In trading, profitability is often decided by details that look small on the surface, but compound dramatically over time. One of the most underestimated of these details is the spread.

Understanding how spreads work and why tight and stable spreads matter can be the difference between consistent growth and death by a thousand small costs.

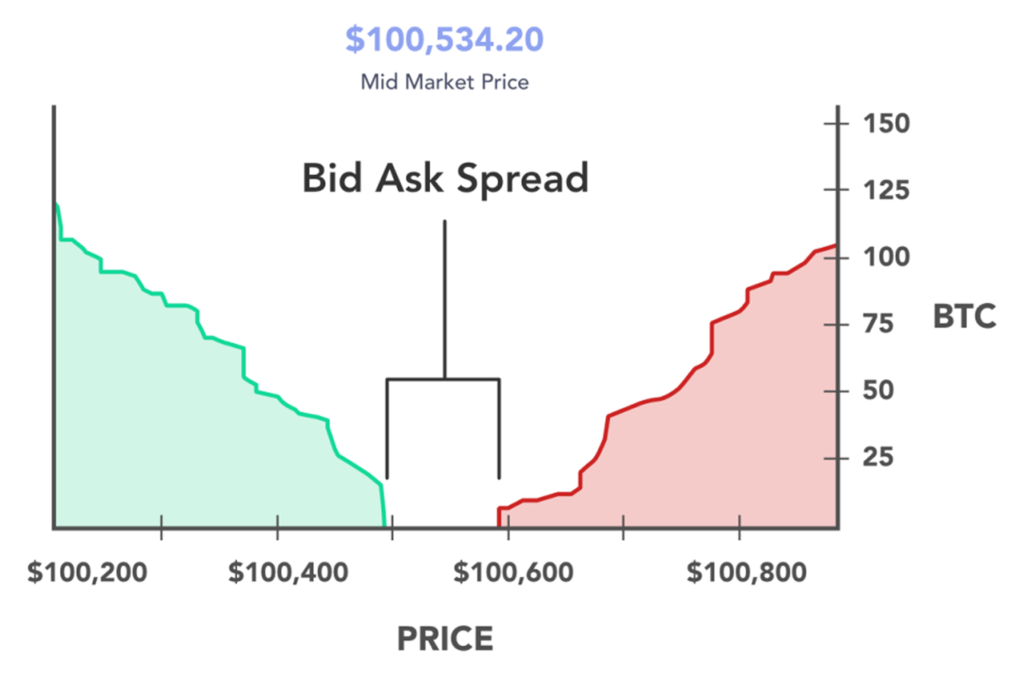

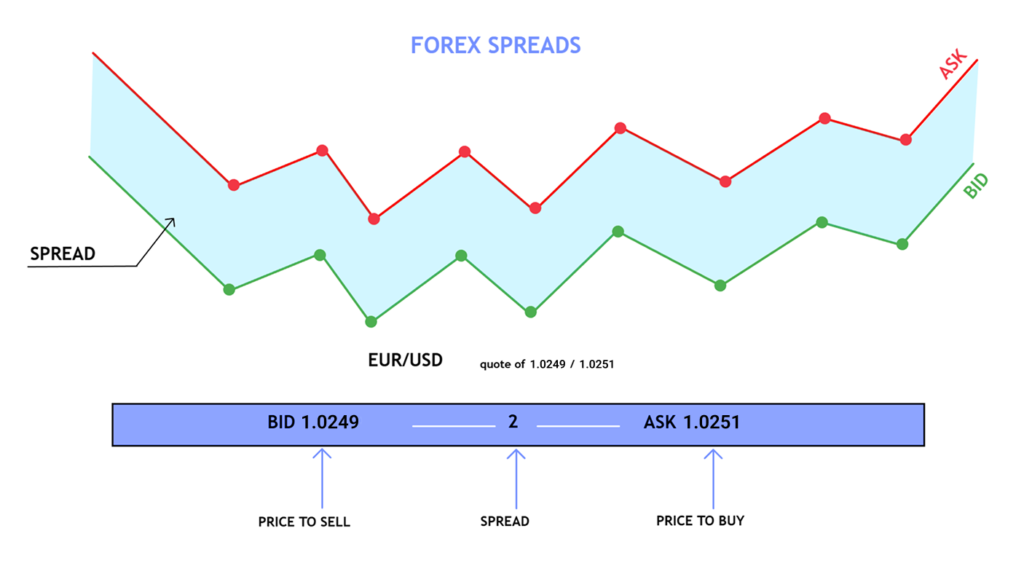

The spread is the difference between:

- the Bid price (where you sell), and

- the Ask price (where you buy).

