The halving event is a process embedded into the Bitcoin protocol and occurs once in about 4 years. It implies the reduction of mining rewards – number of new Bitcoin issued to miners for successfully adding a new block to the Bitcoin blockchain.

While there are no direct mentions and technical references of ‘halving’ in the Bitcoin White Paper, it was initially designed by the Bitcoin founder – Nakamoto Satoshi, that the difficulty of mining new Bitcoins would increase over time, and that subsequently would cut in half the amount of new Bitcoin entering circulation.

By far, Bitcoin halving is considered one of the most significant events in the Crypto world. Given the fact that supply to demand ratio is often affected and the Cryptocurrency’s price has historically proven to correlate with this event, both investors and miners are captivated by the imminent implications the new – anticipated Bitcoin halving will bring, which is predicted to take place by April of 2024.

What is Bitcoin halving and how does it work

What happens during a halving?

In the process of mining when specialised hardware equipment, also known as Application-Specific Integrated Circuits (ASICs), solve complex mathematical problems, random 64-character outputs – hash(es) are produced.

Hashes contain information about the last transactions made from the previous block. Approximately every 10 minutes a new block is added to the chain, awarding the miner who successfully locked in the block by a valid hash with 6.25 BTC.

The halving mechanism is automatically set into motion every 210,000 blocks generated. In such event, the reward for mining each new block is cut in half, while the amount of hashes required to occur before a valid one is obtained continues to increase.

As of December 25, 2023 the mining difficulty is at a total of 72.01 trillion hashes per block.

With the growing mining difficulty, frequency of new blocks added to the chain is decreased and so is the rate at which new Bitcoin and its amount is released into circulation.

Many believe that halving directly affects the demand for BTC and its value, as there are only 21 million Bitcoins to be, and in such events an already limited supply decreases even more.

Historical overview of past halvings

The very first Bitcoin halving occurred back in November 28th, 2012. The block reward was cut down from the initial 50 BTC to 25 BTC. And while uncertainty of the occurred event shacked the mining community, price of Bitcoin reacted positively, increasing in value by over 1000% in the next 6 months from $11 per coin to $139.

