Forex trading offers a wide range of currency pairs. One of them is GBP/USD, which stands out as one of the most recognisable. This guide explores what makes this trading pair so popular, what drives its price action, and most importantly, how to trade it. This guide is for everyone, whether you’re a professional or just starting out.

An introduction to GBP/USD: why this pair matters for traders

GBP/USD quotes the current exchange rate between the British Pound Sterling (GBP) and the US Dollar (USD). At the time of writing, the rate is 1.334, meaning that’s how many US Dollars are needed to buy one British Pound.

This pair is globally popular and frequently traded, partly because both GBP and USD are reserve currencies. For traders, this means access to deeper liquidity, tighter spreads, and strong price action during peak hours.

Key features of the GBP/USD currency pair

Tight spreads and high liquidity are just a few reasons why the British Pound Sterling and US Dollar make such a good pair. Its global popularity fuels deep liquidity, allowing traders to place large orders without noticeably affecting the price. Combined with the fact that GBP/USD isn’t overly volatile, it appeals to both individual investors and major financial institutions.

A trading pair’s popularity can often be gauged by key indicators such as trading volume. Trading volume is a reliable indicator in forex, helping to show how active a market is at any given time. Higher trading volume means more people buy and sell it over a given period of time. Conversely, low volume indicates less interest from traders. With that being said, GBP/USD remains one of the most traded currency pairs in the world.

Historical price movements and global influences

Interest rate decisions, inflation data, and even retail sales can all affect price movements in the forex markets. Of course, exchange rates are also influenced by geopolitical events. In the case of GBP/USD, Brexit stands out as one of the most recognisable events in recent years, leaving a major impact on the markets.

What drives the GBP/USD exchange rate?

Taking a closer look at what shapes the price action of the Pound Sterling and US Dollar trading pair. As mentioned, exchange rates are highly dependent on economic data and geopolitical events, but this section breaks things down in more detail.

Central banks – The Bank of England and the Federal Reserve

Central banks are responsible for setting monetary policies. Their decisions and economic outlooks can either strengthen or weaken their respective currencies. The Bank of England and the Federal Reserve are the ones behind the British Pound and the US Dollar, respectively.

Economic data and political uncertainty

GDP growth, inflation rates, and employment statistics heavily impact GBP/USD. This kind of economic data often reflects the overall health of a country’s economy, showing whether it’s struggling or not.

Worth noting that these factors go hand in hand with political events. Elections, or any major government policy shifts, can in fact trigger sharp swings in the forex markets.

Market sentiment and news impact

Psychology plays a huge role in trading. Traders often act irrationally when they get emotionally attached to their trades. Headlines, unexpected news, and market rumours may fuel their decisions, leading to sudden spikes or drops in price movements, even in major pairs like GBP/USD.

Choosing the right time: when is best to trade GBP/USD?

In forex markets, timing is everything. Tighter spreads and less slippage can usually be expected during peak trading hours, leading to lower trading costs.

Volatility throughout the day

Every day, the London and New York sessions overlap, creating what’s considered the key trading hours. This is when GBP/USD tends to be most volatile. Two major markets being open at the same time drives trading volume and enables traders to make better trades during stronger price action.

Understanding global trading sessions

Forex runs 24 hours a day, five days a week, and is divided into four main sessions: Sydney, Tokyo, London, and New York. The highest trading activity usually occurs when two sessions overlap.

Using economic calendars for trade timing

Tracking economic calendars keeps traders updated on currency-related data, which can translate into better trading decisions and stronger future results.

Trading involves risk.

Technical analysis for GBP/USD trading

Knowing what impacts exchange rates in currency pairs is just the beginning. Forex trading, like any form of trading, can be more complex. Traders may benefit from learning about technical analysis, as it can become one of the most important tools for placing and securing trades.

Essential indicators and price levels

When traders get into technical trading, they quickly realize there are a lot of indicators to choose from. However, some indicators are more popular and widely used than others. RSI and MACD are among them.

RSI (Relative Strength Index) measures momentum and helps identify overbought or oversold conditions, making it easier to spot potential reversals.

