The general sentiment around the cryptocurrency market seems to be heading into negative territory this week. The price of Bitcoin, as well as other major altcoins is still down, and any attempts to rally have been quickly shut down.

There was some good news in the crypto space as China lowered the deposit reserve ratio of financial institutions by 0.5% and released 1.2 trillion yuan in long-term funds. This only bolstered the price of crypto for a short while before the price collapsed again.

In fact, interest in Bitcoin futures has also slumped to 50 percent of what it was a few weeks back. However, there is also evidence to suggest this fall in price has led to some major accumulation of coins elsewhere.

Meanwhile, stocks closed last week at record highs again despite Friday’s release of a fiery inflation number. According to the US Labour Department, inflation surged 6.8% in November, its fastest increase since 1982. While coming in red-hot, the inflation situation had been well anticipated by the stock market and hence posed no threat to the markets that wanted to climb higher.

For the week, the Dow rose 4%, snapping a 4-week losing streak, putting in its best weekly performance since March. The S&P and Nasdaq added 3.8% and 3.6% respectively, the best since February for both indexes. The buoyancy of the stock market could be related to China, which added liquidity to its market.

The People’s Bank of China announced last Monday that it will lower the deposit reserve ratio of financial institutions by 0.5% and release 1.2 trillion yuan in long-term funds. This easing was a pre-emptive move by the China government to prevent a seizure in its financial markets when Evergrande, the second largest property development in China, officially entered default status mid-week. The move seems to have worked as nothing bad happened in not just the China financial market, but also globally.

Gold and Silver had a quiet week, not moving much from the week before, while Oil had its biggest weekly rise since August, gaining 8% back above $70 again due to easing concerns from the Omicron COVID variant.

Oil was sold off heavily the week before at the announcement of the new easily transmissible COVID variant, but traders shrugged off their fears after it was revealed that the Omicron, while very transmissible, did not seem to cause serious conditions for those that had been infected with it. Oil is opening the new week higher by more than 1% above $72, while Gold and Silver are also a tad higher.

With the FED slated to meet mid this week for its final round of meeting this year, and having previously telegraphed the extent of its taper, the USD weakened slightly on profit-taking heading into the event but is still trading at around 96 as the Asian markets opened today.

While being of great help to global stocks, China’s easing news only managed to lift crypto higher for a few hours last Monday, with most coins quickly giving back any gains to continue languishing lower. While BTC tried to climb higher, short-term traders and retail investors were seen to be selling into the strength, curbing BTC’s rise.

