Welcome to our comprehensive guide on crypto derivatives. In this article, we will delve into the world of financial instruments that derive their value from cryptocurrencies like Bitcoin, Ethereum, and other digital assets. Crypto derivatives have gained significant attention in recent years, offering traders unique opportunities to speculate on price movements, manage risks, and gain exposure to crypto market.

In this introductory guide, we will explore the basics of crypto derivatives, their key components, and how they differ from traditional derivatives. We will highlight the role of cryptocurrencies as underlying assets in these contracts and shed light on the emerging trends that are shaping the future of crypto trading.

Starting with the Basics: What are Derivatives?

In the context of finance, derivatives are financial instruments that derive their value from an underlying asset. They are contracts between two or more parties, and their value is based on the fluctuations in the price or value of the underlying asset. Derivatives allow investors to speculate on the future price movements of the underlying asset or hedge against potential risks.

Let’s understand the key components of a derivative:

Underlying Asset: The derivative’s value is linked to the price or performance of an underlying asset, which can be a wide range of financial instruments, such as cryptocurrencies, stocks, bonds, commodities, currencies, or market indices. For example, in the case of a crypto option, the underlying asset would be the coin itself.

Contracts: Derivatives are based on contractual agreements between parties. These agreements outline the terms and conditions of the derivative, including the specific details about the underlying asset, contract size, expiration date, and settlement terms.

Obligations: Derivatives involve rights and obligations for the parties involved. Depending on the type of derivative, one party may have the right to buy or sell the underlying asset (call or put option), while the other party has the obligation to fulfill the terms of the contract if the option is exercised.

To illustrate with a traditional example, consider a crypto option: Suppose you purchase a call option on Ethereum. The underlying asset is the Ethereum itself. The option contract specifies the number of coins, the strike price at which you can buy the coins, and the expiration date. If the Ethereum price rises above the strike price before the expiration date, you can exercise the option, buying Ethereum at the predetermined strike price. However, if the price remains below the strike price, you can choose not to exercise the option, letting it expire worthless.

Derivatives play a vital role in financial markets, enabling investors to manage risks, speculate on price movements, and facilitate efficient price discovery.

Diving Deeper: What are Crypto Derivatives?

Financial contracts known as “crypto derivatives” derive their value from cryptocurrencies like Bitcoin, Ethereum, or other digital assets. Although they resemble conventional derivatives, there are important distinctions:

Underlying Assets: Unlike traditional derivatives, which often involve commodities, equities, bonds, or currencies, crypto derivatives use cryptocurrency as their underlying assets. Decentralization, volatility, and round-the-clock trading are just a few of the distinctive qualities that cryptocurrencies introduce, all of which can affect how crypto derivative contracts behave.

Market reach: Digital asset markets that may be hard to reach or constrained by regulations in traditional finance can now be accessed thanks to crypto derivatives. Without actually owning the underlying assets, they let traders speculate on price alterations, manage risk, and acquire exposure to the cryptocurrency market.

Decentralization and Blockchain Technology: Making use of the decentralized characteristics of cryptocurrencies, several crypto derivatives are created on blockchain platforms. Transparency, immutability, and security are all guaranteed by blockchain technology, which also offers real-time settlement and does away with the need for middlemen.

Innovation: Rapid innovation is a defining feature of the cryptocurrency derivatives market, as is flexibility. Continuously evolving derivative products include perpetual swaps, binary options, and decentralized options. These cutting-edge goods meet the unique requirements of the cryptocurrency market and give traders more freedom in their trading approaches.

Types of Crypto Derivatives

Crypto Futures

Using futures contracts, traders can purchase or sell a specific cryptocurrency at a fixed price and later date.

They give traders the chance to make predictions about how the underlying cryptocurrency’s price will change in the future.

Depending on their price forecasts, traders might take long (buy) or short (sell) positions.

The discrepancy between the agreed-upon price and the market price at the time the contract expires determines whether a profit or loss was made.

Leverage is frequently used in futures contracts, allowing traders to hold a greater stake with a smaller initial financial outlay.

Cash settlement or actual delivery of the underlying cryptocurrency are two ways that settlement can take place.

Options

Contracts for options grant traders the right, but not the responsibility, to purchase (call option) or sell (put option) a certain cryptocurrency at a fixed price (strike price) within a predetermined window of time.

A premium is paid by traders to purchase the option contract.

Put options offer safety against price falls, whereas call options enable traders to profit from price increases.

If exercising the option is not profitable, traders may decide against doing so.

Options give traders flexibility because they allow them to close out positions prior to the expiration date by selling the underlying option contract.

Depending on the exchange and contract details, settlement may take the form of a financial settlement or a physical delivery.

