Shiba Inu has seen its ups and downs. At one point, the coin had gained an outstanding 46,000,000%! However, it has fallen almost nonstop since, and therefore it is important that you understand how to make money in this market when it is falling. The ability to profit from falling prices is due to the ability to short-sell the market. If you wish to make money on the downtrend in Shiba Inu, you need to know how to short Shiba Inu coin.

Short selling Shiba Inu: What Does It Mean?

Short selling Shiba Inu means that you are betting the price of Shiba Inu will fall over time. There is a multitude of ways to take advantage of a market falling, but the most common way is to borrow an asset and sell it to somebody else, hoping to repurchase it at a lower price. You then return that asset to the original owner, hoping to keep the difference.

It’s slightly different in the crypto world as you are not borrowing stock. As a rule, you will be looking at either trading in the perpetual futures contract or the CFD market. The CFD market, also known as the “contract for difference” market, is a pure price play, as it is an agreement between two people to pay the difference when the trade is closed out. There is no borrowing of anything, and neither participant technically owns anything. It’s just an agreement to buy or sell at a specific price and then pay the difference of the transaction with cash.

There are actual coins on the futures markets, and you are borrowing them just as you would if you were shorting a stock. It’s easier to bet on a fallen price in the CFD market than to be bothered by the complications of the futures market.

Can You Short SHIB?

Yes, you can short Shiba Inu via either the futures contracts on an exchange or through the CFD market at PrimeXBT. You are simply betting on the price falling in either case.

When is a Good Time to Short SHIB?

You need to understand that Shiba Inu is known as an “altcoin,” meaning that it is far out on the risk appetite spectrum. Crypto, in general, moves in the same direction, but a coin will rarely buck the trend. This is especially true when you’re talking about a small market like Shiba Inu, so you need to understand the overall risk appetite of crypto traders.

An excellent place to start is Bitcoin, as well as Ethereum. These two larger coins tend to attract monetary flow much quicker than the small markets; therefore, they can give you a bit of a “heads up” when these other coins are going to move to the upside. The exact opposite is true as well because people were not willing to buy Bitcoin, Ethereum, Solana, and others; they are most certainly not going to be ready to buy Shiba Inu. As they fall, so does SHIB.

How to Shiba Inu Coins – Step-by-Step

To profit from a falling market, you need to understand precisely how to go about shorting Shiba Inu. You can go through the entire process of “borrowing” coins from someone else to short on a futures contract, or you could take the much more straightforward route of trading the CFD market at PrimeXBT.

Step 1 – Analyze the Market

Before you do anything, you need to pay close attention to what the market is doing. You need to understand which direction the market is most likely to go and when it would be time to get out of the market if something goes wrong. You also have to have a target in mind before you put money to work.

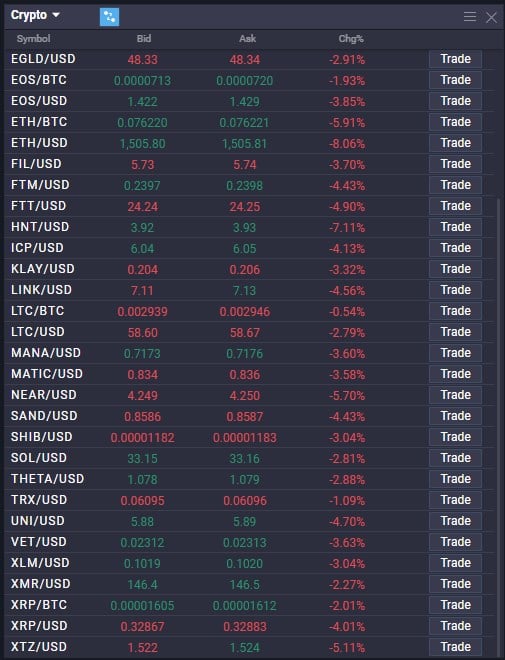

Snapshot of some of the crypto markets available on the PrimeXBT platform.

Step 2 – Place Your Order

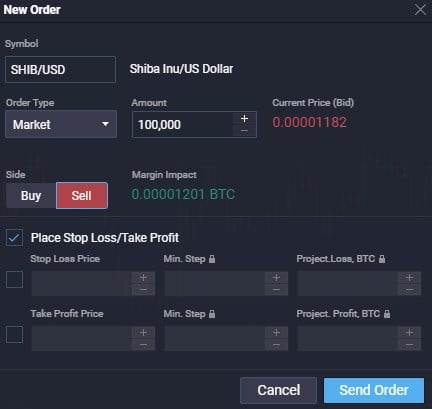

On the PrimeXBT platform, you can either click the market watch window where it says “Trade” next to the price quote or click the “Sell” button at the top of the chart. At this point, you should also place stop loss orders and any potential target. When you press the “Trade” button, it opens up an advanced pop-up window, allowing you to place all necessary orders.

Setting stop loss orders in SHIB/USD via the PrimeXBT platform.

Step 3 – Let the Market Do Its Thing!

