A short squeeze is a dramatic and violent event in financial markets. It happens when traders shorting a market suddenly feel compelled to cover their positions. To close a short position, you need to repurchase it. It is the financial equivalent of a “feedback loop.” In this guide, we will talk about how to deal with a short squeeze.

What is a Short Squeeze?

A short squeeze is when traders who have shorted an asset see its price suddenly rise, forcing them to exit their positions rapidly. Remember, when somebody is “short” a market, they must repurchase it to exit that asset. Short squeeze stocks can be massive winners if you are on the right side of the trade, but can lead to substantial and potentially unlimited losses if you are wrong.

This causes a significant surge in demand because you not only have those betting on higher prices looking to buy that asset, but you have those trying to protect their accounts doing the same thing. This causes a bit of a “feedback loop” in the market that may shoot straight up i for rapid gains.

How Do Short Squeezes Work?

Short-sellers are typically looking for overvalued assets, hoping to benefit from prices dropping. However, things sometimes change rapidly, and the investment is no longer overvalued. This can happen in a very brief amount of time, perhaps during an earnings report or GDP announcement, causing markets to shift focus suddenly.

When they shift focus, volatility picks up, and buyers suddenly find themselves in the driver’s seat. The trick, of course, is being able to identify a short squeeze early enough to benefit.

Many Things Can Cause a Short Squeeze

A short squeeze happens when a sudden and sharp upward change in the price of a financial asset occurs. This can be due to a positive news release on performance. Such news could be earnings, geopolitical, a central bank announcement, and a whole host of other reasons. This unexpected macroeconomic factor leads to higher demand, or a whole host of other situations, depending on the market.

For example, a heavily shorted company may be bought by a more significant and stable company. That shorted stock will suddenly be in demand because those who had bet against this company’s price may find themselves holding stock well below the sale price that the larger company agreed to.

Another example might be a blowout earnings report for a corporation. If a large number of traders short a stock, and the earnings end up coming in much more substantial than anticipated, that can also cause a bit of a short squeeze.

Currencies have these short squeezes from time to time too, such as when the Swiss National Bank suddenly announced that it was no longer willing to defend the Swiss franc against the Euro at the 1.20 level. Traders had been heavily short the Swiss franc and long of the Euro. Once the announcement was made, a financial train wreck awaited those involved in that bet.

How Long Does the Typical Short Squeeze Last?

The correct answer is “it depends.” It comes down to how many traders have shorted an asset, how liquid the asset is, and the nature of the news. Generally, a short squeeze tends to be a relatively short-lived event.

It’s often the case that you get a sudden spike for a couple of days, only to see the price deflate again. This is because many more prominent money managers will leave the market after collecting hefty profits, as they don’t want to be bothered by unnecessary volatility.

Psychology During a Short Squeeze

A short squeeze is not just a technical event — it’s deeply psychological. Once prices start rising, short sellers are hit with fear and urgency. The threat of margin calls or forced liquidations pushes them to buy back positions at increasingly worse prices. This panic can fuel a rapid chain reaction.

At the same time, retail traders and speculators see the surge and pile in, hoping to capitalize. The fear of missing out (FOMO) intensifies the rally. In modern markets, this dynamic is often amplified by social media platforms like Reddit or Twitter, where collective sentiment can turn into a powerful force.

In this environment, emotional trading often overrides logic. For those caught on the wrong side, hesitation can be devastating. Recognizing the psychological factors at play can help you make faster, more rational decisions during these volatile moments.

The Aftermath of a Short Squeeze

The aftermath of a short squeeze can often lead to a quiet market. Because so many traders have been affected by the move, those who got in on the right side of the squeeze are comfortable taking profits and stepping away. Those who were short the market are happy with the lack of volatility in their portfolios.

