Trading the Dow Jones Industrial Average (US30) offers a valuable opportunity to speculate on the strength or weakness of the US economy. The index tracks some of the most well-known companies in the country, making it an essential index to follow. To maximize profits from this opportunity, it is crucial to understand how the index is compiled and its intricacies.

What is the Dow Jones index?

The Dow Jones Index, which is more commonly referred to as the Dow Jones Industrial Average is a stock index that tracks the performance of 30 of the biggest companies in the United States. Because of this, it is used to gauge market strength and is one of the most commonly referred benchmarks in the world.

The Dow Jones Industrial Average has been around since 1896, and initially had a published average of 40.94. It is one of the oldest indices in the world and is price-weighted. This means that it is calculated differently than many of the other indices, which are typically calculated by market cap. The Dow calculates its value from the per-share price of its members.

The Dow Jones Companies

The Dow Jones is made up of 30 different companies, featuring such household names as UnitedHealth Group, financial juggernaut Goldman Sachs, and home improvement giant Home Depot. Many other household names that you would be familiar with make up the Dow Jones Industrial Average, such as Apple, Boeing, and Salesforce.

How Is the Dow Jones Index Calculated?

The Dow Jones Industrial Average is calculated using a price-weighted calculation. The prices of the 30 stocks are added together and then divided by something known as the “Dow divisor”, which is designed to account for the potential anomalies it can rise from stock splits or modifications to the index itself.

The result is that the companies with the higher share prices have an outsized effect on the calculation as well as the price reported. This is different than many other indices, which will use market capitalization to determine the “most important stocks.”

Differences between trading and investing in the Dow Jones

The difference between trading and investing more often than not comes down to your timeframe. Trading almost always means that you are using derivatives to speculate on the price of an underlying market. For example, if you are looking to trade based upon the price movement of the Dow Jones, you are more likely than not going to be looking for leverage.

On the other hand, if you are trying to invest for a longer-term move, you may use something like an exchange-traded fund, commonly called an ETF, that tracks the index, or shares of individual companies listed on the index.

| Trading the Dow Jones with Prime XBT | Investing in the Dow Jones | |

| Ways to trade it | CFDs | ETFs or shares |

| Market hours | 24/7 M-F | 9:30 am to 4:00 pm M-F (New York City time) |

| Deposit required | 1% of the trade size | 100% of the trade size |

| Time Frame | Any | Long-term |

| Liquidity | Much more than ETFs | Varies by instrument |

What Drives the Dow Jones’s price?

To be successful at trading the Dow Jones 30, you need to understand the various fundamental factors that can influence the price. By paying attention to some of the most important factors, you put the odds of success in your favor. Keep in mind that there are always outliers, but the following areas are the most common influences on the index.

Monetary policy and economic data

Since the Great Financial Crisis in 2008, monetary policy has become extraordinarily important for stock markets, and in fact, some have even concluded that it is the most important thing. While monetary policy certainly had an effect before the GFC, this has become an outsized influence since that time.

Accommodative monetary policy from the Federal Reserve causes more money to enter the financial system, drives credit use higher, and reduces interest rates. This will more often than not help stocks rally, as it increases consumption.

You should also be aware of economic data for the United States. Gross Domestic Product numbers show the health of the economy, which most certainly can affect the companies that make up the index. Furthermore, inflationary numbers have a great influence on whether or not companies will be able to be profitable, as they may or may not be able to pass on higher costs to consumers.

Individual corporate influence

The individual performance of companies can have a major influence on the index, especially those that are more expensive than others. Quite often, you will hear comments about Boeing and what it is doing during the day, because it does have an outsized effect on the pricing of the Dow Jones Industrial Average.

Because of this, it is crucial to understand when the major players have an earnings announcement because it can drastically change the direction of the index, at least temporarily.

Sociological and political risks

Understand that trading in the Dow Jones Industrial Average does not happen in a vacuum. After all, it is a representation of the overall United States economy, so, therefore, events such as the Great Financial Crisis and the recent coronavirus pandemic can cause massive moves in the market. At times, elections have also affected the markets.

Looking at the most recent major event, the pandemic, many companies that involved travel were hit hard, as was banking. However, a company like Salesforce did quite well as we started to see more of a “work from home economy.” Conversely, as the world exited the pandemic, you started to see travel companies performing quite well.