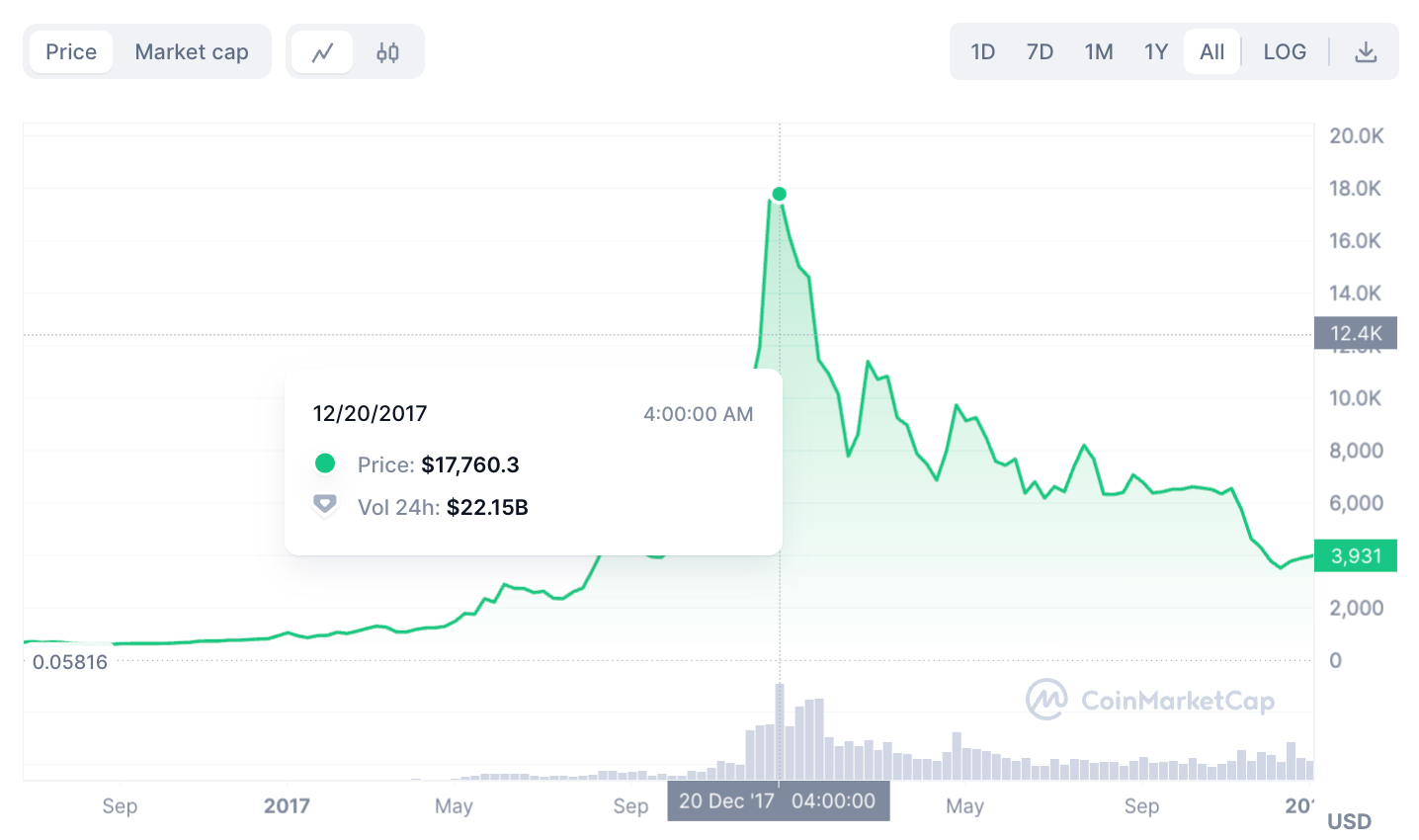

The second halving which took place on July 9th, 2016 decreased the reward amount to 12.5 BTC. And while the following two quarters of the year after the halving did not show any significant affects on the price of Bitcoin, by December of 2017 it reached its all time high of $17.760, gaining an astonishing total of 2600+ in percent equivalent.