You will often see a massive spike in price, followed by a slow and gentle drift lower. Keep in mind the momentum can only last so long as there are only so many players in a particular asset to move the market. Furthermore, many investors are highly risk-averse, meaning they will not want to be involved in a market that has shown a propensity to make massive and sudden dangerous moves.

How to Predict Short Squeeze

When you wish to trade a short squeeze, there are a few things that you will have to pay close attention to. While there is no perfect strategy, the following steps can keep you on the right side of the trade more often than not. Keep in mind that trading a short squeeze is very difficult, but such a “high risk/high reward” environment can be very profitable once mastered.

1) Find Heavily Shorted Stocks

Look for heavily shorted names if you are involved in the stock market. You must remember that some stocks have heavy short interest for a reason: investors expect the share price to fall. This is why you need a significant short interest.

2) Find a Coming Catalyst

There has to be a reason for a short squeeze to happen. You need a catalyst to make it happen. Fundamental triggers include macroeconomic announcements, earnings reports for a corporation, and trading currencies when bringing home profits from overseas..

3) Research the Coming Catalyst

Research must be done on market expectations for your expected catalyst. For example, if GDP in the United Kingdom is expected to be negative, but the announcement is 1.2%, that would suddenly be a catalyst for the British pound to strengthen. By knowing what you are watching and what the market is expecting ahead of time, you can react accordingly.

The most common cause of a squeeze is an earnings report, because stock market earnings reports come out quarterly. If somebody gets something wrong, it could cause chaos. Individual stock names will have less liquidity than a currency.

4) Trust Your Research and Make Your Move

To profit from a short squeeze, or any other trade for that matter, you need to trust the research that you’ve done and place your trade. Understand that you won’t get things correct 100% of the time, but these potential catalysts can be very profitable over the longer term.

The most important thing you can do is place your trade and understand when you need to get out of the position. You should always protect your trading account from adverse reactions.

5) Track the Squeeze

If your research and trade setup leads to a positive move, you must keep track of the short squeeze. Remember that trading a short squeeze is not a set-and-forget strategy. The fast-paced nature of a short squeeze almost always means that you will be out of it rather quickly.

The trick is to maximize gains without giving back too much. You need to keep a close eye on what’s going on. Typically, there are huge higher impulses followed by short-term sideways action. Once you see the market going sideways, you may be reaching the end of the short squeeze.

How to Find Short Squeeze Stocks

There are many different ways to find potential short squeeze opportunities, but there are a handful of things you can do to narrow down the potential short squeeze trades.

- Keep track of short interest: If a stock has more than 20% short interest and an average daily share volume over 100,000 traded, this could be set up as a market with an overextended short interest ratio. Keep in mind that just because it is shorted does not mean that the catalyst to kick off the short squeeze will happen.

- Analyze financial statements: If you are going to trade shares, you need to analyze company financial statements and other statistics. Generally, short squeezes are more likely to occur in small-cap stocks with a market capitalization of over $300 million and a price of over $5.

- Use technical indicators: Many traders use technical indicators to determine whether or not the stock or asset is oversold. Oscillators, such as the Relative Strength Index or the Stochastic Oscillator, are a standard solution to this question.

What Are Some Short Squeeze Indicators?

- Massive buying pressure: If there is a sudden uptick in buying pressure via shares or contracts bought, a pending short squeeze could be in the works.

- High short interest: Short interest rates of over 20% in a stock can signify a market that is vulnerable to a short squeeze. This doesn’t mean that it has to squeeze. It indicates that we are more likely to see a sudden shift in momentum if there is unexpected good news, as there will be more people out there who have to buy back their short positions.

- High Short Interest ratio (SIR) or days to cover above 10: The SIR indicator compares short interest to a stock’s average trading volume. The reading represents the number of days, under average trading volume, short-sellers would need to exit their positions. The higher the number, the more likely a short squeeze could come. This is an indicator you can find on many popular stock reporting sites.

