involved via futures, ETFs, and various stocks. There are also CFD markets available at some brokerages.

What is the highest price of Aluminium in history?

The all-time high price for aluminium occurred on July 13, 2008, when the London Metal Exchange (LME) cash settlement price reached $3,271 per metric tonne.

When should I trade Aluminum?

While you can trade aluminum at all times in various products, the best time to trade is during the day in the United States, as the futures market is most liquid during that time. Remember, when you trade aluminum, it is a bet on the future direction of the global economy, so longer-term trading tends to work best.