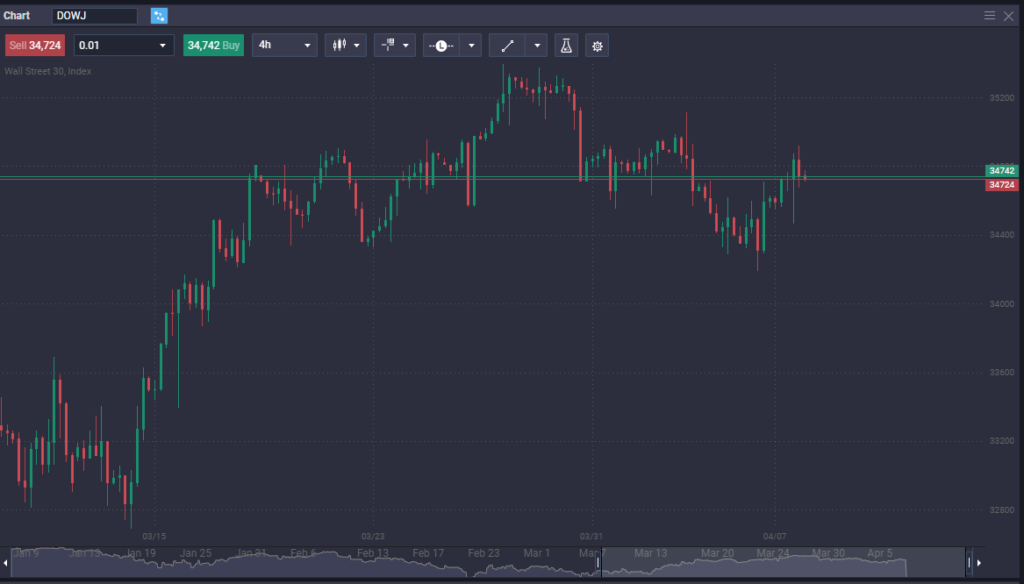

Dow Jones trading hours

At PrimeXBT, we offer 24/7 trading, Monday through Friday. The ability to trade at any time of the day gives our traders a huge advantage over those trading at traditional brokerages, because they can react to the news that happens outside of the standard business hours of Wall Street. Instead of being caught by a market gapping higher or lower due to overnight concerns, our traders can take advantage of news or protect themselves from news immediately.

At a traditional brokerage that handles stocks or ETF markets, there is only a certain amount of time that you have to take a position. This means that you have to trade when the stock market itself is open, starting at 9:30 AM New York time, and ending at 4 PM. Depending on where you are trading, you may have the ability to trade after-hours sessions, which can run from 4 to 8 PM.

What Are the Benefits of Dow Jones trading?

There are numerous benefits to trading the Dow Jones, and it is easy to do at PrimeXBT. Below are some of the biggest benefits that traders enjoy trading this index:

- Representation of the world’s largest economy – By trading the Dow Jones 30, you can trade on the overall health and vibrancy of the United States and its economy.

- Highly liquid market – The Dow Jones is a very highly liquid market, so getting in or out of the position is easy to do around the clock. This allows for “off-hour” trading through the CFD market.

- Simplifies investing – By trading the Dow Jones 30, you are simplifying the investment process, as you are not tied to any one particular company, and therefore you are essentially trading an entire portfolio with one click of the button.

- The ability to hedge – If you own stocks in the United States, you can either buy or sell the Dow Jones Industrial Average contract to hedge your existing positions, protecting your overall portfolio from drawdowns.

- Trade around the clock – The trading of the Dow Jones allows traders to trade around the clock, Monday through Friday. This is a major advantage over Wall Street traders.

What Are the Drawbacks of Dow Jones trading?

While we love trading the Dow Jones 30, there are a few things that you need to keep in mind that can be potential drawbacks to the market.

- Localized – Keep in mind that the Dow Jones Industrial Average is a localized index, meaning that it is US-centric.

- Federal Reserve – If you are going to trade the Dow Jones 30, or any US index for that matter, you need to keep an eye on the Federal Reserve, and various speeches as it can give you a “heads up” on the future monetary policy.

- Leverage – Keep in mind that the index contract is levered, meaning that your losses can be outsized if you do not take care of your position size and risk.

How to trade Dow Jones

To profit from trading the Dow Jones Industrial Average, you need to understand the different options that you have to take advantage of. The various markets all track the same index but behave in different ways. Because of this, you may find that a specific type of instrument is better for you than many of the others.

Dow Jones CFDs

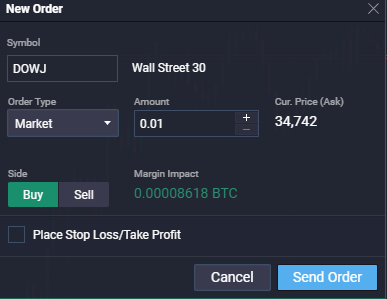

The contract for difference markets are derivatives that base their price on an underlying market, such as the Dow Jones Industrial Average. You never actually take ownership of the asset but enter an agreement with either your broker or another trader that you are going to settle up the difference between the opening price in the closing price in cash.