In simple terms, it is the cost you pay to enter a trade.

If EUR/USD is quoted as:

- Bid: 1.1300

- Ask: 1.1302

The spread is 2 pips.

That means you start every trade slightly negative, and your position must move at least by the spread just to break-even.

Why spreads directly affect your profitability

Spreads may look tiny, just a few pips, but they are paid:

- on every trade,

- on every position,

- regardless of whether you win or lose.

The tighter the spread:

- the faster you reach break-even,

- the more of your move you keep as profit,

- the easier it is to trade actively (scalping, intraday, event trading).

This becomes critical once leverage is involved.

How spread impacts a real trade

Let’s take a realistic trader scenario and break it down step by step.

Assumptions:

- Deposit: $1,000

- Instrument: Gold (XAUUSD)

- Gold price: 5400.00

- Contract size: 1 lot = 100 oz

- Spread examples: $0.20 / $0.30 / $0.50

The spread cost formula is straightforward:

Spread Cost (USD) = Spread (USD) x (Position Value / Gold Price)

With the same $1,000 deposit, different leverage levels create very different exposure.

| Position size | Leverage | Margin used |

| $100,000 | 100:1 | $1,000 |

| $200,000 | 200:1 | $1,000 |

| $500,000 | 500:1 | $1,000 |

Spread impact on a $100,000 position (100:1)

Position size: 100,000 / 5,400 ≈ 18.52 oz

| Spread | Cost | Cost% of deposit |

| $0.20 | $3.70 | 0.37% |

| $0.30 | $5.56 | 0.56% |

| $0.50 | $9.26 | 0.93% |

Spread impact on a $200,000 position (200:1)

Position size: 200,000 / 5,400 ≈ 37.04 oz

| Spread | Cost | Cost% of deposit |

| $0.20 | $7.41 | 0.74% |

| $0.30 | $11.11 | 1.11% |

| $0.50 | $18.52 | 1.85% |

Spread impact on a $500,000 position (500:1)

Position size: 500,000 / 5,400 ≈ 92.59 oz

| Spread | Cost | Cost% of deposit |

| $0.20 | $18.52 | 1.85% |

| $0.30 | $27.78 | 2.78% |

| $0.50 | $46.30 | 4.63% |

As you can see from the examples and calculations above, spreads have a significant impact on your trading results, especially when using leverage.

- Wider spreads scale linearly with position size.

- At higher exposure, spreads become a meaningful percentage of a $1,000 deposit.

- With tight stop-losses, this directly increases stop-out probability.

Key insight: a $0.5 spread at 500:1 leverage costs 4.63 of a $1000 equity (margin) before the trade even moves.

