Thinking about diving into stock trading? You’re in the right place! Whether you’re looking to build long-term wealth or take advantage of short-term market movements, this guide will break down everything you need to know—without the confusing jargon. Plus, we’ll show you how PrimeXBT can be your go-to platform for smarter trading.

Understanding Stock Trading Fundamentals

What Is Stock Trading?

At its core, stock trading is about buying and selling shares of publicly traded companies. When you buy a stock, you own a small piece of that company. The goal? Buy low, sell high, and make a profit.

Example:

Example: Stock Price Fluctuations

Imagine you buy a stock at $50. The next day, it drops to $48. A few days later, it rebounds to $52, then peaks at $60 before settling at $58. This is the kind of movement traders analyze to make informed buying and selling decisions.

Trading happens on stock exchanges like the New York Stock Exchange (NYSE) and NASDAQ, where buyers and sellers are matched in real-time.

Meet the Different Types of Stock Traders

Different trading styles suit different personalities and goals. Here’s a quick breakdown:

| Trader Type | How They Trade | Example |

|---|---|---|

| Day Trader | Buys and sells within the same day, capitalizing on small price movements. | A trader buys and sells a tech stock in a few hours to profit from intraday volatility. |

| Swing Trader | Holds stocks for days or weeks, focusing on short- to mid-term trends. | A trader holds retail stocks for two weeks during a seasonal sales spike. |

| Position Trader | Invests long-term, betting on fundamental growth. | Buying shares of Apple and holding them for years for dividend income. |

| Algorithmic Trader | Uses automated systems to execute trades at high speeds. | A trading bot buys and sells stocks in milliseconds based on predefined patterns. |

Essential Stock Trading Terminology

To trade effectively, you need to speak the language of the markets. Here are some essential terms:

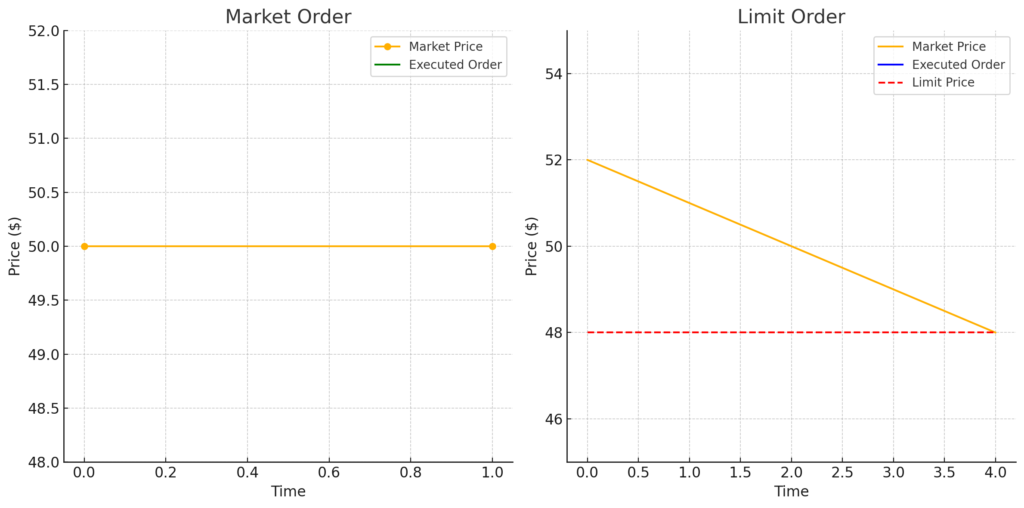

- Market Order – Buying or selling a stock immediately at the best available price.

- Limit Order – Setting a specific price at which you want to buy or sell a stock.