At PrimeXBT, we offer the CFD market to take advantage of the underlying market such as the Dow Jones 30, freeing up a lot of the complications and limitations of trading and many other markets. It is also worth noting that CFD markets allow traders to customize their trade size. This is crucial for money management.

Dow Jones futures

Futures contracts are an agreement that uses a centralized exchange to speculate on the price of an asset. Futures contracts have standardized trade sizes, which can make them quite expensive. Futures markets are highly liquid, and trade 23 hours a day, but quite often are far too expensive for retail traders to take advantage of. Furthermore, it comes with the additional issue have not been able to trade in a specific size other than the standardized contracts offered.

Dow Jones options

Dow Jones options are contracts that give you the ability and the right to buy or sell the index at a set price and a set time. You are not obligated to do so, and as a result most traders simply settle the difference in cash. Options are much cheaper than futures, but again have a fixed contract size, so it does cause some issues for retail traders as far as a fixed position size is concerned.

Be aware that options have an expiry date, which makes them worth less or more based on where the price is currently sitting, and also based upon how much time is left before expiration. This involves relatively complicated calculations, which makes trading options a completely different type of investment.

Dow Jones stocks and ETFs

There is also the ability to trade the Dow Jones through the ETF market, which is an investment that holds an entire group of stocks that mimics the behavior of the index itself. There is a multitude of different ETFs you can trade, and they are available for not only the Dow Jones, but just about anything you can think of at this point.

That being said, they do not offer leverage most of the time, although there are a couple out there that are made for day trading and offer three times leverage. The ETF tends to be an excellent opportunity and choice for those looking to invest for longer-term moves, not necessarily speculate on short-term returns. Furthermore, it is quite common for a trader to hold ETFs in their retirement accounts while speculating in their more aggressive accounts.

Tips for Dow Jones Trading

As you start to trade the Dow Jones, there are a handful of trading tips that you should keep in the back of your mind. While most markets behave essentially the same way, the Dow Jones has a few nuances worth paying attention to.

- Test your system – Make sure that whatever trading session you are using shows historical gains in the Dow Jones Index itself. Not all trading systems behave the same in every market.

- Pay attention to earnings announcements – The Dow Jones is made up of just 30 companies, so earnings announcements can have an outsized effect on pricing. Make sure you are aware of when the big companies are reporting.

- Have a good news source – As the Dow Jones can move quite quickly, you must have access to a good news source. Make sure that you have quality information coming out of the United States to understand what is going on in America.

- Watch your leverage – Make sure you are not over-levering your position and trading too large. Keep in mind that markets can move quite quickly, so protecting your account is paramount.

Why Trade Dow Jones with PrimeXBT

Trading the Dow Jones Industrial Average with PrimeXBT is a great way to get exposure to the blue-chip stocks in the United States, as well as growth in the overall economy. The Dow Jones offers a “shortcut” to playing the US economy and eliminates a lot of the research necessary to trade individual companies.

- CFD market – PrimeXBT offers the CFD for Dow Jones Industrial Average, meaning that you can trade in smaller positions if necessary. Furthermore, the CFD market does not force you to trade a standardized contract, meaning that you can trade partial contracts to customize your exposure. This is crucial for money management.

- Leverage – Prime XBT offers 1:100 leverage on the Dow Jones, allowing traders to increase profits with smaller accounts. Exponential growth is possible with this generous leverage.

- Crypto deposits – PrimeXBT accept crypto deposits and offers the ability to use your crypto to increase wealth while holding them as long-term assets. Furthermore, PrimeXBT also offers the ability to stake, allowing interest to be earned on unused crypto.

- World-Class Platform – PrimeXBT offers a world-class online trading platform that you can access anywhere you have a browser and an Internet connection. PrimeXBT constantly monitors the platform for bugs and applies fixes regularly, ensuring that your platform is always running reliably.

Can you short the Dow?

Yes, you can short the Dow just as easily as you can a currency market or commodity. This is one of the major advantages of trading an index instead of the complications of shorting an individual stock.

What is the Dow Jones Utility Average?

The Dow Jones Utility Average is a stock index that tracks the performance of 15 large utility companies that are traded in the United States. It is not a widely offered CFD market, but it is quite often used as a gauge of risk appetite.

What is the Dow Jones Transportation Average?

The Dow Jones Transportation Average is a US stock market index derived from transportation sector giants, which is quite often used as a gauge of the health of the United States economy, as transportation is such a huge part of the supply chain.

What are Dow Jones Sustainability Indices?

The Dow Jones Sustainability Indices are a family of indices that evaluate the sustainability of thousands of companies that are traded publicly and are used by those who are worried about the Environmental, Economic, and Social Dimension of corporate actions. This is a relatively new feature of the markets, as attitudes have changed about sustainability by investors.