MACD (Moving Average Convergence Divergence) highlights changes in momentum and trend direction and is often used to identify entry and exit points.

Both RSI and MACD are valuable tools for spotting support and resistance zones. Traders looking to enhance their strategies may also consider incorporating Moving Averages, which are excellent for identifying overall market trends and key support and resistance levels.

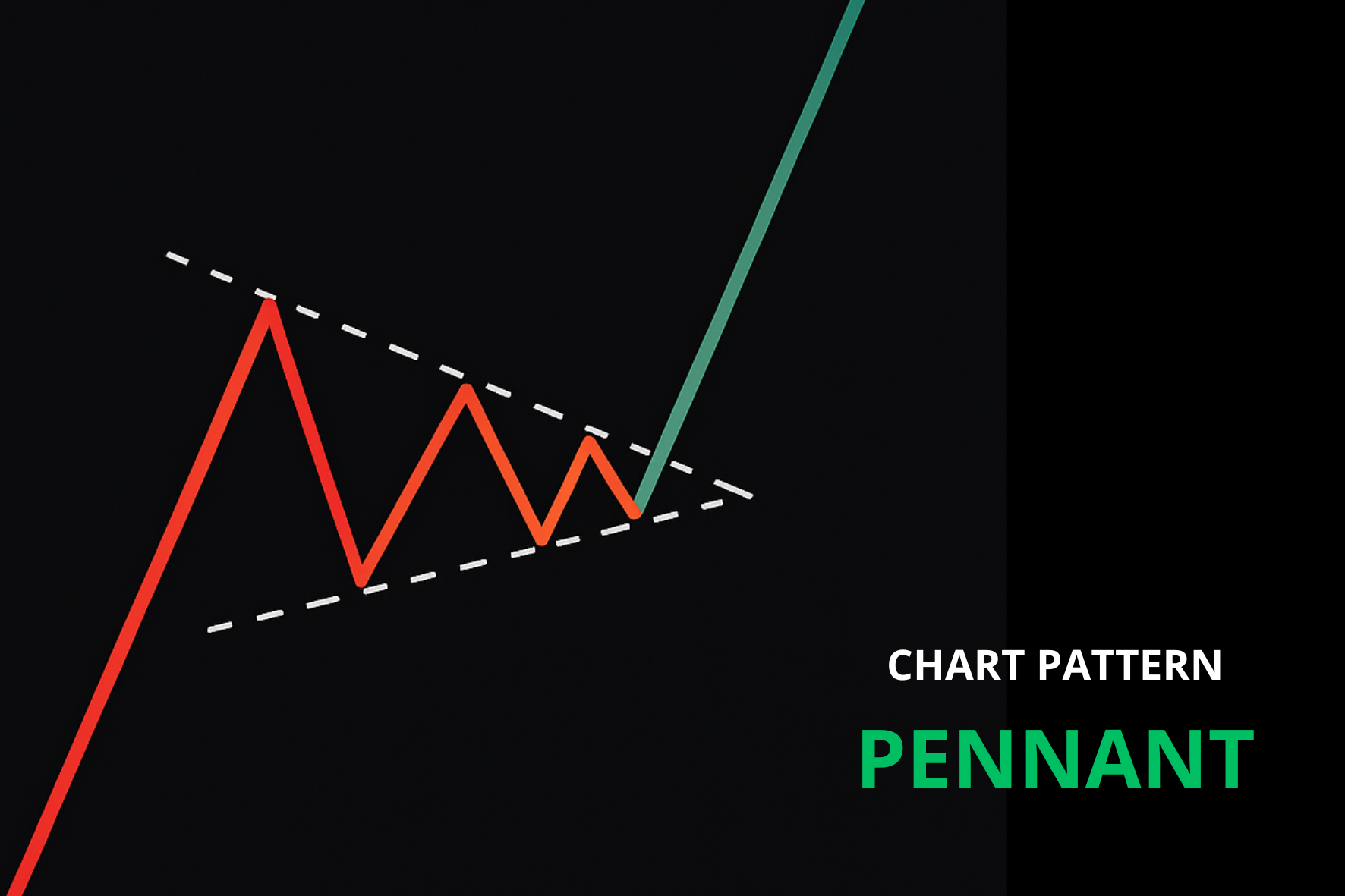

Chart patterns: from flags to pennants

Understanding chart patterns can seem challenging at first at first, but it’s not as complicated as it seems. Some patterns are more common than others, and flags and pennants serve as a great examples.

