The NASDAQ, a frequently repeated name when it comes to investing, is something that is often misunderstood. Much like the S&P 500, the NASDAQ is not an actual thing a person can invest in, it is a composite index offering the chance to invest in a collection of other assets on the financial markets.

The S&P 500, and the NASDAQ for that matter, are often associated with the general health of the economy in the USA, and even the global economy at a larger scale. This is an easy way to understand the NASDAQ, but it is a little more complicated in comparison with the S&P 500, which includes some of the top 500 companies.

What is the NASDAQ exactly?

The NASDAQ is multi-faceted and there are two different things that the term can refer to. First, it is the National Association of Securities Dealers Automated Quotations (NASDAQ) exchange, the first electronic exchange that allowed investors to buy and sell Stock on a computerised, speedy, and transparent system, without the need for a physical trading floor.

Then there’s the Index. This is what people are looking at when they are deciding to invest. This is the Index that can either go up — or down. But, when you are investing in the NASDAQ Index, you are essentially investing in the companies that trade on the exchange. Most of these companies are technology and internet-related, but there are financial, consumer, biotech, and industrial companies as well. The NASDAQ Composite tracks more than 3,300 Stocks.

In comparison to something like the S&P 500, which does not consider different sectors and rather focuses on the size and worth of a company, the NASDAQ is tied to what trades on the exchange. Because of its digital bias, it is often a palace for traders interested in technology to track and trace, as well as invest.

NASDAQ Overview

| Current price for today 28 February 2026 | $18639.4 |

| Price Change 24h | -0.1% |

| Price Change 7d | 2% |

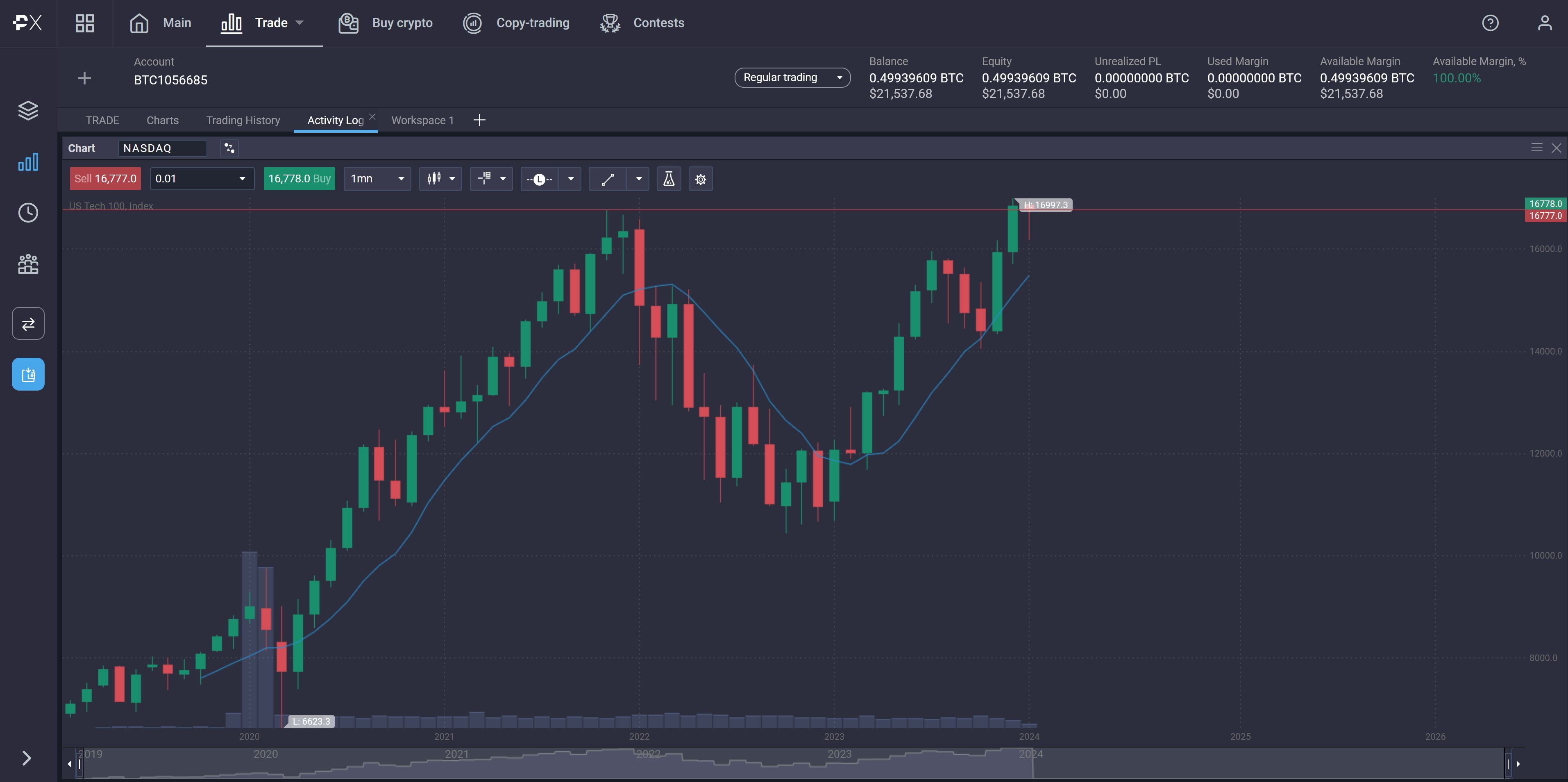

The NASDAQ is not immune to a market crash, as was evident by the impact of the Black Thursday panic collapse of 2020. Its recovery to substantial new highs afterwards, however, does indicate how healthy the Stock market Indices’ future is.