Tight spreads are important, but stability is even more critical

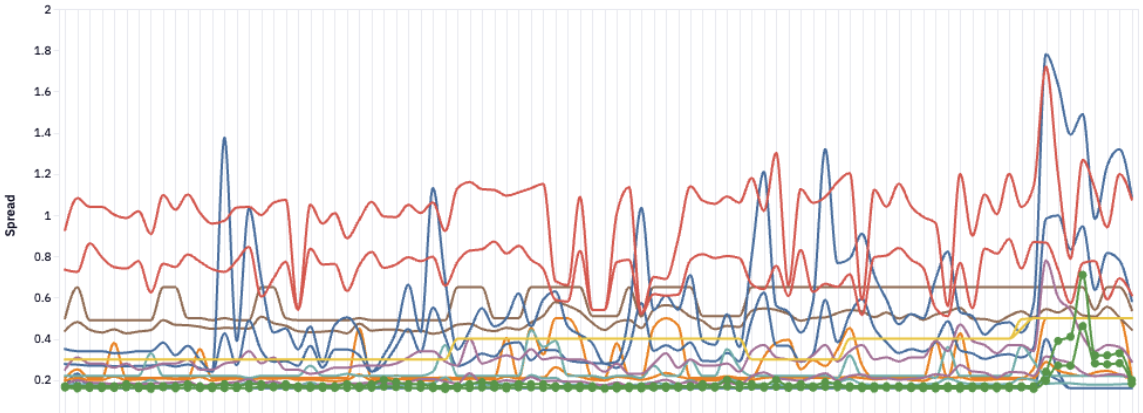

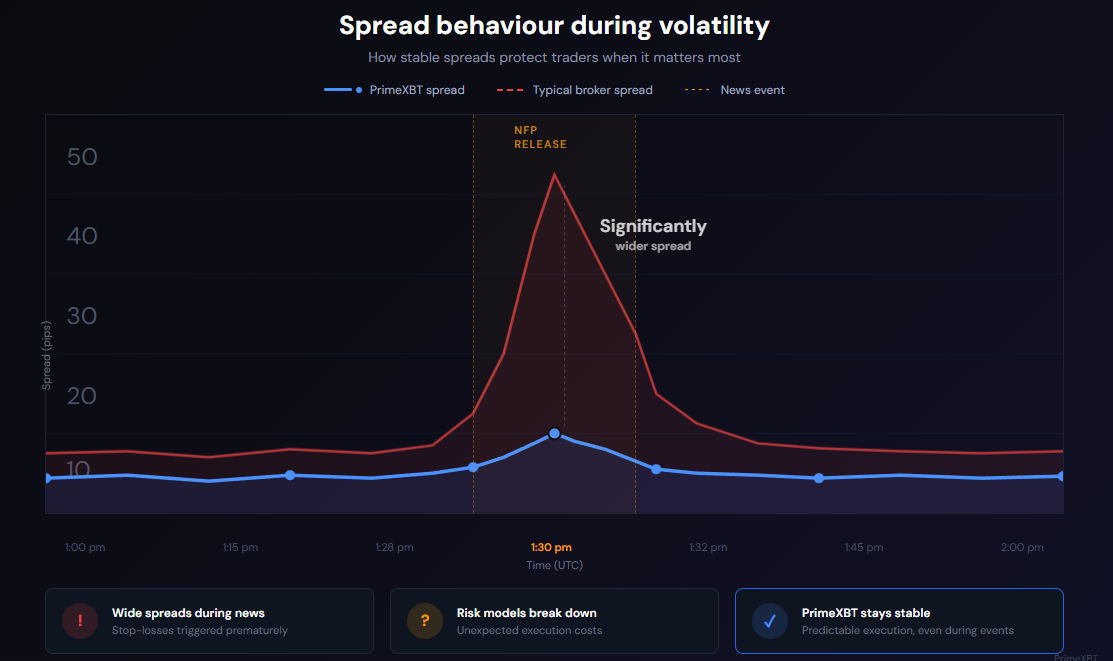

Many traders focus only on average spread size. But experienced traders know the real danger lies elsewhere.

The real risk: spread widening during volatility.

During:

- major economic releases (CPI, NFP, rate decisions),

- market shocks,

- high-volatility sessions,

Some brokers dramatically widen spreads.

What happens then?

- stop-losses get triggered earlier than expected,

- profitable positions are closed prematurely,

- risk management models break down.

This is where many traders are stopped out — not because the idea was wrong, but because execution conditions deteriorated.

The chart above shows how PrimeXBT spreads compare with those of other major brokers during a volatile trading session on Thursday, 29 January 2026. As shown, we not only offer significantly lower spreads, but also maintain greater stability during market events. The green dots represent PrimeXBT spreads, while the other lines represent competing brokers, which are not named for ethical reasons.

Why stable spreads can decide success or failure

A stable spread means:

- predictable execution,

- reliable stop-loss placement,

- consistent risk-to-reward ratios.

When spreads remain tight even during volatility, traders can:

- hold positions through normal market noise,

- execute strategies with confidence,

- avoid artificial losses caused by execution, not price.

Over time, this consistency compounds into better results.

How to compare spreads between brokers

Traders can easily compare brokers by:

- checking live spreads during different market sessions,

- observing spreads during major news events,

- comparing execution quality, not just advertised “from” values.

This is where PrimeXBT stands out.

PrimeXBT offers:

- consistently tight spreads,

- high spread stability during volatility,

- transparent conditions that can be objectively compared.

You don’t need marketing claims — just open charts side by side and watch how spreads behave when markets move.

Tight and stable spreads are part of a bigger mission

At PrimeXBT, tight and stable spreads are not a marketing feature — they are part of a broader mission:

To empower traders with conditions and tools that help them achieve better results.

Execution quality, predictable costs, and professional-grade trading conditions are foundational to long-term trading success.

Because in the end:

- strategies matter,

- discipline matters,

- psychology matters.

— but execution conditions decide whether your edge survives reality.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.