Flags form after a strong price movement. They are recognised as small rectangles that appear against the direction of the current trend, representing a brief pause before the trend resumes. This pattern often reflects the first wave of traders taking profits after the initial upward or downward move.

Pennants are also brief pauses following a strong move, but unlike flags, the price doesn’t pull back as clearly. Instead, it tightens into a small triangle shape. Traders watch pennants closely in order to enter their positions before the price breaks out and the trends continues.

Interpreting candlestick charts

The way candlesticks are formed is pretty simple. Each candle represents a specific time period, depending on the time interval you choose.

When a new time interval begins (such as a 5-minute period), a new candlestick is generated. If the price drops from the opening point, the candlestick turns red. If it rises, it turns green. The thin wicks on both ends show the lowest and highest prices reached during that time.

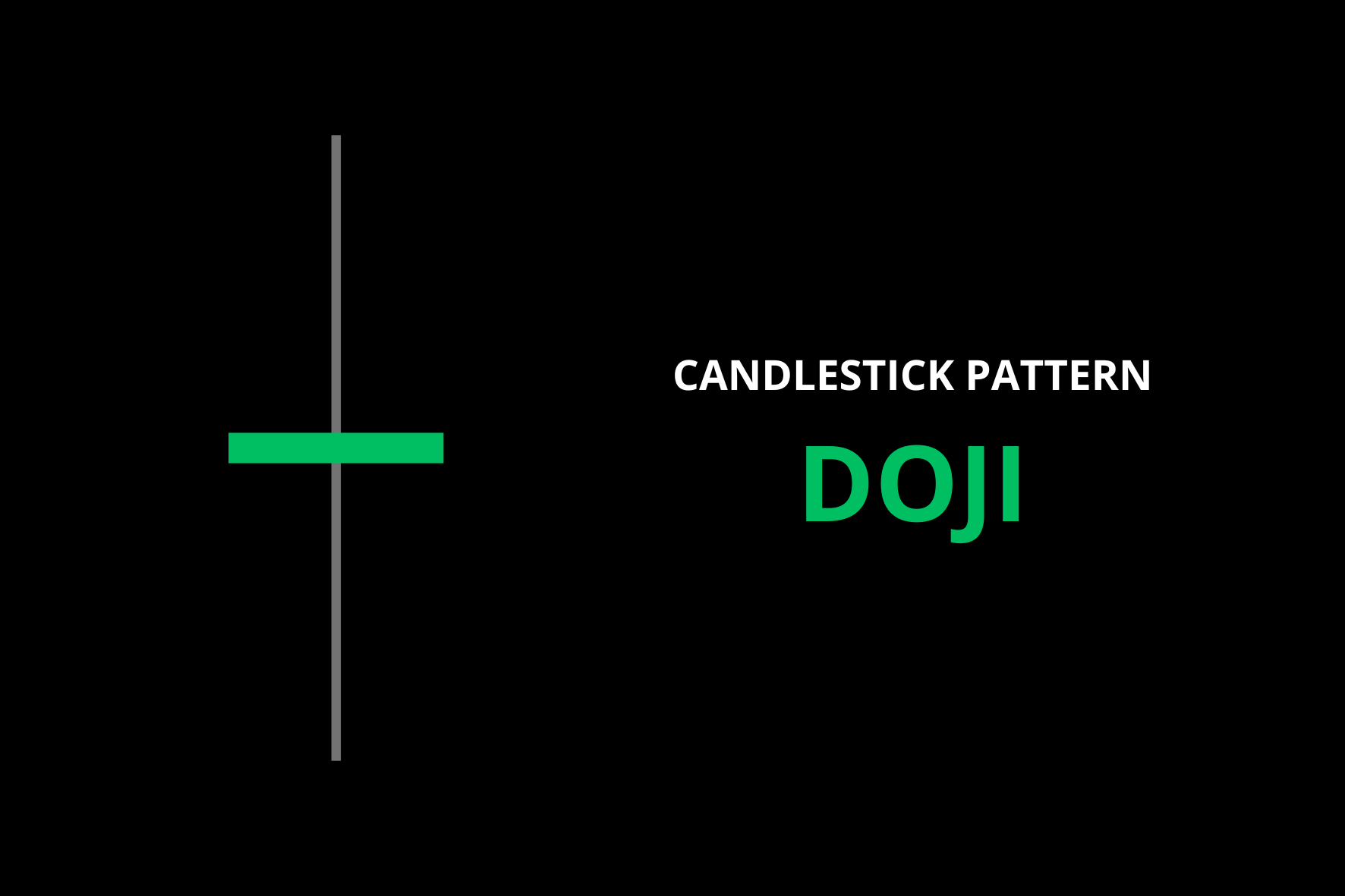

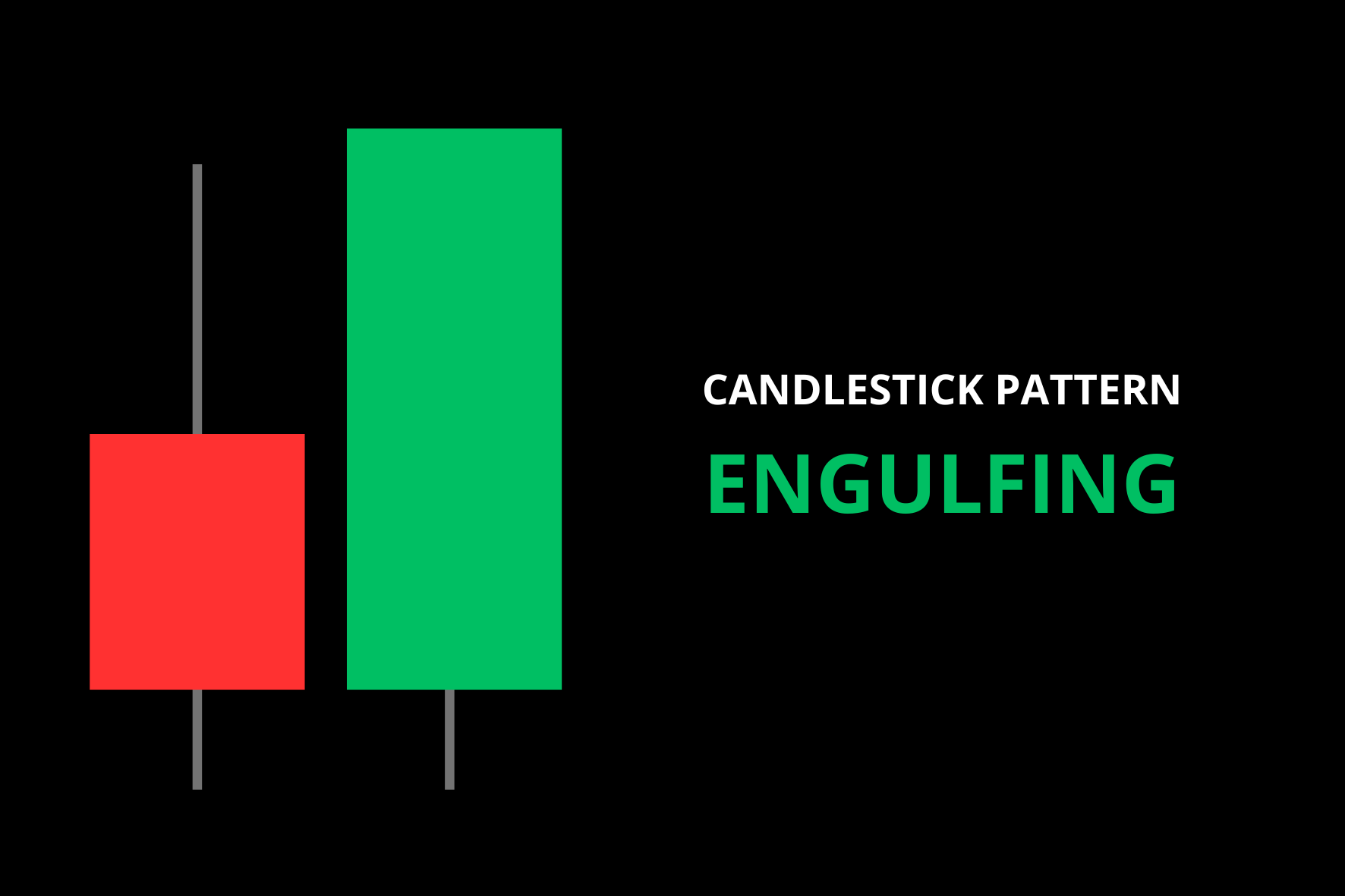

In forex trading, as in any other market, understanding how candlestick setups work is fundamental knowledge. Let’s focus on a few that appear quite often.

Doji is one of the easiest setups to spot. It looks like a thin candlestick caused by nearly identical opening and closing prices. It often signals that a trend reversal might be on the way, especially when it appears after a strong move in clear direction.

Engulfing is also a fairly simple pattern, though it can be a bit trickier to catch. It forms when a candlestick fully covers the body of the previous candle. This suggests that a trend may be forming in the direction of the engulfing candle.