- Relative Strength Index (RSI) in oversold condition: The RSI is an indicator many traders follow. The oscillator is widespread, and a reading below 30 can signify that the market is oversold. If you are short, then it could be time to take profit. However, if you are looking to buy, it could be a sign of an impending move to the upside.

How to Protect Yourself Against a Short Squeeze

There are a few basic things you can do to protect your account in the event of a short squeeze. Make sure you are aware of them, as they can protect you in what is a volatile situation.

- Use stop-loss or buy-limit orders on your short position to mitigate the damage: While we always hope the trade will work out, there is no real way to know if it will. Because of this, you need to take steps to protect your account. You should NEVER trade without a stop loss, especially if you are shorting stocks.

- Hedge your positions: You can also buy the stock, or maybe an option to take advantage of rising prices. In a sense, you are betting against yourself, but at the same time, you will lessen the damages you face.

Short Squeeze Examples

Over the last couple of years, there have been several examples of massive short squeezes, some of which made significant headlines. There have been multiple reasons for the short squeezes, but below are some of the most notable ones. Below we have included the catalysts for a short squeeze and short squeeze charts showing examples.

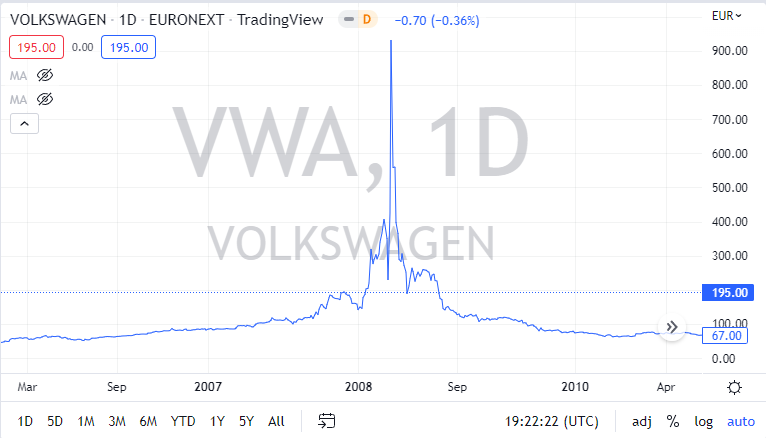

Volkswagen

When Porsche announced in 2006 that it wanted to boost the chairs and Volkswagen to 31%, the VW stock started to rise. However, Volkswagen was in massive debt, and over the next year, quite a few institutional traders and hedge funds began to take on substantial short positions.

As the Great Financial Crisis hit in 2008, causing car manufacturing to plummet, many more institutional traders joined the short-selling frenzy, expecting the stock price to crash. This was exacerbated after Porsche vehemently denied rumors in early 2008 that it would increase its holding to 75%. However, in October 2008, Porsche revealed that it had held 42% of VW shares and had options on a further 31%.

There was also another company called Lower Saxony that held 20% of the VW shares. This meant that less than 6% of VW’s voting stock was on the market. As there was a sudden realization that there weren’t enough shares available, short-sellers panicked as they had to pay to close out their positions, causing a massive imbalance that led to a monumental short squeeze.

On one exchange, the Volkswagen price rose from €210 to just a bit over €1000 in two days. At one point, it had even overtaken Exxon as the company with the world’s largest market capitalization. However, the next day Porsche released 5% of VW shares into the marketplace. Within three days, the VW stock dropped 58%, and by the end of November, it was down 70% from its peak.

Dogecoin

During late December 2021, Elon Musk stated on Twitter that Tesla would make some merchandise buyable with DOGE, and see how it goes. This started a massive short squeeze in Dogecoin, which had been heavily shorted previously.

The market launched from roughly 7 cents to an all-time high of $0.76 just a month later. Since then, Elon Musk has walked back some of his enthusiasm for Dogecoin, and the price has done nothing but fall in value.