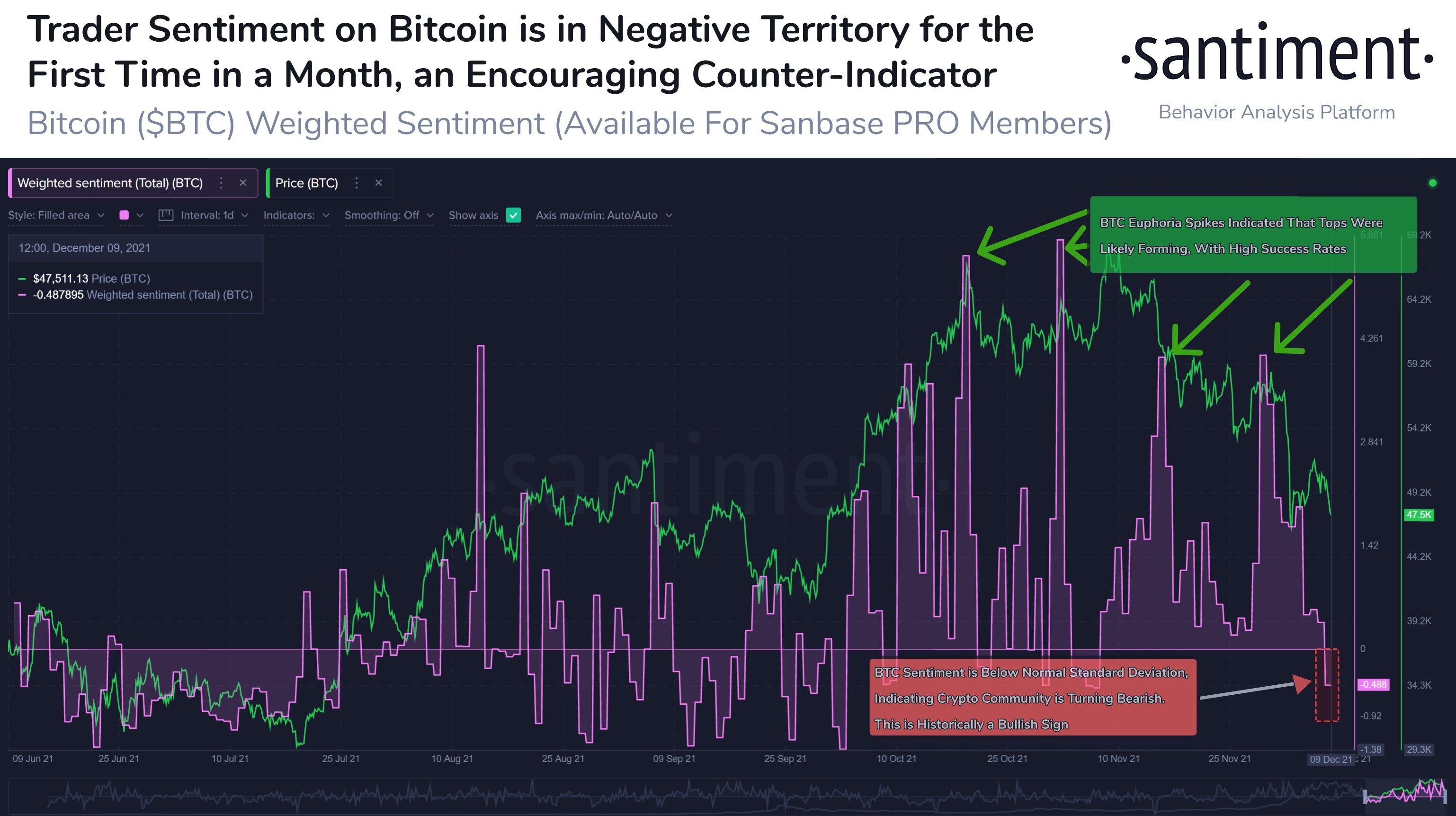

Altcoins have thus slipped back into the lows seen last weekend, with many already trading at an even lower level. Sentiment on BTC and crypto in general has fallen into the negative territory as traders headed into the weekend.

Despite the seemingly weak market, not all is lost as the network health of the BTC network has made a new ATH. And as BTC continues to see dip buying from long-term holders, experts think the bull market may still have further room to go, contrary to retail traders’ bleak outlook – usually is a counter indicator.