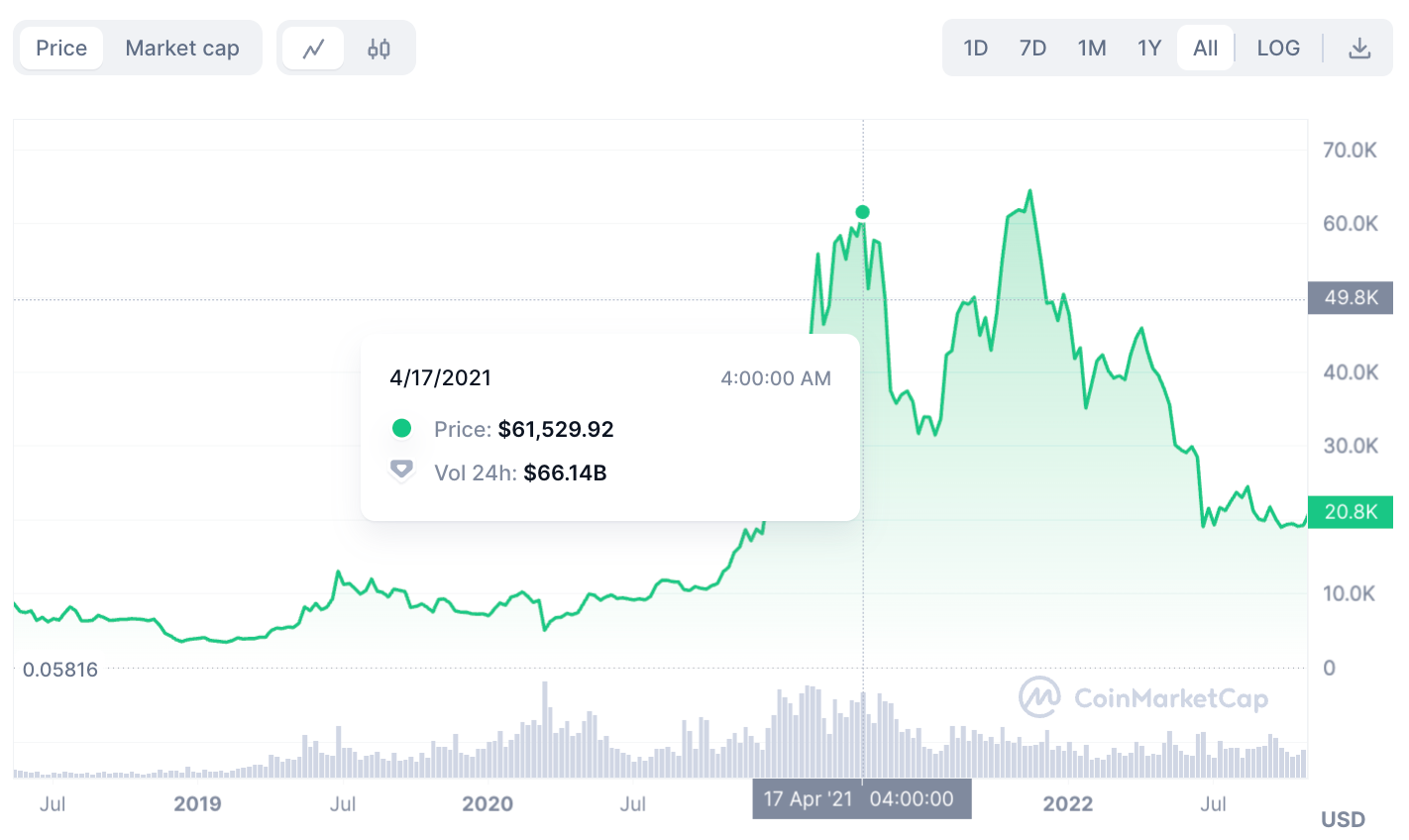

Last halving of May 2020 was preceded by the ending Crypto winter when Bitcoin’s price continued to struggle and was unable to break the psychological barrier with the resistance line at $10.000. However, the halving to a mere 6.25 BTC per block brought another extreme breakout and a new all time high of $61.529 as BTC price rallied over the course of the next year.

Which at first scarred many mining enthusiasts back in 2012 turned to be a rewarding occupation. Historically Bitcoin halvings have shown a positive correlation between the reduction on mining rewards and Bitcoins price.

However the ever increasing need for more computing power and energy consumption has lead to fewer miners capable to sustain the requirements and stay afloat, making the network less decentralised as bigger players start to hold larger shares of the mining market.

Proof-of-Work (PoW) consensus mechanism is the core of Bitcoin’s blockchain network and many start to raise concerns regarding the processing power it demands to maintain mining operations.

Nonetheless, while some chose more accessible mining alternatives, like mining pools where the Bitcoin mining reward is shared, doors open to new adopters. Individuals that are ready to take on the expense obligations in hopes of higher – non-shared returns.

Bitcoin halving 2024: key expectations

Predicted date and block rewards

As the hashrate carries on increasing ever since the genesis block mined and the fluctuating block time varying within an average of 10 minutes, it is quite difficult to precisely predict the next Bitcoin halving dates. However considering its an algorithm based on a predetermined estimate of 10 minutes a rough calculation is possible.

It is anticipated that the Bitcoin halving milestone will be reached and take place some time in April of 2024 with the following block reward reduction from 6.25 BTC to a standard half of 3.125 BTC. Interesting enough, while there is no exact date known for the next halving, such services like the CoinMarketCap have even launched their own countdown timer in expectation of this event.

Impact on Bitcoin miners

With the decreasing amount of Bitcoin awarded per block mined, the profitability of mining operations might become unremunerative for some individuals forcing them to switch their attention to mining other digital assets with more flexible and appealing conditions.

Unfortunately, big outflows of miners who validate transactions thus ensuring network security, could lead to it becoming vulnerable and less challenging for individuals with malicious intents to exploit its weaknesses.

Economic implications of halving

Supply and demand dynamics

By design and strict limitations embedded by Nakamoto Satoshi into Bitcoin code, Bitcoin has a fixed total supply of only 21 million coins that are possible to be mined. With a total of over 19.5 million BTC already mined, and an approximate of 1.5 million remaining, each next halving reduces the reward, providing basis for healthy and sustainable network growth and mining competition.