Having a look at the NASDAQ 100, the Index that tracks the 100 biggest non-financial companies listed on the Nasdaq stock market, it includes Stocks like Microsoft, Alphabet, Facebook, and Intel. This Index often outperforms other popular ones.

Part of the reason for this is because the performance of the NASDAQ 100 Index depends mostly on the performance of the companies it is made up of. And, the movements of some companies tend to have more impact on it than others. For example, companies like Microsoft, Apple, and Amazon have a weighting of over 10 percent each, while 70 other companies have a weighting of less than 1 percent.

Top factors that will impact NASDAQ in 2024 & in the future

Any NASDAQ price forecast for 2024 needs to look at the past performance of the Index, and what typically drives the market. With that in mind, a couple of things need to be known. Any time you put money into the Stock market, you need to be aware of the historical drivers and how these complex instruments work.

Because the NASDAQ is an Index, and carves out a slice of the market and how a range of companies are doing in the economy, it is unsurprising that the movement of the NASDAQ is quite well aligned with how the economy is doing, and the general health of the markets.

Therefore, major geopolitical events can have a massive impact on the NASDAQ, just as it does in the S&P 500 and others. When there are positive moves, especially for the US, and major companies can cash in on that good news, the Index will usually rise. But when there are negative impacts, the same can happen in a downward trend.

One of the biggest influences on the NASDAQ will be the Federal Reserve, and its monetary policy. The central bank of the United States is highly active at times, and has been especially so over the last 14 years. Until 2022, the Federal Reserve had been extraordinarily loose with monetary policy, keeping interest rates low.

As the NASDAQ Stock market is a group of technology companies, loose monetary policy from central planners tends to be bullish for any NASDAQ forecast. This is because loose monetary policy makes it easy for venture capitalists to put money into up-and-coming companies, and of course growth companies that make up a huge portion of the Index.

But in 2023, due to rising inflation, the FED committed a series of 11 rate hikes. With a very tight monetary policy, the Federal Reserve had people running away from risk. Since then, of course, the downward trend has been firmly ensconced as the global economy looks to be in serious trouble.

There was a bit of hesitation to jump back into the Stock market over the last several months of ’23. More geopolitical volatility was seen, and therefore, made it difficult for traders to make decisions with any type of clarity, as fear has taken hold. The Stock market continues to be very volatile, but over the longer term it does tend to rise and, therefore, it’s likely that you will see buyers return eventually.

The temptation to invest money is there though, as many technology stocks saw significant growth. One of the most successful companies of 2023 was NVIDIA, which saw an unprecedented 197% gain. Although many Wall Street analysts were bullish on NVIDIA and other chip makers, I doubt they projected an almost two hundred per cent increase, even though past performance of chip makers has been impressive.

The Federal Reserve has already stated that it does not care so much about the Stock market, but worries more about the real economy, which obviously is completely detached from the NASDAQ Stock market.

Additionally, the maturation of technology companies is certainly helping, as the rise of Apple Inc, a company that wasn’t among the 20 largest companies by market value in the Index 15 years ago, now represents more than 10 percent of its weight. Many of the world’s biggest tech companies are found in the NASDAQ and they are wrestling the momentum from other major companies in terms of performance.

NASDAQ historical overview

The NASDAQ has had a great history, as it is an Index based on technological breakthroughs, after it was the first to offer electronic trading, but this happened as far back as 1971.

When the NASDAQ began it had a brief climb to begin with, hitting 816 points before crashing down to less than 300 points in 1974. But, literally since that low, the NASDAQ trended upwards all the way to the year 2000. That trend got very strong during the dot com times, but also suffered from the dot com bust.

At its 2000 peak it reached over 7,000 points, but fell to 1,660 two years later before recovering and falling again to a similar level in 2009.

Today, the NASDAQ lists more than 3,200 companies and boasts the highest trade volume in the U.S. market. More than $10 trillion worth of companies trade on the NASDAQ. The NASDAQ 100 set a new all-time high in 2021 over 15,600.

NASDAQ forecast for 2023-2024

During 2023, there were a lot of headwinds for the NASDAQ, but quite frankly the only thing that’s been a common feature has been volatility. While the global economy has been stumbling, central banks have been raising interest rates quite steadily. The NASDAQ composite Index took a hit as a result.