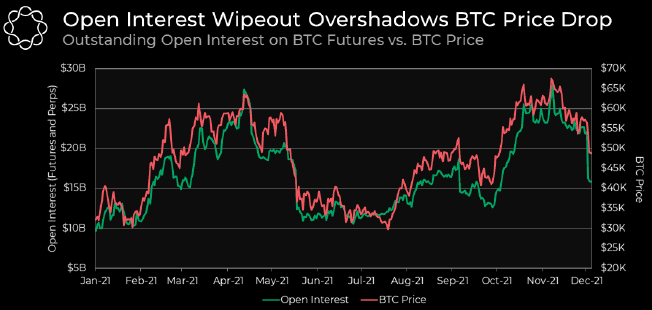

Open Interest in BTC Futures Drop More Than 50%

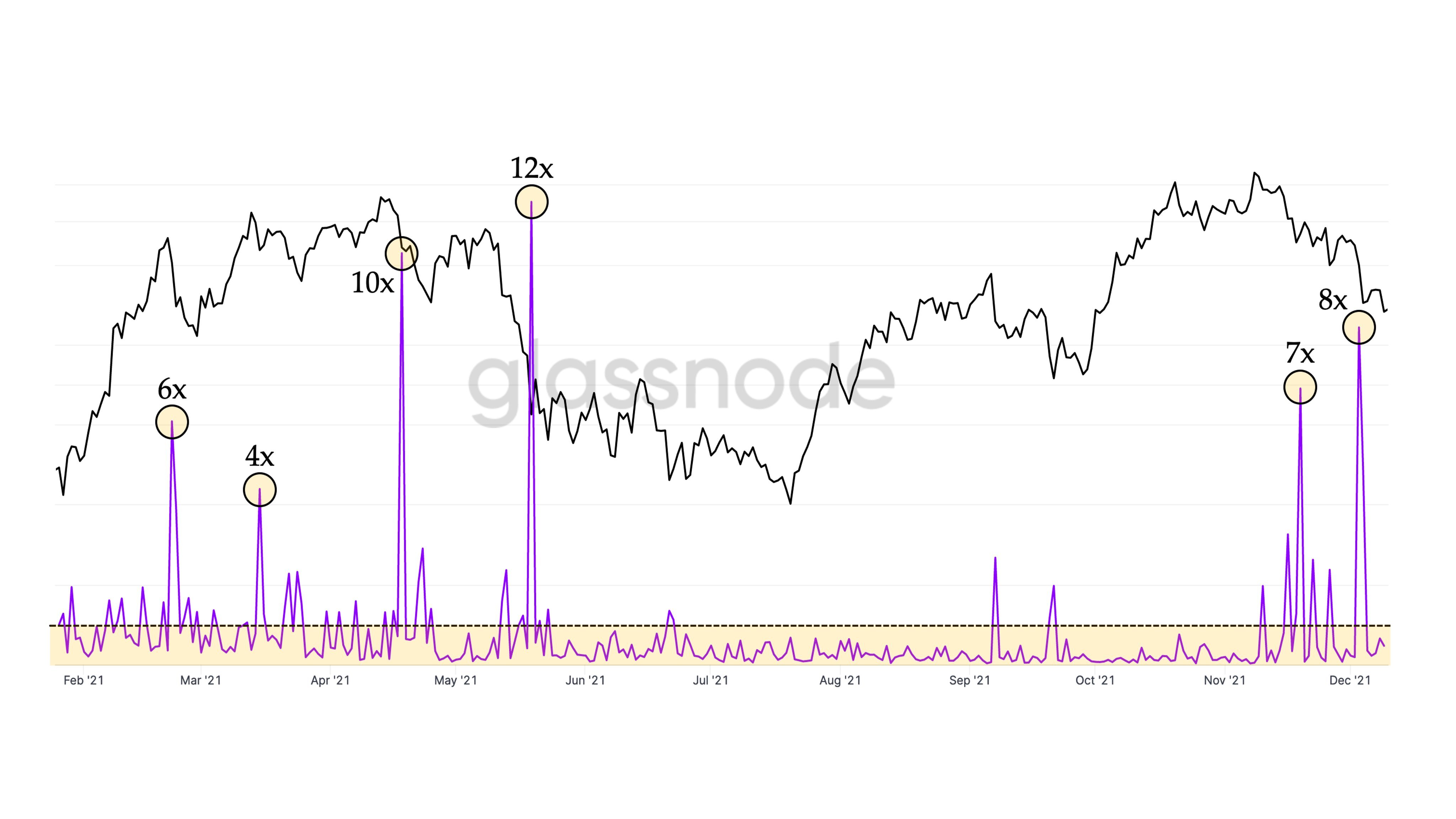

Last week’s price tumble gave BTC its third largest liquidation event this year, with the number of liquidations at 8x average. The highest this year was in May when BTC dipped 50%, with liquidations at 12x average.

Post such a significant liquidation event, the Open Interest (OI) for BTC on derivative exchanges has seen a significant drop, as much as 50%, according to data. This means that over-leveraged players have been getting wiped out as price continues to weaken.

BTC Dip Buyers Mopping Up BTC Supply

Last week, while the price action of BTC seemed lackluster, behind the scenes saw many long-term holders (LTHs) accumulating.

The illiquid supply of BTC which has been locked away is rising as the price of BTC comes crumbling. This disparity in direction clearly shows that LTHs who do not have a track record of selling have been taking the dip to accumulate more BTC.

From the above chart, one can also clearly see the difference between this price dip and the May correction when Illiquid supply dropped in lock-step with the price. With the May dip, illiquid supply dipped together with price, meaning LTHs sold BTC. With the current dip however, illiquid supply increased instead of dropping, a sign that LTHs are buying.

One such buyer was MicroStrategy who said it had purchased an additional 1,434 BTC for $82.4 million in cash at an average price of $57,477 per coin last week. Post this acquisition, MicroStrategy holds 122,478 BTC at an average price of $29,861 per coin. Since June of this year, the price of BTC rebounded in the following one to two weeks every time MicroStrategy announced that it had purchased more BTC. Will this time be the same?