Hammer gets its name from the shape it creates on the chart. If a candlestick has a long lower wick and a small body at the top, it may signal a potential trend reversal, usually to the upside after a downtrend. The opposite is true for uptrends becoming downtrends, and vice versa.

Popular strategies for trading GBP/USD

Everyone has their own strategy. Some traders prefer opening and closing positions within the same day, or even within a few hours or minutes, while others focus on long-term moves. No matter what the strategy is, it’s always important to remember about setting stop losses and practising strong risk management.

Each trading style is defined by different factors: the timeframes for opening and closing positions, the type of data used for analysis, the amount of capital committed to each trade, and much more.

Intraday and scalping approaches

Intraday and scalping strategies are all about quick, frequent trades, usually executed within the same day. This type of trading demands strong skills in reading short-term charts and understanding momentum indicators.

Trading on economic news

News traders take a very different approach compared to scalpers. Before important announcements (like interest rates decisions for example), they often set two pending orders, one above and one below the current price, aiming to catch the breakout. In this case, it doesn’t matter which way the news moves the market.

Swing and longer-term strategies

Swing trades are usually executed on daily or weekly timeframes, while longer-term strategies may require holding positions for months. Traders who prefer this style need a good grasp of both fundamental and technical analysis, along with a basic understanding of macroeconomics, since a currency’s stability is closely tied to its country’s economic health.