That being said, traders are already expecting the Federal Reserve to turn around its monetary policy, and interest rate cuts may be coming later in the year. If that were to be the case, the Stock market typically would try to price that in ahead of time. Because of this, the market could very well see strength toward the end of the year.

In 2024, it’s very likely that the NASDAQ 100, the Index that follows the 100 biggest companies in the NASDAQ, will be above recent or even all-time highs, right along with the overall Index itself. Longer term, it does have a proclivity to rally, especially if the Federal Reserve does loosen monetary policy, as traders will look toward high-flying Stocks to earn returns.

NASDAQ forecast for 2025 and beyond

Any NASDAQ future price prediction for 2025 will be a bit of a guess, due to the fact that there are so many uncertain possibilities out there. This includes changes in major markets and multiple hot conflicts around the world, that are disrupting everything from supply chains to raw material acquisition. Needless to say, future results could very well mirror what has happened in the past, but that can’t be thought of as investment advice. The overall attitude of the market is one that goes higher in the long term, so by the time we get to 2025, hopefully a lot of the systemic and global concerns will be in the rearview mirror.

This does not necessarily mean that it won’t be a rocky road to the upside. But, by the time 2025 rolls around, the market may have broken the recent all-time high, sending it closer to the 20,000 level. Obviously, unforeseen circumstances can pop up, like a global pandemic, wars, the financial collapse of banks, or a whole litany of other things that could cause issues. That being said, the proclivity of the market is to go higher. When it comes to a NASDAQ price prediction for 2030, unfortunately, there aren’t many analysts out there that are willing to make that announcement yet. But some do expect a move all the way to the 25,000 region.

Future NASDAQ predictions

As explained previously, the predictions on the NASDAQ into the future are correlated somewhat to the economy and the general market. But where the NASDAQ differs is with its more digital approach and digital makeup. Any investing strategy for the NASDAQ (and tech Stocks in general) needs to consider industry news, as the largest non-financial companies make multiple announcements a year and are constantly in an arms race with their competitors

The NASDAQ is based in technology and, because of the impending fourth industrial revolution, which will be predicated on technology, this Index is an important one. Future predictions on this market will be determined by how well the technology wave comes in.

What is interesting to note is that, while the pandemic played its part in stunting the market, it may also result in the need for better technology. This could impact the growth of the NASDAQ in the future.

NASDAQ predictions for the next 5 years (until 2028)

Many analysts believe that the NASDAQ should continue to grow over the next 5 years. But that does not mean that we don’t see a deeper correction along the way. The sell-off during 2022 and 2023 has been a bit of destruction, but when you look at the longer-term chart, we have been in an uptrend for decades.

Regardless, the market has matured to the point where the only thing that truly matters is going to be liquidity. So, watching the Federal Reserve and its monetary policy will be crucial. The more loose they are with monetary policy, the better the NASDAQ will do. Looking at the charts, even though there has been a significant pullback, through the lens of the longer-term trend, it’s nothing more than a typical bear market pullback.

NASDAQ 10-year forecast (until 2032)

Predicting long term – like over the next 10 years – is difficult and highly speculative. However, many analysts have offered their take, giving you the chance to check out independent advice.

Expert price predictions

Wallet Investor

Wallet Investor believes that the NASDAQ will reach over 25,000 by the year 2032, which does sound reasonable considering just how explosive the market has been over the last several years. That being said, a significant correction would be expected along the way, as we approach that level.

Gov.Capital

Gov.Capital has a longer-term forecast for the NASDAQ, reaching the 28,000 level by 2032. But just as Wallet Investor believes, they think there will be a significant pullback or two along the way.

What is the future of the NASDAQ?

The NASDAQ Index is one of firsts. It was the first digital market place and it has become one of the leading Indexes for the future of trading. This means it has ties to technological advances and will be a major market mover as technology grows.

| Year | Predicted points |

| 2023 | 14000 |

| 2024 | 15000 |

| 2025 | 15500 |

| 2026 | 17500 |

| 2027 | 18000 |

| 2028 | 19500 |

| 2029 | 20000 |

| 2030 | 22100 |

| 2031 | 24500 |

| 2032 | 28000 |

In order to take advantage of expected market movements, it is a good time to find a platform that offers you the chance to trade the NASDAQ Index — like PrimeXBT! You can sign up here.

Conclusion

Indices like the NASDAQ and the Dow Jones, and their component companies, usually have a positive correlation with economic health. Meaning when the economy does well, so does the Stock market. It is always important to do your own research and expand it beyond strict technical analysis and historical data.

Although the risk tolerance for Stocks is lower than Cryptos, consumer staples (like Wheat and Corn), currencies, and Indices are lower yet. However, they are not immune to macroeconomic and other factors that affect markets at large.

Although NVIDIA saw historical growth, unfortunately, past financial performance is not an indication of future returns. And in an Index like the NASDAQ, although it contributed to the Index’s growth of 43%, it is not even close to the close to two hundred percent the NVIDIA stock grew.

Many professional and institutional traders will diversify across multiple markets to avoid the risk exposure to one. This becomes even more important when trading volatile technology Stocks and Indices.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.