Swaps

Swaps are agreements between two parties to exchange assets or cash flows under pre-established conditions.

Swaps are frequently used in cryptocurrency derivatives to trade perpetual contracts, which are similar to futures contracts but have no expiration date.

Trading positions can be held permanently via perpetual swaps, doing away with the necessity for contract rollover.

The difference between the entry and exit prices determines whether a trader makes a profit or a loss. Traders can hold both long and short positions.

Permanent swaps typically entail financing rates, with long and short positions being periodically modified to preserve market equilibrium.

Cash settlement is used for settlement, and the money received or paid by traders depends on the current funding rate.

Why Crypto Derivatives Matter: Benefits and Risks

Hedging, leverage, and price speculation are just a few of the significant advantages that cryptocurrency futures provide for traders. But it’s important to be aware of any dangers and drawbacks that can come with trading these securities. Traders can better appreciate the possible benefits and dangers by having a balanced approach.

Hedging is one of the main advantages of trading cryptocurrency derivatives. Using derivatives, traders can take opposing positions in the derivative market to hedge their current positions. This gives them the ability to counteract any losses in the underlying asset and safeguard their portfolios from negative price changes.

Another important benefit offered by crypto derivatives is leverage. Leverage permits traders to take on larger positions than their beginning cash will allow. This increases the likelihood of earnings, which attracts seasoned traders who are aware of the risks.

An essential component of trading cryptocurrency derivatives is price speculation. These tools give traders the chance to make money in both rising and falling markets. Derivatives give traders flexibility to profit from such market movements, whether they predict an increase in price or a decrease in price movement.

However, it is crucial to take into account any potential drawbacks and dangers related to trading crypto derivatives. One big risk factor is volatility. The price volatility of cryptocurrencies is well-known, and it can cause abrupt and significant price fluctuations.

Another difficulty in trading crypto derivatives is complexity. These financial instruments frequently have complex procedures, such as margin needs, contract details, and expiration dates. Before engaging in derivative trading, traders must have a firm understanding of these complexity to reduce the possibility of mistakes or misinterpretations.

Trading participants in the cryptocurrency derivative market may also run the risk of regulatory difficulties. The regulatory environment for cryptocurrencies is still developing, and different jurisdictions regulate derivatives in different ways. In order to ensure compliance and reduce any legal risks, traders must be knowledgeable of the statutory and regulatory frameworks governing their operations.

Finally, trading cryptocurrency derivatives has advantages including hedging, leverage, and price speculation. But it’s important to have a level head and be cognizant of the dangers involved. The potential drawbacks that traders should take into account include volatility, complexity, and regulatory difficulties.

Getting Started: Trading Crypto Derivatives

Follow these simple instructions to start trading crypto derivatives as a beginner:

Step 1: Research and education are the first steps

It’s imperative to gain a thorough understanding of the industry before getting started with trading crypto derivatives. Learn about fundamental trading ideas like leverage, futures, options, and spot trading.

Step 2: Pick a Trustworthy Crypto Exchange

To ensure a seamless trading experience, use a reliable cryptocurrency exchange. Find exchanges that have a solid reputation, robust security protocols, and a variety of derivative products. Conduct extensive research and keep things like trading costs, liquidity, client service, and legal compliance in mind.

Step 3: Establish an Account and Verify Your Identity

Identity verification is required by the majority of trustworthy exchanges in order to adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. Get the required paperwork ready, including a government-issued ID, address verification, and perhaps a selfie.

Step 4: Secure your account

To safeguard your trading account, take security procedures. Use an authenticator software like Google Authenticator or Authy to enable two-factor authentication (2FA). Make a secure, individual password, and keep it to yourself. To store your cryptocurrency holdings, think about using a hardware wallet.

Step 5: Fund Your Account

Fund your trading account by making a deposit. Typically, exchanges accept a number of deposit options, including bank transfers, credit/debit card deposits, and cryptocurrency deposits.