Strategies based on pair correlations

Currency pairs often correlate with other instruments. Some traders analyze the broader market to spot new opportunities. For example, comparing GBP/USD with EUR/USD, GBP/JPY, or even gold can reveal valuable insights for finding strong entry points.

Trading GBP/USD with CFDs: practical tips and risks

CFDs, or Contracts for Difference, allow traders to speculate on the price movements of GBP/USD without actually owning the asset – in this case, currency.

Potential profit comes from the difference between entry and exit point. Although the CFDs use leverage and it does increase the profit, it also affect the liquidation price.

Advantages and drawbacks of CFDs

Pros:

- Access to larger positions with lower capital

- Low initial capital required

- Ability to go long or short easily

Cons:

- Higher leverage may include higher risk

- Overnight fees for holding positions open

- Higher leverage requires disciplined risk management to avoid emotional decisions

A step-by-step guide to opening a trade

Opening a GBP/USD position is straightforward. The steps are as follows:

- Choose GBP/USD from the list of available currency pairs.

- Analyse the chart based on patterns and indicators in order to find an entry point.

- Set stop loss and take profit levels to avoid emotional trading and minimise the risk.

- Set the position amount and leverage.

- Place the trade.

Calculating margin and selecting leverage

Understanding margin and leverage is key. Here’s an example to show how it works:

Let’s consider a position of 1 standard lot in GBP/USD, which equals 100,000 units of the base currency.

If a broker offers 20:1 leverage, only 1/20th of the position size is required as margin.