At this point, you have everything you can, and it is time to let the market do whatever it will do. Unfortunately, many retail traders get into trouble by overanalyzing each little micro movement. This is where the phrase “Plan the trade and trade the plan” comes into fruition.

Shorting SHIB Example

An example of an excellent shorting opportunity is when the crypto market is in a significant bear market, and one of the smaller markets suddenly gets a spike. The chart below shows that Shiba Inu had a massive day in the middle of August without sized upward mobility. However, as this is a small market and the rest of the crypto market is struggling, it makes sense that it will eventually fail. You can see that the market had fallen back down to just below where that move started.

One of the best ways to make money in the crypto market when it’s falling is to short the smaller markets. This is because much institutional money is still only trading Bitcoin and Ethereum, so these markets start to hurt in a “risk-off” environment.

Shiba Inu selling opportunity on the PrimeXBT platform.

What Are the Advantages and Disadvantages of Shorting Shiba Inu?

There are, of course, both advantages and disadvantages to shorting Shiba Inu. That being said, traders need to be aware of both the pros and cons of doing so.

Advantages of shorting Shiba Inu

- Ability to make money in a bear market – By shorting Shiba Inu, you can make money in a bear market when other traders are losing money.

- You are no longer stuck with a “HODL” methodology – By using the CFD market, you can easily short a market that will fall. It also allows for hedging other positions that you may already have. This is a great way to ride out the volatility of longer-term holdings.

- Altcoin – Shiba Inu is in altcoin. They tend to have very long cycles, meaning they will be either very bullish or bearish for long periods.

Disadvantages of shorting Shiba Inu

- Theoretically unlimited losses – Although not a problem at PrimeXBT and the CFD market that it offers, if you are shorting the perpetual contract in the futures exchange, you could theoretically lose an unlimited amount.

- Bear market bounces – You should be aware that the occasional bounce can be quite vicious in a bear market. Money management is crucial when you are short an asset.

Why You Should Short Shiba Inu with PrimeXBT

While there are multiple ways to short Shiba Inu, there are significant advantages to doing it through PrimeXBT. Below are just some of the significant advantages of doing so:

- CFD market – PrimeXBT offers the “contract for difference” market, meaning that you are betting on the price movement and do not have to worry about other issues such as custody. You do not need to borrow any coins, nor do you need to return anything. It’s simply a matter of pressing a few buttons to take advantage of price movement.

- Leverage – PrimeXBT offers great leverage. This allows the trader to control a more prominent position than they normally would, enabling more significant gains. Because of this, it takes just a tiny bit of capital to control important position sizes.

- World-class platform – PrimeXBT offers a world-class online trading platform. The platform gives you all the tools you need to do analysis and is available anywhere you can access an Internet connection. It runs in your browser, and the technicians at PrimeXBT make sure that the platform is up-to-date and upgrades are done frequently.

Conclusion

Shorting Shiba Inu can be a great way to make a profit. However, there are a few things that you will have to keep in mind. The first thing is that there are certain advantages and disadvantages in each available market, and you need to understand the differences. Furthermore, the overall best way is through the CFD markets to benefit from pure price action.

The fact is that crypto does go through difficult times. The so-called “crypto winter” is a great time to learn to short-sell. This is when all crypto seems to have very little in the way of appreciating. In these situations, the best way to deal with the market is to bet on falling prices.

The platform that you use is essential as well. PrimeXBT is a leader in this area, and the company keeps up the backend without any need to download software. The online platform has plenty of technical analysis tools to use to trade this market.

Being able to short easily is a significant advantage that you can have over those trading perpetual futures contracts. The platform at PrimeXBT also allows you to deal with leverage easily, as you only must press a few buttons. The astute trader can take advantage of all market conditions, so shorting SHIB is a skill you should have.

Can you short-sell Shiba Inu?

Yes, it is possible. You can short SHIB either through the perpetual futures contract markets or the PrimeXBT CFD markets. However, it’s worth noting that it is much easier to do it in the CFD market than it is through the perpetual futures contract, and you have much more ability to leverage your position size, increasing your profits.

What is the best way to short Shiba Inu?

The best way to short Shiba Inu is through the CFD or contract-for-difference market. PrimeXBT allows people to trade this market without the worries of a perpetual futures contract, and borrowing coins is necessary to short the market.

What’s the best time to short Shiba Inu?

Shiba Inu is best shorted when the entire crypto space is falling apart. The risk appetite spectrum in crypto starts with Bitcoin and Ethereum and works its way down to altcoins such as Shiba Inu. You can think of Shiba Inu much like a small-cap stock in that sense because it is a minor market in the much larger crypto world.

Why is SHIB going down?

Shiba Inu is going down because all crypto is falling. The fact is that risk appetite is falling apart, and this does not induce confidence when it comes to not only Shiba Inu but also risk assets in general.

Can Shiba coins reach $1?

No. This is because there are far too many coins. There are almost 600 trillion coins. If B were to reach that price, it would have to be worth a staggering $600 trillion. This is an impossible amount, as it would swallow the entire financial system.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.