You can see just how violent the initial shot higher was, followed by a rather significant pullback, and then a drift lower as volume started to dissipate. Many of the buyers were Reddit users that follow Elon Musk, and are not very sophisticated investors. In fact, Mr. Musk is being sued for over $280 million by investors as they suggest he has “manipulated the market.”

This could be a bit of an issue for him, because time and time again he seems to sell Tesla at the very highs of each pop. The SEC and Elon Musk have a long history of going back and forth, so this is news worth paying close attention to.

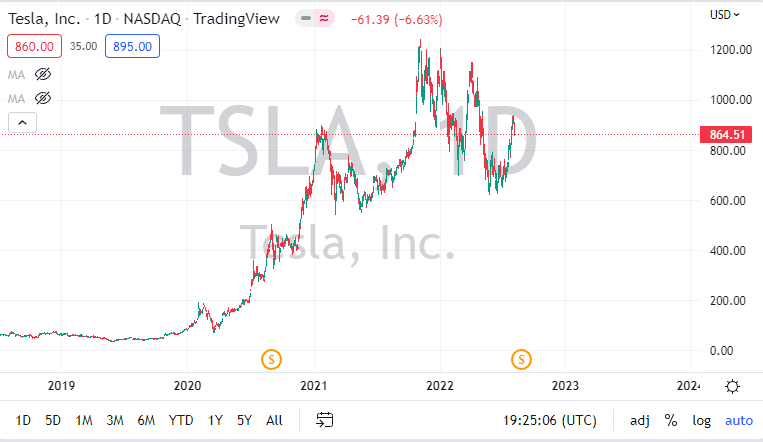

Tesla

In August 2020, Tesla’s stock price suddenly shot up 50%. The stock had been gaining quite a bit of momentum, and even though there were a few fundamental reasons for this, Tesla was about to join the S&P 500 index. They also announced a stock split, which caused short-sellers to bail out of their positions.

Earlier that month, Tesla had become the most shorted stock in the world, setting up the stock for a potential short squeeze. As a whole, Tesla gained 743% during that year. This was a longer-term squeeze, much rarer than the typical short-term spike.

Bitcoin

In mid-2021, investors were betting on Bitcoin to continue falling, but the market turned around and surged higher. On Sunday, July 25, the market surged from $36,000-$40,000 in a matter of a few minutes. The majority of this volume came from ByBit, and even caused so much havoc that the price of Bitcoin on Binance reached $48,000 for a moment.

Bitcoin had been shorted in the futures market at a record rate before this happened. After Bitcoin broke through the $30,000 level about a week earlier, investors were piling in and calling for $20,000 to be targeted in the near future. However, the momentum shifted, and shorts had to be liquidated rather quickly.

In aggregate, short sellers were liquidated over $1 billion. This is the largest short squeeze in the history of Bitcoin, and certainly was one of the quickest.

AMC

AMC was once the world’s largest cinema chain and was in danger of falling apart as the pandemic took hold. The lockdown forced the closing of all 10,500 screens across the world. The company faced bankruptcy, resulting in a massive wave of short-selling.

In mid-2021, it raised $500 million by issuing common stock and restructuring its debt. This ended the immediate threat of insolvency. As a result, the Reddit-based group WallStreetBets began buying stock, and two days later, the market had risen over 300%.

When the first short squeeze started to fade away, new retail traders amassed enough shares to become the company’s significant shareholders. They had raised the price of shares sufficiently for the CEO Adam Aron to sell 4.3 million more shares at $10 each. That boosted the price further to the $25 level, but retail traders piled in again the following day. Within a few hours, the stock reached $70, 20 times its value the previous January.

It was then that Aron realized the company’s future was based on retail traders and not institutional traders. He switched his communication strategy to appeal to them using social media and YouTube. He gave away free popcorn and launched a program called AMC Investor Connect to attract shareholders to become customers. Although the squeeze inevitably fell, the prices dropped to around $40, still eight times their value at the start of the year. This gave the company sufficient breathing space to restructure as cinemas began to reopen.