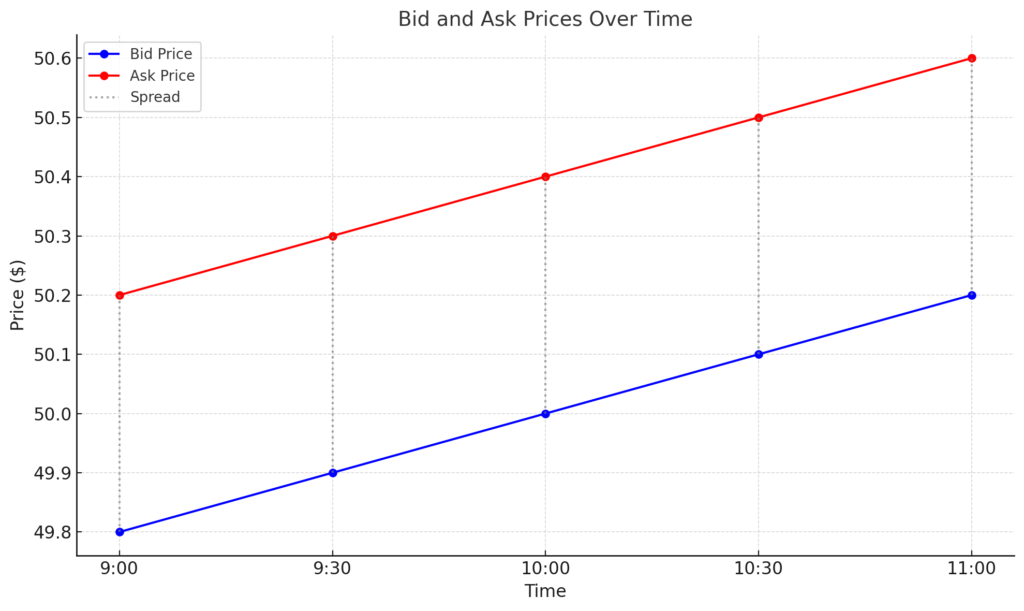

- Bid & Ask – The bid is what buyers are willing to pay, and the ask is what sellers are asking.

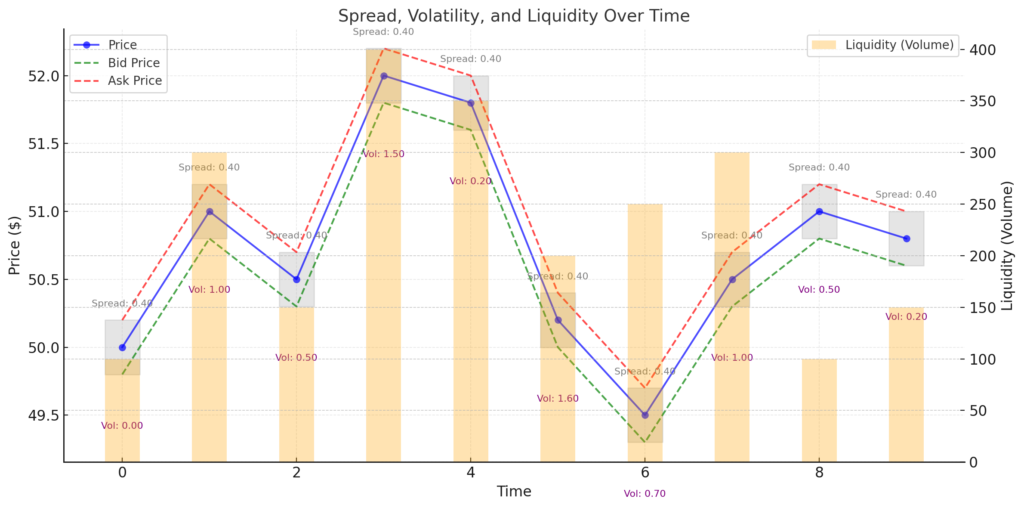

- Spread – The difference between the bid and ask prices.

- Volatility – How much a stock price fluctuates (higher volatility = higher risk and opportunity).

- Liquidity – How easily you can buy or sell a stock without affecting its price.

Stock Types and Trading Options

Common Stock Categories

- Common Stocks:

Offer ownership and voting rights.

Example: Owning shares of a multinational corporation like Apple means you’re a part owner with the ability to vote at annual meetings. - Preferred Stocks:

Provide fixed dividends and have priority over common stocks, though they often lack voting rights. - Blue-Chip Stocks:

Represent well-established, financially stable companies known for consistent performance. - Growth Stocks:

Companies expected to grow faster than the market average. - Value Stocks:

Considered undervalued compared to their fundamentals. - Income Stocks:

Regularly pay dividends, ideal for investors seeking steady income.