Step 6: Understanding Trading Pairs

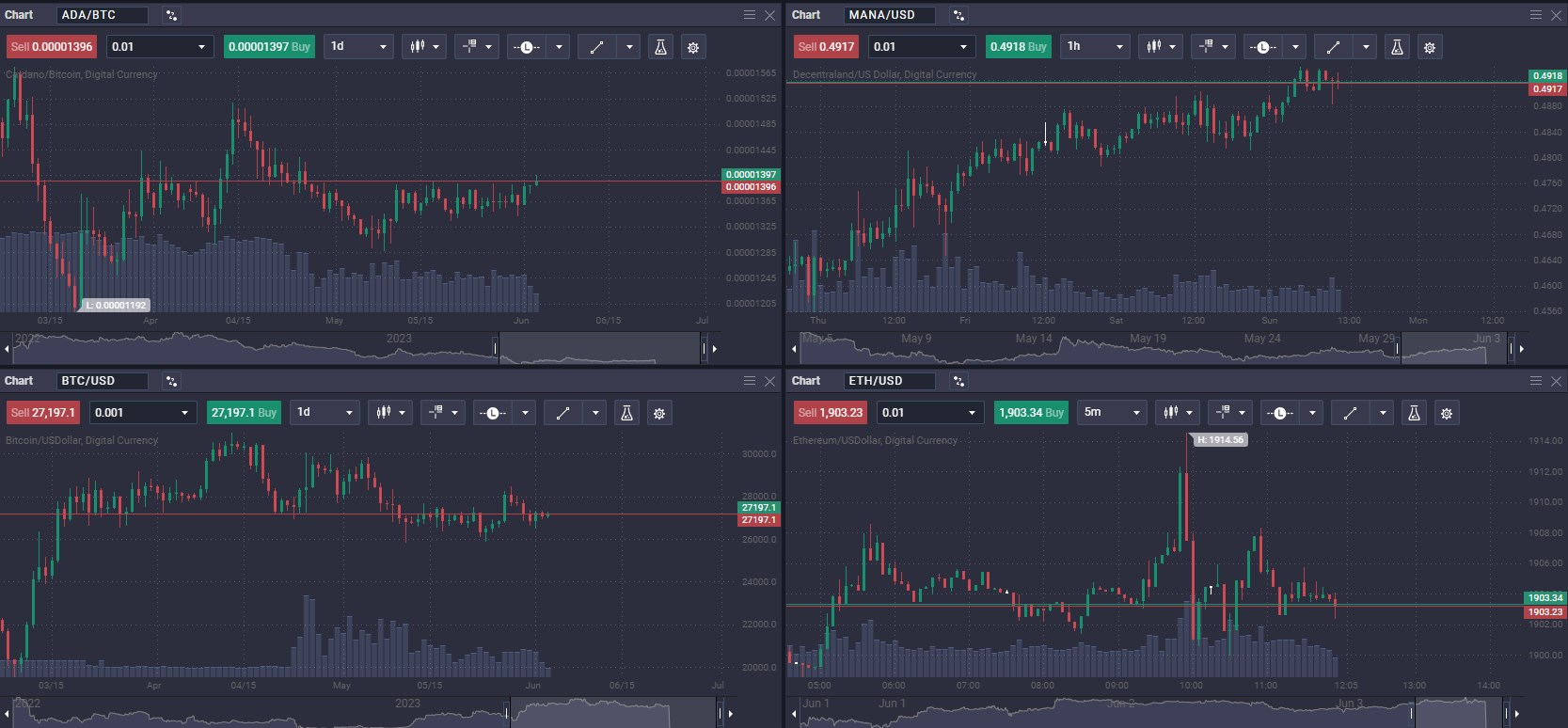

A multi-chart set up in the PrimeXBT platform, monitoring four pairs.

The cryptocurrency you will be trading are determined by trading pairs. For instance, you need to comprehend the BTC/USD or BTC/USDT trading pair if you wish to trade Bitcoin futures. Learn to read order books, pricing charts, and the idea of bid and ask prices.

Step 7: Start with a demo account

Numerous exchanges provide testnet or demo interfaces where you can practice trading with fictitious money. Use these features to gain practical experience without putting your money at danger.

Step 8: Create a trading plan and strategy

Based on your level of risk tolerance and your financial objectives, develop a well-defined trading plan and strategy. Establishing stop-loss and take-profit levels, unambiguous entry and exit points, and a maximum amount you are willing to risk per trade are all important.

Step 9: Start trading with small positions

Start trading with tiny positions using real money if you are comfortable using the trading platform and have had enough practice. As you develop expertise and confidence in your trading talents, gradually raise your position sizes.

Step 10: Constantly learn and adapt

Since the cryptocurrency market is so dynamic, staying informed is essential for profitable trading. Keep up with recent market developments, industry trends, and legislative changes. Join cryptocurrency communities, follow trustworthy traders and analysts, and constantly absorb their knowledge. Based on the state of the market and your own trading performance, adjust your strategies.

Remember that there are dangers involved with trading crypto futures and other derivatives, and losses are possible. Before deciding to trade, only spend money that you can afford to lose and always do your research.

An Overview of Crypto Derivative Exchanges PrimeXBT

PrimeXBT is a crypto derivatives trading exchange that focuses on the unique needs for crypto traders. The deposits are done in crypto, allowing for those who wish to trade crypto derivatives a familar and seemless environment.