100,000 ÷ 20 = 5,000 USD

Or, if the leverage is 50:1, the calculation of the margin required would look like this:

100,000 ÷ 50 = 2,000 USD

At the end, leverage use is tempting, but it leads to higher risk and therefore to higher chance of getting the position liquidated.

Managing risk while trading GBP/USD

Identifying an optimal entry point can be challenging. Often, before reaching a target price, the market will fluctuate. To avoid unnecessary losses, it is good practice to build and follow a solid risk management routine.

Setting stop-loss and take-profit

If the price suddenly moves in the wrong direction, a stop-loss helps protect your capital from larger losses. For example, if you’re in a long position, setting a stop-loss 2% below your entry price can help protect against liquidation. For short positions, a stop-loss 2% above your entry price serves the same purpose.

The same applies to taking profit. You can adjust both stop-loss and take-profit levels based on your trading experience and risk tolerance.

Defining daily risk limits

A series of losing trades can increase the chance of emotional decision-making. That’s why it helps to define clear daily risk limits in advance. Taking small losses is part of the trading journey, and knowing when to pause or adjust your strategy can help you stay focused and in control.

Building a simple risk management plan

A set of rules is a must-have. Traders should define how much time they are willing to spend trading (including chart watching), the number of trades allowed per day, or the maximum capital to risk per position. Those who develop a trading rulebook increase their chance to win in the market.

Common trading mistakes to avoid

Once the risk is under control, there’s still plenty of mistakes a trader can make. Trading the British Pound and US Dollar forex pair is no different in this matter. So, what should traders pay special attention to?

Overtrading

Emotional trading often leads to overtrading, which may result in less thoughtful decision-making. Frequent trading can limit the time available for detailed analysis, making it more difficult to identify high-quality entry points.

Letting emotions drive decisions

Emotional trading goes beyond overtrading. Revenge trading can occur after several consecutive losses or a large loss, where a trader attempts to earn back profits quickly without proper analysis.

FOMO, which stands for the Fear of Missing Out, is another common trap. It happens when traders see an asset or currency pair making a strong move and jump in late, hoping to make a quick profit. In both cases, emotional decisions can increase the risk of losses, especially when trades lack proper analysis.

Overlooking fundamental news

Ignoring fundamental news is rarely a good idea. A chart might signal a breakout, but unfavourable news can quickly reverse the market and send price the other way.

How to start GBP/USD trading

It takes only a few minutes to start trading and open a first GBP/USD position. How to do it?

- Sign up for your personal PrimeXBT account.

- Set up your trading account and verify.

- Deposit funds.

- Select GBP/USD from the currency pairs and wait for the right entry point to place an order!

Final thoughts

Trading can be exciting and rewarding, especially as you begin to explore new opportunities. While learning to read charts and follow global events can be helpful, particularly when trading currency pairs like GBP/USD, getting started doesn’t require expert knowledge. With the right tools and guidance, anyone can begin their trading journey with confidence.

The best traders aren’t just skilled with charts, they’re also disciplined, patient, and in control of their emotions.

Starting small, testing strategies, and building strong risk management habits can make all the difference. The more you practise, the more prepared you’ll be to navigate markets with confidence.

Trading involves risk.

Is GBPUSD good to trade?

GBP/USD is considered a good pair to trade thanks to its trading volume, tight spreads, and strong liquidity. It’s popular among both day traders and financial institutions.

How to trade GBP USD successfully?

Successful trading, no matter what asset or currency pair is picked, requires a mix of fundamental analysis and strong risk management. A lot of factors affect price movements, from economic indicators like inflation data, all the way to any type of political events.

On top of that, traders should focus on finding good entry points and setting appropriate stop losses.

What is the best time to trade GBPUSD?

Many traders consider the overlap of the London and New York sessions to be an ideal time to trade GBP/USD. During these hours, trading volume tends to be higher and spreads are often tighter, which can create more favourable conditions for active trading.

What makes GBPUSD move?

GBP/USD, like every currency pair, is closely tied to the countries it represents. Price movements are mainly driven by interest rates, economic data, geopolitical events, and central bank policies.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.