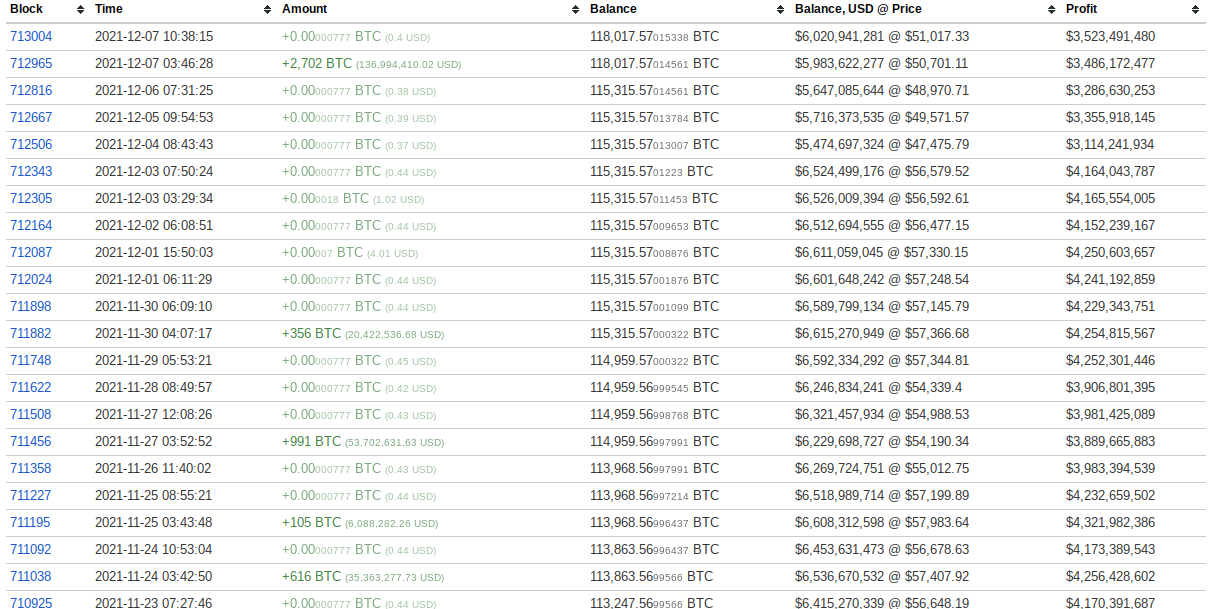

Another interesting LTH buying is the third largest BTC wallet. After buying frequently since BTC hit $69,000 all-time highs last month, this wallet holder upped the ante early last week with a single purchase of 2,702 BTC — taking its total holdings to 118,017 BTC. This is the largest number of BTC this wallet has ever held.

However, his cost is still low, having acquired all the BTC in his stash at an average cost of $21,160 per coin. Despite this fact, the new addition of 2,702 BTC costing around $137 million is one of his largest single day additions to date, a sign that this whale is bullish.

Source: BitInfoCharts

Not only are LTHs buying in the spot market, the futures market is also seeing good interests. Purpose BTC ETF, the first BTC ETF to go live in Canada, saw the biggest inflow of funds to its ETF early last week after the crash, in another sign that investors are taking the chance to accumulate BTC.