These limitation also purport that BTC is a deflationary Cryptocurrency. Before the first Bitcoin halving the inflation rate was approximately 50% back in 2011. Yet after the halving took place, the inflation fell to 12% and below 5% after the following Bitcoin halving, and currently stands below 2% which means BTC increases in value and demand at the same time, while the Bitcoin supply itself decreases.

Despite the obvious correlation between halvings and Bitcoin price performing remarkably well within the given periods, it is crucial to note that significant price fluctuations have proven record of not taking place immediately. A good example of this was the 2016 halving when Bitcoin’s price took a whole year to react to the event and reach a new all time high.

Comparison with traditional markets

To put things into perspective, the traditional financial practises are the counterpart of the blockchain technology concept. Many fiat currencies like the US dollar or Euro were initially created with the purpose of having a gold standard, where the money supply is backed by an equivalent amount of actual gold reserves.

Nevertheless, in the light of constantly changing and modernising world economies these standards shifted, particularly during times when the fiat monetary system faced desperate and endangering periods like the Great Depression or World Wars.

Overprinting by central banks and production of more money at will typically results in substantial drop in value of the currency at hand, unlike the Nakamoto Satoshi’s concept of a fixed supply where no more Bitcoins can be mined above the threshold. Thus preventing its devaluation and making it a deflationary asset protected from downfalls of fiat money.

The future beyond 2024 halving

When all Bitcoins are mined

The Bitcoin network is designed for periodic decrease in the mining reward with a pre-calculated estimate of the total supply of 21 million Bitcoins mined by the year 2140. Upon the conclusion of this long and difficult process, no more Bitcoin will be available for mining and so will the reward have to be replaced with an alternative incentive to maintain the network.

Some speculate that the substitute for Bitcoin mining rewards will be a new reward system based on further validation of Bitcoin transactions and profit returns for the involved in the form of transaction fees. Only 6% of the total profit in a statement of an average miner are rewards from validating transactions, however this may be a 100% case scenario when no new coins could be mined moving forward.

The evolving role of Bitcoin

Ever since the first halving, Bitcoin has proven more than just a simple point of value appreciation and the sustainability of its dedicated blockchain network.

Every consecutive Bitcoin halving event has shown, that the concept outlaid in Nakamoto Satoshi’s White paper is capable of representing the decentralised approach towards a new viable financial economical system.

And whilst these changes are taking place, more and more social and media outreach is aimed at disclosing the benefits Bitcoin carries for individuals, corporate and governmental institutions.

Conclusion

Bitcoin’s halving is a pre-calculated and pre-determined process embedded into the core idea of its network functionality. As Bitcoin decreases its supply over time, its value and demand rise on the market.

Recent halving events have shown the importance of Bitcoin as the new gold among Cryptocurrencies and its role similar to a scarce commodity, yet protected from the disastrous consequences inflation can cause.

In the light of this, the importance of the upcoming 2024 halving event is even more significant as new opportunities may reveal themselves for the overall Cryptocurrency market, as the community anticipates a new potential rally.

Is Bitcoin halving in 2024?

Precisely. As the track record of past halving events shows, it is predicted to expect a new halving approximately every 4 years. With the last occurred in 2020, 2024 will see a new milestone for Bitcoin.

What date is Bitcoin halving?

As the average block time varies within a standard of 10 minutes and an exact calculation is impossible, thus a particular date is unknown. Yet many predict the halving to happen some time in April of 2024.

What happens during a Bitcoin halving?

The main peculiarity of Bitcoin halving is the reduction of the mining rewards. Each Bitcoin halving they are cut by a half, and so the amount of newly minted Bitcoin released into circulation is decreased.

Does Bitcoin halving increase price?

While many have identified a pattern where Bitcoin price systematically raises over time in the following months before or/and after halvings, and its value indeed appreciates the event, demand on the other hand may not always follow this debated theory.

Should I buy Bitcoin before halving?

It is subjective to attempt providing an answer to when or how much Bitcoin one should or shouldn't purchase before a halving event, yet it is vital to understand how does the Bitcoin halving work to make a weighted investment decision.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.