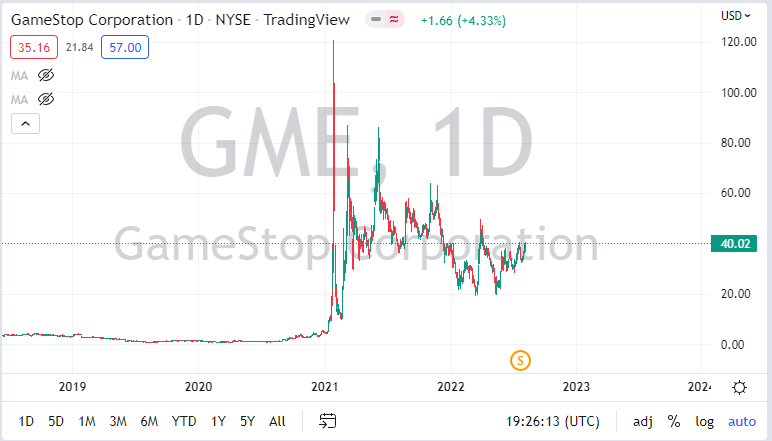

GameStop

In January 2021, US videogame retailer GameStop was in a terminal decline. While the retailer had struggled for several years, the pandemic seemed to be the final nail in the coffin. Traders were so confident that this company was going under that they, at one point in time, had 140% of its shares shorted.

Enter WallStreetBets, Reddit channel. Retail traders decided to force a short squeeze and started buying shares to increase GME’s value. The interest in this stock turned it into the world’s first “meme stock,” sending institutional traders scrambling to save their business. Some short-sellers had to buy back the stock.

Shares doubled in roughly three days, culminating in the stock reaching a value of over $500, just five months after it was worth only $4. The rally was so brutal that some major brokers had to hold buying the stock for fear of a more significant financial issue.

Once that happened, the stock started falling to the $40 level. The harsh backlash against brokers began from retail traders, who pushed the market back $350 before losing and then regaining 50% of its value in just 24 hours.

What Are the Risks of Short Squeeze?

- Heavy short interest stocks aren’t great investments: Keep in mind that heavily shorted stocks are heavily shorted for a reason. Typically, there is some type of significant issue with the corporation, and traders have been willing to sell. Without some shocking positive catalyst, these shares or assets will likely continue going lower.

- This is a speculative strategy: This is a very speculative strategy and, therefore, should be considered high risk. That being said, the more risk you take, the higher the reward will be when it works out for you. When speculating like this, the risk of ruin can be pretty high if you do not take proper risk management steps.

- You must keep greed under control: Greed can become a significant problem with this type of speculation. When a trade is working out in your favor, you need to understand that a short squeeze is a short-term move, not something you simply hang on to. Understand that you will more than likely not be able to get the entire move, and be willing to accept that going into the trade.

- You need to be quick: You have to be quick when trading this strategy because things can change so quickly. However, if you cannot monitor the trade in real-time, this will not be your strategy.

Is Short Squeezing Legal?

No, short squeezing is not illegal as it is a natural reaction to a change in fundamental analysis. That being said, most of what drives a short squeeze isn’t necessarily nefarious; it’s people trying to protect their accounts by dumping their short positions that drove down prices in the first place.

Tips for Trading a Short Squeeze

While trading a short squeeze can be very profitable, there are a few things that you need to keep in the back of your mind to make sure that you do not damage your account in what is a very volatile and dangerous situation.

- Understand that although the volatility can be very beneficial, it also can be hazardous. Position sizing is critical to protect your account.

- In order to avoid being squeezed, you absolutely must have stop losses on any short position you put out into the stock market. You should always have a stop loss on any trade you place in any market.

- Make sure you become familiar with the short interest ratio (SIR), as it can keep you out of trouble to a certain extent.