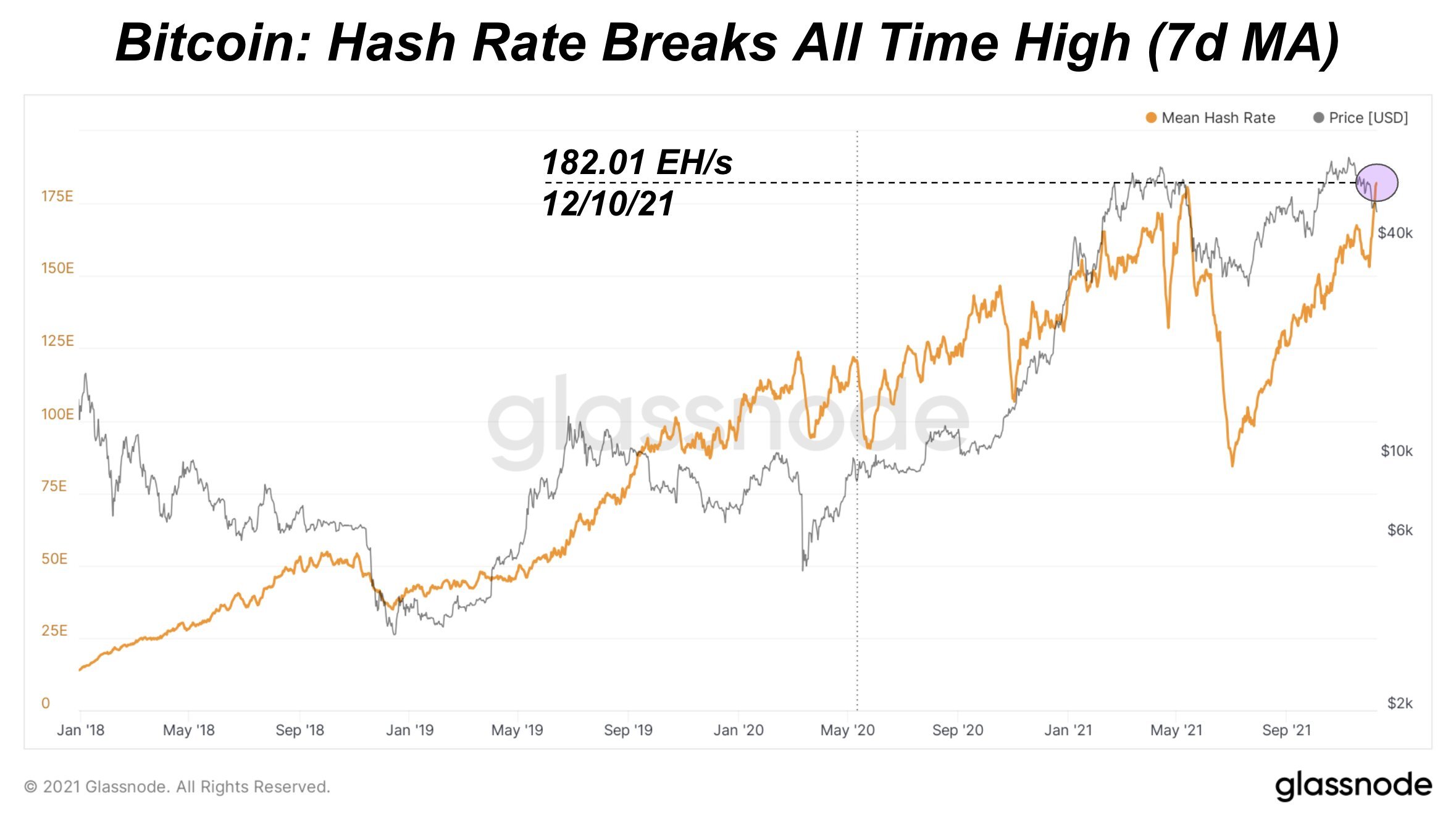

BTC Network Healthier Than Before

As for network health, BTC hash rate has not only fully recovered from its 50% fall in May when China banned BTC mining, it has just made a new ATH of 182 EH/s. This means that the network has not only brushed off the ill effects of the China ban; it has gone on stronger. This means that BTC would no longer be adversely affected by the whim and fancies of China policies, which certainly is good news. As price always follows hashrate, will the sharp recovery of hashrate in the past week be a sign that BTC price could post a sharp rally soon?