Traditional vs. CFD Trading: What’s the Difference?

| Feature | Traditional Stock Trading | CFD Trading |

| Ownership | You own actual shares | You don’t own the stock, just speculate on price movements |

| Leverage | No leverage | High leverage available (amplifies gains & losses) |

| Costs | Transaction fees | Lower fees but potential spread costs |

| Risk | Limited to investment amount | Higher risk due to leverage |

Example:

- Traditional Trade: Buy 100 shares at $100 = $10,000 investment. If the price rises to $120, you make $2,000.

- CFD Trade: With 10:1 leverage, you only need $1,000 to control the same $10,000 position. If the price rises to $120, you still make $2,000—but losses are amplified if the trade goes the other way.

Proven Stock Trading Strategies

Want to trade like a pro? These strategies can help:

- Technical Analysis: Analyzing price charts and indicators to predict movements.

- Fundamental Analysis: Studying a company’s financial health to determine its true value.

- Momentum Trading: Jumping on fast-moving stocks with strong trends.

- News Trading: Reacting quickly to breaking news or earnings reports.

- Swing Trading: Using both technical and fundamental analysis to trade short-term trends.

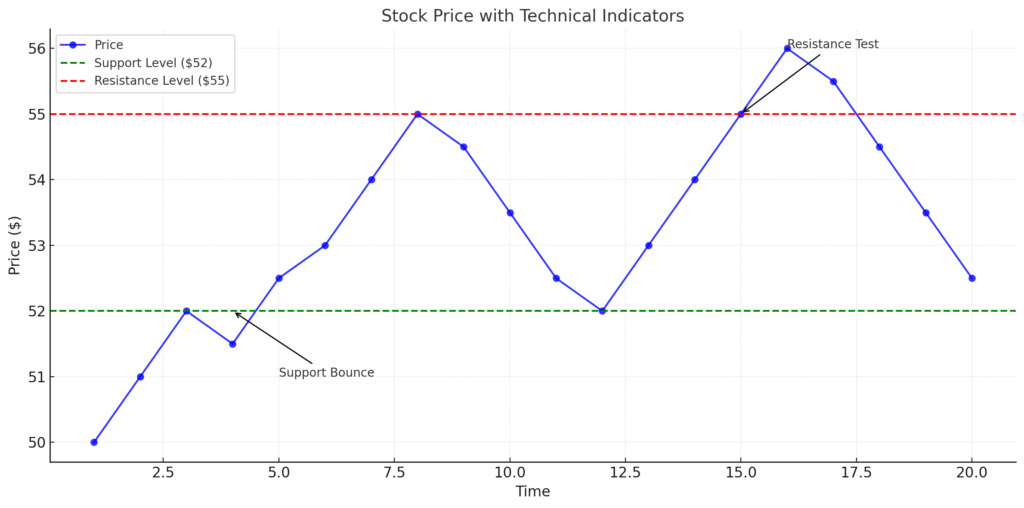

This annotated chart illustrates key technical analysis indicators using a hypothetical stock price over time:

- Support Level ($52): Highlighted with a green dashed line, indicating the price level where the stock tends to bounce back upwards.

- Resistance Level ($55): Highlighted with a red dashed line, showing the price level where the stock struggles to rise further.

- Annotations:

- Support Bounce: The price tests the support level and bounces back upward.

- Resistance Test: The price reaches the resistance level, testing it before reversing.

Getting Started in Stock Trading: A Step-by-Step Guide

1. Develop Your Strategy

Set clear goals, assess your risk tolerance, and choose a trading style that suits you. Research different strategies and start small with paper trading to test your plan.

2. Open a Trading Account with PrimeXBT

Select a reputable broker like PrimeXBT, which offers:

- Robust Trading Tools: Access cutting-edge charting, technical analysis, and multi-asset trading from one platform.

- Educational Resources: Comprehensive guides, tutorials, and customer support to help you grow.

- Flexible Funding Options: Fund your account with fiat or cryptocurrencies, providing more freedom and speed in trading.

