The volatile nature of the Cryptocurrency market often makes it highly unpredictable. While some investors look to significant price movement to maximise their earning potential, others resort to a more conservative trading strategy that suggests waiting until the market enters a more stable phase.

When a Cryptocurrency like Bitcoin enters such periods, it is identified as a consolidation phase. During consolidation the price of an asset doesn’t experience rapid fluctuations, and trades within a relatively determined zone.

Crypto consolidation, also known as ‘market correction’, is an important phase that many traders use to their advantage to either prepare for a trend they anticipate, or simply build strategies beneficial within a predefined market.

What is Bitcoin consolidation?

Bitcoin consolidation, i.e. consolidation of an asset on the Crypto market is very similar to that in other financial markets. In the course of an ongoing consolidation period, the driving forces of supply and demand near a balance. As a result of this, a Crypto asset swings within a comparatively stable price range.

However consolidation is more prevalent among traditional assets than in the Crypto market, which is generally more volatile and influenced by other moving factors. Traders find Crypto consolidation an important event, necessary to reevaluate the market and the opportunities it can provide.

How long does Crypto consolidation usually last?

The span of a consolidation period in the Crypto market depends on many things, and there is no universal formula to calculate it.

Some of the crucial factors that may affect its duration are the overall market conditions, distinctive features of the Cryptocurrency itself, as well as time frames that the trader uses for analysis.

A consolidation period ends when a certain market event occurs, eventually causing the price to breakout in either an uptrend or a downtrend.

For example, news about some important developments are released, investor’s interest rises and the buying pressure on the market increases.

Crypto consolidation is a dependent process that can last just a few hours/days or carry on for several weeks or even months. The ability to identify consolidation patterns allows traders to carry out effective trading strategies and benefit from sideways markets.

How to identify consolidation on the market

Within a consolidation phase, a Cryptocurrency can form various patterns. These patterns signal that market sentiment has changed, and are used to confirm that an asset is undergoing a period of balanced price action.

How to confirm a consolidation pattern

Consolidation patterns reflect repeated movements of an asset within an average range of buy and sell prices, which represent the support and resistance levels. Together they embody the consolidation range of the pattern.

Due to low volatility in the market, the consolidation range is accompanied by a corresponding trading volume. As long as the volume remains low, a consolidation pattern can be considered confirmed. Analysing distinctive features of these patterns helps determine if the chosen trading strategy will be effective.

Consolidation patterns

A consolidation pattern can form various shapes on the chart. Here are some of the most common consolidation patterns:

Ranges

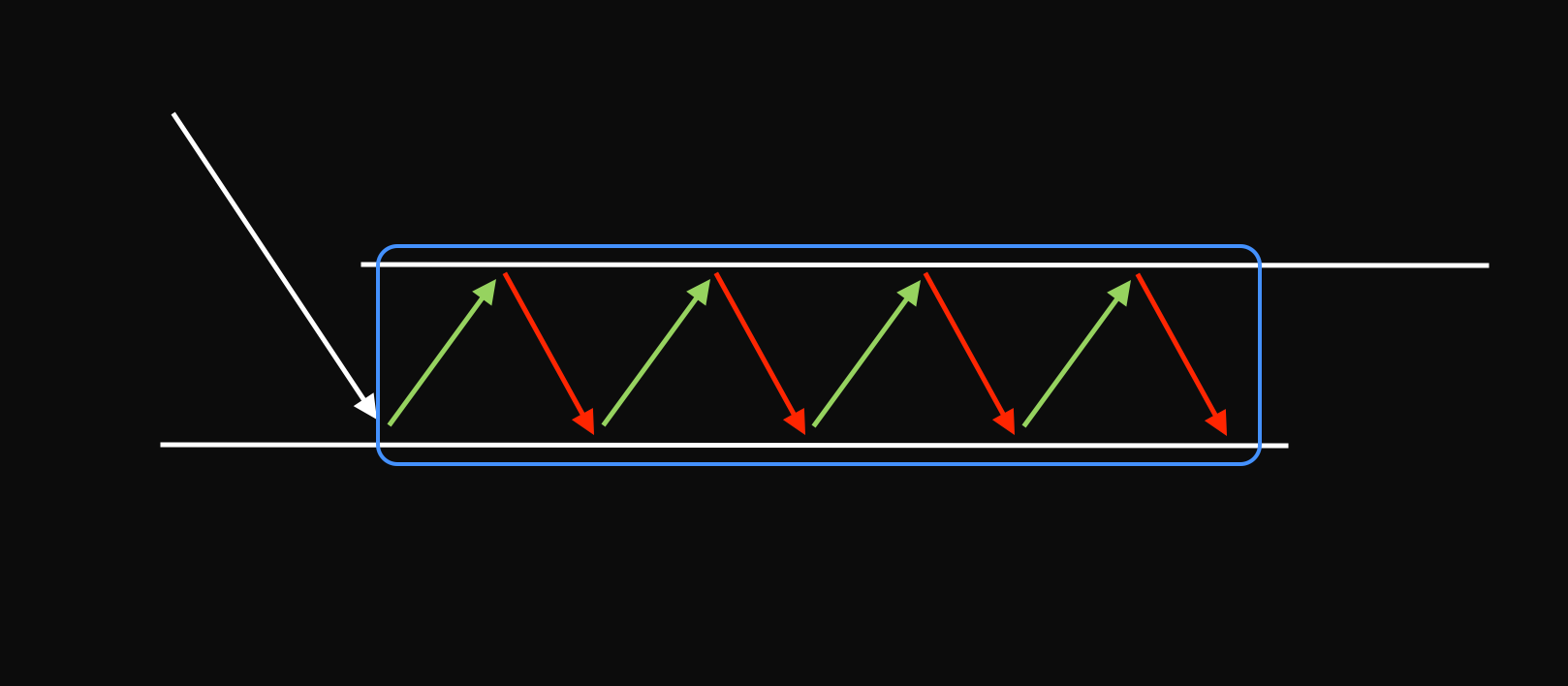

Ranges represent classical shapes of consolidation patterns with a horizontal channel – consolidation range, formed by parallel support and resistance levels.

Both of these levels display the selling and buying pressures, which determine the strength of consolidation.

Pennants

Pennants typically form during a strong market trend after major price movements. Pennants resemble symmetrical triangles that form at a mid point of a developing trend.

Traders identify this pattern as a price consolidation phase before the trend picks up in the same direction.

Flags

Similar to Pennants, flags occur amid a strong trend. Two parallel trend lines connect either lower highs and higher lows or higher highs and lower lows.

Direction of these lines determines what prices are connected, forming a rectangle shape leaned against the prevailing trend.

How to trade during a consolidation period

Traders resort to different trading strategies during Crypto consolidation on the market, depending on their risk appetite, experience and trading style.

Essentially there are two fundamental methods: Breakout strategy and Price swings.

Breakout strategy

The Breakout strategy suits investors with higher risk tolerance, and implies waiting until the price of the consolidated asset breaks through the resistance level or vice-versa.

This approach requires identifying support and resistance levels and receiving confirmation of a breakout before entering into a trade.

The Breakout strategy carries risks of trading false breakouts, while the range of the consolidation pattern is simply widening.

Experience as well as proper risk management are necessary skills for traders who are willing to yield greater profits at the cost of higher risks.

Price swing

The Price swing is a rather conservative approach. Once the support and resistance levels are identified, the possibility of a potential breakout needs to be eliminated before entering a trade.

Price swings could be dangerous when consolidation ends. A potential breakout can resume or initiate a new trend, leading to significant price movements.

If a trade, based on a range-bound movement was anticipated, the trade will no longer be favourable and may lead to loss. Using Stop Loss orders can help protect against such unpredictable scenarios.

What happens after the consolidation phase?

Consolidation is typically interrupted by a price breakout, resuming the previous trend or creating a new one. A breakout serves as a signal that the market is entering a less balance price action.

Pressure dips more towards supply or demand, indicating that volatility is rising and a confirmation is required to ensure the next trade will align with the anticipated market direction.

Using a Crypto consolidation screener

Crypto consolidation screeners provide historical data about previous asset consolidation events. They can help fine-tune and develop new trading strategies, however cannot guarantee their spot-on performance and effectiveness.

Cryptocurrency markets are generally more volatile then traditional stock markets, which makes them quite unpredictable. f

Trading consolidation events requires technical analysis of the current conditions and practising risk management skills.

Is Crypto consolidation good?

Crypto consolidation is neither a positive or a negative event. Consolidation is the natural lifecycle of the Crypto market.

By exercising best trading practises, such as technical analysis and improving risk management techniques, any direction dictated by an event on the market has the potential to provide earning opportunities.

Conclusion

Consolidation occurs on the financial markets when prices of an asset are trading in a continuous average price range, indicating that the buying and selling pressures are at relative balance.

When the Crypto market undergoes consolidation periods, both expert and less experienced traders can benefit from this event.

Nonetheless, it’s crucial to remember that consolidation carries inherent risks due to the unpredictable nature of Cryptocurrencies.

Risk management and due diligence is key to succeed in trading on consolidation.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.