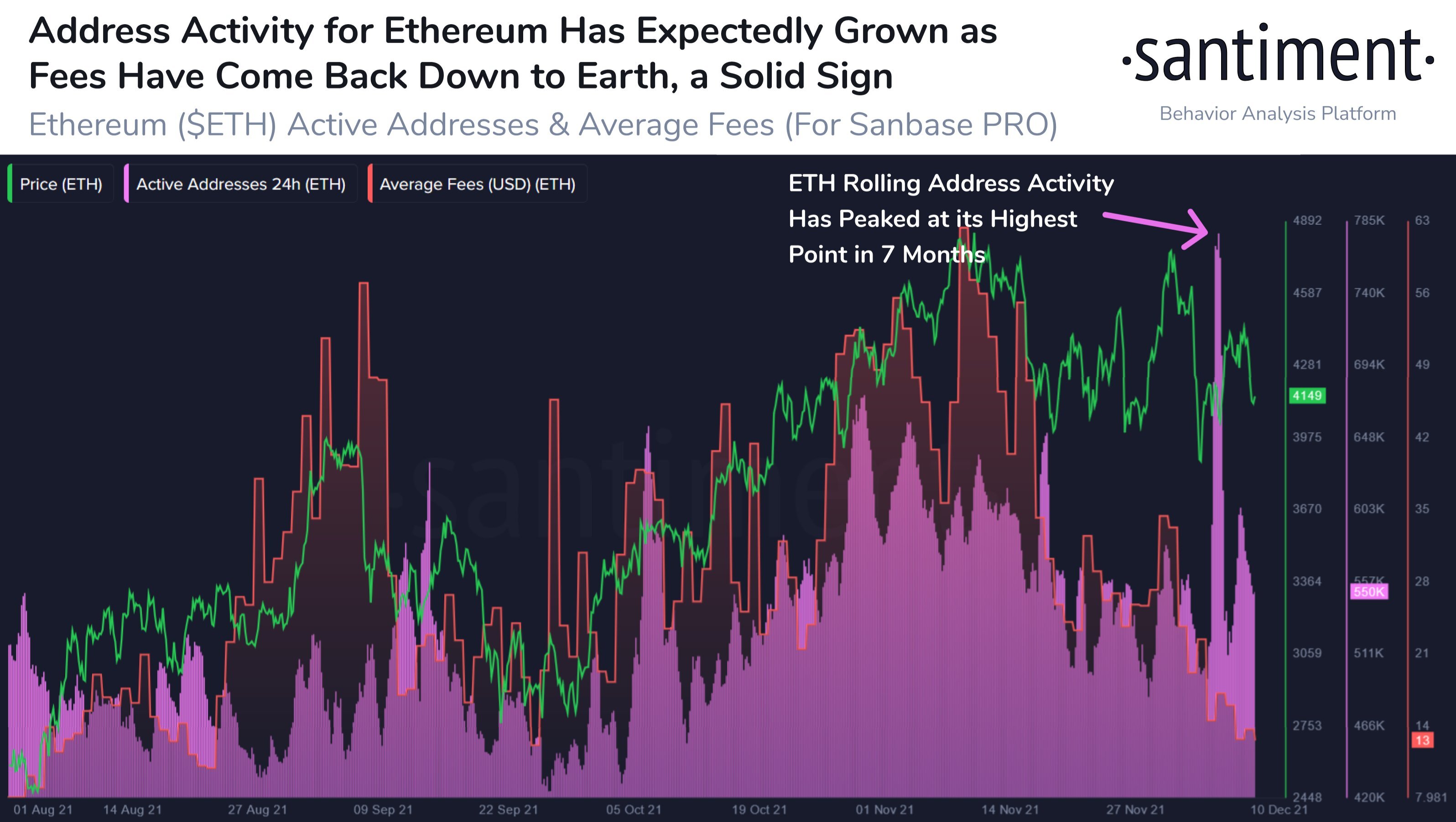

ETH Network Activity Rises As Fees Drop

With prices correcting, the median gas fee for using the ETH network has fallen quite significantly since mid-November when ETH was trading near its ATH. This fall in fee has caused activity on ETH to spike higher. The network activity on the ETH blockchain is now at the highest in 7 months, a sign that users are back interacting with the blockchain, usually a precursor for higher prices ahead.

While network activity looks good for now, some news out of South Korea in the weekend could put in a bit of a damper for ETH. On Saturday, the South Korean government announced that withdrawals from South Korean exchanges to non-KYC wallets such as Metamask, where most ETH transactions are done, will be prohibited.

This move could negatively affect the usage and development of DeFi, NFT, and DAO, which would then affect the usage of ETH, SOL and other smart contract blockchains. Whether this move could be replicated by other countries will be important to keep an eye on.

Other than this news, the upcoming most important event this week should be the FED meeting. While the FED has already informed the markets about how much taper it is going to do at this meeting, most eyes and ears will be on the narrative surrounding the early ending of the bond buying program that Fed Chair Powell said would be discussed during this meeting.