3. Set Your Budget and Manage Risk

Determine how much capital you’re willing to invest and never risk more than you can afford to lose. Utilize risk management techniques such as:

- Stop-Loss Orders: Automatically exit a trade if the price moves against you.

- Diversification: Spread your investments across different stocks or asset classes.

4. Execute Your First Trade

Begin with small positions in well-known companies. Monitor your trade, adjust your strategy as you learn, and always review your performance.

5. Continuous Learning and Adaptation

Keep educating yourself by staying updated with market trends, economic indicators, and new trading strategies. Use tools like stock screeners and maintain a trading journal to track your progress.

Why Traders Choose PrimeXBT: Key Features & Benefits

PrimeXBT stands out for its innovative trading platform that combines simplicity with advanced features tailored for both beginners and experienced traders. Here’s what makes PrimeXBT unique:

- Multi-Asset Trading:

Trade stocks, CFDs, cryptocurrencies, and more—all from a single, intuitive interface. - Advanced Trading Tools:

Enjoy professional-grade charting, risk management features, and real-time market data. - Flexible Funding Options:

Deposit with fiat currencies or cryptocurrencies like Bitcoin, giving you faster access to global markets. - Competitive Fees and High Liquidity:

Benefit from lower fees and robust liquidity, ensuring smoother execution of your trades. - Educational Support:

Access detailed guides, tutorials, and customer support designed to help you learn and succeed in your trading journey.

Stock Trading Tips

- Use Stock Screeners:

Filter stocks by key metrics such as volume, volatility, and price trends to quickly identify opportunities. - Practice with Paper Trading:

Test your strategies without risking real money to build confidence before trading live. - Implement a Trading Journal:

Document your trades, decisions, and outcomes to refine your strategy over time. - Stay Informed:

Regularly read financial news and analysis to stay ahead of market trends.

Stock Trading Conclusion

Stock trading offers exciting opportunities for financial growth, but success requires dedication, continuous learning, and disciplined risk management. By mastering the basics, understanding key concepts, and developing a solid strategy, you’re positioning yourself for a more informed and potentially successful trading journey.

Ready to start your trading adventure? Open your free account with PrimeXBT and experience a platform designed with both cutting-edge features and beginner-friendly support. Dive into the world of stock trading today and harness the power of innovation to reach your financial goals.

How do beginners start trading Stocks?

Beginners can start trading stocks by opening a brokerage account, learning key stock market concepts, and starting with small, diversified investments. It’s essential to understand stock trading basics, develop a strategy, and practice risk management to avoid losses

How much money do I need to start trading stocks?

You can start trading stocks with as little as $100. Focus on low-cost investments, use fractional shares, and prioritize learning over immediate profits to grow your portfolio gradually.

What is meant by stock trading?

Stock trading involves buying and selling shares of publicly traded companies to profit from price fluctuations. Traders aim to buy low and sell high, using strategies like technical analysis or fundamental analysis to make informed decisions.

Can you make money trading stocks?

Yes, it’s possible to make money trading stocks, but success requires knowledge, discipline, and risk management. Profits come from price gains, dividends, or short-term trades. Be cautious of market risks and avoid emotional trading

How to trade stocks: the basics of stock trading for beginners?

To trade stocks, start by learning stock market fundamentals, opening a trading account, and developing a strategy. Use tools like stock screeners, track performance, and practice with paper trading before committing significant funds

How do I choose the best stocks for beginners?

Look for stocks of well-established companies with strong financial performance and lower volatility. Consider blue-chip stocks, dividend-paying stocks, or ETFs for diversification. Research thoroughly and start with a small investment

What are the risks involved in stock trading?

Stock trading risks include market volatility, economic downturns, and company-specific issues. Beginners should use stop-loss orders, diversify portfolios, and avoid overtrading to mitigate potential losses

What tools can help beginners trade stocks?

Beginners can use trading platforms, stock screeners, charting tools, and educational resources like courses and market analysis apps. Many brokers offer demo accounts to practice without risking real money

What’s the difference between stock trading and investing?

Stock trading focuses on short-term price movements to generate quick profits, while investing aims for long-term growth by holding assets for extended periods. Trading requires active monitoring, whereas investing emphasizes patience and compound growth

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.