Furthermore, PrimeXBT has a world-class platform, which can be used from anywhere with internet access and a browser. The spreads on crypto asset price difference is slight, allowing traders to keep more of their profit margins. The low fees are also a major benefit to trading derivatives at PrimeXBT.

PrimeXBT even allows you to copy other traders that have shown themselves to be extremely profitable in the crypto markets.

Navigating Regulations: Crypto Derivatives and the Law

The regulatory environment for cryptocurrency derivatives is changing as different jurisdictions enact differing regulations. To maintain legal compliance and to be aware of potential effects on their actions and methods, traders must keep up with these restrictions.

Regulations may have the following effects on traders:

Access and Eligibility: Some jurisdictions limit who can trade cryptocurrency derivatives, such as accredited investors or particular professional categories. The eligibility standards and access requirements established by authorities must be understood by traders.

Investor Protection: Regulations set standards for openness, disclosure, and ethical trading methods in an effort to safeguard investors. To make sure they are using platforms that adhere to investor protection procedures, traders must be aware of these rules.

Leverage and Margin Requirements: Regulatory authorities have the authority to impose restrictions on leverage and margin requirements for trading in crypto derivatives. These limitations have a direct impact on traders’ risk exposure and potential rewards, therefore they should be aware of them.

Reporting and Tax Obligations: Regulations frequently compel traders to record their cryptocurrency derivative operations and to meet their tax requirements. If you don’t, you risk fines and other legal repercussions. Traders should be aware of their jurisdiction’s reporting and tax laws and keep complete records.

Exchange Compliance: Regulatory control is imposed on cryptocurrency exchanges that supply derivative goods. To reduce counterparty risks and maintain a fair trading environment, traders should use exchanges that operate inside a regulated framework.

Looking Ahead: The Future of Crypto Derivatives

Several potential trends that could influence the direction of cryptocurrency trading are currently seen in the field of crypto derivatives:

Institutional Adoption: A key trend is the rise in institutional investors’ involvement in cryptocurrency derivatives. Increased liquidity, stability, and legitimacy are brought to the market via institutional engagement.

Regulation-Related Developments: Regulators are working hard to create frameworks for cryptocurrency derivatives. By attracting a wider spectrum of participants and supporting the widespread adoption of crypto derivatives, clearer laws can offer a more safe and transparent trading environment.

Product Innovation: New products and trading techniques are constantly being developed in the world of cryptocurrency derivatives. Traders may have access to a wide range of investment opportunities and risk management tools thanks to innovation in fields such decentralized derivatives, options contracts, and structured products.

Decentralized Finance (DeFi): DeFi platforms are transforming conventional financial services, such as derivatives. Decentralized derivative markets can be established thanks to smart contracts, enhancing accessibility by doing away with middlemen. DeFi derivatives may offer more transparent and productive trading environments.

Integration with Traditional Finance: There is an increasing amount of convergence between traditional finance and cryptocurrency derivatives. The integration of crypto derivatives into existing financial institutions’ products is being looked into as a way to close the gap between conventional and digital assets and broaden the market for cryptocurrency trading.

It is essential for traders to keep up with these trends and to keep learning more about the cryptocurrency market. Understanding cryptocurrency derivatives can help traders make more informed decisions about risk management, market dynamics, and trading tactics.

Conclusion: Embracing the World of Crypto Derivatives

In conclusion, crypto derivatives are innovative financial instruments that derive their value from cryptocurrencies. They offer traders the ability to speculate, hedge risks, and gain exposure to the crypto market. With unique features like decentralized assets and integration with blockchain technology, crypto derivatives are shaping the future of finance.

What are bitcoin derivatives?

Bitcoin derivatives are financial contracts whose value is derived from the price of Bitcoin. They allow traders to speculate on Bitcoin's price movements without owning the underlying asset. Bitcoin derivatives include futures, options, and swaps that enable traders to manage risk, hedge positions, and gain exposure to Bitcoin's price volatility.

Is a token a derivative?

No, a token is not inherently a derivative. A token typically represents a unit of value or a digital asset on a blockchain network. It can have various purposes, such as serving as a medium of exchange, utility token for accessing certain services, or representing ownership rights. Derivatives, on the other hand, are financial contracts whose value is derived from an underlying asset, such as a token, stock, commodity, or currency.

Are crypto derivatives financial instruments?

Yes, crypto derivatives are considered financial instruments. They are contracts that derive their value from cryptocurrencies, such as Bitcoin or Ethereum, and are traded in financial markets. Crypto derivatives, like traditional derivatives, enable traders to speculate on price movements, hedge risk, and gain exposure to the crypto market without directly owning the underlying assets.

Where can i trade crypto derivatives?

There are many exchanges where they are available, including PrimeXBT, a leader in crypto trading derivatives.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.