- When short interest is extraordinarily high, over 20%, it’s possible that you may see a short squeeze. You do not want to base a trade solely upon that, but this does set up a market for a potentially explosive move to the upside.

Short Squeeze vs. Long Squeeze

While short squeezes attract attention due to their explosive nature, long squeezes can be equally destructive — just in reverse. Both phenomena are driven by one-sided positioning, extreme sentiment, and sudden reversals that force traders to exit positions under pressure.

In a short squeeze, it’s the short sellers who are trapped, leading to rapid buying. In a long squeeze, bullish traders are caught on the wrong side of the move, leading to panic selling. Below is a comparison of the two situations and what typically defines them:

| Feature | Short Squeeze | Long Squeeze |

|---|---|---|

| Direction of movement | Upward | Downward |

| Who’s under pressure | Short sellers | Long buyers |

| Common trigger | Unexpected bullish news | Unexpected bearish news |

| Psychological effect | Panic buying, FOMO | Capitulation, fear of deeper losses |

| Typical duration | Short-lived but explosive | Gradual or sudden, often prolonged |

| Common market environment | Low float, high short interest | Overhyped markets, crowded long positions |

| Risk management key | Cover shorts quickly or hedge | Use stop losses and manage greed |

Understanding the nature of both types of squeezes is critical for any trader — knowing whether you’re entering an overpopulated trade can help you avoid becoming the exit liquidity.

Conclusion

Finding a decent short squeeze opportunity takes a certain amount of work that some traders won’t have the ability to do. It comes down to whether or not you have time to watch the trade because, quite frankly, most short squeezes happen in a very brief amount of time. If you are a 9-to-5 employee, taking advantage of this strategy may be challenging.

That being said, you should also remember that it’s a hazardous strategy. You should make sure that you protect your account and take extra care to keep your position size reasonable. After all, if you get a massive short squeeze, it takes a minimal risk to make quite a bit in return. You should also ensure that you have your protective stop losses in place and an idea of where you want to take profit. Trading a short squeeze is not to be done “on the fly.”

Is a short squeeze good?

A short squeeze is when a stock or asset suddenly returns to the upside in a positive move. It is suitable for the asset but can be bad for the trader if they are short of the asset itself.

What is a short squeeze example?

Herbalife was a heavily shorted company in the United States in 2012 by hedge fund manager Bill Ackman. He made a short bet against the supplements company, explaining his decision in a three-hour presentation. He described it as a pyramid scheme that was about to go bust.

Ackman had spent $1 billion shorting Herbalife when trading at roughly $45. One of his greatest rival hedge fund managers, Carl Icahn, publicly disagreed with his bet and, as a result, took 26% of Herbalife shares. This made him the company’s largest shareholder, allowing him to make over $1 billion in the next few years. When Ackman exited the short position a few years later, it traded at more than $90 a share.

How do you profit from a short squeeze?

You buy a stock or asset as it is squeezed higher, exiting rather quickly before the dust settles.

What's the biggest short squeeze ever?

Volkswagen was the most significant short squeeze during the Great Financial Crisis of 2008. While it looked like the automaker was going to go under, the outlook suddenly reversed when Porsche revealed that it had a controlling stake in VW.

How do you tell if a stock is heavily shorted?

You can find this information on any stock quoting service, as it is public information. As a general rule, anything with more than a 20% short interest falls into this category.

What happened with the Gamestop short squeeze?

Approximately 140% of GameStop’s public float had been sold short, so as Wall Street Bets jumped into the market, short-sellers were forced to cover themselves by buying as much stock as possible, thereby adding to the surge.

When should you buy a short squeeze?

The answer would be the same as almost anything else: as soon as possible. The most money is made heading into the catalyst, assuming that you are aware of one impending. Many short-covering catalysts happened out of the blue, so it is sometimes considered to be a ‘black swan event.”

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.